How to Cancel Revolut Premium

Subscription in a Few Steps

Need to cancel your Revolut Premium subscription? Learn how to do it in a few easy steps and manage your finances effectively.

Although Revolut Premium provides its customers with many useful extras, you may need to terminate your subscription at some point due to unforeseen circumstances. There are only a few easy steps to cancel your Revolut Premium subscription, so it's easy to do when your financial situation changes, your banking demands evolve, or you no longer need the premium services.

In this article, we'll cover everything you need to know about canceling your Revolut Premium subscription, including how to do it, the refund policy (if any), how much money you can save, how to invest it, what alternatives there are, and what you should take away from the whole thing.

Methods of Cancellation

If you would like to terminate your Revolut Premium membership, please do the following:

Step 1

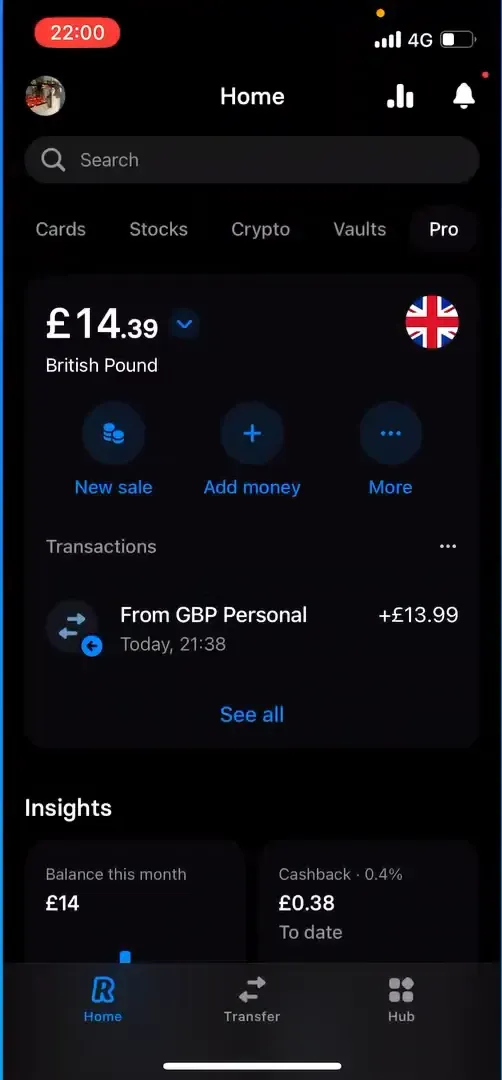

Open the Revolut app

Step 2

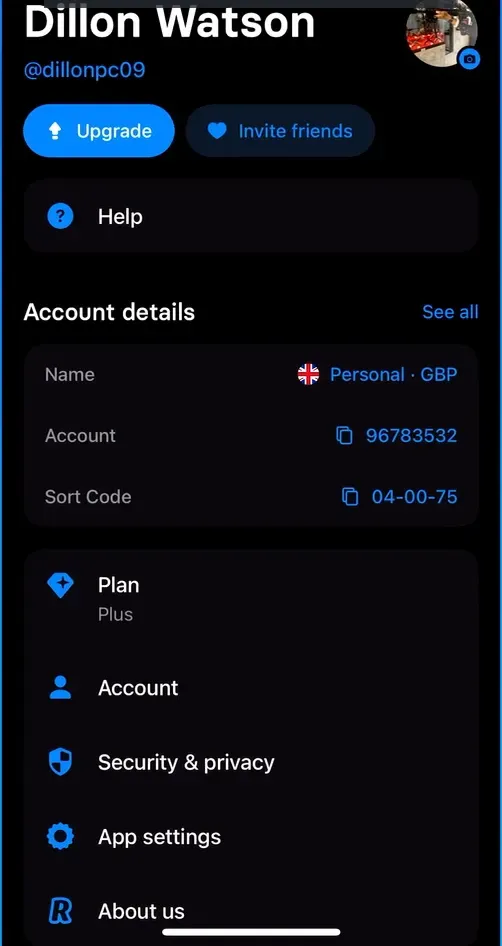

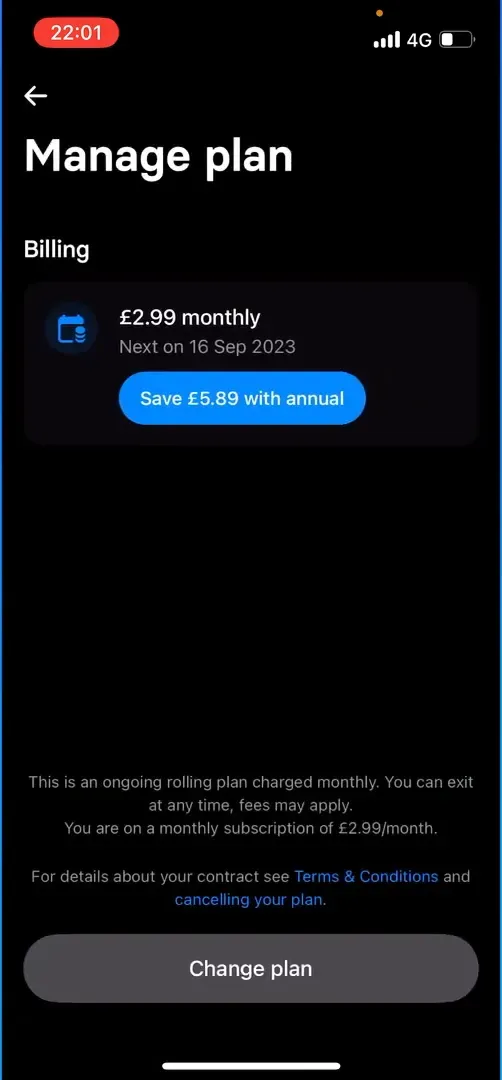

Go to your Profile and Click Plan Button

Step 3

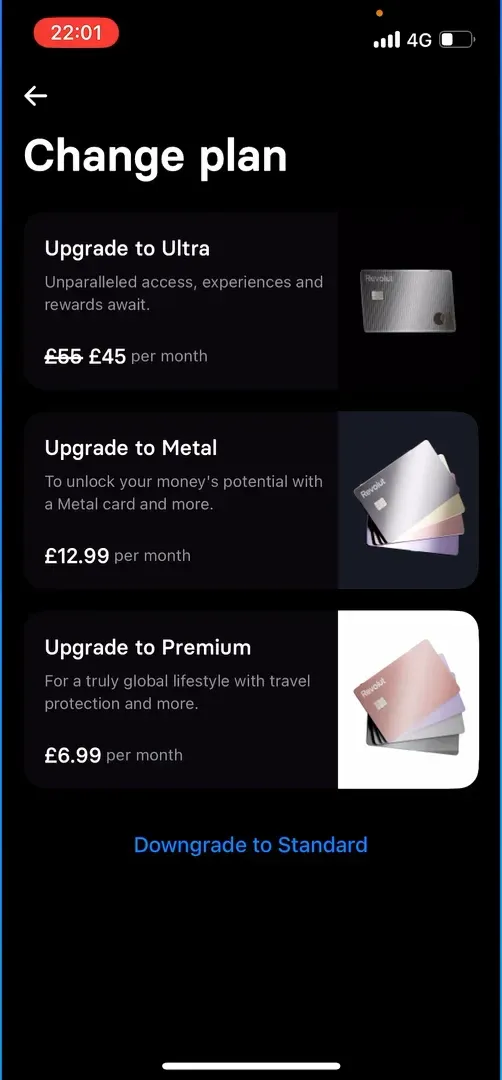

Click on the Change Plan

Step 4

Click Downgrade to Standard.

Step 5

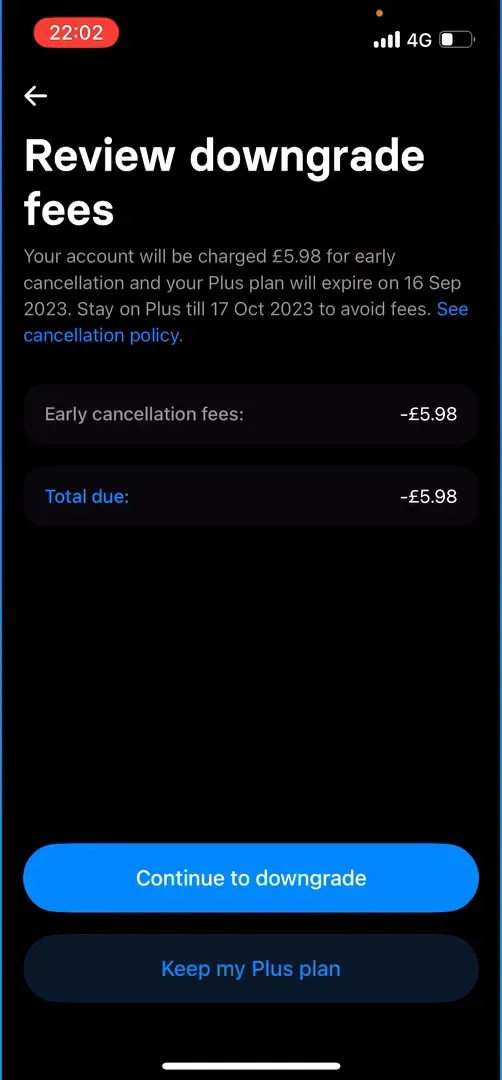

Click on Yes, Proceed with downgrade.

