How to Cancel SmartCredit

Subscription in Few Steps

Need to cancel your SmartCredit subscription? Learn how to do it in a few easy steps and manage your finances effectively.

Innovative Credit is a personal finance management tool that helps users monitor credit scores, track expenses, and get identity protection alerts. However, if you're considering switching services or cutting costs, you might cancel your SmartCredit subscription. Here's how to do it effectively and explore options afterward.

Methods of Cancellation

There are multiple ways to cancel your SmartCredit subscription, so you can choose the most convenient method.

Online Cancellation

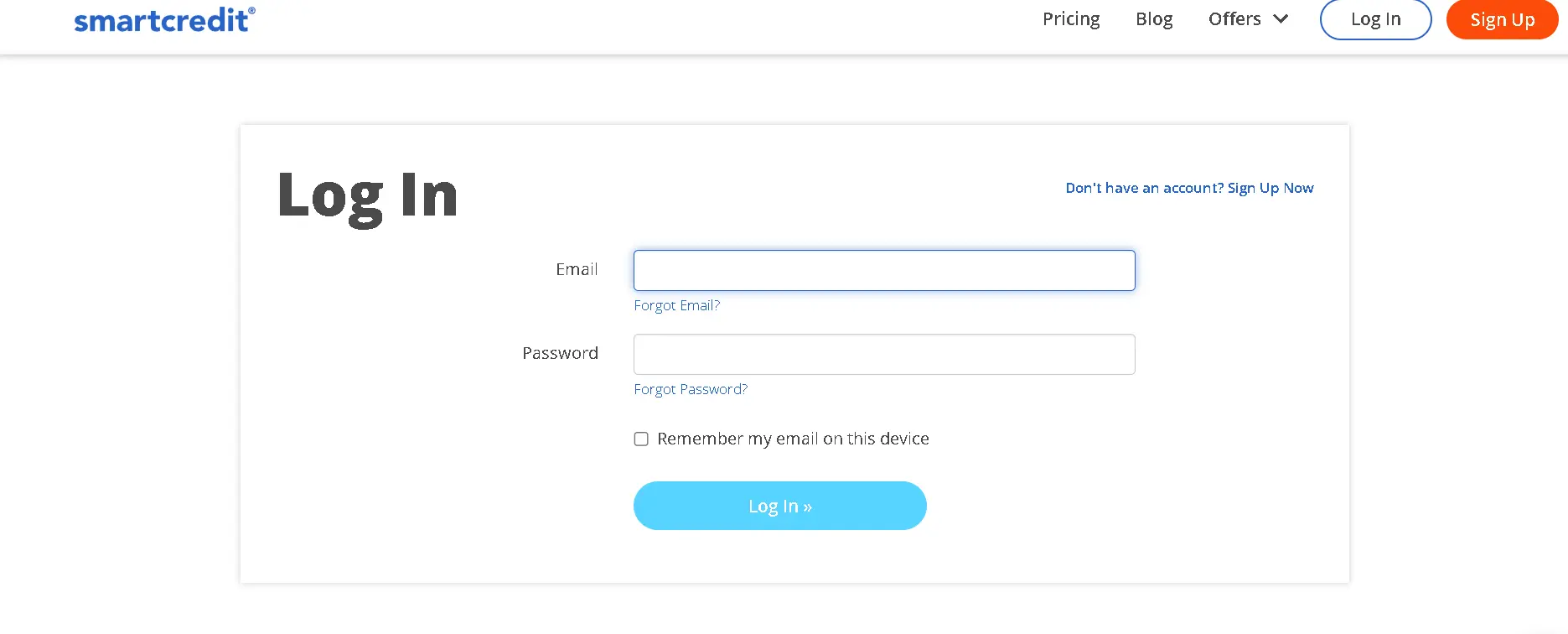

Step 1

Log in to your SmartCredit account.

Step 2

Navigate to the "Account Settings" section, where you'll find the option to manage your subscription.

Step 3

Follow the prompts to cancel, and make sure to confirm.

