Physically demanding construction jobs require knowledge, accuracy, dedication, and strength. Still, they also present unique financial difficulties that might make saving and budgeting tough. Financial tips for construction workers can help address these challenges with tailored guidance. Because of seasonal labor, contract-based employment, and changing job availability, construction workers sometimes have varying incomes, unlike in conventional paid positions. Work-related expenses such as tools, transportation, and safety gear may quickly mount up, taxing personal resources.

Innovative financial plans can help building professionals overcome these obstacles, stay financially stable, prepare for crises, and reach long-term economic success. Following good budgeting guidelines, saving for slow-moving projects, and investigating other revenue sources help builders take charge of their financial destiny. Ten basic financial ideas in this book will help building professionals control spending, boost savings, and lower financial stress.

Managing Finances in the Construction Industry

The nature of their profession often presents unique financial difficulties for construction workers. Contract-based income, seasonal employment, and changing job availability can all complicate financial security. Long-term security depends on financial preparation since high expenses for tools, transportation, and safety equipment further tax resources.

The Importance of Smart Financial Strategies

Construction workers must adopt good financial habits to guarantee their well-being. Good savings and planning prepare employees for unexpected costs and seasonal downtime. A well-organized financial plan can help lower financial stress and encourage stability even during lower activity.

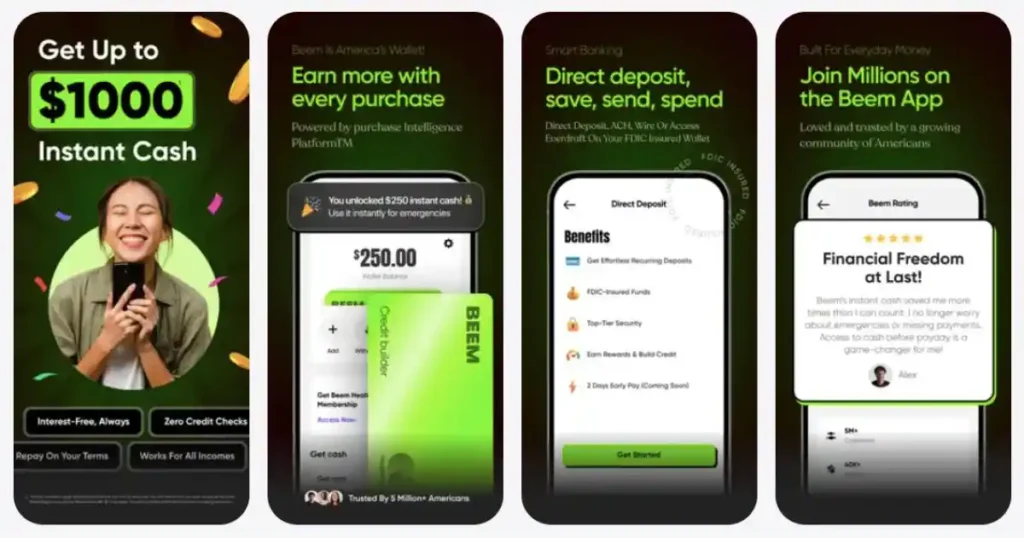

How Beem Everdraft™ Can Provide Immediate Financial Relief

Without credit checks, fees, or set payback schedules, Beem Everdraft™ provides quick cash advances of up to $1,000. Furthermore, simplifying financial management and increasing efficiency are Beem’s innovative budgeting tools, which enable employees to track revenue, track expenses, and create savings objectives.

Top 10 Financial Tips for Construction Workers

Track Your Income & Expenses

Construction occupations sometimes pay differently because of changing work hours and contract-based employment. Maintaining a thorough record of revenue and expenses helps employees better control cash flow and prepare for economic swings. Applying a budgeting app or Beem’s innovative budgeting tool can make the process easier.

Budget Based on the 50/30/20 Rule

- 50% for needs: Tools, food, utilities, rent.

