Entry-level workers are the backbone of many industries, yet they often face significant financial challenges. With limited starting salaries and minimal benefits, covering basic expenses like rent, transportation, and food can be challenging. Handle unplanned bills as an entry-level worker with the right financial strategies to avoid debt.

Rising living costs only add to the strain, making it difficult to save or plan for the future. Many rely on side gigs or credit to make ends meet. This section explores entry-level employees’ financial hurdles and why smart budgeting is essential from the start.

Why Budgeting is Essential for Entry-Level Workers

Do you know how many people in the US cannot afford basic necessities? Often, people sympathize with the lower-income population, but what can one do? Entry-level workers do not have sufficient experience to switch to better job opportunities and struggle to make ends meet. This is where budgeting comes into the picture.

Most jobs have low starting wages, but the higher living costs can cause a financial strain. With Budgeting, you can manage your salary more efficiently. You can also learn how to save money for unexpected expenses and manage bills you were not prepared for. Let us explore this article for more tips on saving.

The Importance of an Emergency Fund

If you are new to the working class, you might have high hopes to become something huge. Dreams and hopes are often broken when burdened with responsibilities they cannot fulfill. Most entry-level positions have high work pressure, long hours, and minimum wage salaries. One cannot work a side hustle or switch fields to find better opportunities.

Financial assistance is needed to ensure economic security during emergencies. When you join a company, you should start a savings journey. You must save $500-$1000 every month to create an emergency fund. People with irregular incomes should pay extra attention to financial planning and building an emergency fund. With strategic savings, one can save sufficient emergency amounts to manage unexpected expenses in the future.

How Beem Everdraft™ Can Help Entry-Level Workers

Freelancers face unique financial challenges. It makes budgeting a crucial tool for their success. They must strategically manage their finances without a stable paycheck to ensure long-term sustainability. Below, we explore freelancers’ common challenges and how innovative budgeting strategies and helpful tools like Beem can provide financial stability.

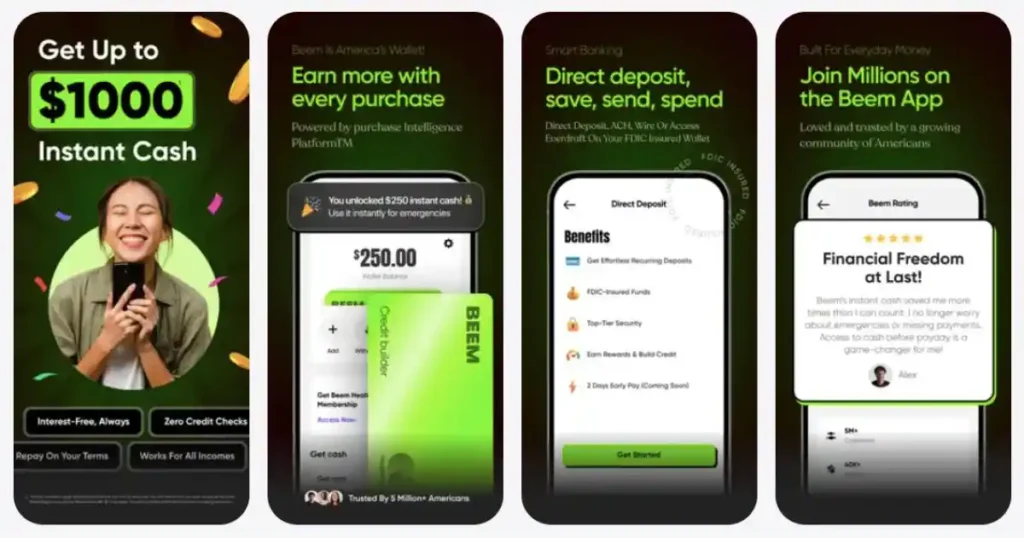

Various cash advance options are available to help these workers with irregular pay. However, with high interest rates, fixed repayment structures, and complex credit checks, the struggle to get money to pay your bills becomes quite a challenge. This is when Beem comes to the rescue. Beem’s Everdraft™ is an instant cash advance option that offers funds up to $1000 without interest rates or credit checks. No income restrictions or fixed due dates make it a convenient way to pay your bills.

