How to Cancel EveryDollar

Subscription in Few Steps

Need to cancel your EveryDollar subscription? Learn how to do it in a few easy steps and manage your finances effectively.

EveryDollar is a budgeting app that helps you track your income and expenses. It has features for budgeting, saving, and tracking. Over 10 million users have used it to manage their finances.

If you need help with the steps to cancel your EveryDollar subscription, this blog is for you! Identify steps for subscription cancellation, EveryDollar refund policy, and the money you can save by canceling this dating platform's subscription.

Methods of Cancellation

Canceling your EveryDollar subscription is a straightforward process. If you would like to cancel your subscription, then follow the below steps:

Cancel via website

Step 1

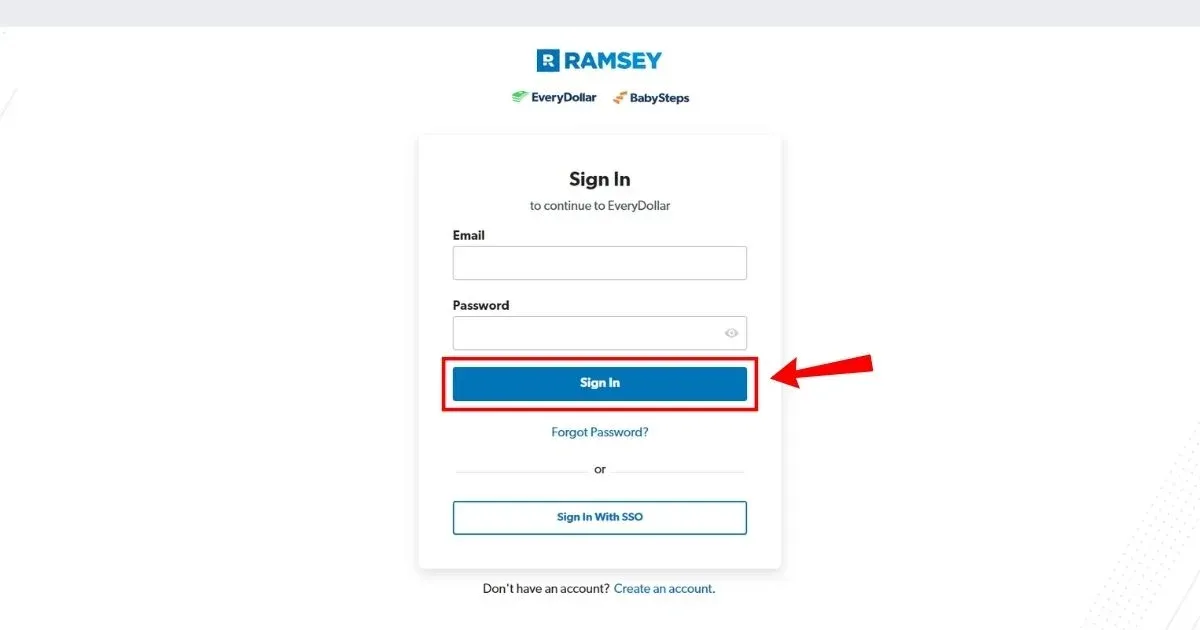

Login into your EveryDollar Account.

Step 2

Go to the Settings.

Step 3

Select the Manage Subscription option.

Step 4

Tap on the auto-renew.

Step 5

Confirm your cancellation.

EveryDollar Refund Policy

EveryDollar has a clear refund policy for its Premium subscriptions.

Annual Premium Subscription: 30 days available till the last charge.

Monthly Premium Subscription: Only the initial month's fee is returnable within 30 days from that charge date; however, monthly subscription renewal fees are not refundable, though they can be canceled anytime.

How Much You Can Save After Canceling Your EveryDollar Subscription

Depending on your plan, there can be substantial savings upon cancelation of your subscription to EveryDollar. Here's how much:

Monthly Plan: If you use the monthly plan, you could save roughly $12.99 per month.

Annual Plan: For those using the annual plan, canceling could save approximately $129.99 annually.

These savings add up over time, thus creating a significant sum that can be used for other investments or financial goals.

Where to Invest That Amount

Retirement Accounts

Please put it in retirement accounts such as 401 (k) or IRA. These usually provide tax advantages and the power of compounding interest, which secures future earnings.

Stocks

Invest in individual stocks of companies with robust future growth prospects. Although risky, they could provide substantial profits and increase portfolio diversification opportunities.

Alternatives to EveryDollar

Quicken

Quicken is personal accounting software that helps people effectively manage their finances. This software package includes features like budgeting, bill paying, investment tracking, and tax preparation. The software allows the creation of financial reports, setting objectives, and making informed decisions related to personal finance.

Mint

Mint is a well-known personal finance manager that supports expense classification, outlay control, and portfolio management. In other words, it unifies financial information from different accounts into one view, giving a holistic insight into the state of your finances. It strives to make life easier for those who struggle with money by providing bill reminders and online budgeting tools.

Conclusion

EveryDollar offers users a streamlined way to track expenses and maintain a budget. Canceling your EveryDollar subscription can help you save funds for emergencies and investments. Small savings are significant achievements for the future. If you want to start an intelligent financial journey or dive deep into one, Beem is just the right place! This digital wallet will help you with personal loans, car loans, emergency funds, credit tracking, and other services!