How to Cancel Square One Insurance

Subscription in Few Steps

Need to cancel your Square One Insurance subscription? Learn how to do it in a few easy steps and manage your finances effectively.

Square One Insurance is a Canadian insurance provider that offers customizable home insurance policies. It aims to provide flexible and unique policies that cater to each customer's specific needs.

If you want to end your subscription with Square One Insurance and invest money somewhere else, read this blog post! Find how to cancel your Square One Insurance subscription here and explore saving opportunities!

Methods of Cancellation

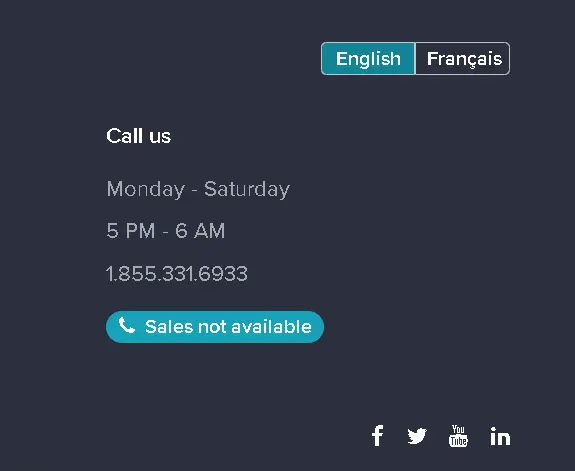

Cancel via phone

Step 1

Dial +1(855)331-6933.

Step 2

Request the agent to cancel your policy.

Step 3

Provide your policy number, phone number, name, and many more.

Step 4

Then the agent will proceed with your request.

Cancel via email

Step 1

Write an email to the support team.

Step 2

Include the policy name and reason.

Step 3

Send it to [email protected]

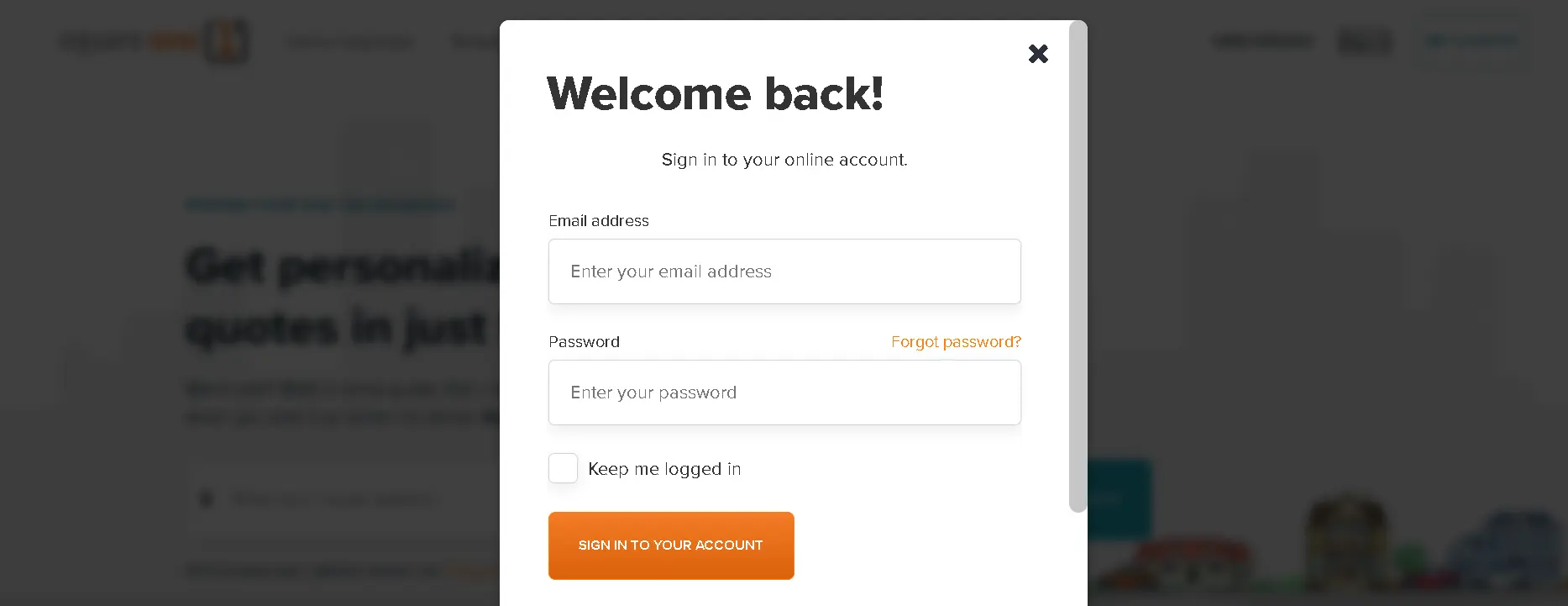

Cancel via online

Step 1

Login into your Square One Insurance account.

Step 2

Go to the My Policies option.

Step 3

Tap on the "Cancel Policy" button.

Step 4

Confirm your cancellation.

Square One Insurance Refund Policy

Square One Insurance has a refund policy. The policy for a return is different in each case of cancellation. If you cancel following the effective date, you will receive a partial refund. However, even if you cancel before the effective date, the first $54 of your premiums is not refundable.

How Much Can You Save After Canceling Your Square One Insurance?

The amount saved by canceling your Square One insurance plan depends on the price. For example, if your plan is priced at $1,200 and you cancel halfway through, you will have a total savings of approximately $600.

Where to Invest That Amount

Emergency Fund

Building up an emergency fund is always a smart move. Aim to have saved three to six months' worth of living expenses.

Debt Repayment

Use the funds here to pay off high-interest loans. Reducing your debt can improve your financial health and, over time, save you interest fees.

Education

Invest in your or your children's education through college savings plans, professional certification, or continuing education courses.

Alternatives to Square One Insurance

Duuo Tenant Insurance

Duuo provides personal liability liability coverage, additional living expenses, identity theft coverages, water damage insurance, and sewer backup insurance at affordable prices. It aims to provide renters with flexible coverage options that satisfy their individual needs and budgets while ensuring they are fully protected against unforeseen events that may interrupt their daily routine or cause financial problems.

Sonnet Insurance:

It is referred to as "Digital-first" Sonnet Insurance, which is sought by tenants who want an easier way of obtaining insurance in the digital world. They have customizable policies that cover personal property, liability, and extra living costs; you may add various optional features like identity theft and water damage. This provides a balance between convenience and coverage, allowing policyholders to access their insurance documents online and get help quickly from support staff, improving the overall client experience.

Conclusion

Square One Insurance is an insurance provider that offers personalized insurance policies with flexible coverage options. For better financial management optimization purposes, consider Beem. This enhances your financial stability and enables you to make the best decisions regarding your expenditures.

SQUARE ONE INSURANCE SE VANCOUVER

SQUARE ONE INSURANCE SERV

SQUARE ONE INSURANCE SERVVANCOUVER BC

Square One Insu

SQUARE ONE INSURANCE SERV VANCOUVER, BC

SQUARE ONE INSURANCE S VANCOUVER BC

SQUARE ONE INSURANCEVANCO

SQUARE ONE INSURANCE

SQUARE ONE INSURANCE S

SQUARE ONE INSURANCE BC

Business PAD Square One Insu

BUSINESS PAD -Square One Insu

Business PAD Square One Insurance

Square One Insu BUS

SQUARE ONE INSURAN

SQUARE ONE INSURANCE AZ