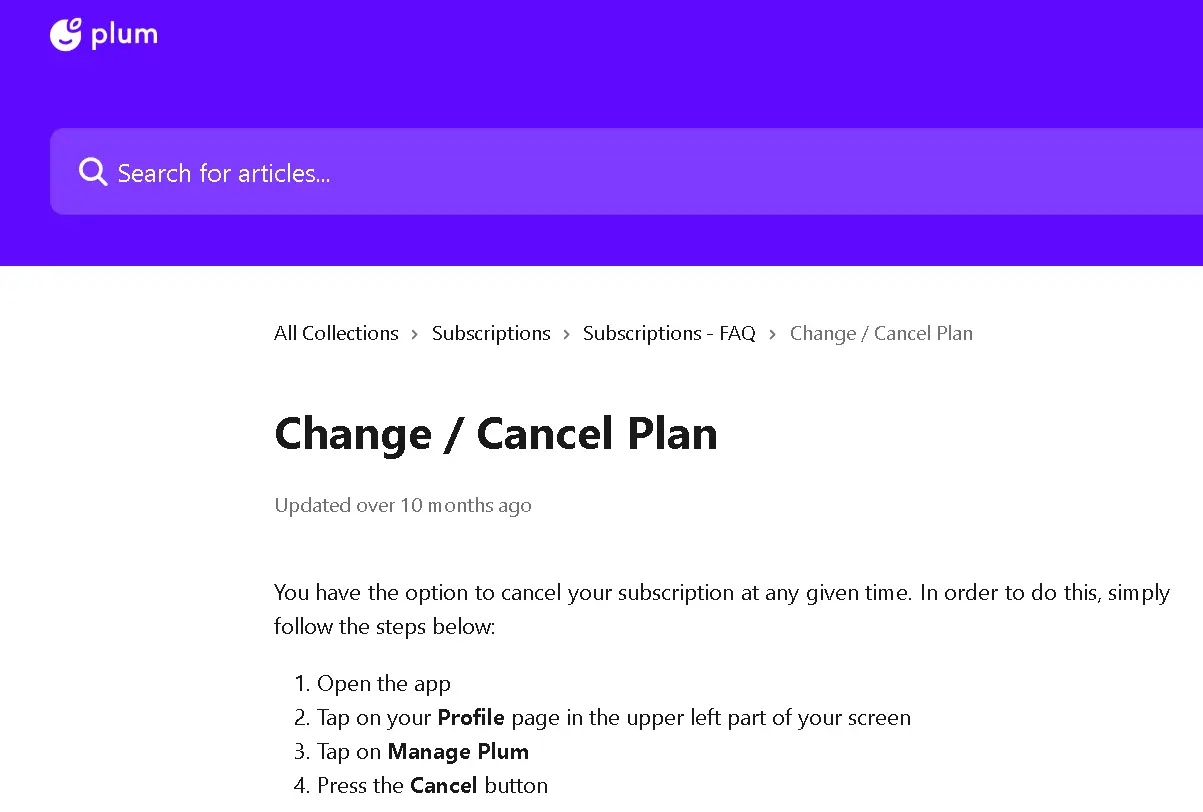

How to Cancel Plum

Subscription in Few Steps

Need to cancel your Plum subscription? Learn how to do it in a few easy steps and manage your finances effectively.

Plum is a savings and investment app that can help you save and invest money, manage your budget, and find a better deal on household bills.A smart money app advises users to invest and save money smartly. However, if you are unsatisfied with your Plum subscription or do not obtain the expected results, you can cancel it. This article will teach you how to cancel your Plum account and invest your savings better.

Methods of Cancellation

Investment and saving money depend on one's personal choice. People often explore and research different platforms before finalizing one. If you have decided to cancel your subscription, follow the instructions below:

Step 1

Go to the Plum app and log in.

Step 2

Click Manage Plum to open your profile section in the bottom right corner.

Step 3

Click on 'Cancel Account'.

Step 4

You must wait a week to get your saved investments until your funds are settled..

Plum Subscription Refund Policy

The refund policy for your Plum account is quite different from that of your other subscriptions. Before you finalize your account closure, you must wait for any pending deposits or withdrawals. Once you cancel your subscription, you must look for pending transactions in the investment section. If you cancel without receiving all pending transactions, your transaction will fail.

How Much Can You Save After Canceling Your Plum Subscription

A plum subscription is an investment app that allows you to save and grow your funds. It depends on your capacity to save. However, they charge a 10 euro monthly premium to open access to premium investments. They also help beginners manage their funds and grow their savings exponentially.

You can save this premium account access fee if you cancel your subscription. You can also look for affordable investment alternatives such as Beem and earn returns up to 5% APYs on their high-yield savings account. Beem guides its users during financial crises and provides financial assistance without interest rates or due dates up to $1000.

Where To Invest That Amount

Your investment journey depends on your future financial goals. Most individuals seek investment opportunities with minimum risk and maximum growth. However, investments with minimum risk often yield small returns. Hence, it is essential to prioritize your needs and investments accordingly. You can start investing after properly researching your needs and market requirements.

Beem is a super app that provides ultimate solutions for users in financial crisis. The app guides people with loan options and investment opportunities and protects them from money troubles. It provides financial assistance and checks credit scores to safeguard future financial goals.

Alternatives To Plum Subscription

If you're looking for alternatives to a Plum subscription, which is known for its features related to budgeting, savings, and financial management, here are some other apps and services that offer similar functionalities:

Mint

Mint is a widely used app that helps you track spending, create budgets, and manage your finances in one place. It also offers financial insights and goal-setting features.

YNAB (You Need A Budget)

YNAB focuses on helping you create a zero-based budget, which means every dollar is assigned a job. It offers robust budgeting tools and educational resources.

PocketGuard

The PocketGuard app helps you manage your spending by showing how much disposable income you have after accounting for bills, goals, and necessities.

GoodBudget

A digital envelope budgeting app that helps you plan your spending and savings by allocating funds into virtual envelopes.

Albert

Albert combines budgeting tools with automated savings features. It also provides personalized financial advice and insights.

Conclusion

Plum is a smart money app that connects your investments to bank accounts for analysis. With your subscription to Plum, you can check your savings, expenses, and income and use the insights to make the right decisions about your finances. With the proper research and analysis, you can become a financial professional.

You can switch to other alternative apps, which are much more affordable and valuable than Plum. To ensure you are on the right path to success, plan your finances and investments with experts from Beem. Beem will help you grow your business and your savings the right way

PLUM

MANGOPAY PLUM

MANGOPAY, PLUM BY MANGOPAY

MANGOPAY PLUM BY MANGOPAY

MANGOPAY, PLUM, BY MANGOPAY

PLUM, FIRST PAYMENT

EDUARDO CHOU, STARLIN BANK

GC RE PLUM

MANGOPAY, PLUM

PLUM REFERENCE: DSQ37C9

PLUM ZAS94S5

GC Re Plum

PLUM REFERENCE: GQB6ZYS

PLUM REFERENCE: W66R2VM

PLUM REFERENCE: ANHQJHR

PLUM REFERENCE: T2MBF4Z

PLUM REFERENCE: SKB5S86

PLUM REFERENCE: ZM7HB3Y

PLUM REFERENCE: MH6DDW9

PLUM REFERENCE: ZR9PN8C

PLUM REFERENCE: K3F89RA

PLUM REFERENCE: WCAFSGE

PLUM REFERENCE: VWM7SN3

PLUM REFERENCE: Z7KTK79