How to Cancel Penn Mutual

Subscription in Few Steps

Need to cancel your Penn Mutual subscription? Learn how to do it in a few easy steps and manage your finances effectively.

Penn Mutual provides a variety of policies tailored to address different financial requirements. Despite the flexibility and benefits, changing financial circumstances could make you consider canceling your subscription, finding a more cost-effective policy elsewhere, or no longer needing coverage. Whatever the reason, understanding how to cancel your policy efficiently is essential to avoid unnecessary costs and complications.

Methods of Cancellation

To cancel your Penn Mutual subscription, follow these steps:

Step 1

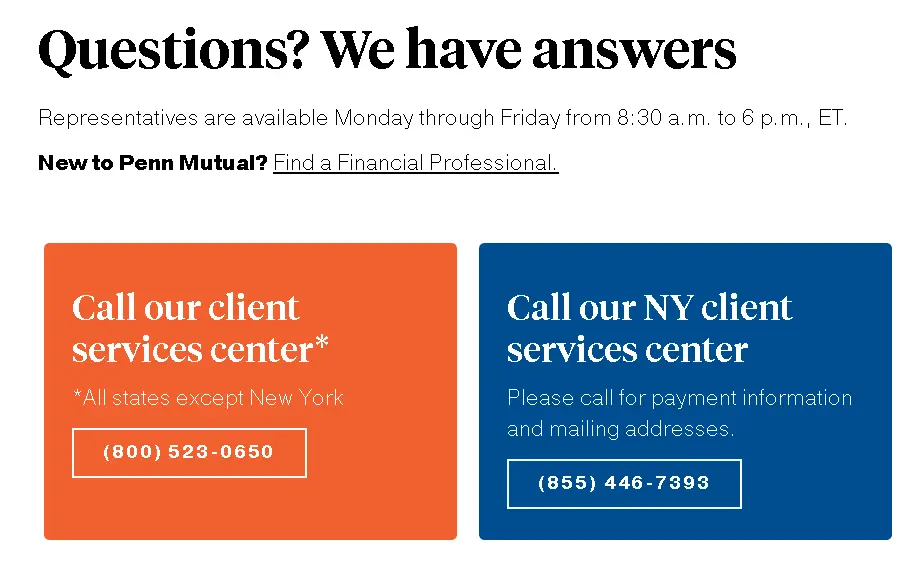

Dial 800-523-0650 to reach Penn Mutual's customer service department. New York should must call 855-446-7393. Call during business hours for a quicker response.

Step 2

Ask to speak directly with a representative who can assist with your cancellation request. This step is crucial to ensure that your request is handled correctly.

Step 3

You will need to provide your policy number and other customer details. Having this information ready will make the process smoother.

Step 4

Clearly state that you wish to cancel your policy and stop all recurring payments. The representative will guide you through the process and confirm your request.

Step 4

After completing the steps, you should receive a confirmation letter or email. This document will serve as proof that your policy has been canceled.

Penn Mutual Refund Policy

If you cancel your Penn Mutual subscription, you may be eligible for a refund, depending on the terms of your policy. Typically, if you cancel within a certain period after purchasing the policy, known as the "free look" period, you may receive a full refund of any premiums paid. After this period, refunds may be prorated based on the time remaining on the policy.

How Much Can You Save After Canceling Your Penn Mutual Subscription

The amount you can save after canceling your Penn Mutual subscription depends on the type of policy and premiums you are paying. For instance, if you were paying $100 monthly for a term life insurance policy, canceling the subscription would free up $1,200 annually. Over the years, this amount could add up, allowing you to reallocate these funds toward other financial goals.

Where to Invest That Amount

Emergency Fund

Allocate your savings to an emergency fund. This fund should cover at least three to six months of living expenses, providing a financial cushion in case of unexpected events.

Retirement Accounts (IRA or 401(k))

Contribute to your IRA or 401(k) to grow your retirement savings. These accounts offer tax benefits and help secure your financial future.

Stock Market Investments

Consider investing in the stock market through individual stocks, mutual funds, or ETFs. With time, these investments can yield significant returns.

Real Estate Investment

Invest in real estate by purchasing property or investment trusts (REITs). Real estate can be a stable and profitable investment.

Alternatives to Penn Mutual Subscription

If you're canceling your Penn Mutual subscription but still need life insurance services, here are three alternatives to consider

Northwestern Mutual

Northwestern Mutual offers a variety of life insurance policies, including term, whole, and universal life insurance. Their policies are known for their flexibility and strong customer support. Monthly premiums start at around $25 for term life insurance, depending on age and coverage amount.

New York Life

New York Life provides customizable life insurance options, including term, whole, and variable universal life insurance. They are recognized for financial stability and comprehensive policy features. Term life insurance policies start at approximately $30 per month, with options to convert to permanent life insurance later.

Prudential

Prudential offers various life insurance products, including term life and indexed universal life insurance. They are well-regarded for their policy flexibility and living benefits. Term life insurance policies start at around $20 per month, offering affordable coverage with options to adjust as your needs change.

Conclusion

Canceling your Penn Mutual subscription is a significant step that can free up funds for other financial goals. Whether you decide to save, invest, or explore alternative insurance options, making choices that align with your current and future needs is essential. Tools like Beem can help you manage your finances, track savings, and find better health insurance plans to protect you without overextending your budget. Taking a proactive approach to your financial health can lead to greater peace of mind and long-term security.

PENN MUTUAL LIFE INSPAYMENT

Penn Mutual Insurance

Penn Mutual Insurance Co

Penn Mutual Life Ins Co

AUTOMATIC, PENN MUTUAL LIFEINSPAYMENT PPD

PreDebit PENN MUTUAL LIFE INSPAYMENT

PENN MUTUAL LIFE

Penn Mutual Life Insurance Co

PENN MUTUAL LIFE INSPAYMENT 200108 115663520010801 HEATHER A BOOTHMAN

PENN MUTUAL LIFE INSPAYMENT CO REF- 114063519080102

PENN MUTUAL LIFE INSPAYMENT 200508 115663520050802 HEATHER A BOOTHMAN

PENN MUTUAL LIFE INSPAYMENT CO REF- 114063520050102

PENN MUTUAL LIFE INSPAYMENT 200908 115663520090802 HEATHER A BOOTHMAN

PENN MUTUAL LIFE INSPAYMENT 181015 113893018101501 WENDY C VILLALTA FLORE

PENN MUTUAL LIFE INSPAYMENT CO REF- 114063519010202

PENN MUTUAL LIFE INSPAYMENT 190617 113893019061701 WENDY C VILLALTA FLORE