Step 6

Review Your Decision and Continue to Downgrade.

You can also go to the support and Click on 'New chat' in 'Chat with us'. Then Ask Rita to cancel your Revolut Premium subscription.

Revolut Premium Refund Policy

Your subscription plan, the timing of the cancellation, and any terms and conditions included in your agreement can affect Revolut's refund policy for Premium subscriptions. For more information on how to get your money back or if you qualify for a refund, check out Revolut's terms of service or contact customer service. Not all reimbursements are identical and may be subject to restrictions and conditions.

How Much Can You Save After Canceling Your Revolut Premium Subscription?

Since you won't be paying for the premium features and services anymore, canceling your Revolut Premium subscription can result in substantial savings. Your membership plan and the cost of the premium perks you were receiving will determine the exact amount you save. If you reevaluate your banking needs and sign up for a free or standard account, you can use that money toward something else or invest it.

Where to Invest That Amount?

Before you cancel your Revolut subscription, you must consider where to invest your savings to achieve your financial targets.

Diversified Investment Portfolio

Beem aims to structure the investment portfolio of your choice to fit your appetite for risk while also considering your overall financial goals. Various types of investments offer the benefits of insuring yourself against risk and considerably increasing your chances of a return on investment in the long run.

Retirement Planning

Work with Beem to create a thorough retirement plan to ensure financial security in your golden years. With Beem's assistance, you can find the best retirement accounts, establish reasonable savings goals, and maximize your investing plan to reach your retirement objectives.

Education Savings

Be smarter, think ahead, and save money through 529 plans or Coverdell ESAs. With us, you will make the most appropriate and efficient decisions in choosing educational savings options with additional tax benefits to finance college.

Tax-Efficient Investing

Partnering with Beem increases your profit after tax and reduces your tax bill. Combine Beem's strategy with your own, and you'll get a tax-efficient investment. Enjoy enhanced tax savings, and donate more savings by strategically allocating assets to taxable, tax-deferred, and tax-exempt accounts.

Wealth Management Services

Look into Beem's wealth management services to simplify your financial life and maximize your wealth creation tactics. Protect and develop your wealth for years with individualized guidance and solutions from Beem, whether it's estate planning, charity giving, or legacy planning.

Alternatives to Revolut Premium

Here are a few alternatives to consider:

Traditional Banking Services

Buying your place in this fast-paced world can seem daunting. However, we at Beem Services are here to help you transition from purchasing an apartment to a regular bank account so you can take advantage of attractive financial opportunities.

Robo-Advisors

Among the array of robotic investment advisers(robo-advisors), their algorithms aid in automating specific tasks related to portfolio management. He can point you to reliable robo-advisors tailored to your investment goals and secured with round-the-clock monitoring and balancing to ensure your best results.

Financial Planning Apps

Beem suggests several financial planning apps that help with budgeting, investment tracking, and getting tailored financial advice. Beem can assist you in incorporating these applications into your routine to manage your finances and make the most of their features to reach your financial objectives more efficiently.

Credit Unions

Beem can help you join a credit union to take advantage of lower costs, attractive interest rates, and individualized customer care. If you're looking for a credit union that meets all of your requirements in terms of services and benefits, Beem can help you compare your possibilities.

Independent Financial Advisors

Considering your situation, consult one of Beem's independent financial experts for individualized financial advice. Beem can connect you with reliable experts who can help you reach your long-term financial goals and make sense of complicated financial decisions.

Conclusion

A simple way to get financial freedom and save money is to cancel your Revolut Premium subscription. With Beem's support, you can maximize your finances and reach your long-term goals by following the suggested steps and investigating other banking and investing choices. To ensure you're financially prepared for the future, check out Revolut's return policy, reevaluate your banking needs, and invest your savings smartly. You can achieve your financial goals and take charge of your situation with the correct techniques and help.