How to Cancel Experian Credit Report

Membership in Few Steps

Need to cancel your Experian Credit Report subscription? Learn how to do it in a few easy steps and manage your finances effectively.

Methods Of Cancelation

Canceling your Experian Credit Report subscription is straightforward. But you must follow the correct steps.

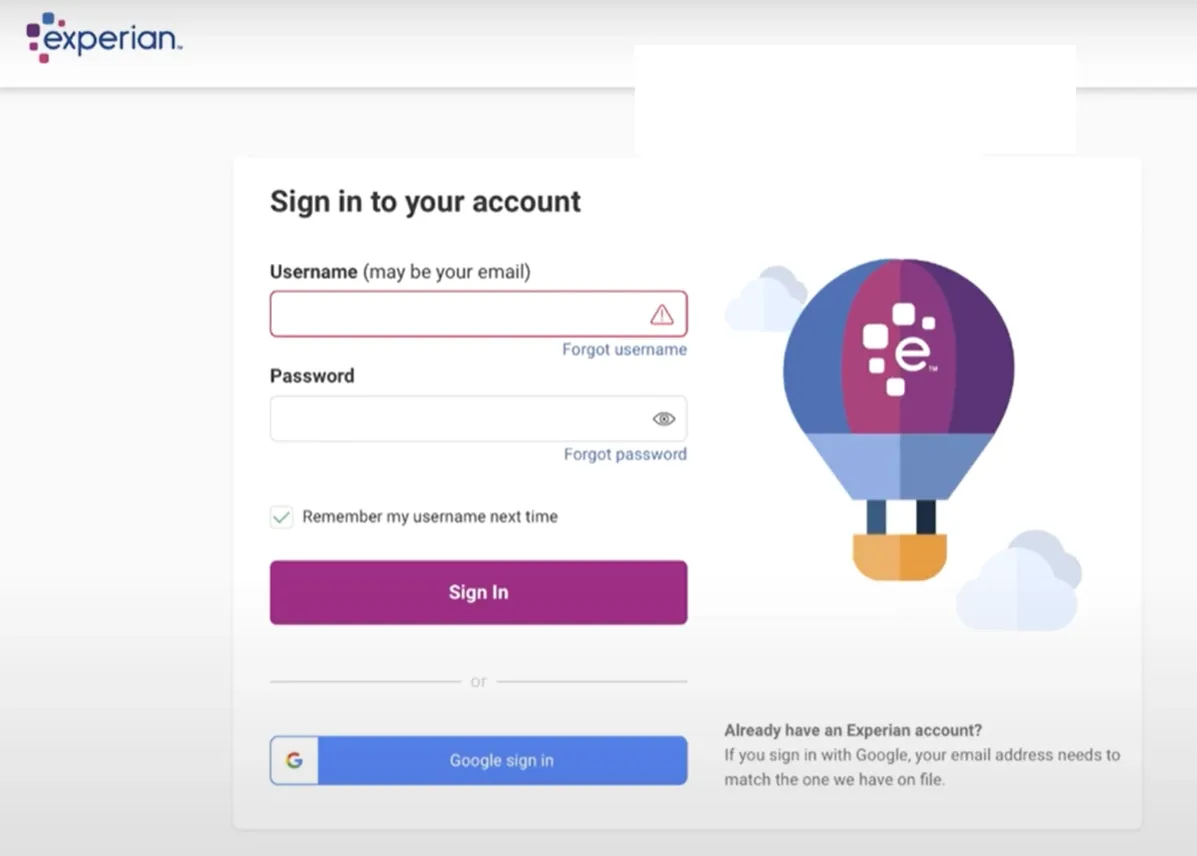

Step 1

Sign in to your account

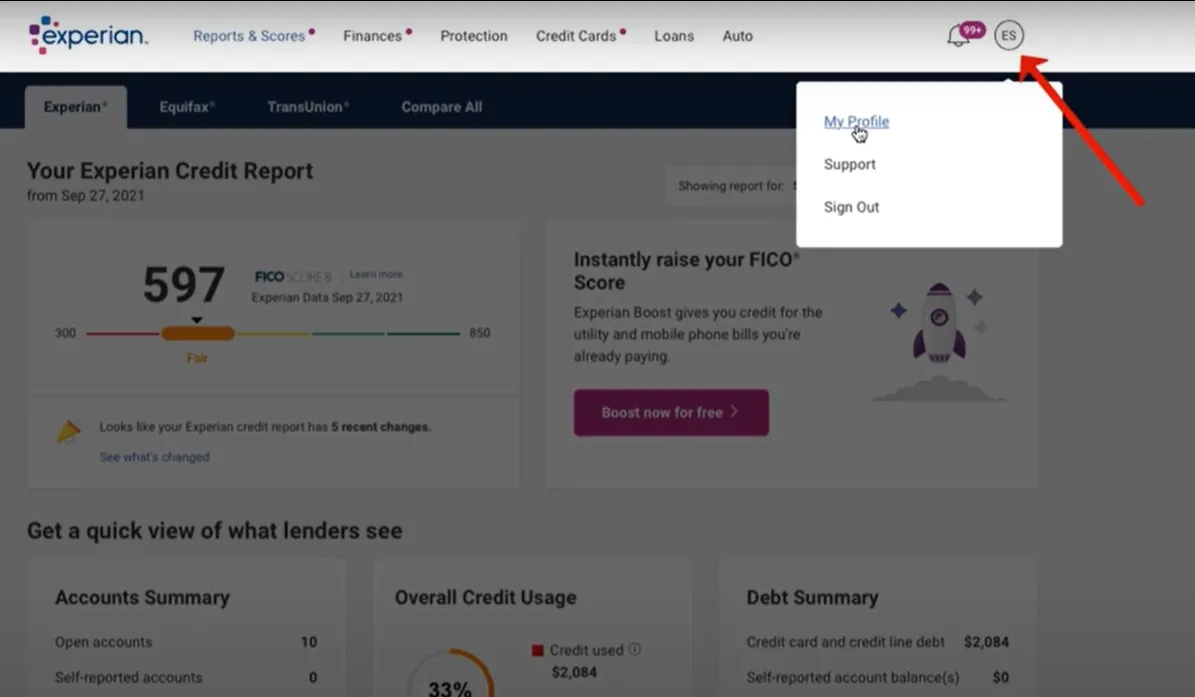

Step 2

Go to my profile at the top right corner

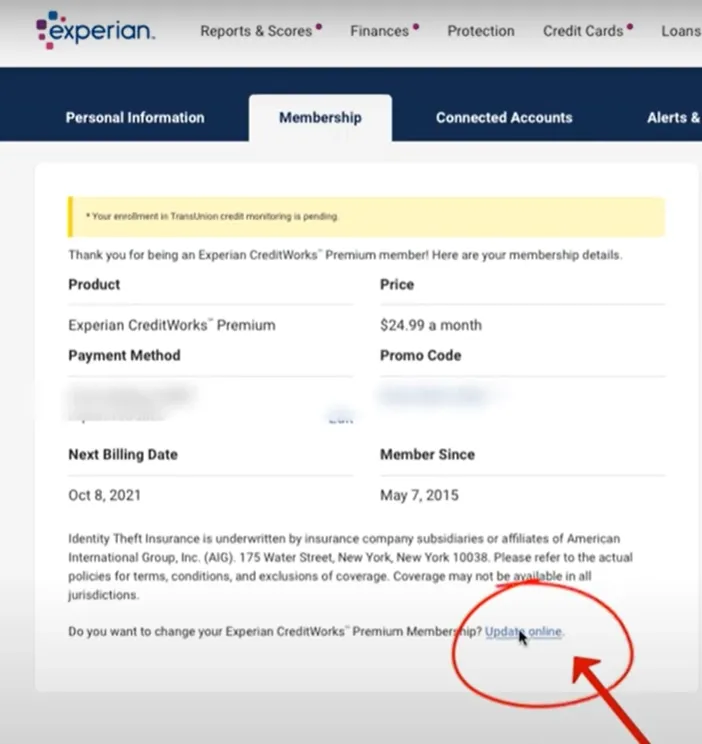

Step 3

Go to membership and scroll down. Look for "update online" and click it.

