How to Cancel Progressive Insurance Subscription in Easy Steps?

Need to cancel your Progressive Insurance subscription? Learn how to do it in a few easy steps and manage your subscriptions.

While canceling your Progressive Insurance may initially seem daunting, it's a straightforward process that can be done quickly and efficiently.

Whether you've chosen to transfer agencies, no longer require the coverage, or just changed your mind, this content will walk you through the cancellation process and provide comfort.

To Cancel Your Progressive Insurance Subscription, You Can Follow These Steps:

Write a Cancellation Letter

Step 1

Please provide your complete name, phone number, and Progressive vehicle insurance policy number.

Step 2

Your new insurance company's name.

Step 3

Your new car insurance policy's effective date and start time.

Step 4

Your digital signature is superimposed on your written name and the date.

Send the Letter

Step 1

Your letter should be addressed to Progressive Corporation, 6300 Wilson Mills Road, Mayfield Village, Ohio 44143.

Step 2

To guarantee prompt processing, send your cancellation request at least three weeks before the day you would like it processed.

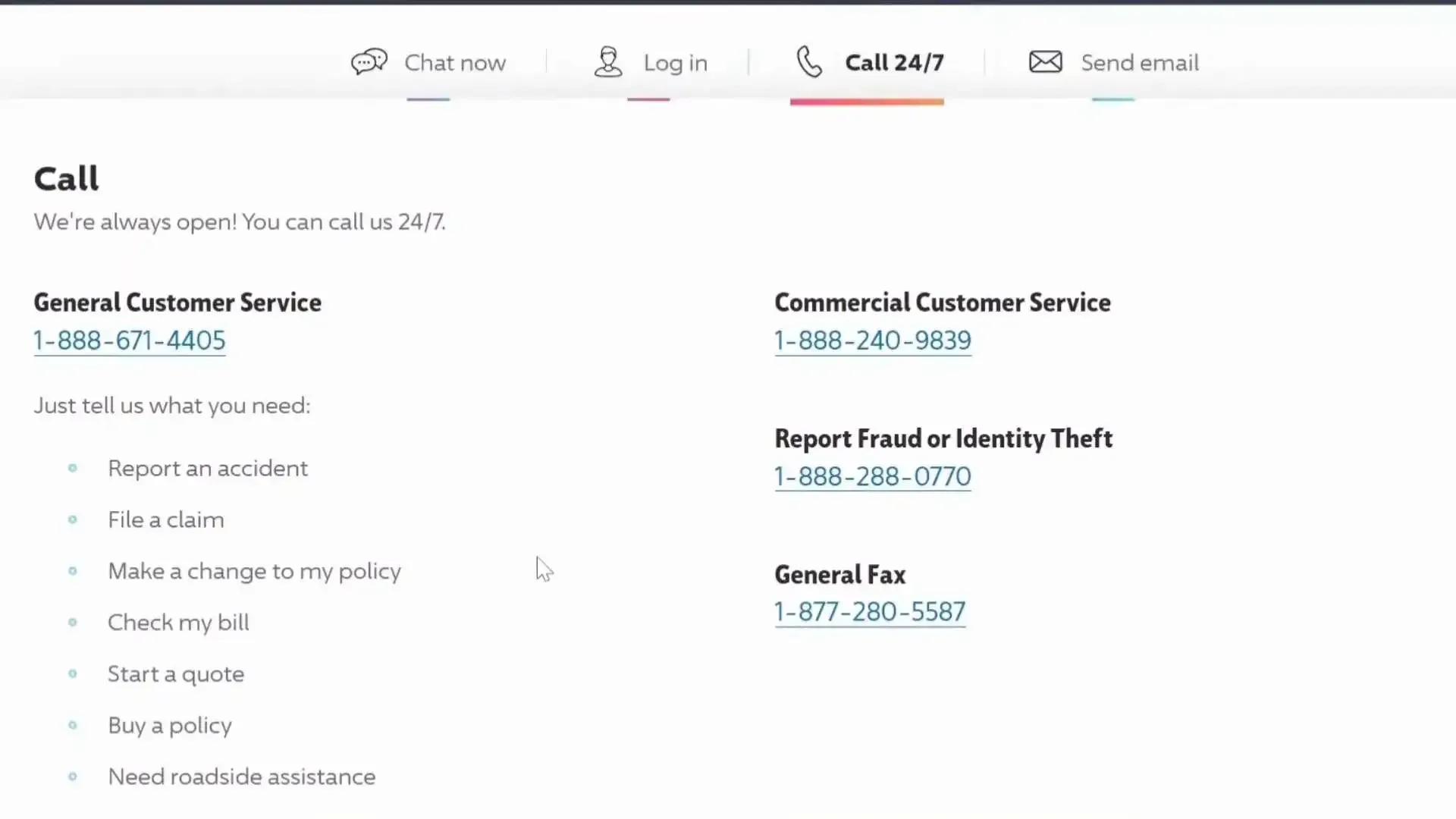

Canceling by Phone

Step 1

Alternatively, you can contact Progressive's customer care department to terminate your vehicle insurance policy.

Step 2

This simple approach allows you to have conversations in real-time.

Step 3

Let the agent know you want to cancel your coverage by calling 888-671-4405 or 888-240-9839.

Step 4

Even if the agent tries to entice you with discounts, you should cancel once you've committed to a new supplier.

