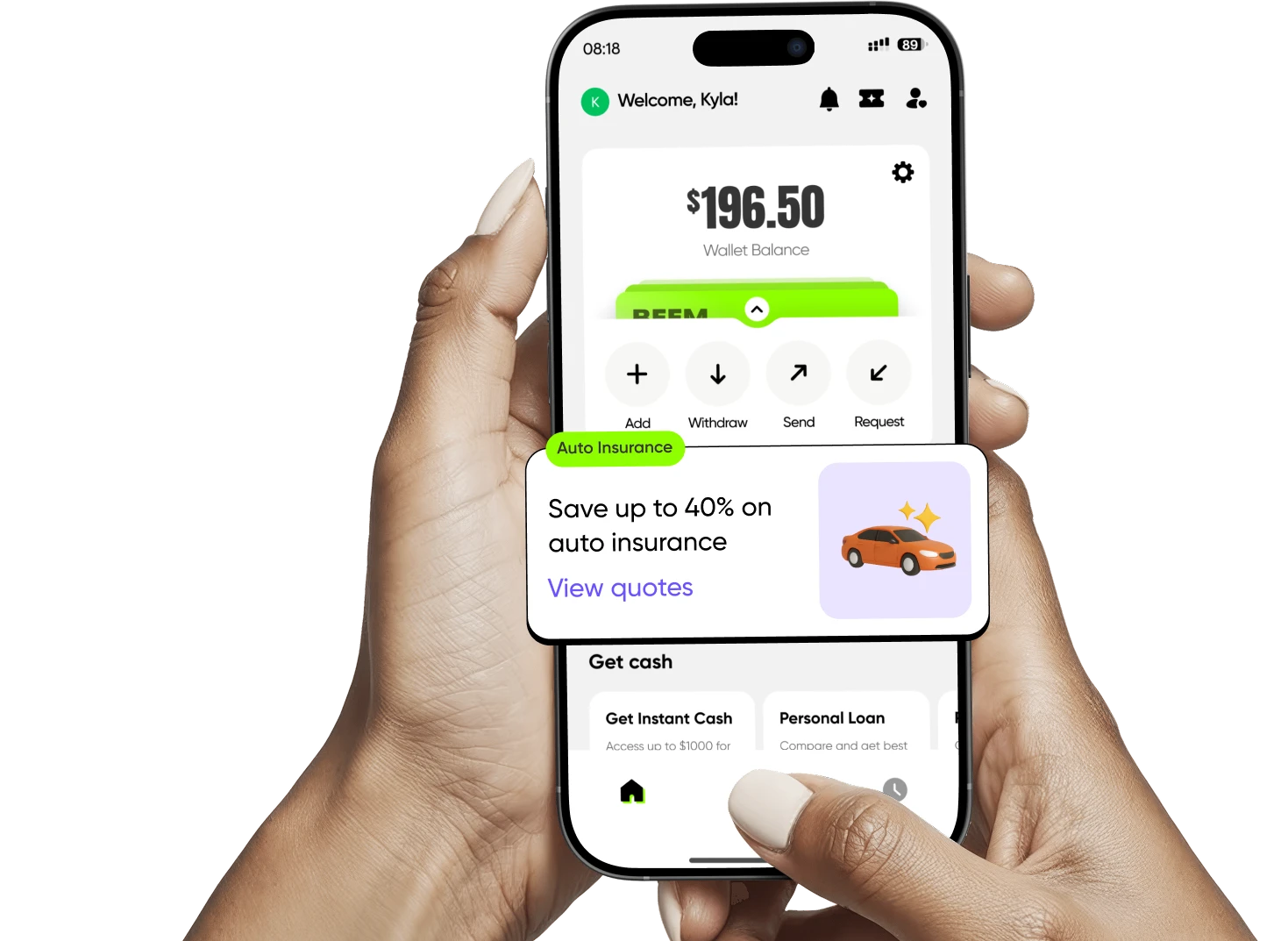

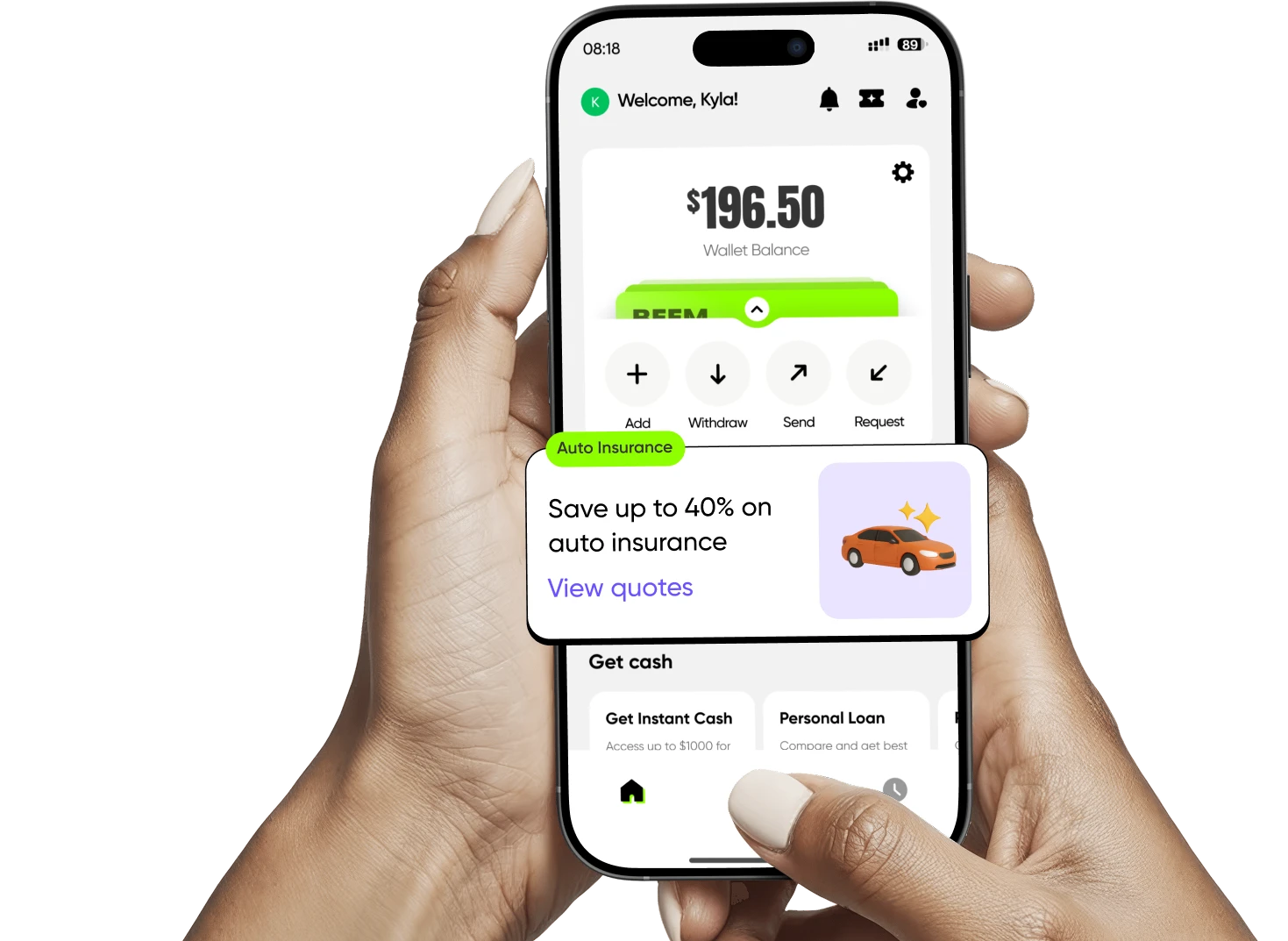

Save up to 40%

on car insurance

Get personalized car insurance quotes from industry leading insurance providers. Compare rates in one place.

