How to Cancel FloatMe Subscription in Few Steps

Need to cancel your FloatMe subscription? Learn how to do it in a few easy steps and manage your finances effectively.

With increasing inflation and sinking economies, meeting financial obligations is becoming more challenging daily. During such times, apps like FloatMe can help. They offer consumers small, short-term cash advances automatically debited from their bank accounts on their next payday.

While FloatMe is a fantastic cash app, it has its downsides — especially its high-cost subscriptions. If you do not wish to continue using it, read on to find a detailed guide on everything you need to know to cancel your subscription.

How To Cancel FloatMe in Simple Steps

If you have decided that FloatMe is not for you, this is how you can cancel FloatMe.

Step 1

Before starting the account deletion process, ensure you have all required details, such as login credentials, linked bank accounts, and any pending transactions.

Step 2

You can email FloatMe's customer support team or their in-app support feature to express your desire to delete your account. They might require additional verification for security purposes.

Step 3

Clear any pending transactions or outstanding balances before proceeding with the account deletion. This will help ensure the smooth closure of your account.

Step 4

Inside the FloatMe app, remove any linked bank accounts as a security measure to prevent unauthorized access to your financial information post-deletion.

Step 5

Once you've completed the necessary steps, confirm your decision with FloatMe support. They will assist you with the final procedures to delete your account.