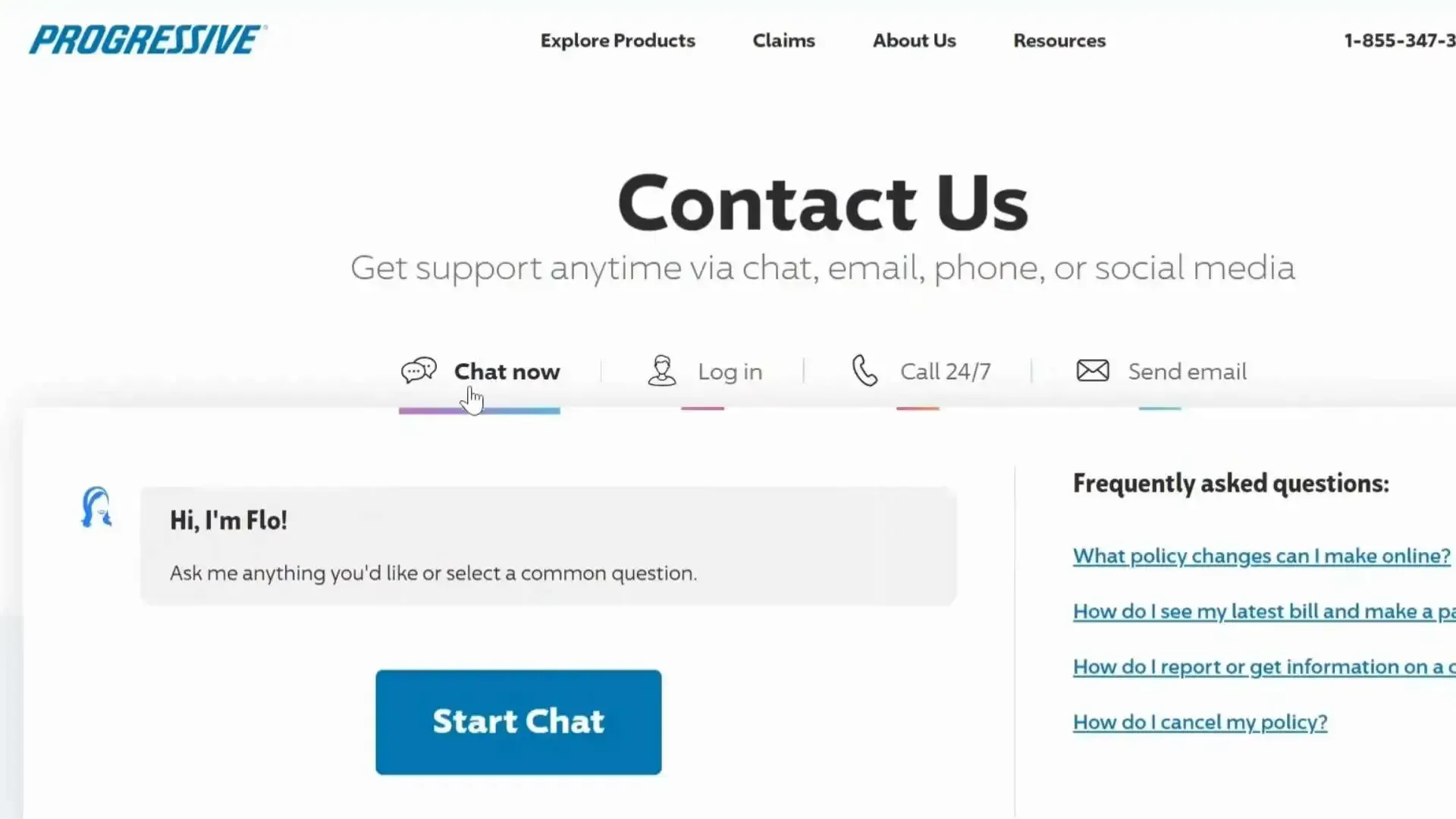

Online Cancellation

Step 1

Step one is to access your Progressive account by logging in online.

Step 2

To ask about policy cancellation, use the chat option to connect with a customer care agent.

Step 3

To understand the specific requirements and fees connected with cancellation, check the terms and conditions of your insurance.

Note: Canceling your Progressive auto insurance online may be possible only if your state allows it.

Methods of Cancellation

Multiple options are available for terminating your Progressive Auto Insurance coverage, so you may select the one that best suits your needs and preferences.

Progressive Insurance Refund Policy

Before canceling your Progressive car insurance, it's crucial to understand their return policy. This understanding can help you avoid any unforeseen financial implications.

Depending on your insurance and state regulations, you may or may not be subject to cancellation fees. Progressive usually gives a prorated refund for the part of the payment that isn't used if you've paid for the coverage in advance.

Your final bill will include any remaining charges or fees after you cancel. Make sure all payments are completed to avoid a negative effect on your credit score.

Progressive will refund any overpayments using the same payment method you used to pay. Keep an eye on your account or payment method for the return; it may take a few weeks.

How Much Can You Save After Canceling Your Progressive Insurance Subscription?

If you shop around and discover a better deal, you can save money by dropping Progressive as your auto insurance provider. The possible savings are broken down as follows:

