How to Cancel Simplyhealth

Subscription in Few Steps

Need to cancel your Simplyhealth subscription? Learn how to do it in a few easy steps and manage your finances effectively.

According to Statista, nearly 304 million people in the United States had some health insurance in 2022. Simplyhealth is a health insurance provider offering medical and dental plans to individuals and companies. Let's discuss refund policies, alternatives, and investment options after Simplyhealth's cancellation!

Methods of Cancellation

Over phone

Step 1

Dial 0370 908 3304.

Step 2

Ask the agent to cancel your subscription plan.

Step 3

When asked, tell him all the relevant account information.

Step 4

Then, the agent will proceed with your request.

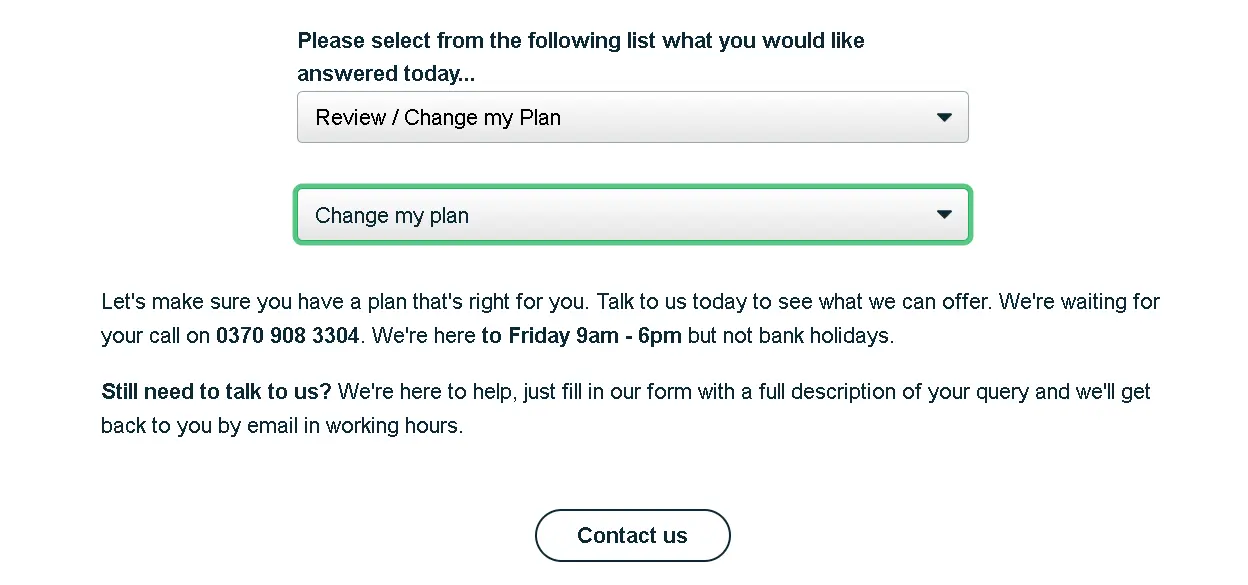

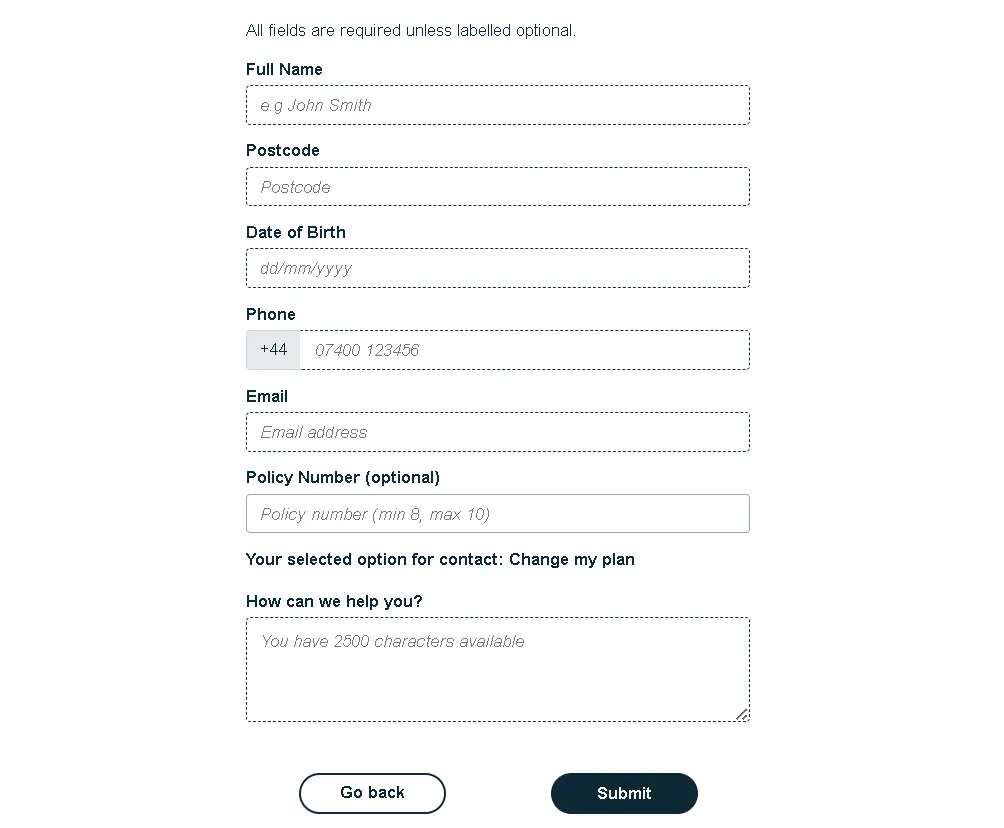

By filling out the form

Step 1

Visit the Simplyhealth website.

Step 2

Go to the Help & Support page.

Step 3

Select ‘review/change the plan’ and then ‘change my plan’.

Step 4

Tap on the Contact Us button.

Step 5

Fill out the cancellation form by including the necessary details.

Step 6

Once filled, they will email confirmation.

