Table of Contents

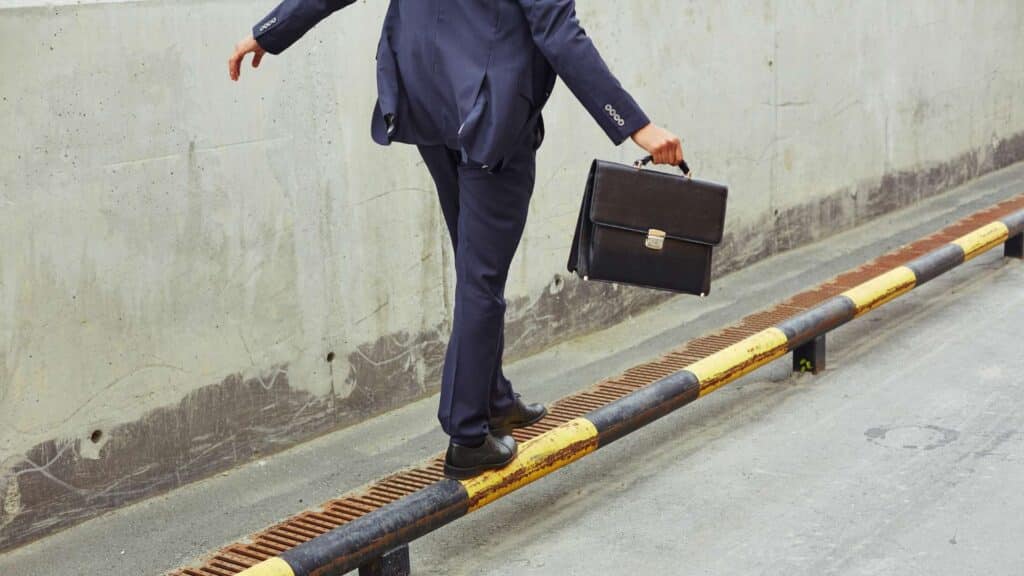

Your 401(k) is one of the most powerful tools you have to secure a comfortable retirement. But simply contributing to your plan isn’t enough. To maximize your savings, you need to strike the right balance between risk and growth. If you take on too much risk, you may face big losses during market downturns. If you play it too safe, your money may not grow enough to outpace inflation and support you through decades of retirement.

Finding the sweet spot between risk and growth is different for everyone. It depends on your age, financial goals, and how comfortable you are with market ups and downs. In this guide, we’ll break down what risk really means, how to assess your own comfort level, and how to build a 401(k) portfolio that can weather storms while still growing for the future. In other words, balancing risk and growth in your 401(k) investments.

Balancing Risk and Growth in Your 401(k) Investments: Understanding Risk and Growth

What Is Investment Risk?

Investment risk is the possibility that your investments won’t perform as expected, and you could even lose money. There are several types of risk to consider:

- Market Risk: The chance your investments will lose value due to overall market downturns.

- Inflation Risk: The risk that your money won’t grow fast enough to keep up with rising prices.

- Interest Rate Risk: The possibility that changes in interest rates will affect the value of your bonds and other fixed-income investments.

- Longevity Risk: The danger of outliving your savings.

Generally, the greater the risk, the greater the potential reward. Stocks, for example, are riskier than bonds but historically offer higher long-term returns.

Growth Assets vs. Defensive Assets

- Growth Assets: Stocks and equity mutual funds are the main drivers of growth in your 401(k). They offer the potential for high returns but can be volatile in the short term.

- Defensive Assets: Bonds, stable value funds, and cash equivalents help reduce risk. They provide stability and income, but usually lower long-term growth.

A healthy 401(k) portfolio combines both, with the mix shifting as you get closer to retirement.

Assessing Your Risk Tolerance and Time Horizon

How to Evaluate Your Comfort With Risk

Risk tolerance is personal. Some people can sleep soundly during market swings, while others worry at every dip. To gauge your risk tolerance:

- Take a risk assessment questionnaire (many 401(k) providers offer these).

- Reflect on how you reacted during past market downturns.

- Consider your financial situation: Do you have an emergency fund? Is your income stable?

- Think about your goals: Are you aiming for aggressive growth, or do you value stability?

