How to Cancel Root Insurance

Subscription in Few Steps

Need to cancel your Root Insurance subscription? Learn how to do it in a few easy steps and manage your finances effectively.

Root Insurance offers innovative, use-basis car insurance policies. However, you may need to cancel your policy for various reasons. This guide will walk you through the methods of cancellation, explain Root's privacy and refund policy, discuss how much you can save after canceling, suggest where to invest that amount, and present some alternatives to Root Insurance.

Methods of Cancellation

Canceling your Root Insurance policy is straightforward. Here are the steps you need to follow:

Via App

Open the app and navigate to the 'Policy' section. Select 'Cancel Policy' and follow the prompts to complete the cancellation process.

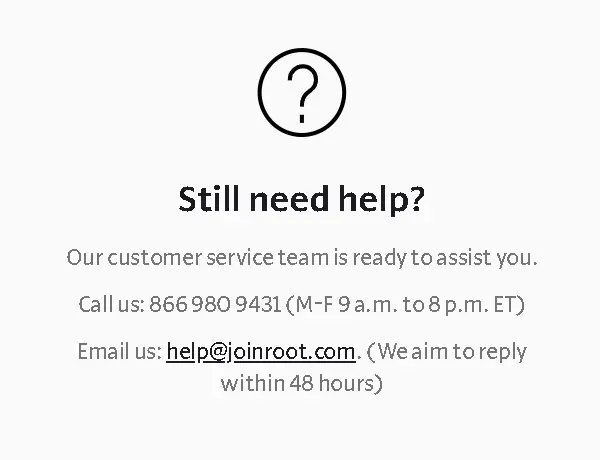

You can also email Root Insurance's customer support at [email protected]. Include your policy number, the reason for cancellation, and your contact information.

Phone

If you prefer speaking to a representative, call Root Insurance at 1-866-980-9431. Be prepared with your policy details and personal information for verification.

Information Needed for Cancellation

When contacting Root Insurance for cancellation, have the following information ready:

Policy number

Full name and contact information

Reason for cancellation

Preferred cancellation date

Confirming Cancellation

After initiating the cancellation, ensure you receive a confirmation email or notification. This confirmation will detail the effective date of the cancellation and any applicable refund or outstanding balance information.

Privacy and Refund Policy

Root Insurance is committed to protecting your personal information. Even after you cancel your policy, Root continues to safeguard your data according to its privacy policy. It collects and stores personal information necessary for providing insurance services, and even after cancellation, your data is handled securely to prevent unauthorized access or misuse.

Root Insurance's refund policy is generally straightforward:

Prorated Refunds: If you cancel your policy before the end of the term, you may be eligible for a prorated refund of the unused premium. The refund amount depends on how much of the policy period has elapsed.

Payment Method: Refunds are typically issued using the original payment method used for the policy.

Processing Time: Allow up to 30 days for the refund to be processed and reflected in your account.

How Much You Can Save After Canceling Your Root Insurance

Canceling your Root Insurance policy can lead to significant savings, especially if you move to a cheaper provider or no longer require specific coverage. Here's an example of potential savings:

Monthly Premium: If your monthly premium is $100, canceling your policy can save you $1,200 annually.

Usage-Based Refunds: With Root's usage-based insurance, if you drive less than anticipated, you might receive a partial refund based on your reduced mileage and driving behavior.

Where to Invest that Amount

Once you've saved money from canceling your Root Insurance policy, here are some suggestions on where to invest it:

Savings Account

Put the savings in a high-yield savings account to earn interest.

Investments

Consider potentially investing in stocks, bonds, or mutual funds to grow your savings.

Retirement Fund

Contribute to your retirement savings plan, such as an IRA or 401(k).

Emergency Fund

Build or replenish your emergency fund to cover unexpected expenses.

Debt Repayment

Pay off high-interest debts, such as credit cards or personal loans, to reduce financial burden.

Home Improvements

Invest in necessary home repairs or improvements to increase your property's value and comfort.

Alternatives to Root Insurance

If you're looking for alternatives to Root Insurance, consider these options:

Geico

Known for competitive rates and extensive coverage options, Geico offers various discounts and a user-friendly mobile app.

Progressive

Progressive's Snapshot program provides usage-based insurance similar to Root and a wide range of policy options.

State Farm

Offers personalized service through local agents and a comprehensive range of insurance products.

Allstate

It features usage-based insurance through its Drivewise program and provides numerous discounts for safe driving and multiple policies.

Conclusion

Canceling your Root Insurance policy is straightforward and can lead to significant savings. Understanding the cancellation methods, privacy and refund policies, and exploring alternatives ensures a smooth transition. You can invest in financial or practical areas that enhance your overall financial health with the money saved. Whether you switch to another insurer or reallocate your funds, making informed decisions will benefit your long-term goals.

ROOT INSURANCE OH 07/28

ROOT INSURANCE OH

ROOT INSURANCE 6149150703

ROOT INSURANCE O

ROOT INSURANCE 6149150703 OH

ROOT INSURANCE 6149150703 OH 0000

ROOT INSURANCE 6149150703 OHUS

ROOT INSURANCE US

ROOT INSURANCE OH 6149150703

ROOT INSURANCE 2938

ATM ROOT INSURANCE ROOT INSURANCE

Recurring Pymt ROOT INSURANCE OH #9709

ROOT INSURANCE 6149150703 OH US

ROOT INSURANCE / OHUS

ROOT INSURANCE 6149150703 OH 0000 445388685999

Root Insurance Co