How to Cancel FreeCreditReport.com

Subscription in Few Steps

Need to cancel your FreeCreditReport.com subscription? Learn how to do it in a few easy steps and manage your finances effectively.

To keep your creditworthiness on the safe side today, you should keep the record of your credit report clear. Consumers may readily look for errors or fraud with services such as FreeCreditReport. com. However, some advantages make your FreeCreditReport subscription tremendously convenient. This might lead to the cancellation of the short-term deficit, which might later lead to saving the short-term deficit. This manual will provide step-by-step guidance on how to easily cancel your FreeCreditReport.

Methods of Cancellation

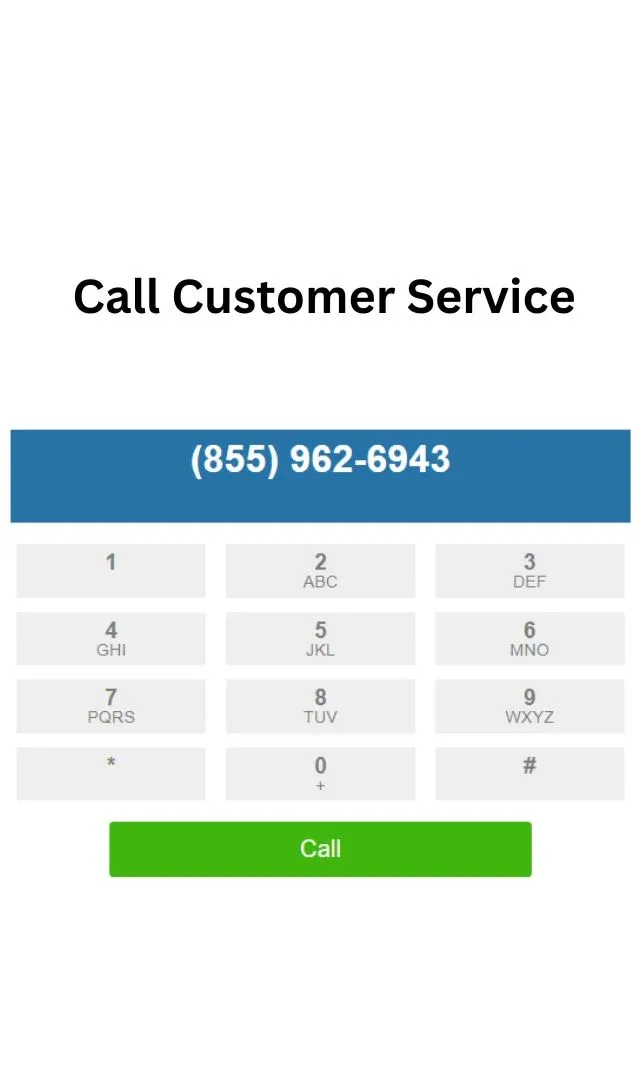

The first step to canceling your FreeCreditReport.com subscription is to contact their customer support. Here's a simplified version of the process:

Step 1

Get in Touch With FreeCreditReport.com's Support Team by Dialing 855-962-6943. If you want to cancel your membership, you can reach a representative at this number.

Step 2

When you call customer support, they will ask for your social security number to verify your identity. For this step to be valid, the account holder must have initiated the cancellation request.

Step 3

Let the customer support representative know you want to terminate your FreeCreditReport.com subscription. They will help you cancel and may even ask why you're canceling, so they may use that information internally.

Step 4

Before ending the call, ask for confirmation of the cancellation. This confirmation will allow you to rest easy and be clear about future billing cycles, as it is proof that your subscription has been successfully stopped.

Step 5

Please remember that any confirmation numbers or emails sent by FreeCreditReport.com should be kept as evidence of cancellation for your purposes.

FreeCreditReport.com Refund Policy

The specifics of your subscription and when you decide to discontinue can affect FreeCreditReport.com's refund policy. In most cases, subscription services are paid for in advance for a set amount of time, usually monthly or yearly. If you cancel your prepaid subscription, you can get your money back for the time you didn't use it, as long as you follow the company's policies.

Contact FreeCreditReport.com's support staff if you have any questions regarding their refund policy or if you qualify for a refund. They can provide specifics about a specific procedure or deadline for a refund.

How Much Can You Save After Canceling Your FreeCreditReport.com Subscription?

By canceling your FreeCreditReport.com subscription, you can save significant money in the long run. Subscription credit monitoring services can be costly, especially if you use them sparingly. This step can help you feel more financially secure.

Where to Invest That Amount?

Prioritize spending choices supporting your ambitions and future goals when deciding how to spend the money you'll save by canceling your FreeCreditReport.com subscription. Here are a few investment opportunities to think about, interspersed with a subtle pitch for Beem's financial aid services:

Your top financial goals should be having emergency funds or building up your amount. Beem's financial aid services provide easy payment arrangement systems and financial advice, which can be a great support in times of emergency. You can still save in your emergency fund intact.

If you aim to be financially sustainable in the long run, put some of your funds aside in a retirement account. Through Beem's personalized retirement planning services, you can finally make your retirement plans as easy and effective as possible and maximize your savings.

Allocating money to pay off high-interest debt will resolve your financial position. Beem can also mediate discussions with creditors to get a lower interest rate or create a repayment plan that works for your budget and schedule.

Allocating your investments into different assets can maximize your return and minimize your loss risk. To balance it out, Beem financial advisors may help you design an investment portfolio, considering the amount of risk you are willing to take, your investment objectives, and your time horizon.

You can position yourself better within the job opportunities and salary range by contributing to the education sector and enhancing your skills. To ensure you get the chance to benefit from the scholarship and financial aid opportunities, Beem will provide you with services to help fill out the applications for these programs.

Alternatives to FreeCreditReport.com

Although FreeCreditReport.com provides a handy service for monitoring your credit, other options are available, and they all have advantages and disadvantages. Take a look at these options to see which one works best for you:

AnnualCreditReport

Customers are mandated by law to get one free copy of their credit reports from Equifax, Experian, or TransUnion per annum. You may also receive a free copy of your credit review or check it for mistakes at www.AnnualCreditReport. com.

Credit Karma

Credit Karma’s significant features include non-chargeable credit reports, scores, and advice directly affecting your situation. Users can be informed and capitalize on the platform's educational materials and resources, consequently rectifying their credit.

Identity Guard

The service provides maximum security against identity theft and constantly supervises your credit. It has this function by instantly monitoring the darknet, informing you about any suspicious activity, and providing you with insurance coverage of up to $1 million in case of stolen funds. Being an intelligent electronic commerce tool, this service will prevent customers' identity theft and other fraud that exploit their confidential and sensitive information.

myFICO

The most popular credit scoring model among lenders is FICO®, and myFICO offers credit monitoring services and access to these scores. Users can monitor changes to their credit scores over time and learn about the elements that affect their creditworthiness.

Credit Sesame

Credit Sesame provides free services to check your credit and protect you from identity fraud. Users can monitor their credit reports, identify any signs of fraud, and take the initiative to raise their credit ratings. The site also provides personalized tips for optimizing financial health.

Conclusion

Canceling your FreeCreditReport.com subscription opens up opportunities for financial progress and security. Consider making saving for emergencies, investing in retirement, paying off debt, and diversifying your investments a top priority. Remember to explore alternative credit monitoring services like AnnualCreditReport.com, Credit Karma, and Identity Guard. These services can give you the tools and information to reach your financial objectives confidently.