How to Cancel Aflac

Subscription in Few Steps

Need to cancel your Aflac subscription? Learn how to do it in a few easy steps and manage your finances effectively.

Canceling an insurance policy can be tentative, but it is possible to accomplish it with the right advice. Therefore, you are in the right place if you need information on canceling your Aflac subscription. Secondly, we will look at the Aflac return policy and the possible reductions that could be made if you cancel your policy with Aflac, where you can channel that amount of money and other available policies apart from Aflac.

Methods of Cancellation

Via Call

Step 1

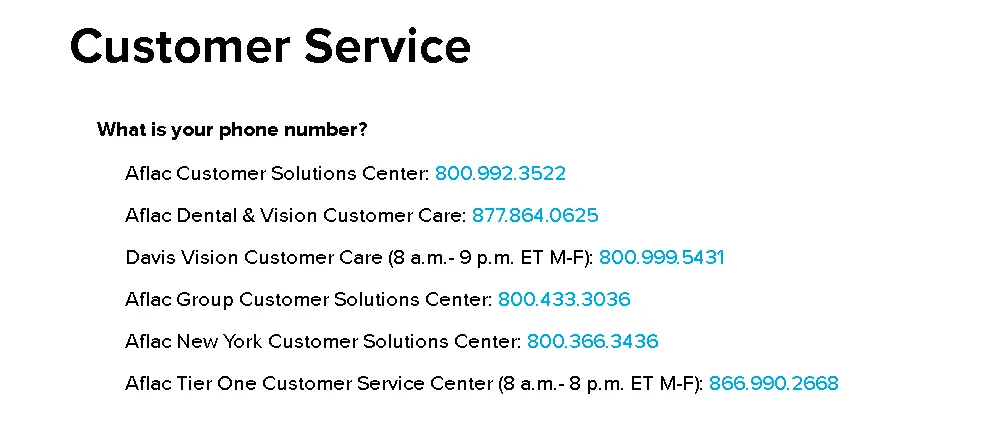

Call 800-992-3522 and request to talk with a customer support representative.

Step 2

Have your policy number and customer information handy. You will need to give these to prove your identity.

Step 3

Let the agent know you want to cancel your coverage and any recurring payments.

Confirmation: Once your cancellation has been processed, you will receive a confirmation letter or email.

Via Online Form

Step 1

Create a free DocHub account or use your existing login credentials.

Step 2

Click the 'New Document' button, then drag and drop the Aflac cancellation form or import it from the cloud or through a link.

Step 3

Include text, photos, checkboxes, and other fields. Ensure that all required information is filled out correctly.

Step 4

You can save the changed document, export it to the cloud, print it, or share it with the appropriate parties.

Aflac Refund Policy

Aflac typically does not provide prorated reimbursements for partial months. When you cancel your subscription, your coverage will remain active until the conclusion of the current monthly cycle. Aflac may refund your annual premium paid for the rider, the policy, and other linked benefit riders. Any paid-out claims will lower this value.

If your policy has a return-of-premium rider, you may be entitled to a refund of premiums paid minus any claims paid. Contact Aflac for particular information on your coverage. Ensure you receive a confirmation letter or email from Aflac to avoid future billing concerns. This confirmation provides proof that your policy has been canceled.

How Much You Can Save After Canceling Your Aflac Subscription?

Canceling your Aflac subscription might lead to significant savings. Here's a sample breakdown:

Monthly Premium: You can save up to $50 monthly for your Aflac policy.

Annual Savings: By canceling, you will save $50 x 12 = $600 per year.

Extra Savings: Any extra riders or insurance you cancel will boost your overall savings.

Where To Invest That Amount?

After canceling your Aflac policy, consider investing the money you saved. Here are a few choices:

High-yield savings account

A high-yield savings account is a sure way to save money and receive more interest than a regular one. It is suitable for short-term savings and emergencies.

Retirement Accounts

One can either create or contribute to a Roth or Traditional IRA Account. Both businesspersons and independent persons affectionately adopt these in terms of taxes; they should be used for future needs, such as creating a fund for use after the person has retired.

Stock Market

This is less costly than investing in the stock exchange, where the long-term effects of the investment are considered. Moderation and consulting a financial advisor are recommended to understand the persuasive risks and goals.

Certificates of Deposit (CDs)

Almost all CDs are fixed-interest and characterized by maturity dates. They are categorized as low-risk intended medium-term savings.

Alternatives To Aflac

If you still need insurance coverage but want to cancel your Aflac policy, here are some options:

Other Supplemental Insurance Providers

Consider additional providers, including Colonial Life, MetLife, and Allstate Benefits. They provide comparable supplemental insurance packages that better fit your needs.

Employer-sponsored insurance

Check to see if your work provides extra insurance choices. Employer-sponsored plans offer more extensive coverage at a reduced cost.

Health Savings Accounts

If you have a high-deductible health plan, an HSA can be a tax-efficient way to save for medical bills. Contributions are tax-deductible, while withdrawals for eligible medical costs are tax-free.

Conclusion

Canceling your Aflac subscription is a simple step that can result in significant savings. You can improve your financial situation by reinvesting your savings or pursuing other financial objectives. If you need additional help managing your funds or researching investing opportunities, contact Beem's financial assistance services. Beem provides experienced assistance to help you manage your financial path and make sound decisions. Schedule a free appointment with one of Beem's financial advisors for more financial insights and personalized assistance.

AFLAC COLUMBUS

AFLAC INSURANCE PPD ID: 1580663085

AFLAC NEW YORK PAYMENTS PPD ID: C520807803

AFLAC COLUMBUS OT 706-3233431 GA

AFLAC 8009923522 GA

AFLAC COLUMBUS PAYMENTS

AFLAC

AFLAC COLUMBUS PAYMENTS PPD ID: C580663085

AFLAC COLUMBUS 800-992-3522 GA

AFLAC INSURANCE

AFLAC NEW YORK PAYMENTS PPD ID: C520807803

AFLAC COLUMBUS PAYMENTS

AFLAC COLUMBUS PAYMENTS PPD ID: C580663085

Aflac