Low pay and the erratic nature of employment cause financial problems for caregivers and daycare providers. Many positions offer barely a minimum income, making it challenging to pay for utilities, food, housing, and transportation. Furthermore, caring for others can be emotionally and physically taxing, draining workers of the energy to pursue other revenue streams. Financial tips for Caregivers and Childcare Workers can provide much-needed guidance to navigate these challenges and build greater financial stability.

Reality of Low Wages & Financial Difficulties in Caregiving

Another significant financial challenge is the lack of employer-sponsored benefits. Many caregivers lack health insurance, paid sick leave, or retirement savings choices, making financial security even more difficult. Lack of job stability also results in unemployment spells, aggravating financial difficulties.

Caregivers and daycare providers must be proactive in their financial planning to help them overcome these difficulties and guarantee their readiness for unanticipated costs and economic stability.

Many caregivers and daycare providers manage significant financial obligations yet receive lower pay. Medical issues, unexpected costs, and unstable employment can all cause financial difficulties that complicate future planning or savings.

Why Financial Planning is Essential for Caregivers

Given their limited financial resources, caregivers and daycare providers depend on effective financial planning. Debt can rapidly spiral out of control without a well-organized financial plan, often due to unanticipated expenses such as medical problems or unemployment.

A good financial plan requires long-term goals, budgeting, and emergency savings. Many caregivers lack traditional work benefits like a pension plan or 401(k). Therefore, it is advisable to consider other savings options, such as IRAs or high-yield savings accounts.

Financial planning guarantees caregivers enough savings when they can no longer work, guiding their retirement preparedness. Using better control over expenditure patterns and avoidance of reliance on credit cards or high-interest payday loans, planning enables

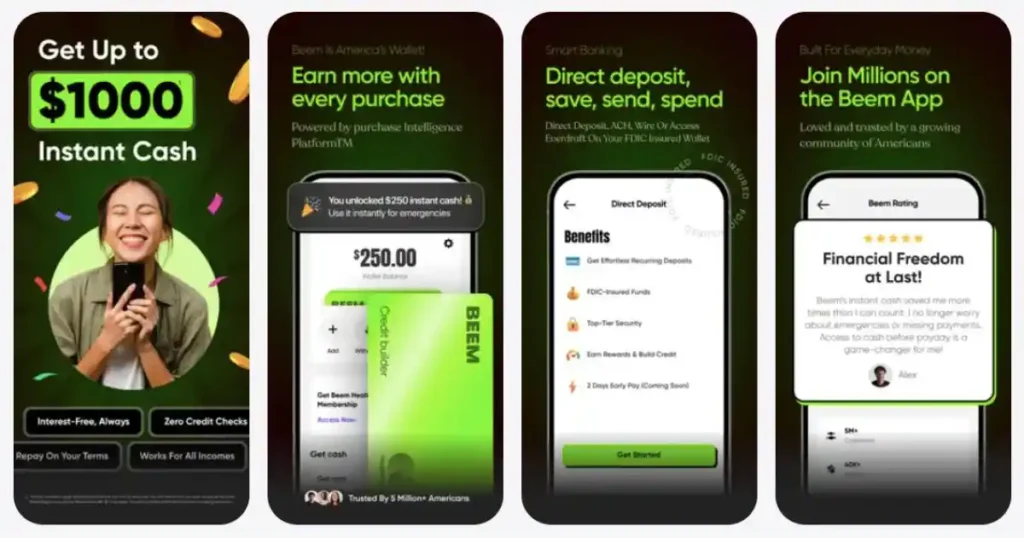

How Beem Everdraft™ Can Provide Immediate Financial Relief

Beem Everdraft™ offers a necessary safety net for those in childcare and caregiving roles experiencing financial difficulties. Unlike conventional payday loans with high rates, it provides a stress-free approach to acquiring emergency funds without credit checks, interest, or set repayment tortes.

Caregivers can use Beem Everdraft™’s quick cash advances of up to $1,000 to pay for basic needs such as rent, groceries, and utilities. Those with erratic incomes might find it challenging to make ends meet between paychecks and significantly benefit from this service.

Furthermore, Beem’s clever budgeting features enable consumers to monitor their income and expenses, guaranteeing efficient financial management and avoiding debt. Using Beem Everdraft™ allows caregivers to achieve greater financial security without exploiting exploitative financing methods.

Without credit checks, interest, or set payback schedules, Instant Cash Advances, up to $1,000, help caregivers better manage their money by tracking income, expenses, and savings objectives.

