When a loan comes down to feeling like a financial albatross pulling you down with a heavy interest rate, you can refinish your loan. You might have taken the first loan from whatever lender you found first, and it was readily available because of urgency, even with brutally high interest rates. In this blog, you will get your answers, like what refinancing is, how to refinance your loan, when you can opt for refinancing your loan, and more.

Can You Refinance a Personal Loan?

Yes, you can refinance a personal loan. Simply put, refinancing is transferring your old loan to a new lender. It is usually done in cases where your current interest in the present lender is high compared to the new one or it was increased later. It can be beneficial if the central bank has revised lending rates since you last took the loans. You might also have improved your credit score, leading to better interest rates.

Refinancing a personal loan allows borrowers to replace the existing loan with a new one with a new interest rate or a revised repayment timeline. It can be a good option for those looking to extend their repayment term or improve their credit score. Furthermore, refinancing can help reduce the cost of borrowing with a lower interest rate. As a result, borrowers are required to pay less overall on their loans.

How to Refinance a Personal Loan

So, one finds themselves considering the prospect of refinancing a personal loan. It’s a journey worth embarking upon, akin to giving one’s finances a refreshing makeover. Here’s a guide to navigating this terrain:

Comprehensive Understanding: Begin by delving into the depths of the current loan arrangement. One must discern the interest rate, monthly obligations, and any concealed charges lurking.

Credit Score Assessment: Like a financial report card, the credit score demands attention. One should procure it and rectify any discrepancies. A bolstered score often translates to more favorable refinancing terms.

Exploration of Lenders: Time to peruse the market for potential refinancing partners. Whether it’s traditional banks, credit unions, or online lenders, one must scrutinize their offerings meticulously, seeking those with commendable reviews and enticing rates.

Submission of Application: Having identified a suitable lender, the next step is the application process. Gather all pertinent financial documentation and brace for a lot of paperwork.

Comparison of Offers: As offers start trickling in, engaging in a thorough comparative analysis is imperative. Interest rates, fees, and additional perks must be meticulously weighed.

Discerning Selection: After careful consideration, one must select the refinancing offer that aligns best with their financial goals. The cumulative cost, repayment duration, and potential savings should guide this decision.

Decide if refinancing is right for you

You can refinance a loan as soon as you start paying off your loan installments. However, it is important to consider whether refinancing is a good option for you or not. In most cases, it is a good idea if you are getting better interest rates from other lenders. Additionally, it can also be considered when your credit score has improved, paving the way for better offers to be made available.

Choose how you’d like to refinance your personal loan

Two main options for borrowers include going to a new lender and negotiating with the current one.

Going with a New Lender: Ideally, this is the most common reason for refinancing. Let’s say you borrowed money in case of an emergency from the first lender that came your way. Now, that you have time, you must shop around and find out what it best lender for you is available at the best interest rate available in the lenders’ market for you to borrow. The idea is to get a better deal.

Negotiate with current lender: Sometimes, it is a better option to renegotiate your loan with your current lender. Your current lender might be willing to refinance your loan at a lower interest rate. Since they have already lent you money, the loan refinance would be more seamless as the paperwork is already in place with your history of installment payments. But remember to compare their offer with other lenders.

Shop around for a rate

There are tons of online resources dedicated to loan comparisons. These websites allow you to plug in your loan details and see refinance offers from a variety of lenders all in one place. It’s like online window shopping for interest rates! Don’t be afraid to reach out to multiple lenders directly. Call them up, chat online, or visit a branch in person if they have one. Explain your situation and ask about their refinance rates and terms. The more lenders you talk to, the better chance you have of finding the absolute best deal.

Prequalify and compare offers

Alright, you’ve got a few lenders in mind that seem promising. Now it’s time to see what kind of rates they can actually offer you without hurting your credit score. Here’s the secret weapon: prequalification!

Think of prequalification like a test drive. You provide some basic info like loan amount, income, and job details, and lenders show you potential rates and terms. The best part? No hard credit check, so your score stays sparkling.

Most lender websites have a prequalification option these days. It’s quick and easy, and within minutes you’ll have a sense of their rates and terms. Calling a loan officer directly can also be helpful. They can answer questions about their refinance options and might even prequalify you over the phone. You might even snag a better rate by talking to a real person!

Choose a lender and formally apply

While the interest rate is obviously a big deal, don’t get tunnel vision. Look at the whole package. Are there any origination fees, application fees, or prepayment penalties you need to factor in? Furthermore, understanding the loan terms and conditions is key. Is it a fixed or variable rate? Are there any prepayment restrictions? Make sure everything aligns with your financial goals.

Research the lender’s reputation for customer service. Reading online reviews or talking to friends who’ve used them can be helpful.

Pros and Cons of Refinancing a Personal Loan

Personal loans – sometimes they feel like an anchor. Refinancing can be a game-changer, but it’s not magic. If rates have plunged, refinancing can save you big. Acing your credit score?