+1

Trusted by

5 Million+

Insurance offerings

Personalized\n quotes In 5

mins

Get a quote tailored to your needs, based on

your driving habits and preferences

Compare rates

in one place

See the best car insurance rates from top

providers in one simple comparison

Drive safe &

save big

Safe driving habits pay off. Enjoy discounts on

your driving behavior and save on premiums

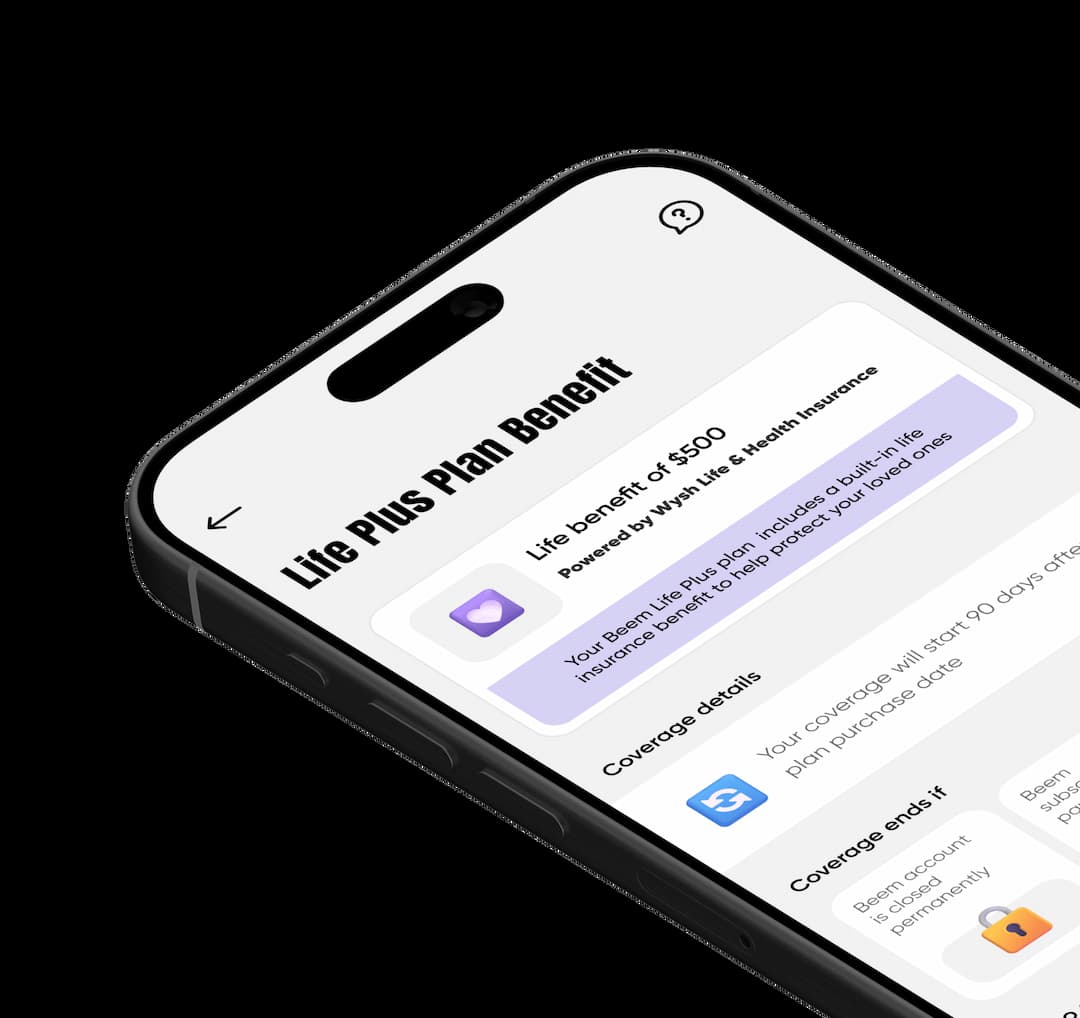