Top 10 Financial Tips for Caregivers & Childcare Workers

1. Track Your Income & Expenses Every Month

- One of caregivers’ most crucial financial behaviors is keeping a neat record of their income and expenses. Ignorance of your finances makes it simple to overspend and battle with budgeting.

- Record every source of income and every expense in a financial journal or using budgeting applications.

- Sort your spending into discretionary (entertainment, dining out) and basic (rent, utilities, food) categories to find unneeded outlays.

- Every month, check your budget to find areas where you may cut expenses and direct more into savings.

- https://trybeem.com/Knowing where your money goes facilitates more wise financial planning. Track expenses and find savings using Beem’s free applications or budgeting tool.

2. Create a Budget That Works for Your Irregular Income

- Budgeting is tricky for caregivers since their employment might involve changing hours and irregular earnings. A financial plan that fits income fluctuation will help you properly handle your money.

- Use the 50/30/20 rule to distribute income fairly:

- 50% for needs like food, rent, bills, healthcare.

- 30% for flexible spending—entertainment, dining out, hobbies).

- 20% for debt reduction, retirement, emergency fund, and savings.

- Consider applying a zero-based budgeting strategy, whereby every dollar of your revenue serves a purpose and guarantees the deliberate use of money.

3. Build an Emergency Fund for Unexpected Expenses

- Unexpected medical expenditures, auto repairs, job loss—all financial emergencies—can strike without notice. Having an emergency fund helps you stay out of financial hot water.

- Starting with at least $500 to $1,000 as an essential emergency reserve, progressively target three to six months’ worth of spending.

- Set up an auto-transfer for each pay to a different emergency fund account to automatically save.

- Build your emergency savings with windfalls, including tax returns, bonuses, or unanticipated cash gifts. Save at least $500 to $1,000 to handle unplanned medical events or job losses.

- Save little sums for every pay to free yourself from financial burdens progressively.

4. Find Ways to Cut Unnecessary Expenses

- Cutting pointless expenditures helps to liberate money for savings and basic needs. One excellent way to increase your financial security is to reduce unnecessary spending.

- Cancel unused subscriptions like gym memberships, magazine subscriptions, or streaming services.

- Save hundreds of dollars monthly by cooking at home instead of dining out.

- Use discount programs, cash-back apps, and coupons to save grocery and daily purchase costs. To cut travel expenses, consider public transit, carpooling, or walking.

- Cook at home, cancel unneeded subscriptions, and take advantage of discounts.

- Search for free daycare services, food aid, and travel savings coupons to cut costs.

5. Take Advantage of Tax Credits & Benefits

- Many people who work in childcare or as caretakers are qualified for tax advantages that may assist in easing their expenses. Knowing and applying these credits will help you yearly save money.

- Applying for the Earned Income Tax Credit (EITC) a tax cut worth thousands of pounds for low to moderate income earners.

- Claim the CTC, Child Tax Credit: This credit can drastically lower your tax load if you have dependents.

- Deduct work-related costs like mandatory certifications, clothes, travel miles, and supplies.

- See a tax professional to optimize your refund and guarantee you claim all qualified deductions.

- Consider the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) for financial support. Deducting work-related expenses such as travel, clothing, and training helps lower taxable income.

6. Explore Side Hustles for Extra Income

- While side projects help augment income, caring occupations frequently pay meager salaries, providing financial stability and more disposable cash.

- Think about freelancing outside of your primary employment as a babysitter or caregiver.

- Provide house-sitting, dog walking, or pet-sitting services right in your neighborhood.

- Gigconomy sites such as TaskRabbit, Uber, DoorDash, or Fiverr. Allow you to earn extra money on a flexible schedule. Run with a home-based business that sells baked products, homemade crafts, and online courses.

- Think about pet sitting, tutoring, childcare, or market-selling handcrafted goods.

Read related blogs: Home Health Aides Financial Guide: How to Manage Unexpected Expenses

7. Avoid High-Interest Payday Loans & Credit Card Debt

- If you depend on high-interest credit choices to pay everyday bills, debt can rapidly spiral out of hand. Maintaining stability calls on avoiding these financial traps.

- Payday loans are difficult to repay without entering a debt cycle because their APRs often exceed 300%.

- Choose Beem Everdraft™ instead of payday loans; it provides interest-free cash advances for crisis needs.

- If you use a credit card, pay off the debt completely every month to prevent paying hefty interest.

- Because of their high interest rates, payday loans can entangle caregivers in debt cycles. Use Beem Everdraft™ instead for interest-free cash advances as needed.