What is Budgeting, and Why is it Important?

Budgeting is a financial plan that involves spending and saving in a structured way. One can spend money on rent, groceries, bills, and other expenses in a limited way, and one must save some cash for emergencies. How much you must save or spend depends on each person’s financial situation and goals. It can make you save sufficient money over the years to avoid high-interest loans during an economic crisis.

Key Elements of a Budget for Entry-Level Workers

Fixed costs

The fixed costs of a budget remain the same for every month. Your house rent, transportation charges, utility bills, and insurance premiums are mostly the same every month.

Variable expenses

The next priority on your budget is your variable expenses. These can be clothing bills, food, or work-related expenses. They are essential for your family to maintain a lifestyle.

Savings

You can increase your savings contributions with increased earnings and better financial management. This way, you can stay prepared for every future financial challenge without needing loans.

1. Track Your Spending to Identify Unnecessary Expenses

One should begin their financial planning journey by tracking your expenses. Financial Budgeting is not a quick journey; you must learn, research, and explore tips. It ensures you can follow the best planning method that suits your needs. You can use notebooks, notepads, or budgeting tools to keep track of your expenses and save money better.

2. Use the 50/30/20 Budgeting Rule

This 50/30/20 is an ultimate rule that works for almost everyone. It can resolve all your worries about managing your budget in a planned way.

50% for essentials

The essentials for your budget are the bills that you cannot avoid. Grocery, rent, or utility bills are a must for a living. You should spend 50% of your pay on these expenses.

30% for discretionary spending

The next section of your budget includes your fun money. This is discretionary spending that can vary from person to person. Once you have kept aside 50% on essentials, you can spend about 30% on making your lifestyle fun, whether it is a small picnic with your family or taking them on a budget trip.

20% for savings and debt repayment

Now, the left 20% of your budget is the money that should be spent on loan repayments. You should save 5-10 % of your earnings as an emergency fund. However, your priority must be debt repayment to ensure you can live comfortably without damaging your credit score.

3. Build an Emergency Fund – Start Small, Save Consistently

Set an initial savings goal of $500–$1,000

An emergency fund is a must for every salaried person. People who depend on their next paycheck need some assurance to stabilize their lives. Most experts recommend saving about twenty percent of one’s earnings to achieve one’s financial goals. However, if you cannot afford that much, keep at least $500- $1000 monthly.

Automate savings to set aside a portion of each paycheck

While manually saving funds can seem challenging, it will help you save money in the long run. If you cannot keep your savings or often forget about them, it is better to automate them. This way, you can keep a certain amount of your paycheck aside in the name of emergency funds.

4. Reduce Costs with Smart Spending Habits

Cook at Home Instead of Dining Out

Cooking at home allows you to control ingredients and portion sizes. You can plan out your whole week in advance and buy groceries accordingly. This will not only save you money but also improve your health.

Find Discounts and Use Cashback Apps for Daily Purchases

Look for discounts on groceries and supplies, and use cashback apps like Ibotta, Rakuten, and Honey to get rebates and apply coupons for everyday purchases. These strategies help you find sales, coupons, and discounts to maximize savings.

5. Use Beem Everdraft™ for Emergency Cash Needs

Get Access to Instant Cash Without High-Interest Loans

You can get instant cash up to $1000 with Beem’s Everdraft™. The quick and convenient way to get funds with Beem ensures you can access funds as soon as you come across an emergency. With quick funds approval and transfer, Beem provides an effective solution for financial problems.

No Repayment Deadlines, Providing Flexibility for Unexpected Bills

Beem is an overall solution for all your financial needs. You can get funds without any interest rates or credit checks. Without the hassle of repayment deadlines, you can enjoy this alternative of payday loans to the fullest.