You might snag a lower rate. Refinancing will also help you pay off your debt faster or consolidate it all under one roof. But watch out for fees! If you’re nearing the finish line with your current loan, the savings might be small. Do your research, compare rates, and make sure it makes financial sense for you!

How Refinancing Your Personal Loan Can Affect Your Credit

Let’s face it! Your credit score is like your financial report card. You want to keep that thing sparkling! So, here’s the deal with refinancing and your credit score – it’s not all doom and gloom.

The Short-Term Blip

There’s a tiny catch. When you apply for refinance, lenders will make a hard inquiry on your credit report. This inquiry can cause a temporary dip in your score, usually by a few points. Think of it like a tiny ding on your report card when applying for a new loan product. Nothing major, but it’s there.

The Long-Term Potential

Refinancing can actually help your credit score in the long run, especially if you land a sweet deal:

Lower Interest Rate = Credit Score Boost: Snagged a lower interest rate with refinancing? That can improve your credit utilization ratio (the amount of credit you’re using compared to your total limit). A lower utilization ratio is a major turn-on for credit bureaus and can give your score a nice bump.

Shorter Loan Term = On-Time Payment Powerhouse: Opting for a shorter loan term with refinancing shows lenders you’re serious about responsible borrowing and timely payments. Consistent repayment behavior like this is music to their ears and can positively impact your score over time.

What Does It Mean to Refinance a Personal Loan?

Once you secure the perfect match, your new lender swoops in and uses the loan amount to completely pay off your existing loan.

New Lender, New Payments: From then on, you make repayments to the new lender, hopefully with a significantly lower interest rate. It’s a fresh start with a potentially sweeter deal! Refinancing can be a powerful tool, but it’s not a magic wand. Consider these before diving in:

Interest Rate Savings: Is the new interest rate significantly lower than your current one? Aim for at least a 1-2% reduction to make it worthwhile. Every penny counts!

Fee Frenzy: Watch out for origination fees, application fees, and prepayment penalties that come with refinancing. Make sure the savings outweigh these extra costs. You don’t want hidden villains (fees) lurking!

Your Credit Score: A good credit score generally means a lower interest rate with refinancing.

When Refinancing is a Good Idea

In case your credit score improved enough to get you better deals, or the US Federal Bank decided to slash bank rates, and the public sector bank followed suit but cut interest rates. This would be a good time to consider refinancing.

When Should You Wait to Refinance a Personal Loan

Refinancing a personal loan can be helpful in certain situations, including:

You’re nearing the end: The savings might be minimal if you’re close to paying it off anyway. Celebrate that win soon!

Your future income is shaky: Refinancing could lock you into a higher payment you might not be able to afford later.

Big expenses are looming: You might need that extra wiggle room in your budget for upcoming costs.

Conclusion

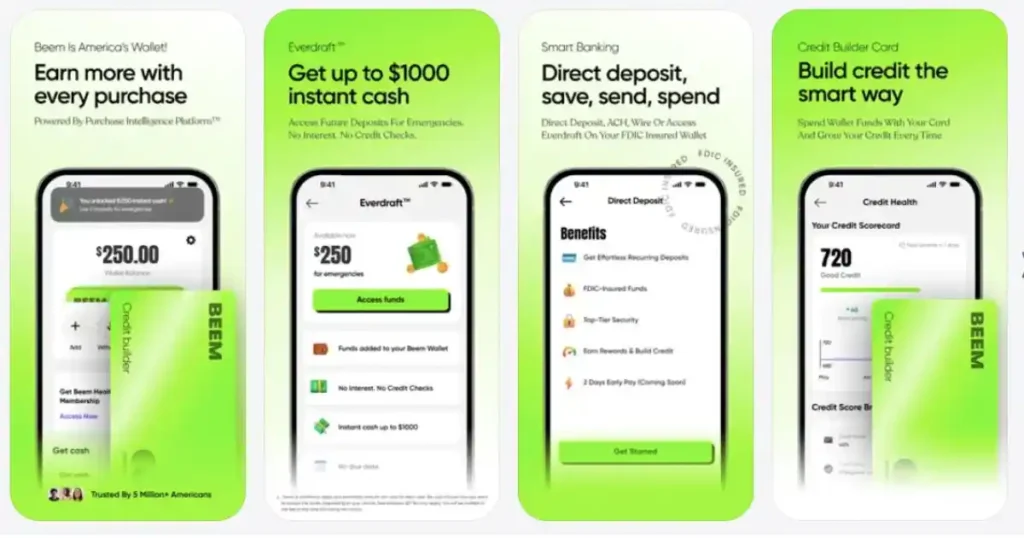

So, is refinancing your personal loan a magic bullet? Not quite. But by considering these scenarios, you can see if it could be your financial superhero. Remember, knowledge is power. Do your research, compare rates, and make sure it makes financial sense for you. Now go forth and conquer that debt! At the same time, check out Beem which helps you compare personal loan options from the biggest lenders across and the country and choose the best suited for your financial needs.