Phone Call

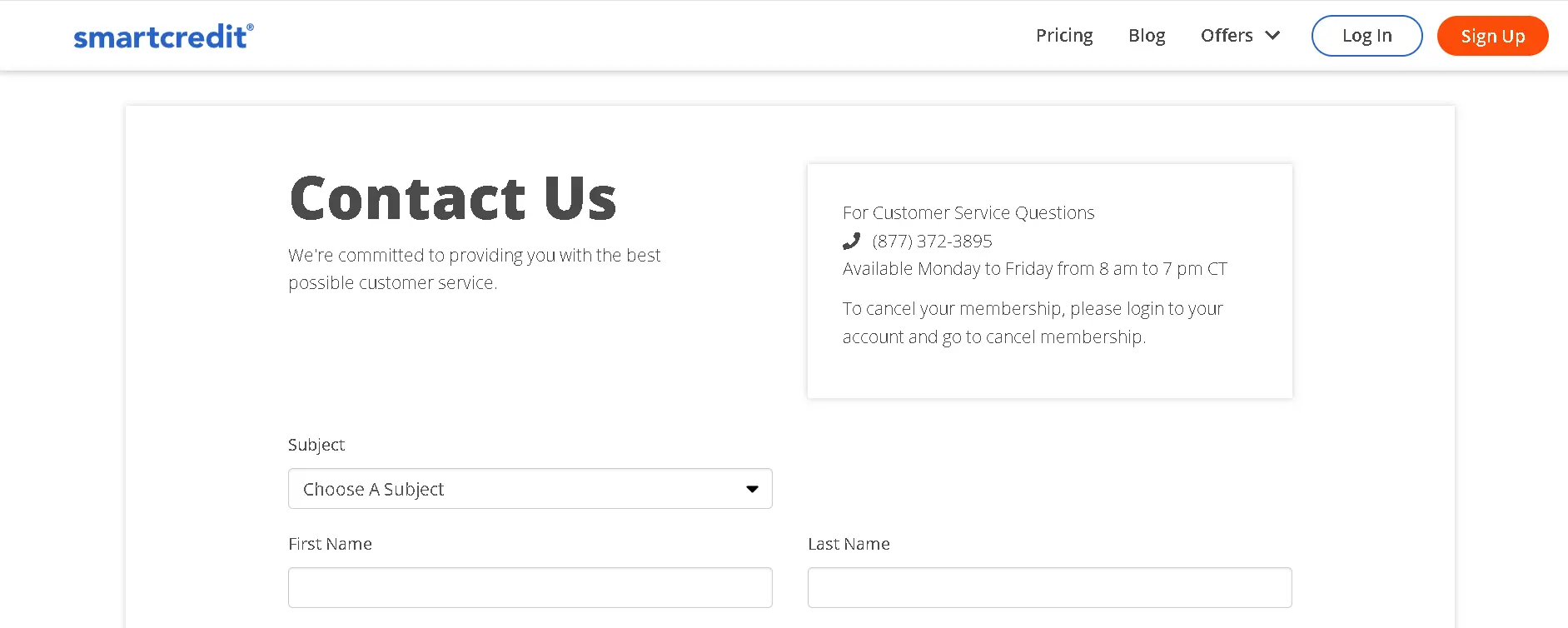

Step 1

Dial (877) 372-3895 to contact SmartCredit's customer service.

Step 2

Be ready to provide your account details to the representative, who will guide you through the cancellation process.

Step 3

Make sure you confirm your cancellation at the end.

SmartCredit Refund Policy

SmartCredit offers a monthly subscription, so refunds generally depend on their terms of service. They often do not issue refunds for partial months once your subscription is billed. However, you won't be charged for the following month if you cancel before the next billing cycle. Check their specific refund policies to see if you qualify for partial refunds.

How Much Can You Save After Canceling Your SmartCredit Subscription

SmartCredit subscriptions range from $20 to $30 monthly, depending on your selected features. By canceling, you could save between $240 and $360 annually. This amount can be allocated to other financial needs or invested elsewhere to add value to your budget.

Where to Invest That Amount

If you're canceling SmartCredit, consider these innovative investment options to maximize your newly saved funds.

Emergency Fund

Save the monthly fee by putting it into an emergency fund, which is essential for unexpected expenses.

Investment Apps

Consider investing $20-$30 monthly in apps like Acorns or Robinhood. Compounding can make even small investments grow substantially over time.

Credit Monitoring Alternatives

Use some savings for affordable credit monitoring with Beem that still meets your needs but is more budget-friendly, such as Credit Karma or other free services.

Alternatives to SmartCredit

If you are looking for more affordable credit monitoring services, here are some alternatives:

Credit Karma

This service provides free credit scores, reports, and insights into your credit health. It's a reliable alternative if you want to keep track of your finances without paying a subscription fee.

Experian Credit Monitoring

Experian offers a basic free plan and a premium version less expensive than SmartCredit, offering a solid option for those wanting to monitor their Credit.

Mint

Mint is a free finance app that helps you manage expenses, budget effectively, and track your credit score—all without monthly subscription costs.

Conclusion

Canceling your SmartCredit subscription can save you up to $360 annually, which you could invest in your financial future. Whether building an emergency fund or using a cost-effective credit monitoring service with Beem, there are multiple ways to use those savings to benefit your financial health. Explore the alternatives above to find the exemplary service that fits your budget and goals.

SMARTCREDIT.COM