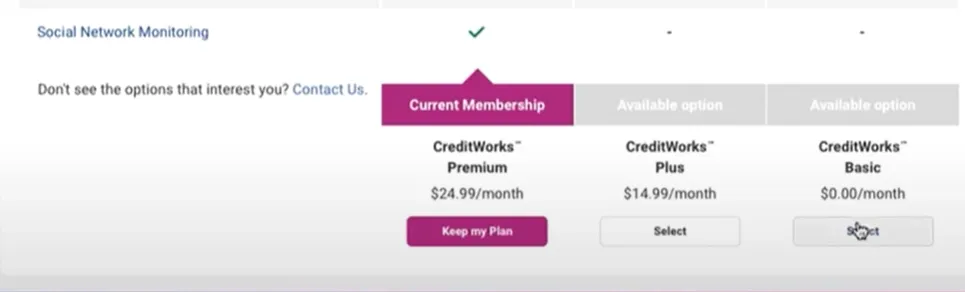

Step 4

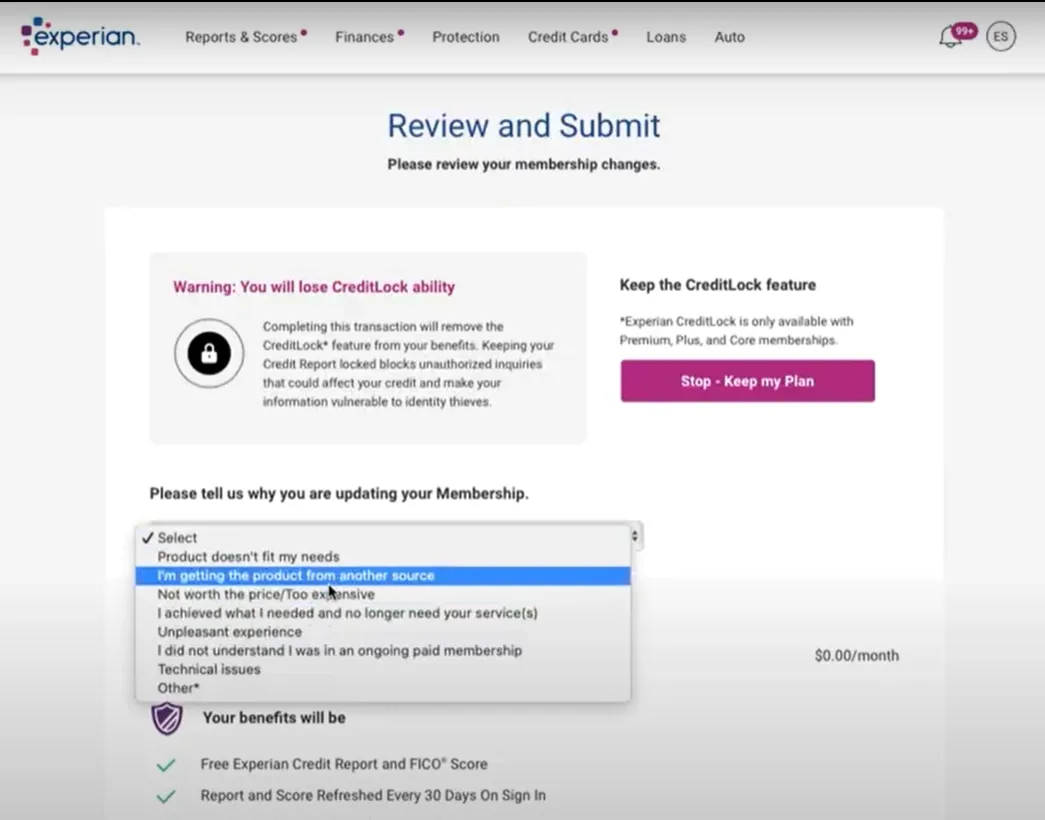

Select a basic membership plan

Step 5

Give a reason for the plan update