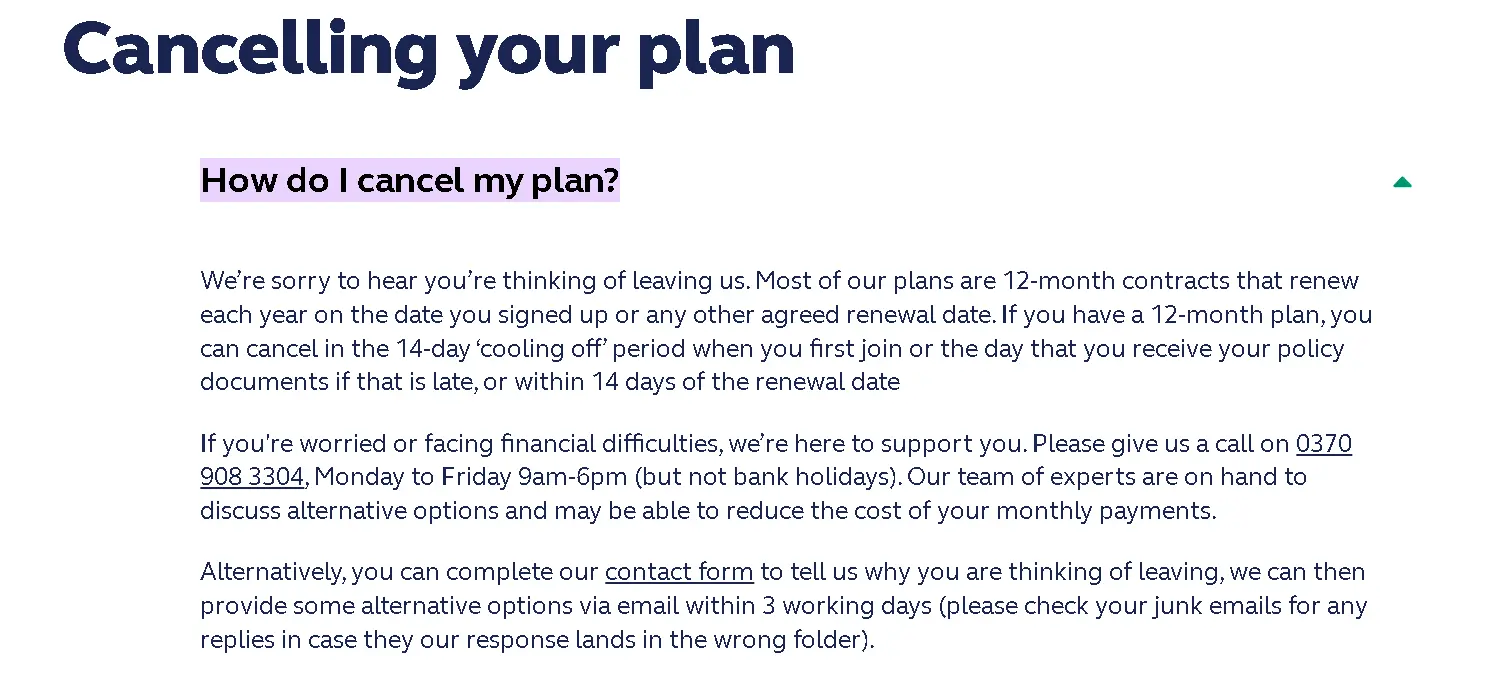

Simplyhealth Refund Policy

Simplyhealth has a distinct refund policy for canceled subscriptions. If you cancel within the cooling-off period—usually fourteen days from the beginning day of your policy—you will be refunded completely if no claims have been made. Refunds are usually only given for cancellations during this period. It would help to review your plan's terms and conditions since policies might change.

How Much Can You Save After Canceling Your Simplyhealth Subscription

The amount you can save by canceling your Simply Health subscription depends on the premium cost and the type of plan. Simply Health plans range between $20 and $60 per month. For instance, canceling a plan with a $60 monthly premium would save you up to $720 every year. These savings could be huge, especially if some services covered under the plan are underutilized.

Where to Invest That Amount

ETFs: If you are investing in single stocks or ETFs, it can provide huge earnings.

High-Yield Savings Accounts: These accounts give higher rates of interest than ordinary savings accounts.

Index Funds: They have low expense ratios compared to other funds; furthermore, they offer consistent performance, which makes them perfect for passive investors.

Alternatives to Simplyhealth

Health Shield

