How to Cancel Venmo

Subscription in Few Steps

Need to cancel your Venmo subscription? Learn how to do it in a few easy steps and manage your finances effectively.

If you're a US resident, you will likely have a Venmo account, as it is among the most popular platforms for online money transfers. In Q4 2023, Venmo's Total Payment Volume increased by $68 billion to $63.5 million in Q4 2022, according to Statista.

However, situations such as budget cuts, use of other services, or switching to another service provider can lead to canceling your subscription. This blog post will show you how to cancel your Venmo subscription and explain related policies!

Methods of Cancellation

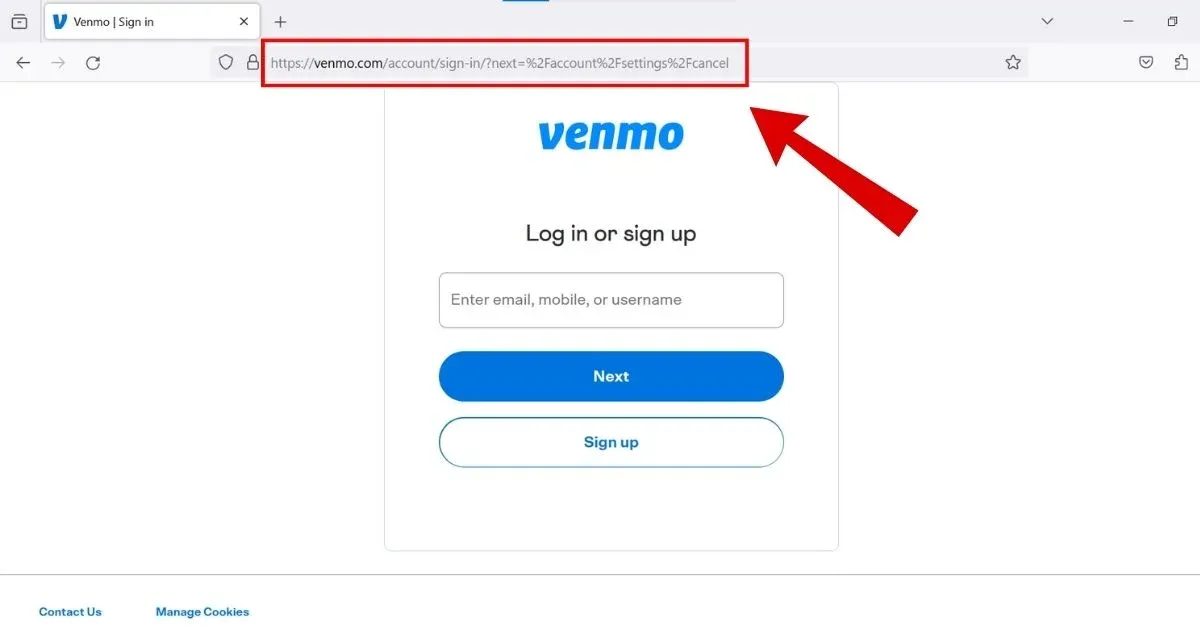

Step 1

Login into your Venmo account.

Step 2

Go to the Me tab by tapping your picture.

Step 3

With the ‘Me’ tab, click on the Settings option.

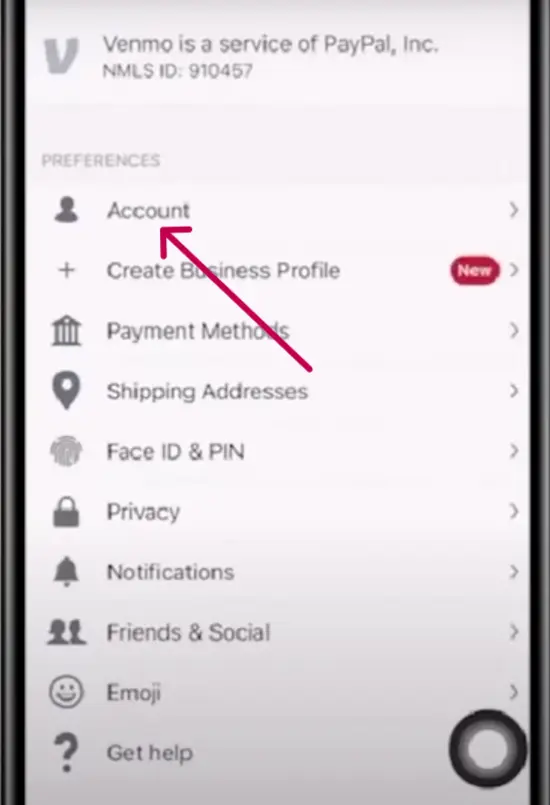

Step 4

Tap on the Account under the Preferences option.

