Financial Tips for Service Industry Workers are essential, as many in the field face unpredictable hours, fluctuating income, and limited benefits, making financial stability difficult to achieve.

Living paycheck to paycheck is standard, leaving little room for savings or emergency expenses. As the cost of living rises, many workers feel increased financial pressure. Understanding these challenges is the first step toward creating a realistic and resilient budget.

The Reality of Financial Instability in the Service Industry

Many service workers depend on hourly wages, tips, and unpredictable shifts, making it hard to maintain financial stability. Their fluctuating incomes make budgeting difficult, leaving workers vulnerable to sudden expenses. Saving money or planning for financial emergencies can be challenging without a steady paycheck.

Why Financial Planning is Essential for Service Workers

A single unexpected bill can create a financial crisis for workers without an emergency fund. Strong money habits, such as saving consistently and minimizing unnecessary expenses, can help prevent debt. Proper financial planning enables service workers to avoid economic stress and build a secure future.

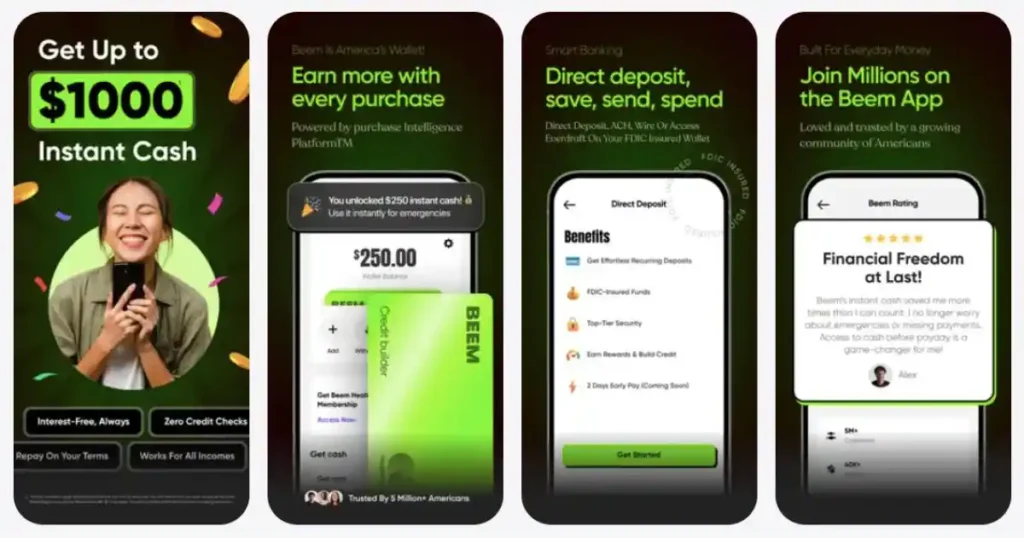

How Beem Everdraft™ Can Provide Financial Relief

Beem Everdraft™ offers instant cash advances up to $1,000 without credit checks, interest, or fixed repayment terms. Additionally, Beem’s innovative budgeting tools help service workers track their income and expenses, making it easier to plan for emergencies and maintain control over their finances.

Read related blogs: Simple Budgeting Hacks for Gig Economy Workers

1. Track Your Income & Expenses

Beem’s financial tools can help monitor spending and identify unnecessary expenses. Understanding where money goes each month allows service workers to make informed financial decisions and reduce non-essential spending.

2. Follow the 50/30/20 Rule

Allocate income wisely by spending 50% on essentials like rent, food, and utilities, 30% on discretionary expenses such as entertainment and dining out, and 20% on savings and debt repayment. This budgeting rule helps create financial stability and long-term security.

3. Build an Emergency Fund

Setting aside $500–$1,000 for unexpected expenses can prevent financial hardship. Setting up automatic transfers to a savings account ensures consistent contributions. Beem Everdraft™ provides cash relief without high-interest loans or hidden fees in emergencies.

