How to Cancel a TurboTax

Subscription in a Few Steps

Need to cancel your TurboTax subscription? Learn how to do it in a few easy steps and manage your finances effectively.

TurboTax is a popular software suite for filing tax returns used by millions of Americans. If you’ve subscribed to TurboTax and no longer need its services, canceling your subscription is simple. This guide will help you understand how to cancel your subscription, the refund policy, possible savings, investment suggestions, and what else you can do.

Methods of Cancellation

There are two convenient ways of canceling your subscription from TurboTax:

Cancellation through website

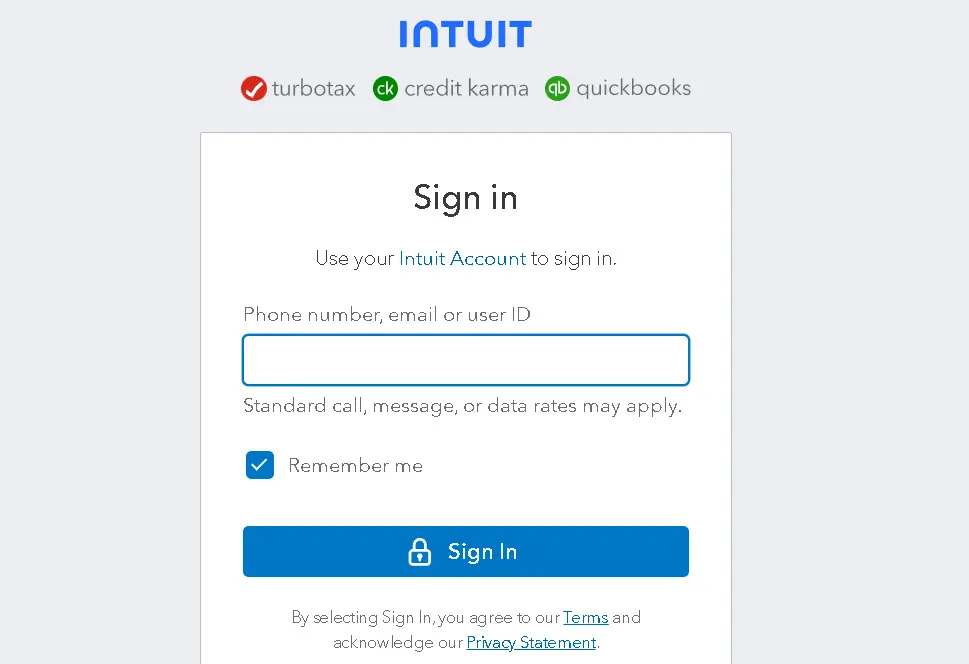

Step 1

Go to the TurboTax website and log in with your login details.

Step 2

Navigate to account settings and find a 'Products & Services' section or 'Subscriptions'.

Step 3

Click on the link to cancel your subscription and follow any ensuing prompts until the cancellation process is over.

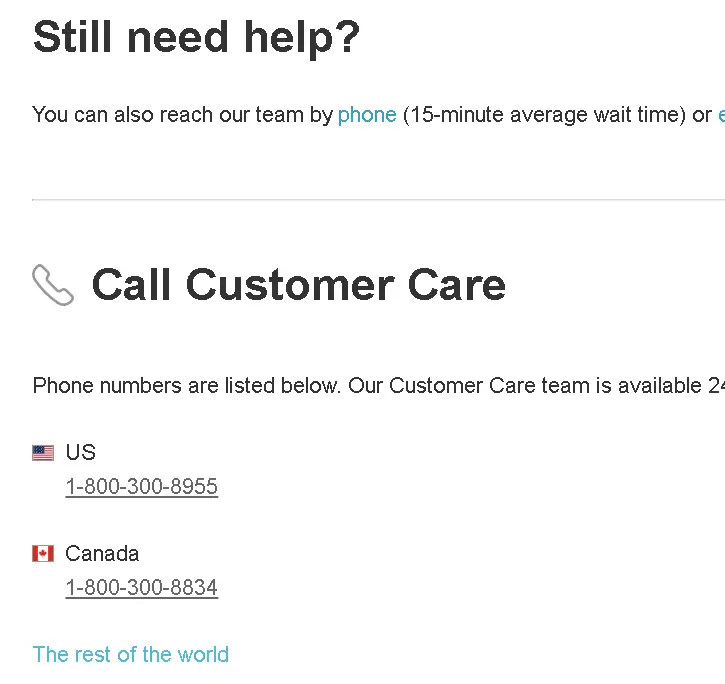

Phone Cancellation

Step 1

Call up TurboTax customer care at 1-800-446-8848.

Step 2

Tell the representative that you want to cancel the subscription and provide them with some information.

Step 3

The representative will process your request.

TurboTax Refund Policy

TurboTax Desktop offers refunds with conditions. When errors occur in individual returns, TurboTax will repay any penalties and interest resulting from their calculations, except for payment plans. Additionally, both individual and business returns have a 60-day satisfaction guarantee. Please note that these guarantees have limitations. Refer to TurboTax’s License Agreement for more details.

How Much You Can Save After Canceling Your TurboTax Subscription?

Depending on the product type one picks and the billing period, canceling your subscriptions to Turbotax can save you a lot of money. While canceling any plan, you can save $50 -130 $ per month.

Where to Invest that Amount?

After canceling TurboTax subscriptions and saving some cash, consider making wise investments to help it raise its finances.

Deposit the money in a high savings account that earns good interest yet is always accessible.

One must diversify one's investment portfolios by investing in index funds that can enable long-term stock market expansion.

For future financial security, contributing to IRAs or 401(k)’s is wise as it will come with tax benefits.

Alternatives to TurboTax

If you are looking for other software apart from Vertex ProSeries Tax that can be used for taxation purposes, then here are some of them:

Vertex

Vertex is the best tax technology solution provider, offering innovative software and services to streamline business tax compliance and reporting processes.

ProSeries Tax

ProSeries Tax is one of the most influential tax preparation software developed by Intuit. It simplifies filing taxes on behalf of accounting professionals and tax preparers. With seamless integration features and a vast library of tax forms, this platform makes it easy for users to do their taxes using ProSeries Tax while efficiently focusing on their client's needs.

Conclusion

Canceling a TurboTax subscription can free up valuable funds needed to reach your financial goals. Understanding the cancellation procedure, return policy, and investment opportunities will help you make the decisions necessary to manage your finances adequately. Additionally, consider using Beem's budget planner to optimize your spending and investments for a brighter financial future.

INTUIT *TURBOTAX

INTUIT *TURBOTAX CA

INTUIT TURBOTAX

Intuit *turbotax800-446-8848ca

INTUIT *TURBOTAX 800-446-8848 CA

INTUIT *TURBOTAX 800-446-8848, CA, US

TurboTax/Intuit

INTUIT *TURBOTAX, 800-446-8848, CA

INTUIT *TURBOTAX / CAUS

INTUIT *TURBOTAX 800-446-8848

INTUIT *TURBOTAX 7535 Torrey Santa Fe Ro 8

INTUIT *TURBOTAX, 800-446-8848

INTUIT *TURBOTAX 80

INTUIT TURBOTAX JP MORGAN

CONSUMER / INTUIT *TURBOTAX CA