Why Time Horizon Matters

Your age and the time you have until retirement are crucial. The longer your time horizon, the more risk you can afford to take because you have time to recover from downturns. Younger investors should focus on growth, while those nearing retirement should shift toward preservation and income.

Balancing Risk and Growth in Your 401(k) Investments: Building a Balanced Portfolio

Diversification Basics

Diversification means spreading your investments across different asset classes (stocks, bonds, cash) and sectors (technology, healthcare, energy, etc.). This reduces the impact of any single investment’s poor performance on your overall portfolio.

- Mutual Funds and Index Funds: These offer instant diversification and are common in 401(k) plans.

- Target-Date Funds: These automatically adjust your asset mix as you approach retirement, making them a simple option for many savers.

Sample Asset Allocations by Age/Stage

- Aggressive (20s-30s): 80-90% stocks, 10-20% bonds/cash

- Balanced (40s): 60-70% stocks, 30-40% bonds/cash

- Conservative (50s-60s+): 40-60% stocks, 40-60% bonds/cash

These are just starting points. Adjust based on your risk tolerance and goals.

Rebalancing and Staying on Track

Over time, market movements can throw your portfolio out of balance. For example, if stocks perform well, you might face more risk than you intended. Rebalancing means selling some assets and buying others to restore your target allocation. Most experts recommend rebalancing at least once a year.

Avoiding Common Pitfalls

Taking Too Much or Too Little Risk

- Too Much Risk: Chasing high returns with an all-stock portfolio can lead to big losses just when you need your money most.

- Too Little Risk: Playing it too safe with all bonds or cash can mean your savings don’t grow enough to last through retirement.

Emotional Investing and Market Timing

Trying to time the market, often selling during downturns and buying during rallies, is a recipe for poor returns. Emotional decisions can lock in losses or cause you to miss out on recoveries. Stick to your plan and rebalance regularly.

Ignoring Fees and Plan Options

High fees can quietly erode your returns over time. Review your 401(k) plan’s investment options and choose low-cost index funds or ETFs when available. Don’t set and forget your portfolio forever; review your choices at least annually.

How Beem Helps You Balance Risk and Growth in Your 401(k)

Beem is a digital financial platform designed to make retirement planning easier and more effective:

- Budget Planner: Model different asset allocations and see how they impact your growth over time.

- Risk Assessment Tools: Take quizzes and get personalized recommendations based on your comfort level and goals.

- Rebalancing Reminders: Get alerts when it’s time to review and adjust your portfolio.

- Educational Resources: Access articles, videos, and tips to build your investment confidence and knowledge.

With Beem, you can make informed decisions, avoid costly mistakes, and stay on track for a secure retirement.

Conclusion

Balancing risk and growth in your 401(k) is the key to building wealth and protecting your future. By diversifying your investments, adjusting your allocation as you age, and avoiding emotional decisions, you can set yourself up for a comfortable retirement. Use digital tools like Beem to stay organized, informed, and proactive.

Avoid common mistakes, review your plan regularly, and use digital tools like Beem to stay organized and motivated. With careful planning and Beem, you can take control of your retirement savings and build a more secure financial future. In addition, Beem’s Everdraft™ lets you withdraw up to $1,000 instantly and with no checks. Download the app here.

FAQs on Balancing Risk and Growth in 401(k) Investments

How do I know if my 401(k) is too risky or too conservative?

Review your asset allocation and compare it to your age, time horizon, and risk tolerance. It may be time to adjust your mix if you’re losing sleep over market swings or your portfolio hasn’t grown in years.

How often should I rebalance my 401(k) portfolio?

Most experts recommend rebalancing at least once a year, or whenever your allocation drifts more than 5-10% from your target. Some plans offer automatic rebalancing.

What’s the best way to diversify my 401(k) investments?

Use a mix of mutual funds or index funds that cover different asset classes and sectors. Target-date funds are a simple way to achieve instant diversification.

Can I change my risk level as I get older?

Absolutely. As you approach retirement, gradually shift your portfolio toward more conservative investments to protect your savings from market downturns.

How does Beem help me maintain a balanced 401(k)?

Beem tracks your asset allocation, sends reminders to rebalance, and offers educational resources to help you make smart, confident decisions.