4. Cut Down on Unnecessary Spending

Managing finances starts with eliminating unnecessary expenses. Small, everyday costs can add up, making it harder to save. By tracking spending, using discounts, and canceling unused services, part-time workers can stretch their income further and build better financial habits. Here’s how to cut down on wasteful spending.

Reduce impulse purchases and track non-essential spending

Impulse buying can quickly drain your budget, especially when making frequent small purchases. To avoid this, track all non-essential spending and set a limit for discretionary expenses. Using a budget app or keeping a spending journal can help identify areas where you can cut back and save more monthly money.

Use cashback apps and discounts for groceries and daily expenses

Cashback apps and discount programs can significantly reduce your grocery and daily expenses. Many stores offer digital coupons, and several apps provide cashback on everyday purchases. Taking advantage of these tools saves money effortlessly while still buying the essentials you need.

Cancel unused subscriptions and memberships

Monthly subscriptions for streaming services, gym memberships, or apps can add up, even if you rarely use them. Review your bank statements to identify and cancel subscriptions you no longer need. This simple step frees up extra monthly money, which can be redirected toward savings or essential expenses.

Read related blogs: Top 10 Financial Tips for Part-Time Workers: Managing Surprise Expenses

5. Explore Extra Income Opportunities

Extra income can help part-time workers manage expenses and build savings more effectively. Whether through additional work hours, side hustles, or selling unused items, there are many ways to increase financial stability. Here are some practical methods to supplement your income and maximize your available time.

Pick up extra shifts or work weekends for additional earnings

If your job offers flexible scheduling, consider taking on extra shifts or working weekends to boost your income. Many employers provide higher pay for weekend or holiday shifts, making it a great way to earn more in less time. This can be especially useful for covering unexpected expenses or saving for future financial goals.

Start a side hustle – freelance work, babysitting, or food delivery

A side hustle can provide a steady stream of extra income without requiring a full-time commitment. Freelancing in areas like writing or graphic design, babysitting, or driving for food delivery services are great options. These flexible jobs allow you to earn additional money while balancing your work schedule.

Sell unused items online for extra cash

Selling unused or unwanted items quickly generates extra income. Online platforms like eBay, Facebook Marketplace, and Poshmark make selling clothes, electronics, or furniture easy. Decluttering your space while making money can effectively improve financial stability without taking on additional work.

6. Avoid High-Interest Debt & Payday Loans

High-interest debt can quickly drain your finances and make it challenging to stay ahead. Payday loans, in particular, create a dangerous cycle of borrowing and repayment. Instead, safer financial alternatives and responsible credit management should be considered to maintain economic stability. Here’s how to avoid costly debt and protect your income.

Payday loans trap workers in a cycle of debt

Payday loans may seem like a quick fix, but their high interest rates and short repayment terms often lead to repeated borrowing. Many workers struggle to pay them off, leading to ongoing financial stress. Avoiding these predatory loans can prevent long-term debt problems and keep your budget under control.

Beem Everdraft™ provides a safer, interest-free alternative

Instead of turning to payday loans, Beem Everdraft™ offers an interest-free cash advance to cover unexpected expenses. With no hidden fees or rigid repayment schedules, it provides a more flexible and affordable way to manage short-term financial needs without falling into debt.

Pay off credit card balances to avoid interest fees

Carrying a credit card balance from month to month leads to high-interest charges that add up over time. To avoid unnecessary debt, pay your balance in full each month. If that’s impossible, make more than the minimum payment to reduce interest costs and financial strain.

7. Take Advantage of Employee Benefits

Employer benefits can significantly improve financial stability for part-time and hourly workers. Many companies provide health coverage, retirement plans, and other monetary perks that often go unused. Understanding and utilizing these benefits can help you save money, increase earnings, and secure a stronger economic future.