6. Look for Additional Income Opportunities

Consider Freelancing or Part-Time Gigs to Supplement Income

If you have a limited salary, freelancing or taking on part-time gigs can be a flexible way to earn extra money. Increasing your income and ensuring you can save more over the years is better. This also allows you to spend money on discretionary expenses to ensure your family can upgrade their lifestyle and enjoy family trips now and then.

Take Advantage of Available Overtime or Weekend Shifts

You can always ask your employer to work overtime to increase your pay. If your employer agrees, you can earn better without learning or exploring other ways of earning. This will ensure you can spend time with your family on weekends.

Steps to Take When Facing an Unexpected Bill

When facing an unexpected bill, you can take a few steps. Firstly, you must prioritize your essential bills, such as rent, utilities, and other fixed costs. If you have funds to pay the bills, you must move forward.

Otherwise, you can use Beem’s Everdraft™ for immediate financial relief. Beem offers funds up to $1000 to help you with the unexpected bill payment. If immediate funds are still not sufficient for the bill, you must try to negotiate payments to avoid depending on high-interest loans.

Why Beem Everdraft™ is a Smarter Alternative to Payday Loans

Beem Everdraft™ offers several financial advantages over traditional payday loans. Here are some reasons why to choose Beem over other payday lenders:

1. No Interest or Hidden Fees

Unlike payday loans, Beem provides zero-cost advances. It ensures you receive the full amount without additional or hidden charges.

2. Instant Access to Funds

Beem allows you to access funds within minutes. It enables you to cover urgent expenses promptly.

3. Flexible Repayment with No Fixed Due Dates

Beem offers flexible repayment options without fixed due dates. It allows you to repay on your schedule. To access Beem’s Everdraft™, download the Beem app and choose a subscription plan that suits your needs.

H2: Budgeting Pitfalls to Watch Out For

Not tracking expenses and overspending

Without properly tracking your expenses, you do not know what you earned or saved. This messes up our entire budget and often leads to overspending.

Relying on credit cards for daily purchases

Credit cards charge high interest rates if you miss their deadlines. You must avoid using credit cards and try to manage your daily budget with your paycheck only.

Ignoring savings and emergency funds

Most people fail to set aside money for savings or emergencies. They face financial stress when unexpected situations arise. Establishing a savings habit can offer peace of mind and financial security.

Additional Ways to Handle Financial Emergencies

Local Nonprofit Financial Assistance Programs

Many local nonprofits offer financial assistance for individuals facing hardships, including those managing chronic health conditions like diabetes. These programs may support medical bills, groceries, utilities, or transportation costs.

Employer-Sponsored Hardship Funds

Some employers provide hardship funds or financial assistance programs for employees experiencing challenging circumstances. These funds cover medical emergencies or financial struggles.

Government Assistance and Grants for Low-Income Workers

Various government programs offer financial support to low-income workers. These may include food assistance programs like SNAP (Supplemental Nutrition Assistance Program), utility bill relief, or grants. They are designed specifically for workers facing financial hardship due to medical conditions.

FAQs: Handle Unplanned Bills as an Entry-Level Worker

How much should I save monthly as an entry-level worker?

You must save 10-20% of your income for emergencies and future expenses.

What’s the best way to track my spending?

You can use free budgeting apps or manually track expenses in a notebook. To budget your funds properly, you should note down all earnings and expenses.

What if I have no emergency savings?

You can start small by setting aside $5–$10 per paycheck. You can consider using Beem Everdraft™ for instant cash needs up to $1000.

How can I cut costs on a low salary?

To save money, you must find cheaper alternatives for everyday expenses, take advantage of discounts, and eliminate unnecessary subscriptions. You should also implement budgeting tips to keep your expenses in control.

Conclusion: Take Charge of Your Financial Future

Budgeting tips can help you manage your income in a structured way. One cannot save or spend funds properly without keeping track of earnings. You can use budgeting tools and apps to plan your expenses smartly. With Beem’s budgeting tools, you can achieve financial success and grow your funds significantly. You can also explore interest-free financial assistance options by Beem’s Everdraft™. You can take control of your finances and get financial stability on your terms with Beem.

“Plan and protect yourself from financial stress—sign up for Beem Everdraft™ today!”