How to Cancel Empower Bank

Subscription in Few Steps

Need to cancel your Empower Bank subscription? Learn how to do it in a few easy steps and manage your finances effectively.

Empower Bank is a digital banking platform in the USA created to allow individuals to manage their finances efficiently. It is equipped with a list of services that include current and savings accounts, budgeting tools, and finance planning resources. The bank has a monthly subscription model. You can cancel your Empower Bank subscription by changing your membership status or shutting down your account. Let's read this blog post and learn more!

Methods of Cancellation

To cancel Empower Bank, follow the below steps:

Step 1

Download the Empower Bank app.

Step 2

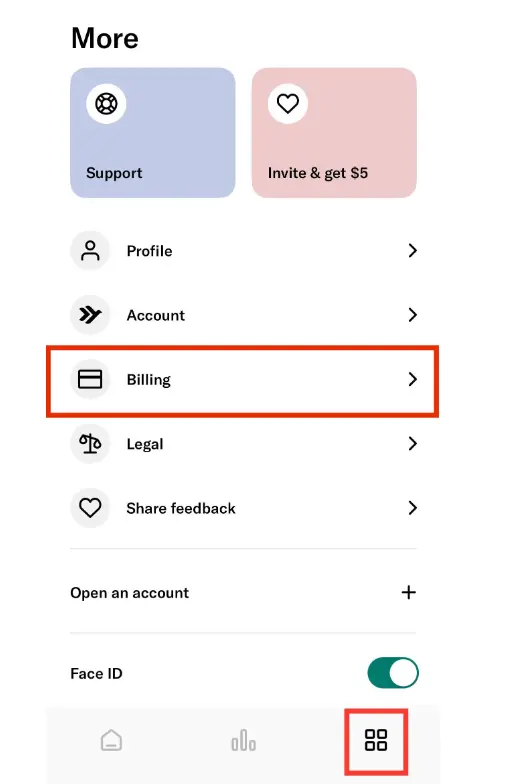

Visit the More section at the bottom right corner of your app.

Step 3

Then tap on 'Billing'.

Step 4

Click on 'Cancel subscription.'

Step 5

Finally, follow the instructions to cancel the subscription.

Empower Bank Refund Policy

Empower Bank does not refund money if you cancel your subscription. Nevertheless, during this period, you will maintain access to premium features and won't be charged for subsequent periods.

How Much Can You Save After Canceling Your Empower Bank Subscription

Significant savings can result from discontinuing your Empower Bank subscription. Here is how:

If you cancel a subscription, you can save $8 per month, totaling $96 annually.

In addition, you can save 0.49% and 0.89% on fees.

Thus, by canceling your account, these charges shall be avoided; hence, you will free up such money for other financial goals or investments that could save hundreds yearly.

Where to Invest That Amount

Once you have canceled your Empower Bank subscription, there are different options for investment of this saved amount:

Savings Account: Put your savings into a high-yield savings account that offers reasonable interest rates.

Micro-Investing Apps: Appreciating micro-investment platforms enables regular investment in tiny amounts.

Index Funds: Go for index funds that track particular market indices, giving diversification and reduced charges.

Alternatives to Empower Bank

If you're searching for alternative sites for Empower Bank, consider the options below:

Viva Payday Loans

Viva Payday Loans offers lenders short-term loans totaling $5000. It is designed to cater to urgent financial needs with a simple application process and quick approval.

Prestamos USA

Prestamos USA provides personal and business loans with flexible terms and competitive rates. This institution focuses on people in communities that were not well served by traditional financial institutions.

Beem

In emergency cases, Beem allows users to get an overdraft limit of up to $1000 without any associated interest charges. Clients must pay a subscription fee to access this service, making it a reliable option during unexpected money situations.

Conclusion

The money you preserve by canceling Empower Bank can be invested in personal loans, identity insurance, subscriptions for other platforms, or health benefits. Try Beem and find options to budget your funds, monitor and grow credit scores, and more!

Empower