Check for employer-sponsored health insurance, 401(k), and tuition assistance

Some employers offer health insurance and retirement savings options, even for part-time workers. A 401(k) plan with employer matching helps build long-term financial security. Additionally, tuition assistance programs can reduce the cost of education, making career growth more affordable. Always check with your employer to take full advantage of these valuable benefits.

Participate in tip pooling if available to maximize earnings

Participating in tip pooling programs can create more financial consistency for workers in tipped industries. By sharing tips among employees, workers receive a steadier income and reduce the unpredictability of daily earnings. This system ensures all staff members benefit, especially on shifts with varying customer traffic.

8. Plan for Taxes & Withholdings

Understanding tax obligations is crucial for avoiding financial surprises. Proper tax planning ensures that part-time workers and those earning tips aren’t caught off guard during tax season. You can manage your taxes more effectively by adjusting withholdings, tracking earnings, and using tax-advantaged savings plans.

Adjust tax withholdings to avoid surprises at tax time

Many part-time workers receive smaller paychecks because taxes aren’t always correctly withheld. Adjusting your W-4 form with your employer helps ensure the correct amount is deducted. It prevents unexpected tax bills and reduces financial stress when filing your annual return.

Keep records of tips and income for accurate tax filing

Tracking earnings is essential for workers who receive tips to ensure accurate tax reporting. The IRS requires tip income to be reported, and failing to do so can lead to penalties. Keeping daily or weekly tip records helps ensure compliance and prevent tax issues.

Consider a tax-advantaged savings plan for future security

Tax-advantaged accounts like an IRA or Health Savings Account (HSA) can help part-time workers build financial security while reducing taxable income. Contributing even small amounts to these savings plans provides long-term financial benefits and ensures stability for future expenses like medical bills or retirement.

Read related blogs: Office Assistant Guide to Budgeting: How to Manage Monthly Expenses

9. Set Financial Goals for Stability

Setting financial goals like saving for a home, education, or retirement provides long-term security. Exploring investment options can also help build wealth, ensuring future economic stability.

10. Use Financial Tools for Better Money Management

Beem’s budgeting tools track income, manage spending, and help plan. Round-up savings apps can automatically set aside small amounts of money, making saving effortless and more consistent.

What to Do When Facing an Unexpected Expense

Unexpected expenses can disrupt your budget and create financial stress. Whether it’s a medical bill, car repair, or sudden rent increase, a plan can help you manage the situation without resorting to high-interest loans. Here’s how to handle emergency costs while maintaining financial stability.

Prioritize urgent expenses like rent, utilities, and food

When facing a financial emergency, focus on covering essential expenses first. Rent, utilities, and groceries should be prioritized to ensure you have a place to live and necessary services. Reducing non-essential spending can also free up extra funds to manage unexpected costs.

Use Beem Everdraft™ for instant cash access

Instead of turning to high-interest loans or credit cards, Beem Everdraft™ offers an interest-free cash advance to help cover urgent expenses. Quick approval and instant access to funds provide a reliable way to manage financial shortfalls without the burden of costly debt.

Negotiate payment plans with service providers if necessary

If you struggle to pay a bill, contact your service provider to discuss flexible payment options. Many companies offer hardship programs, extended due dates, or installment plans to help customers manage temporary financial difficulties. Communicating can prevent late fees, service disruptions, or collection actions.

Why Beem Everdraft™ is a Safer Alternative to Payday Loans

Payday loans often come with excessive interest rates and hidden fees, trapping borrowers in a cycle of debt. Beem Everdraft™ provides a more reliable, stress-free alternative by offering instant access to funds with no interest or rigid repayment terms. Here’s why Beem Everdraft™ is the better choice for financial relief.

Zero interest and no hidden fees

Unlike payday loans that charge exorbitant interest rates and fees, Beem Everdraft™ provides cash advances with zero interest and no hidden costs. It ensures borrowers can access emergency funds without worrying about accumulating debt, making it a safer option for those facing short-term financial difficulties.

