How to Cancel Vitality Life Insurance

Subscription in Few Steps

Need to cancel your Vitality Life Insurance subscription? Learn how to do it in a few easy steps and manage your finances effectively.

Life insurance policies come with their ups and downs. Most people who can afford it pay vast sums of money to leave something for their loved ones in case they die. However, you can cancel your policy if you realize other better alternative life insurance policies or cannot pay more money to one insurance provider.

Depending on the insurance provider, there are various ways to cancel your insurance policy and claim a refund. This article will guide you through the steps to cancel your life insurance policy with Vitality. It will also offer insight on using your funds better and saving enough for a financially stable future.

Methods Of Cancellation

The steps to cancel your Vitality life insurance are as follows:

Step 1

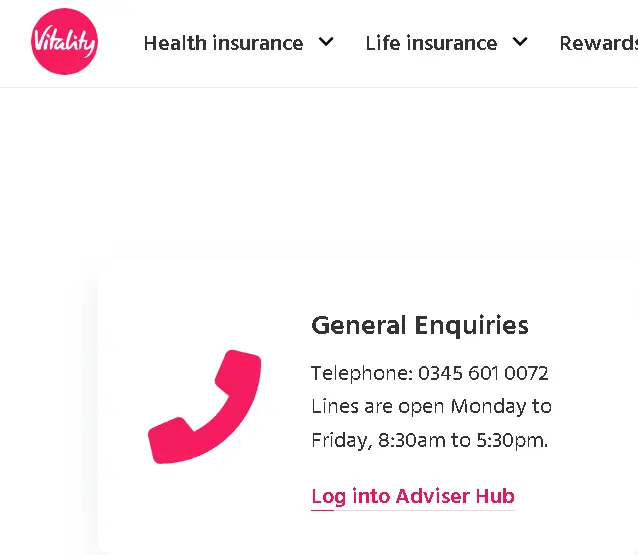

To cancel over the phone, call: 03456010072.

Step 2

Inform the representative about your account details so they can be verified.

Step 3

Share your request to cancel your policy.

Step 4

Stop the auto payment and initiate the cancellation process.

Vitality Life Insurance Refund Policy

Vitality's life insurance refund policy is valid for 30 days after purchasing. One can cancel their insurance policy to claim money back. This refund policy will also include any prepayments or additional charges. However, if one fails to cancel within 30 days, one can only withdraw money from life insurance premiums without getting any tax benefits on those funds.

How Much Can You Save After Canceling Your Vitality Life Insurance

Various life insurance coverages and premiums are available for different types of customers. One can save money by canceling their Vitality Life insurance and switching to other affordable insurance coverages. One should always research before putting money into insurance providers and select the one with maximum perks and minimum costs. You must stay cautious while spending your money on insurance policies.

Where To Invest That Amount

Investments and savings must be planned well for a secure financial situation. One must plan how to spend their money on needs and wants. They must reduce these needs by spending less on expensive insurance policies and buying affordable ones. The money saved can be used to buy stocks or invest in the share market for a greater return. One can also try savings with a high-yield account at Beem and earn returns of up to 5% APYs. The proper investment guidance can help boost your savings and create rainy-day funds for future financial troubles.

Alternatives To Vitality Life Insurance

If you're exploring alternatives to Vitality Life Insurance, which is known for its innovative approach combining life insurance with health and wellness incentives, here are some other insurance providers that offer similar policies or features:

John Hancock Vitality

Like Vitality Life Insurance, John Hancock offers life insurance policies that incorporate the Vitality program. It provides incentives for healthy living, such as rewards for physical activity and discounts on premiums.

AIA Vitality

AIA offers life insurance policies with the AIA Vitality program in several countries. It encourages policyholders to stay healthy through fitness challenges, health assessments, and rewards.

Prudential Wellness

Prudential offers life insurance policies that include wellness benefits and incentives for healthy behaviors. They may offer discounts on premiums or rewards for participating in wellness activities.

Conclusion

Every US citizen has several insurance coverages, whether life, a car, or for his house. No matter how hard you try to reduce your spending on insurance policies, they return to your budget. It is wise to save money on these expensive insurance policies and replace them with savings and investments. You can save money for retirement goals or your child's college education. However, the best place to start your savings plan is with an emergency fund. The proper steps for your financial future can safeguard you from a financial crisis.

VITALITY LIFE

VITALITY

VITALITY LIFE 400250 81359118

Vitality

Vitality Life Limited

VITALITY LIFE FIRST PAYMENT

Vitality Life, 0194343793

Vitality Life, 0194343227

VITALITY LIFE INITIAL PAYMENT

Vitality Life, 0294781071

Vitality Life, 0194744967

Vitality Life, 0194781071

Vitality Life, 0194771607

Vitality Life Limi

VITALITY LIFE 070436 38630651

VITALITY LIFE REFERENCE: 0194632977/ 14