How to Cancel Earnin

Subscription in Few Steps

Need to cancel your Earnin subscription? Learn how to do it in a few easy steps and manage your finances effectively.

EarnIn is a financial services company that provides earned wage access services and lets you access your money as you earn it. Canceling your Earnin subscription could seem confusing; however, it is relatively easy if you understand the steps. Here is a step-by-step guide on how to cancel Earnin, the refund policy, the amount of money one can save using Earnin, investment tips on the money earned through Earnin, and other apps similar to Earnin.

Methods of Cancellation

To cancel your Earnin subscription, take the following steps

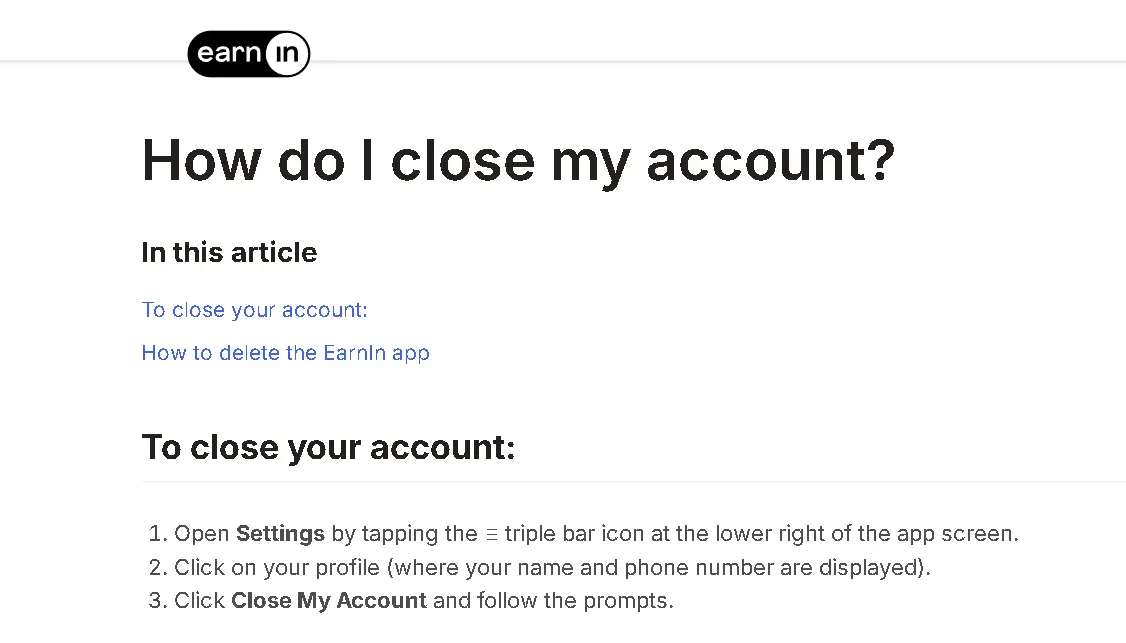

Closing Your Account via the App

Step 1

To open settings, tap the triple bar symbol at the lower right of the app screen.

Step 2

Click on your profile to display your name and phone number.

Step 3

Click "Close My Account" and follow the steps to finish the cancellation procedure.

Pending Debits and Considerations

Cancel Pending Debits

You can cancel pending debits before processing. Remember that if you cancel any ongoing debts, you can only utilize Earnin's services or open a new account once they are reimbursed.

Support Access

If your account has already been closed, please get in touch with support by touching the question mark symbol in the upper right corner of the Earnin app login screen.

Failed Debit Requests

If a debit request is unsuccessful after your account is closed, you will receive an email or push warning regarding future debit attempts.

Post-Closure Considerations

Account Access

You cannot review debit data or other information once your account is closed.

Tip Yourself Balances

Any remaining Tip Yourself balances will be automatically transferred to the associated bank account. If Earnin cannot send funds to your associated bank, they will arrange for a paper cheque delivery.

Reopening Accounts

Closed accounts cannot be opened again. To utilize Earnin's services again, you must establish a new account. It is important to note that you cannot use the exact banking details on your old Earnin account for 30 days after the last transaction occurred.

Confirmation

Earnin will email you an email confirmation after terminating your account.

Earnin' Refund Policy

The app's accessible earnings show how much you earn during a specific pay period. You can transfer your entire pay period, and Earnin will only debit the amount you moved on your payday. Tips made to Earnin are not refundable as they are voluntary contributions, not mandated payments.

How Much Can You Save After Canceling Your Earnin Subscription?

If you utilize Earnin to access $100 of your earnings early per pay period and tip $5 each time, you could tip roughly $10 monthly. By canceling your Earnin subscription, you save $10, multiplied by 12 months, which equals $120 annually.

Avoiding Earnin can save you money on overdraft fees and other financial goods. Managing your finances without relying on payday loans may enhance your financial discipline and savings.

Where to Invest That Amount?

After canceling your Earnin subscription, consider investing your savings to improve your financial situation. Here are a few choices

High-Yield Savings Account

A high-yield savings account has a slightly higher interest rate than the standard one, but it saves money and is highly secure for creating an emergency fund.

Retirement Accounts

Saving for a Roth or Traditional IRA is helpful since the premiums are taxed, and it has a good increase in the long run.

Stock Market

Evidence indicates that diversification is beneficial in increasing an investment's long-term returns. Consider investing in a robo-advisor or consulting a financial advisor.

Certificates of Deposit (CDs)

CDs are considered low-risk methods of investing for medium-term savings.

Alternatives to Earnin

If you need financial flexibility but are canceling Earnin, consider these alternatives

Employer-Sponsored Financial Assistance

Some firms provide fee-free early access to earnings through financial wellness programs.

Credit Unions

Credit unions typically offer cheaper interest rates and better loan conditions, including payday advances.

Budgeting Apps

Apps such as Mint, YNAB (You Need A Budget), and PocketGuard can improve financial management and reduce the need for payday advances.

Traditional Loans

Consider obtaining a small bank or credit union loan. These often offer lower interest rates than payday advances.

Conclusion

Earnin, like any other application, can be canceled, which may lead to financial savings and increased control over one’s budget. You can invest your money back or chart other goals to improve your financial situation. For further assistance with your funds or investing inquiries, kindly consult Beem Financial Assistance Services. Schedule a free appointment with one of Beem's financial consultants for more financial insights and personalized assistance.

EarninActivehour

EarninActivehour PAYMENTRET

Earnin-Activehours

EARNIN-ACTIVEHOURS CA

EarninActivehour PAYMENTRET 0002121486

EarninActivehour VERIFYBANK

EarninActivehour PAYMENTRET 0012114039

EarninActivehour - PAYMENTRET

Earnin - Activehours

EARNINACTIVEHOUR PAYMENTRET CO REF

EarninActivehourPAYMENTRET

EarninActivehour/PAYMENTRET

Electronic / EarninActivehour - PAYMENTRET

PreDebit EarninActivehour PAYMENTRET

EarninActivehour PAYMENTRET Electronic