Step 6

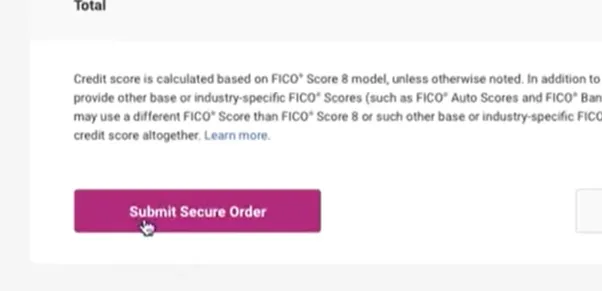

Submit your order

Cancel via Phone

Step 1

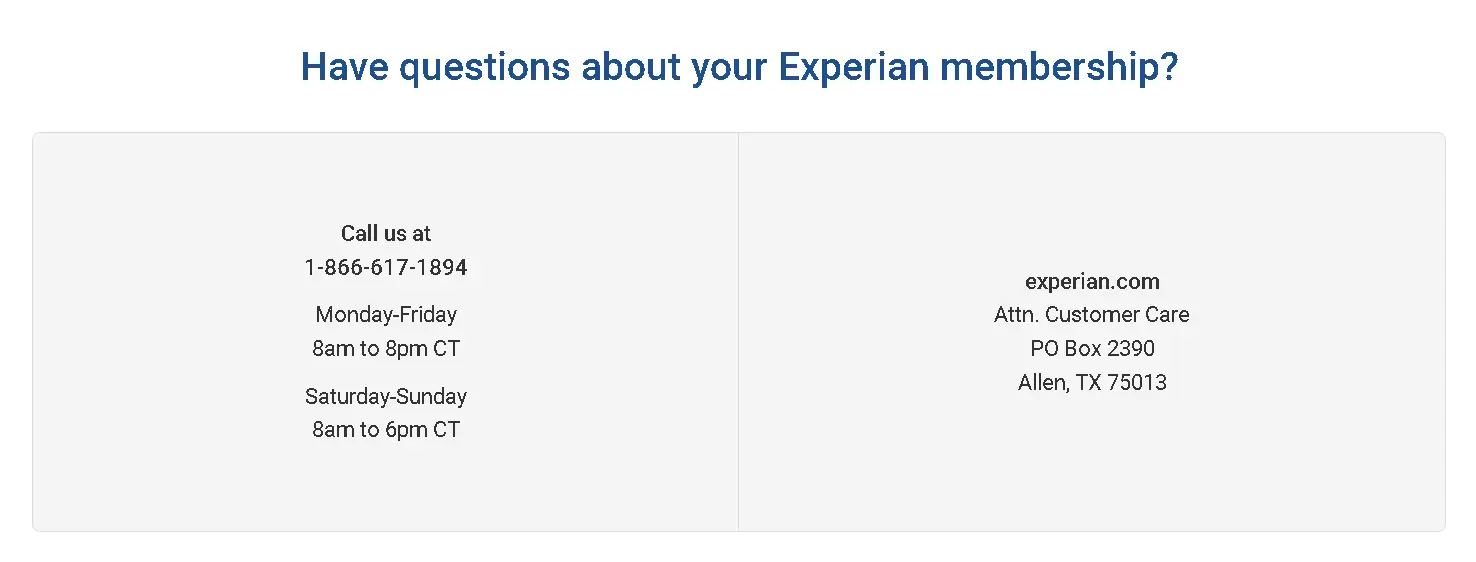

Dial +1(866)-617-1894.