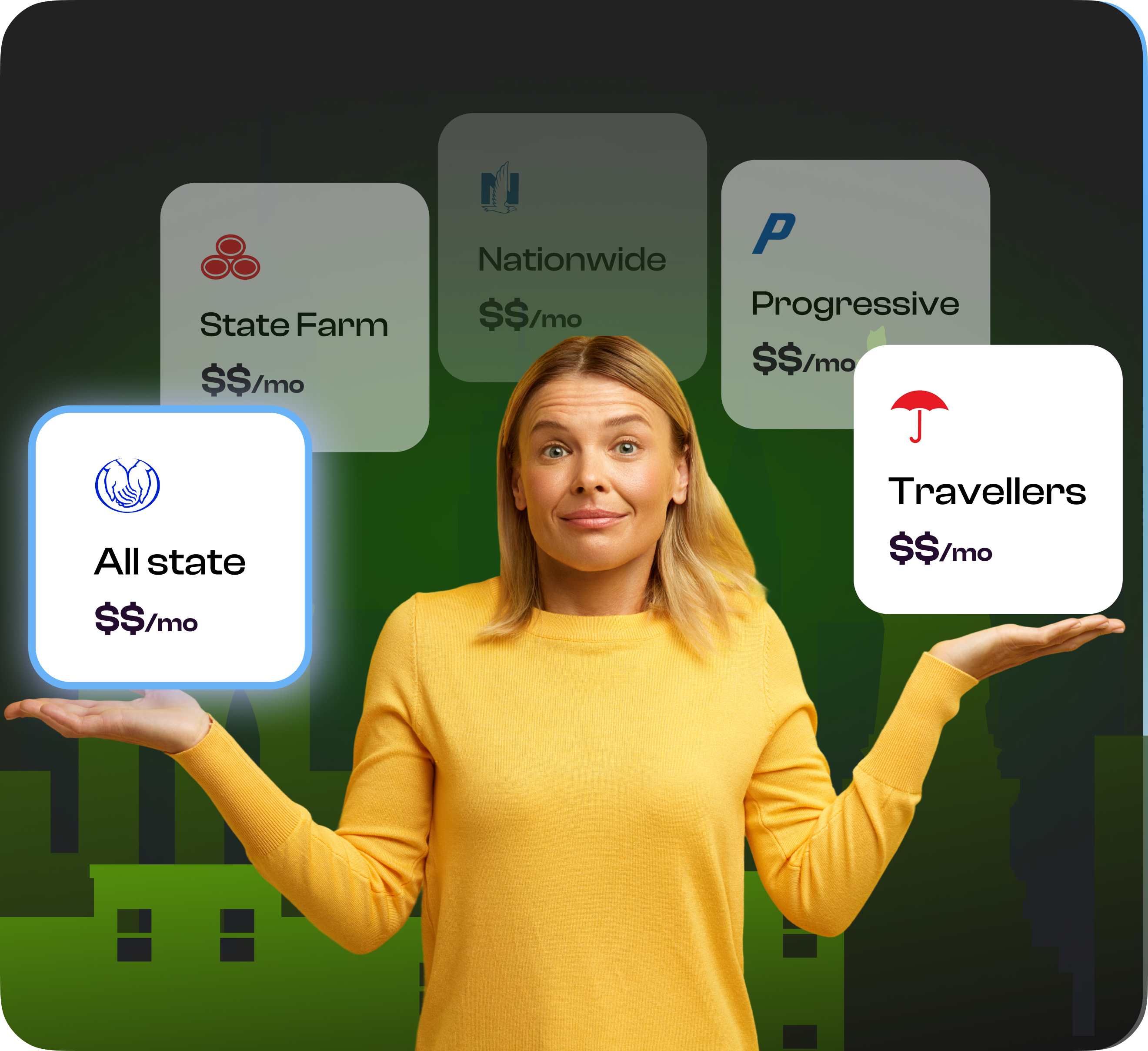

Why should you trust Beem?

- Beem is trusted by 5M+ users for their daily financial activities. Beem partners with the industry leading insurance companies to provide the best insurance quotes tailored to your needs.

Drive Safe and save up to

40% on car insurance!

40% on car insurance!

Life happens. Whether it’s for bills, family, or an unexpected

expense, Beem’s Everdraft™ is here when you need backup.