Health Shield's range covers cash plans for healthcare and provision for well-being. These may cater to different types of healthcare expenditures, including dental care, eye treatment costs, and physiotherapy payments, among others. In addition to this, Health Shield also assists people with mental illness and offers wellness programs that promote general good health.

Westfield Health

Westfield Health provides a range of services, including cash health plans, private medical insurance (PMI), and mental health support. They focus on helping employees attain better health so they can perform more efficiently by covering routine healthcare expenses like accessing medical specialists or wellness resources.

Conclusion

If you cancel your Simplyhealth subscription, here is what you can do with the saved amount. You can invest in another service, use the money for loans and insurance, or send it to your bank account. Beem can help you with payments, personal loans, credit monitoring, and other financial aspects.

SIMPLYHEALTH 18546275

SIMPLYHEALTH 18637339

SIMPLYHEALTH 10244460

SIMPLYHEALTH 00604696

SIMPLYHEALTH, FIRST PAYMENT

SIMPLYHEALTH ACCESS T/A SIMPLYHLT

BANK CREDIT SIMPLYHEALTH

SIMPLYHEALTH ACCES

SIMPLYHEALTH 604696

SIMPLYHEALTH, INITIAL PAYMENT

SIMPLYHEALTH

SIMPLYHEALTH 600117 45616442

Simplyhealth Access t/a Simplyhlt

SIMPLYHEALTH FIRST PAYMENT

Simplyhealth Acces

SIMPLYHEALTH INITIAL PAYMENT

SIMPLYHEALTH REF 18800679

SIMPLYHEALTH 17529659 DDR

SIMPLYHEALTH 18483990 DDR

SIMPLYHEALTH 18338728 DDR

SIMPLYHEALTH 19116940 DDR

SIMPLYHEALTH REF 18490016

SIMPLYHEALTH REF 18902171

SIMPLYHEALTH 13769634 DDR

SIMPLYHEALTH 10031082 DDR