- 30% for personal spending: Hobbies, dining, entertainment.

- 20% for paying off debt and savings: Creating financial stability and preparing for quiet business times.

Following this budgeting guideline guarantees a balanced financial strategy, which helps building professionals handle their money correctly.

Build an Emergency Fund

Any period can bring financial crises, particularly in a field with erratic income. Having at least $500 to $1,000 saved for unexpected costs, such as equipment replacements or medical bills, can save your life. Beem Everdraft™ offers fast, interest-free emergency cash to cover pressing needs when savings fall short.

Cut Unnecessary Expenses & Save More

Reduce daily spending by making cost-effective choices:

- Create your lunches rather than depending on purchases every day.

- Plan a carpool among colleagues to cut travel expenses.

Take advantage of tax deductions:

Tax-deductible work-related items such as boots, tools, and uniforms help to lower total costs.

Plan for Seasonal Downtime & Unpredictable Income

Seasonal construction activity often requires careful financial planning. To offset sluggish times, employees should save additional money in busy months. Part-time side gigs or freelance work during off-seasons can also side gigs or freelance work found during off-season Income Opportunities.

Explore additional earning options:

- Work side projects in house maintenance, plumbing, or carpentry on weekends.

- Online sales of secondhand tools or supplies could provide extra money.

- Give new employees or apprentices building knowledge so they may make extra money.

Avoid High-Interest Loans & Credit Card Debt

High-interest credit cards and payday loans can rapidly ensnare people in a debt cycle. Workers can utilize Beem Everdraft™ to access emergency money without interest or fees, guaranteeing a safer financial alternative rather than depending on these expensive choices.

Use Employer Benefits & Union Resources

Many builders are unaware of the financial help schemes their unions or companies provide. Inquiring through union reps or HR departments will reveal advantages, including:

- Retirement savings plans

- Health insurance options

- Training programs for career advancement

Invest in Your Future – Retirement & Career Growth

Over time, even small contributions to an IRA or 401(k) can accumulate to offer a safe financial future. Employees should also consider opportunities to improve their qualifications and skills, which can qualify them for more lucrative employment with more job security.

Use Smart Tools for Financial Planning

Automated savings tools and financial management apps let users monitor spending and enhance budgeting practices. Beem’s budgeting tool lets employees track their economic behavior in real time, helping them manage their money and satisfy long-term savings targets.

Read related blogs: Top 10 Financial Tips for Caregivers and Childcare Workers

What to Do When Facing an Unexpected Expense?

Prioritize Urgent Bills First

- Dealing with a financial crisis requires initially addressing the most critical bills. Rent, transportation, and medical expenses should rank highest among discretionary spending to guarantee economic security.

- Late rent payments could result in eviction threats. Hence, it is wise to contact landlords to review payment schedules or extensions.

- Getting to work depends on transportation; the first concern should be saving money for petrol, public transit passes, and vehicle upkeep.

- Though negotiating payment plans with medical providers or using free or low-cost clinics can help, healthcare bills can be daunting.

Use Beem Everdraft™ for Quick Financial Relief Instead of Payday Loans

- A safer option than payday loans, Beem Everdraft™ provides quick cash advances up to $1,000 with no interest, no hidden costs, and no strict repayment schedules.

- Beem Everdraft™ offers a customizable payback schedule that fits a worker’s financial flow, unlike payday lenders, who demand outrageous interest rates and costs.

- This financial safety net enables employees to manage immediate needs without running into debt over time.

Negotiate Payment Plans with Creditors if Struggling with Bills

- Many service providers, including landlords, medical professionals, and utility companies, offer flexible payment schedules for people who are struggling financially.

- Early contact with the creditor and a situational explanation will help secure a modified payment schedule, avoiding late fines and service interruptions.

- Certain financial institutions and service providers could have temporary hardship programs that cut monthly payments or postpone due dates until income stabilizes.