Step 2

Ask the representative to cancel your subscription.

Step 3

When asked, provide your account credentials.

Step 4

Then, your subscription will get cancelled.

Cancel via email

Step 1

Draft an email to the support team.

Step 2

You have to include your name, phone number, and email address.

Step 3

Also, write the reason for the cancellation.

Step 4

Send it to [email protected]

Step 5

Wait for confirmation.

Experian Credit Report Subscriptions Refund Policy

Experian has a no-refund policy. You can't return any unused subscription time if you pay for it. The service will be active until the end date of your current billing cycle. If you cancel in the middle of this period, you will get credit monitoring services until then.

How Much You Can Save After Canceling Your Experian Credit Report

Your plan to cancel your Experian subscription may affect your savings. The company offers services from $9.99 to $29.99 monthly. Canceling could save you $120 to $360 a year.

Where To Invest That Amount?

High-yield savings account

Save this money into high-yielding accounts available at banks, where the interest earned is higher than ordinary ones, leading to consistent wealth growth.

Index funds

Consider buying low-cost index funds such as the S&P 500; they have historically offered good returns because they represent a broadly diversified market basket, thus constituting long-term investment opportunities.

Repaying debt

If borrowers still owe debts or loans, such as those whose interest rates seem too high, then this strategy would be suitable to apply after getting money saved via canceling a subscription.

Alternatives to Experian Credit Report

Credit Karma

Credit Karma provides free credit scores and reports. The app provides financial tools and personalized tips. It uses the VantageScore model instead of the FICO score.

Equifax

Equifax is one of the leading credit bureaus in the US. It collects and maintains consumer and business credit data. Some buyers must pay before accessing their scores or reports from this site.

FICO

FICO is an organization that creates credit rating systems applied by loan lenders. For many financial companies, the FICO score remains the most critical measure of an individual's borrowing capacity; thus, it can be purchased directly from FICO or other third-party vendors.

Conclusion

Experian Credit Report is widely used to calculate your credit score when applying for loans or determining interest rates. You will find multiple options if you no longer want to use Experian and use your funds in another manner. TryBeem, a platform that more than 5 million Americans trust. Get help with personal loans, health services, payments, budgeting, tax calculation, and more!

CREDITEXPERT.CO.UK, . GB

CREDITEXPERT.CO.UK .

EXPERIAN GROUP

CREDITEXPERT.CO.UK NOTTINGHAM, NO GBR

CREDITEXPERT.CO.UK, .

CREDITEXPERT.CO.UK . GB

CREDITEXPERT.CO.UK, . GREAT BRITAIN

EXPERIAN LIMITED NOTTINGHAM GBR

EXPERIAN WISECONSUMER NOTTINGHAM GBR

CREDITEXPERT.CO.UK, ., GBR

CREDIT FROM CREDITEXPERT.CO.UK

CREDITEXPERT.CO.UK, 4TH FL TOLLHOUSE HILL., NG15FS GBR

EXPERIAN, IS WISECONSUM

CREDITEXPERT.CO.UK, ., GB

CREDITEXPERT.CO.UK, . GB, REFUND

EXPERIAN UK

EXPERIAN NOTTINGHAM

EXPERIAN IS WISECONSUM GB

EXPERIAN WISECONSU LONDON

VEHICLECHECK, FROM EXPERIAN

EXPERIAN GROUP NOTTINGHAM GBR

EXPERIAN, IS WISECONSUM GREAT BRITAIN

EXPERIAN WISECONSU LONDON, GB, EXPERIAN WISECONSUMER

EXPERIAN GROUP, NOTTINGHAM GB

EXPERIAN LTD NOTTINGHAM GBR

CREDITEXPERT.CO.UK