How to Cancel Acorns

Subscription in Few Steps

Need to cancel your Acorns subscription? Learn how to do it in a few easy steps and manage your finances effectively.

Saving and investing are two essential elements of your financial journey. No matter how much you try to ignore savings, you must understand the potential an investment can bring to your finances. Most people are afraid to invest vast sums of money or need more funds to save or invest strategically.

But what if you could save roundups? This is what Acorns offers to its users. From expert portfolios and multiple features to better investing funds, Acorns is a financial tool that can help one strategize their financial future. But what if it does not serve its purpose? In this article, you will learn the steps to cancel your Acorns subscriptions and get insights on how to invest funds alternatively.

Methods of Cancellation

The cancellation steps can help you cancel your subscriptions smoothly so you can use this fund for other purposes. Here are steps one can follow to cancel your Acorns subscription:

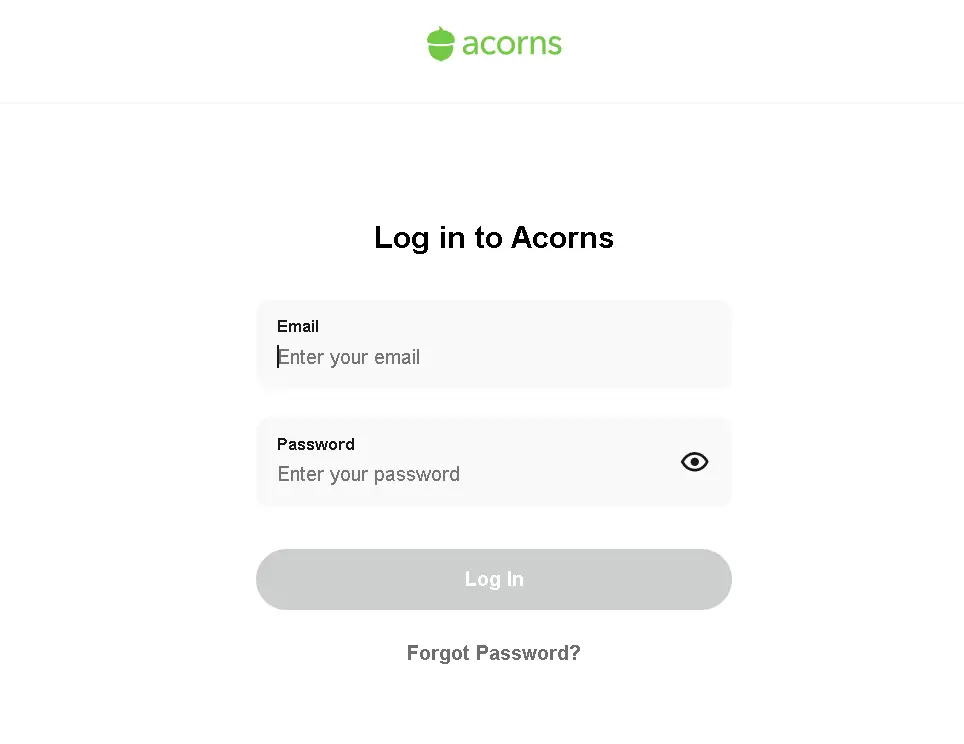

Step 1

Log into your Acorns account.

Step 2

Click your profile in the top right corner.

Step 3

Under the 'Personal Settings', click ‘My Subscription’.

Step 4

Scroll down to ‘Manage’ and click ‘Cancel subscription’.

Step 6

Follow the instructions and select 'Close my account.'

Privacy Refund Policy

The refund policy at the Acorns store is straightforward. One can cancel and return any product they are unhappy with within 15 days to request a refund. One can avail of a full refund that one paid, excluding the discounts and shipping costs. Also, the condition of the products and their tags must remain in their original condition. You must preserve the proof of purchase and receipt for a full refund.

How Much You Can Save After Canceling Your Acorns

The annual subscription costs around $80 annually. It might seem quite affordable as this includes several products, tools, and education about the right investment strategy. However, sometimes, one cannot afford such unnecessary subscriptions. If you find any subscription costs out of your budget or do not need one, you must cancel it. Subscriptions to apps you feel are not worth it can disturb your track to effective investments and saving strategies. You must decide carefully about your funds and plan how much to use and where.

Where to Invest that amount

Moving closer to your investment goals, you must decide where and how to invest. The right investment opportunity can put you on the path to success in no time and will allow you various opportunities that can help you explore a different world. You can invest your savings into government bonds, gold, mutual funds, or retirement accounts.

You can also select apps like Beem and invest funds in high-yield savings accounts. This can provide exceptional returns and help you financially and mentally secure your future. Beem is an app one can trust to get quick funds and explore trustworthy investment opportunities. ̧

Alternatives to Acorns

If you're looking for alternatives to Acorns, which is an investment app that rounds up your purchases and invests the spare change, here are some options to consider:

Robinhood

Known for commission-free stock and ETF trading, Robinhood also offers a feature similar to Acorns called "Robinhood Roundup," where spare change from purchases is invested.

Stash

Stash allows you to invest in fractional shares of stocks and ETFs. It offers personalized investment recommendations based on your financial goals and risk tolerance.

Betterment

This is a robo-advisor that offers automated investing and portfolio management. Betterment builds and manages a diversified portfolio of ETFs based on your risk profile and goals.

Wealthfront

Wealthfront is another robo-advisor that offers automated investing in a diversified portfolio of low-cost ETFs. It offers features like tax-loss harvesting and direct indexing.

M1 Finance

M1 Finance allows you to create a custom portfolio of stocks and ETFs, offers fractional shares, and has automated portfolio rebalancing features.

Ellevest

This platform is specifically designed for women investors, focusing on their unique financial needs and goals. It offers automated investing and goal-based strategies.

TD Ameritrade's Essential Portfolios

TD Ameritrade offers a robo-advisor service that builds and manages a diversified portfolio of ETFs based on your risk tolerance and goals.

Conclusion

Your savings can help you in times of financial crisis. Your relationship might dry up, but money becomes your savior when a financial crisis hits. This is why you must permanently save up funds for the difficult times. You can trust various investments and financial institutions to grow your funds better. Beem is a super financial app that offers high-yield savings accounts with returns of up to 5% APYs. The app is a great way to save and get funds in case you are stuck in a crisis. There are no interest rates or due dates for funds up to $1000.

SUBSCRIPTION ACORNS

Subscription Acorns 0011192468

PreDebit Subscription Acorns

DIRECT, SUBSCRIPTION ACORNS

AUTOMATIC, SUBSCRIPTION ACORNS WEB(S )

Subscription Acorns WEB

Subscription Acorns [email protected]

Subscription Acorns Eric Mcbride

Subscription Acorns 090319

Subscription Acorns christian.schuler145@g

Subscription Acorns 100219

Subscription Acorns Ural Miles Jr

PreDr Subscription Acorns

Subscription Acorns 110419

Subscription Acorns 120219