Read related blogs: Home Health Aides Financial Guide: How to Manage Unexpected Expenses

8. Set Financial Goals for Long-Term Security

- Clear financial goals enable those in childcare and caregiving roles to focus on creating long-term economic stability.

- Make short-term plans, including credit card balance pay-off or $1,000 emergency savings.

- Set long-term goals such as supporting further education, retirement savings, or homeownership.

- Even if your company does not offer a 401(k), you can open a Roth IRA or conventional IRA to save for retirement.

- Track your progress toward your objectives using financial tracking tools, including Beem’s budgeting software.

- Financial stability can be developed by saving for debt payback, homes, or retirement.

- With regular contributions to an investment or savings account, even modest amounts increase with time.

9. Use Financial Assistance Programs & Community Support

- Many government and nonprofit initiatives are intended to assist financially strapped caregivers. Investigating and requesting support can reduce the financial burden.

- Childcare programs help pay for daily operations. WIC and Food Healthy provide nutritional help for qualified households.

- Programs for rental and utility assistance aim to stop power outages and eviction.

- Community groups and nonprofits often offer grants, free financial advice, or emergency relief.

- Many states include food programs for caregivers, rental relief, and childcare aid.

- Community organizations and nonprofits offer hardship grants and free financial education.

10. Plan for Future Career Growth & Income Increases

- Higher pay and more work security follow from professional development and career advancement investments.

- To land better-paying jobs, pursue certificates in healthcare, early childhood education, or caregiving.

- Consider moving into more lucrative positions as a registered nurse, social worker, or daycare director.

- To increase your skill set, use employer-sponsored training courses or internet resources.

- Speak with others in your field to learn about fresh prospects and career developments.

- Invest in certificates and professional training to be eligible for positions paying more.

- Look for chances for professional growth in education, healthcare, or caring to increase income.

What to Do When an Unexpected Bill Arrives

- Prioritize essential bills first and negotiate payment plans if needed.

- Take on extra shifts or temporary gigs for short-term cash boosts.

- Use Beem Everdraft™ instead of taking out payday loans or credit card cash advances.

Read related blogs: Extra Income Strategies for Underemployed Workers

Why Beem Everdraft™ is Better Than Payday Loans & Credit Cards

No Interest or Hidden Fees

Unlike payday loans, Beem offers cash advances with zero extra costs.

Instant Access to Emergency Funds

Get money within minutes rather than waiting for your next pay.

Flexible Repayment with No Fixed Due Dates

Repay at your convenience without late fines or extra costs with flexible repayment without specified due dates.

Pitfalls That Can Hurt Caregivers Financially

Not Saving for Taxes or Retirement

Use tax-advantaged savings accounts like IRAs to create long-term financial security. Not saving for taxes or retirement will hurt caregivers financially.

Overspending During High-Income Months

Save extra during the busiest times to offset slower months and build a contingency for unforeseen events.

Not Seeking Financial Assistance When Available

Many caregivers eligible for rental assistance, SNAP benefits, and low-income support programs do not seek financial help when available.

Alternatives to Beem Everdraft™ for Financial Assistance

State & Local Financial Aid Programs

Many governments provide housing, food, and childcare subsidies as part of their state and local financial aid programs for emergencies.

Employer Hardship Funds & Grants

A few home care companies grant temporary aid to employees in financial need.

Side Hustles & Freelance Work for Additional Income

Side Projects and Independent Contractual Work for Extra Money: Search for gig employment that pays extra money, such as dog walking, online tutoring, or babysitting.

FAQs: Financial Tips for Caregivers and Childcare Workers

What is the best way for caregivers to save money on a low income?

Track spending, cut unnecessary expenses, and save small amounts from each paycheck.

How much should caregivers save for emergencies?

Start with $500 to $1,000, then aim for three months’ living expenses.

What should I do if I can’t pay a bill on time?

Negotiate a payment plan, seek financial assistance programs, or use Beem Everdraft™ for quick cash.

Are there financial aid options available for childcare workers?

Many organizations provide grants, tax credits, and financial aid for caregivers.

7. Conclusion: Achieve Financial Security as a Caregiver

While handling money as a caregiver or daycare provider might be complex, financial stability is within reach with the correct plans. Caregivers can better handle their financial obligations by developing an emergency fund, tracking income and expenses, and making a reasonable budget.

With its no-interest cash advances and budgeting tools, Beem Everdraft™ offers a sensible way to handle unanticipated costs. It enables caregivers to negotiate financial difficulties quickly. Everdraft™ can help you manage your money and start toward long-term economic success.

Take control of your finances—get instant cash advances with Beem Everdraft™! – Apply for Emergency Cash Now