Why People Love Beem?

The testimonials above are not related to the Beem Card or its services.

They refer exclusively to other Beem offerings.

They refer exclusively to other Beem offerings.

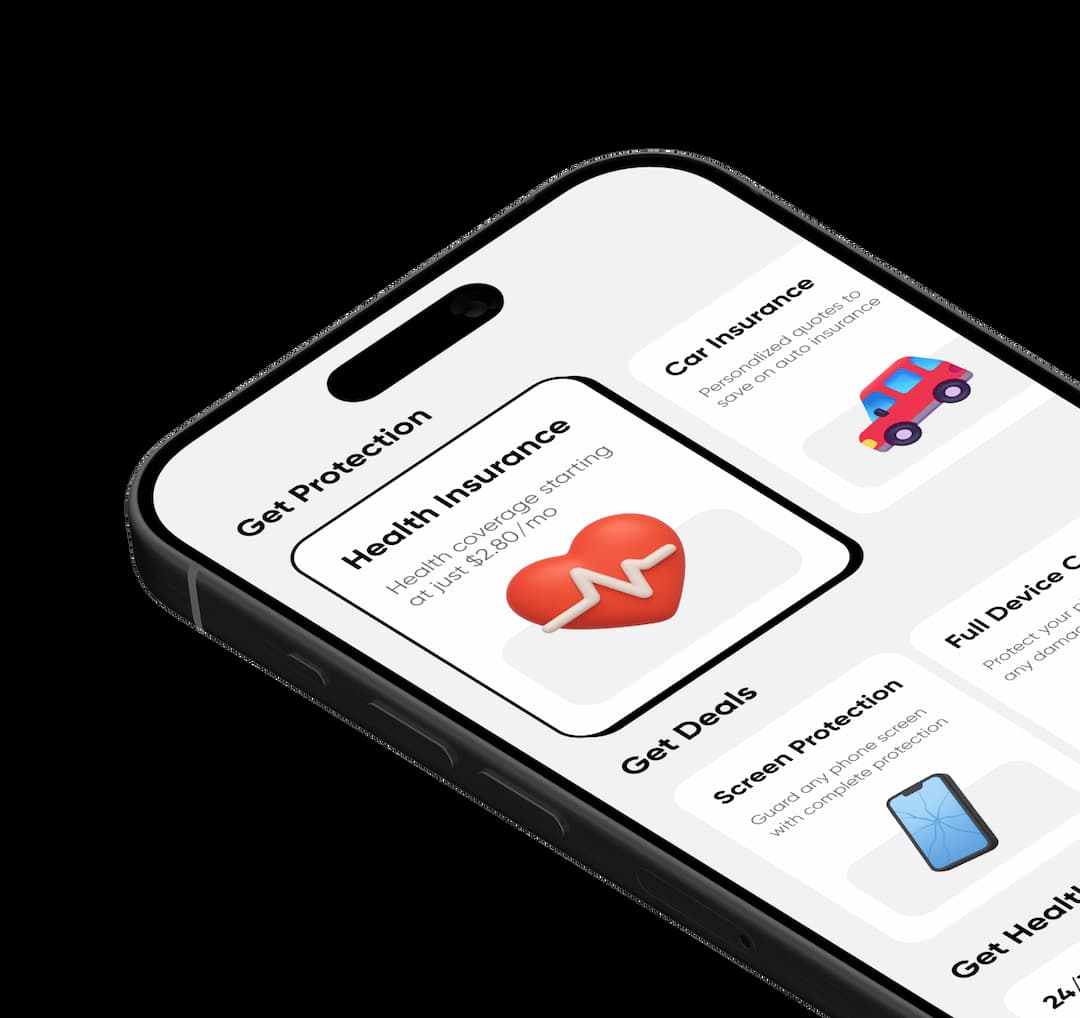

Do more with Beem

Fast personal loans, health program, & so much more!

Frequently asked questions by Beeeeemers!

Comparing car insurance quotes can help you get the best deal for your budget and provide the coverage you need in case of an accident. Using Beem to find the best insurance quotes can help you make the right choice.