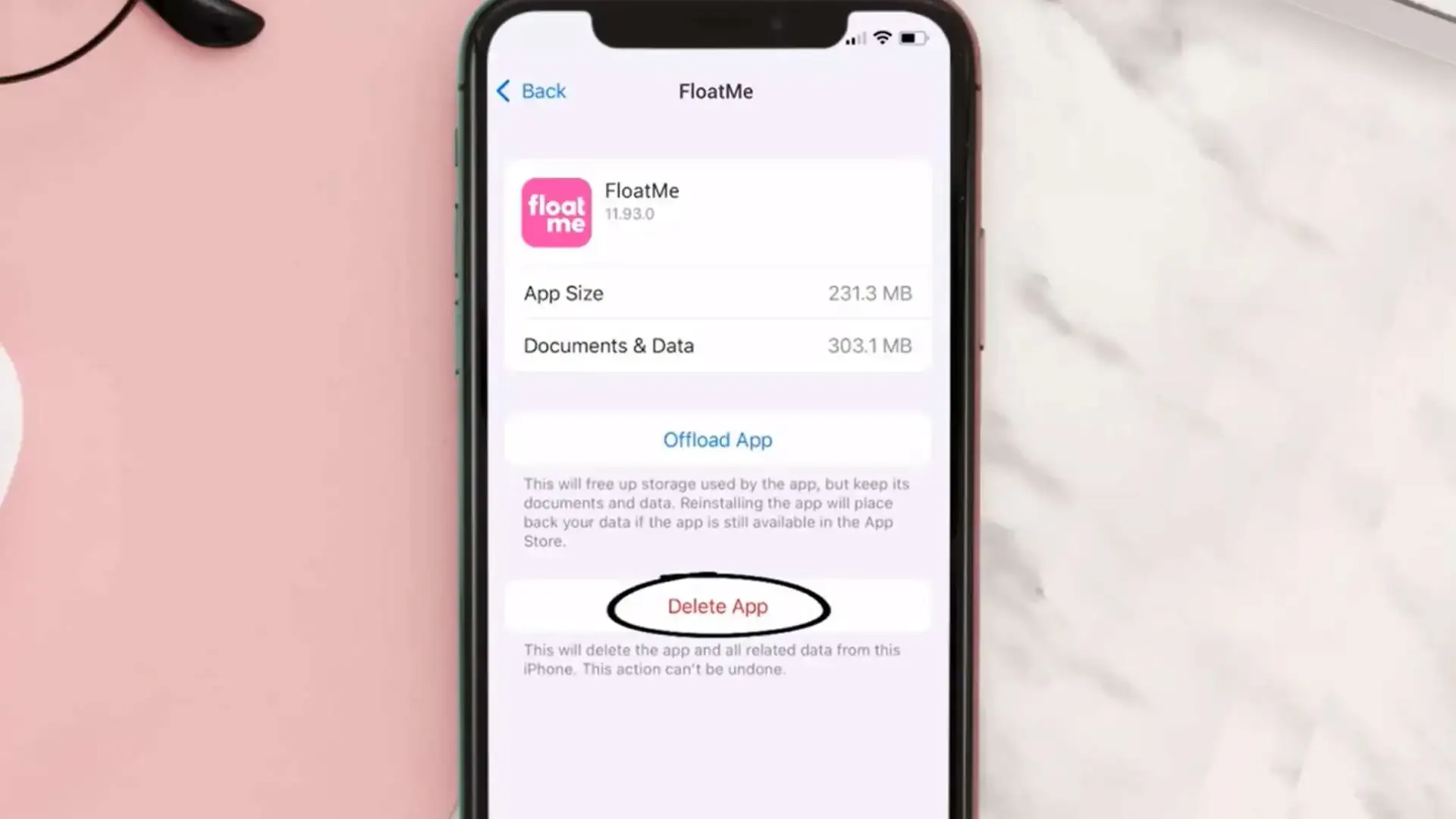

Step 6

After successfully deleting your FloatMe account, uninstall the app from your device to ensure no residual data or login credentials remain.

FloatMe's Refund Policy

FloatMe's refund policy offers users peace of mind and protection from unexpected charges. The app's ‘FloatMe refund’ program ensures reimbursement for any overdraft fees resulting from FloatMe transactions.

Eligible users must maintain an active, in-good-standing account and submit refund requests within seven days of incurring overdraft fees, providing relevant documentation. Approved refunds are credited to the user's FloatMe account within two business days.

How Much Can You Save After Canceling Your FloatMe Subscription?

In a FloatMe subscription, users benefit from features like no credit checks, no interest charges, and a user-friendly tool for money tracking. Additionally, subscribers can access fast funds when needed, with instant floats available at varying fees ($3.00 for $10, $4.00 for $20, and $5.00 for $30 or more).

By canceling their FloatMe subscription, users can save on instant float fees and the monthly subscription cost of $3.99. Therefore, the potential savings after canceling the subscription include avoiding these instant float fees and the recurring monthly membership fee.

Where To Invest That Amount?

After canceling your FloatMe subscription, consider investing the saved amount wisely. Start or bolster an emergency fund for unexpected expenses, pay off high-interest debts, or contribute to retirement accounts for long-term financial security.

You could also invest in stocks or ETFs for growth potential, explore real estate opportunities, or use the funds for personal development. Additionally, consider starting a small business or saving for education expenses.

Tailor your investment choice to align with your financial goals, risk tolerance, and time horizon. Consulting a financial advisor can provide personalized guidance for your situation.

The money you save by canceling your subscription can be used to create a savings account. Beem is a Super App that provides various tools and services to help individuals improve their financial situation.

Alternatives To FloatMe

While FloatMe is a fantastic cash app providing stellar services like payday loans, it has several drawbacks. FloatMe does not impose interest or fees on advances, distinguishing it as a cost-effective payday loan alternative.

However, users should be aware of potential additional costs, such as bank or expedited transfer charges, transparently disclosed within the app. Therefore, consumers must shop around and consider alternatives like Beem, Empower, Brigit, Fig Loans, Youtap, etc.

Conclusion

Unsurprisingly, most of the workforce today, especially the younger generation, is hardly scraping by. Most people working minimum wage jobs are just surviving paycheck to paycheck.

Payday loan apps like FloatMe become crucial in situations like this to avoid penalties and overdue. However, they also come with various drawbacks. Therefore, it is essential for consumers to carefully assess and compare them and select the one that best suits them.