Monthly Premiums

It's no secret that Progressive car insurance is notoriously pricey. Possible savings can be estimated as follows:

Monthly Premium on Average: $150 (varies by area and level of coverage)

Average Annual Savings: $1,800 (calculated using an average premium of $150 per month)

Extra Charges

You can save money on administrative costs, policy renewal fees, and other hidden expenses by terminating your Progressive coverage.

Sales and Packages

You could unlock significant savings by transitioning to a different insurance provider. These providers often offer better rates, discounts for multiple policies, and introductory deals. This financial advantage could be a compelling reason to consider exploring alternative options.

Where to Invest That Amount?

Overall, it is possible to achieve many positive outcomes with the money you save by being able to drop progressively as a vehicle insurance policy. Some suggestions are as follows:

Emergency Fund

It is crucial always to be ready for rainy days and thus have an emergency fund. For emergencies, keep money in a high-yield savings account so you can quickly access it.

Paying Off Debt

This way, your total income and the number of interest paid will increase, while using your savings to pay off high-interest liabilities, such as personal loans or credit cards, will improve your financial position and reduce the amount of interest you will be paying.

Investment Accounts

Consider investing in stocks, bonds, or mutual funds for retirement by opening a Roth IRA, 401(k), or other retirement account. These accounts are even better because you can save more in taxes and accumulate more for your retirement nest egg.