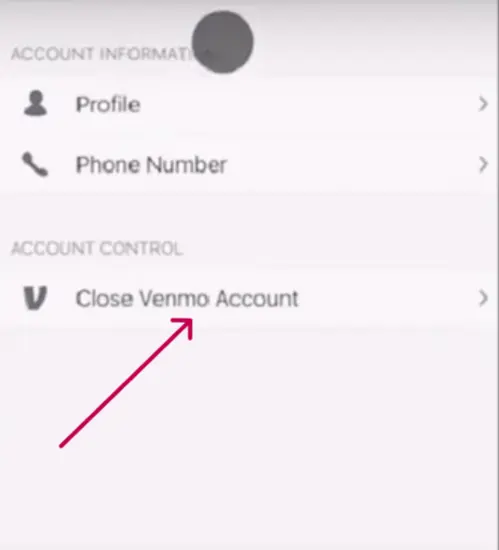

Step 5

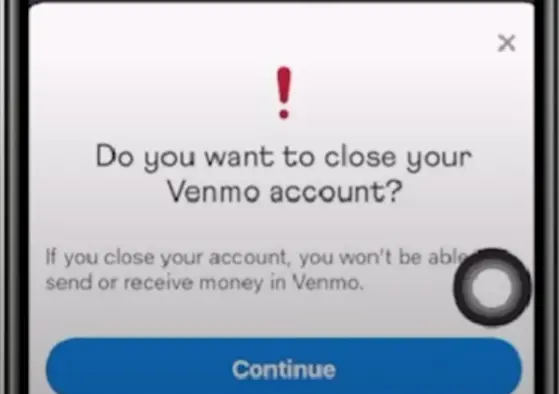

Click on the Close Venmo Account button.

Step 6

Confirm your cancellation.

Venmo Refund Policy

It should be noted that there are no refunds concerning subscription fees that have already been remitted to Venmo. Moreover, make an error or even mistakenly send a payment to the wrong person through Venmo. They do not guarantee any refund for this action. Nonetheless, there is the possibility of approaching the recipient for your money-back request.

How Much Can You Save After Canceling Your Venmo Subscription

When you cancel your subscription with Venmo, you will no longer pay direct subscription fees for personal accounts. Still, you can save on transactional costs tied to using different services they provide. They charge between 2.29% and 3% fees plus some amounts ranging from $0.10-0.49.

By canceling your subscription, these transactional costs could potentially be reduced, leading to savings per transaction made via various payment methods offered by the Venmo service provider itself (this line seems too long).

Where to Invest That Amount

Stock Market

Investing in single stocks or exchange-traded funds (ETFs) permits one to participate in corporate growth and earn divestiture or capital earnings.

Bonds

Acquire government or business bonds that provide regular interest payments and moderation against risks.

Savings Accounts

Keep liquidity while earning interest through high-yield savings accounts or certificates of deposit (CDs).

Precious Metals

Buy gold, silver, or other precious metals for inflation protection and economic uncertainty hedge.

Alternatives to Venmo

Zelle

Zelle is an expedient real-time payment network that empowers US residents to transfer funds straight from their bank accounts. Its transactions are almost instantaneous; they commonly take only minutes to complete, which is why many top banks or credit unions are connected to it.

Cash App

Cash App enables users to send and receive money, invest in stocks and Bitcoin, and even get direct deposits using mobile devices. Its advantages include a user-friendly interface, instant transfers, and a Cash Card for purchasing directly from the app.

Conclusion

You will find multiple options to use something other than Venmo and use your funds differently. Try Beem, a platform that more than 5 million Americans trust. Get help with personal loans, health services, payments, budgeting, tax calculation, and more!

VENMO

VENMO NEW YORK NY

Venmo