Get cash advances up to $1,000 in minutes

When emergencies arise, fast access to cash is essential. Beem Everdraft™ offers advances of up to $1,000, which can be deposited within minutes. This quick solution helps individuals cover urgent expenses without using expensive short-term loans or credit card debt.

Flexible repayment – no fixed due dates

Traditional payday loans have strict repayment deadlines, often leading to penalties or rollovers that increase debt. Beem Everdraft™ allows users to repay at their own pace without rigid due dates, providing financial flexibility and reducing the risk of falling into a cycle of recurring debt.

Pitfalls That Service Industry Workers Should Avoid

Managing finances in the service industry can be challenging due to unpredictable income and high living costs. Avoiding common financial mistakes is key to maintaining stability and long-term security. Here are three financial pitfalls service workers should watch out for.

Not Saving for Emergencies

Without a savings cushion, workers may rely on high-interest credit cards or payday loans when unexpected expenses arise. Setting aside a small portion of each paycheck can provide financial security and prevent debt accumulation during emergencies like medical bills or job gaps.

Overspending on Non-Essentials

Inconsistent earnings make it easy to overspend during high-income periods, leading to financial stress later. Tracking spending, sticking to a budget, and prioritizing essential expenses over luxury purchases help service workers stay financially stable, even when income fluctuates.

Ignoring Credit Health

A low credit score can make securing loans, renting apartments, or accessing financial opportunities harder. Paying bills on time, keeping credit utilization low, and avoiding unnecessary debt can help workers build and maintain good credit, ensuring better economic prospects in the future.

Other Ways to Secure Emergency Funds

When facing financial difficulties, service industry workers can explore various assistance options to bridge shortfalls. From employer programs to government aid, multiple resources can provide relief. Here are three ways to secure emergency funds.

Employer Assistance Programs

Some service industry employers offer hardship loans, paycheck advances, or employee relief funds to help workers in financial distress. Checking with human resources can provide access to these programs, offering a lifeline without the high costs of traditional loans.

Local Nonprofits & Community Assistance

Many nonprofits and community organizations offer emergency grants, food assistance, and rental relief for workers facing financial hardship. Food pantries, utility assistance programs, and housing aid can help cover essential expenses without added debt.

Government Assistance

Workers earning below a certain income threshold may qualify for government programs such as unemployment benefits, housing vouchers, or food assistance. Programs like SNAP (food stamps) or LIHEAP (utility assistance) can provide essential support during financial hardships.

FAQs: Financial Tips for Service Industry Workers

How much should service workers save for emergencies?

Start by saving at least $500–$1,000 as a basic emergency fund. Over time, aim to build savings that cover three to six months of living expenses. This cushion helps manage unexpected costs like medical bills, job loss, or urgent repairs.

What’s the best way to budget on a fluctuating income?

Base your budget on your lowest monthly earnings to ensure you can cover essential expenses. Save any extra income earned during peak seasons to create a financial buffer for slower months, helping maintain stability even when your paycheck varies.

How can I get emergency cash if I don’t have savings?

Beem Everdraft™ offers quick, no-interest cash advances to help cover unexpected expenses without the burden of high-interest loans. It allows service workers to access emergency funds immediately without falling into debt or relying on payday loans.

What are some easy ways to make extra money?

Consider freelancing, gig economy jobs like food delivery or ridesharing, or selling unused items online. Taking on side work during free hours can provide additional income, helping to cover expenses or grow your emergency savings faster.

Secure Your Financial Future Today

Budgeting and saving are essential for service workers to handle financial emergencies confidently. Beem Everdraft™ offers instant, no-interest cash advances for urgent expenses, helping workers stay financially secure.

Use Beem’s budgeting tools to track spending, manage income fluctuations, and build a stable financial future. Be prepared for any financial emergency—get instant cash advances with Beem Everdraft™! Apply for Emergency Cash Now.