Stock Market

Compared with regular savings accounts, there are high chances of earning high with the stock market, meaning more income is earned. The Beem software, available for download on the internet, helps you monitor your finances.

Beem has designed its all-in-one financial support platform for users dealing with subscriptions, investments, and different aspects of well-being. This platform may be useful for maintaining financial stability and maximizing savings accounts.

Alternatives to Progressive Insurance

If you're looking for alternatives to Progressive, here are several options that provide competitive pricing and outstanding coverage:

GEICO

The company's policy focuses on providing its clients with low-priced services and comprehensive coverage possibilities. It offers good driver discounts, multiple policyholder discounts, and more.

State Farm

State Farm has another advantage: low prices and high-quality service are complemented by the availability of insurance for all types of cars. The good news is that you can get even more discounts by adding all your plans to their many insurance deals.

Allstate

Allstate offers policyholders numerous coverage options and discounts. One of their products, Drivewise, offers a discount for safe driving, making this insurer cheap for safe drivers.

USAA

Among USAA's strengths are the best rates, especially if the client meets the requirements to become a member of this company, and the possibility of good customer service. Their primary focus is the total happiness of their customers, and they provide insurance to all enrollees, including serving members in the active military and their dependents.

Liberty Mutual

Liberty Mutual allows you to add value to your insurance policy and benefit from multiple discount choices. Its charges are affordable, and they can adjust your policy based on your unique situation.

Conclusion

Policies issued by Progressive auto insurance can be canceled to allow you to enjoy more freedom and save more costs. It's crucial to have adequate knowledge regarding the financial choices one will make, such as saving, investing, or paying off one's debts.

Beem is dedicated to helping anyone who would require information on personal finance or financial help. Beem has unique features of financial management, such as budgeting tools, fast cash advances to employees and others, charging a minimal monthly fee. Choose Beem wisely now and take your future into your own hands so you can easily manage your finances.

PROGRESSIVE *INSURANC 800-776-47

Debit Card Purchase PROGRESSIVE *INSURANCE 800-776-4737 OH

Electronic Withdrawal Prog Direct Ins

PROG DIRECT INS INS PREM PPD ID: 9409348039

PROG DIRECT INS INS PREM PPD ID: 9409348096

PROGRESSIVE *INSURANCE 800-776-4

PROGRESSIVE *INSURANCE 800-776-4737 OH 44143 USA

CHECKCARD PROGRESSIVE *INSURANCE 800-776-4737 OH

Debit Card Purchase - PROGRESSIVE INSURANCE 800 776 4737 OH

ACH Transaction - PROG DIRECT INS INS PREM

External Withdrawal - PROG DIRECT INS BRANCH16DEBIT ACH - INS PREM

PROG DIRECT INS INS PREM

PROG DIRECT INS INS PREM PPD ID: 9409348062

Payment to Progressive Direct Insurance

Debit: Signature purchase from PROGRESSIVE INSURANCE MAYFIELD VLG OHUS

PROGRESSIVE *INSUR800-776-4737, OH #0000

Web Authorized Pmt Prog Direct Ins

Debit Card Purchase PROGRESSIVE INSURANCE 800 776 4737 OH

PROG DIRECT INS INS PREM PPD ID: 9409348070

PROGRESSIVE *INSUR

CHECK CARD PURCHASE PROGRESSIVE *INSURANCE 800-776-4737 OH

PROGRESSIVE *INSURANCE 800-776-4737 OH

: PROGRESSIVE *INSURANCE 800-776-4737 OH

ACH Electronic Debit - UNITED FIN CAS INS PREM

PROG DIRECT INS INS PREM PPD ID: 9409348112

PROGRESSIVE *INSURANCE 800-776-4737 OH 44143 US

POS DEBIT PROGRESSIVE *INSURANCE 800-776-4737 OH

PROGRESSIVE INSURANCE Bill Payment

UNITED FIN CAS INS PREM

PROGRESSIVE *INSURANCE