Why Beem Everdraft™ a Better Alternative to Payday Loans?

- No interest or hidden fees: Unlike payday loans, Beem Everdraft™ offers zero-cost advances. Hence, there is no interest or hidden expenses.

- Quick and flexible. Funds are available in minutes without any set payback times.

- Simple application process: Credit checks or income verification are not needed.

Read related blogs: Budgeting for Healthcare Support Roles: How to Balance Low Income and High Expenses

Mistakes That Can Hurt Construction Workers’ Finances

Read below to discover common mistakes that can hurt construction workers’ finances—and how to avoid them for a more secure financial future:

Not Saving During High-Earning Months

If employment slows down, ignoring saving money during busy times could lead to financial difficulties. Seasonal needs cause pay swings for construction workers; therefore, investing extra during high-earning months helps to give economic stability during downtime. Creating an automatic savings plan whereby a portion of every salary goes into a savings account allows employees to create a financial cushion for sluggish times progressively.

Relying on High-Interest Debt

Covering daily expenses using credit cards or payday loans can rapidly cause long-term financial difficulty. The significant interest rates linked with these financial instruments might trap people in a debt cycle, therefore hindering their capacity to reach financial security.

Workers can investigate less expensive options, such as credit unions, zero-interest financial solutions like Beem Everdraft™, or employer-based hardship funds, rather than payday loans.

Not Taking Advantage of Employer/Union Benefits

Many building workers ignore worthwhile financial help initiatives their union or company provides. These could call for subsidized insurance programs, financial advice, retirement plans, and hardship handouts.

Employees might uncover perks through HR departments or union representatives that enhance their financial status, save out-of-pocket costs, and offer long-term financial security.

Other Ways to Secure Emergency Funds

Government Aid Programs

Government aid programs offer financial relief for qualified low-income construction workers. While LIHEAP (Low-Income Home Energy Assistance Program) helps with power payments, programs like SNAP ( Supplemental Nutrition Assistance Program) help with grocery costs.

Those having financial difficulties with housing can find eligibility for Section 8 housing assistance or local rental relief programs offering subsidized homes or direct rental aid. When work is slow, filing for unemployment benefits during off-seasons might augment missed income.

Union or Employer Financial Support

Several unions and construction companies provide low-interest loans, hardship awards, or emergency financial assistance to employees with unexpected bills. These initiatives can offer a brief respite for job-related financial problems, housing expenses, or medical obligations. Many unions also offer job placement programs that enable employees to locate new job prospects quickly, lessening their financial burden during periods of unemployment.

Crowdfunding or Community Support

GoFundMe and other crowdsourcing sites allow employees experiencing extreme financial difficulty to solicit money from friends, relatives, and the larger community.

Direct donations, food aid, or utility bill relief are common ways local charities, nonprofit groups, and religious institutions offer emergency financial help. Peer-to-peer lending programs or community-based lending circles could provide access to reasonably priced loans from reputable sources.

FAQs: Financial Tips for Construction Workers

How much should construction workers save for emergencies?

Start with $500–$1,000, then try to cover three months’ living expenses.

What’s the best way to budget with an irregular income?

Use the 50/30/20 rule and modify savings targets depending on seasonal work cycles to budget with an irregular income.

How can I get emergency cash if I have no savings?

Use Beem Everdraft™ for quick, no-interest cash advances. It’s a reliable solution for covering urgent expenses between paychecks without falling into debt.

What are some side hustles for construction workers?

Some side businesses for construction workers include carpentry, handyman services, apprenticeship teaching, and tool sales from past use.

Conclusion: Financial Success Starts with Smart Budgeting

Budgeting and savings are vital for construction workers to control spending and prepare for job slowdowns. For financial situations, Beem Everdraft™ offers quick, no-interest cash advances to guarantee employees can access money as needed.

Control your money—get quick cash advances using Beem Everdraft™! Apply for Emergency Cash Now