Table of Contents

Improving your credit score is one of the most impactful steps you can take toward achieving financial stability, but it requires more than just paying off a few debts. Creating a strategy that fits your unique financial situation is key—a custom credit improvement plan that works for you and your goals.

Raising your credit score takes time, but it’s well within your power with the right strategy. A personalized credit improvement plan gives you power over your financial destiny, allowing you to focus on the areas of your credit that can be improved. Here’s how you can break down exactly how you can develop a tailor-made plan that suits your circumstances and works.

Step 1 – Get Your Full Credit Report

The first step in creating a real credit improvement plan is understanding your starting point. Request your credit report from all three major bureaus — Experian, Equifax, and TransUnion. You’re entitled to a free copy from each bureau once a year through AnnualCreditReport.com.

What to Look For:

- Errors in your personal information (wrong addresses, misspelled names)

- Inaccurate account statuses (e.g., payments marked late when they weren’t)

- Outdated negative marks that should have fallen off

- Accounts you don’t recognize (which could indicate fraud)

Why This Matters: Errors and outdated information can unfairly drag down your credit score. Disputing inaccuracies ensures your credit file accurately reflects your financial behavior. Fixing even minor errors can boost your score quickly and significantly.

Tip: Document any errors you find with screenshots or copies of the report sections, and submit disputes directly to the reporting bureau online or via mail.

Step 2 – Assess Your Financial Situation

Once you know what’s on your credit report, it’s time to look hard at your overall financial health. Create a complete list of your debts, including:

- Creditor name

- Balance amount

- Minimum payment

- Interest rate

- Payment due date

Also, note any negative marks on your credit report, such as late payments, charge-offs, collections, or high credit utilization ratios.

Questions to Ask Yourself:

- Which debts are costing me the most?

- Are there any accounts close to their credit limit?

- How many late payments are reported?

Why This Matters: This information helps you prioritize which issues to tackle first. A high-interest loan might require faster repayment, while a high-utilization credit card could significantly lower your score.

Bonus Tip: Set up a simple spreadsheet to track your debts and payments each month. It’s easier to stay organized when you can visually monitor progress.

Read related blog: How to Prepare for Major Purchases by Tracking Your Credit Score Effectively

Step 3 – Set Specific, Measurable Credit Goals

General resolutions like “I want better credit” are easy to forget. To stay focused, you need clear, measurable targets. Think about SMART goals — Specific, Measurable, Achievable, Relevant, and Time-bound.

Examples of Good Credit Goals:

- “Raise my credit score by 50 points in the next 6 months.”

- “Lower my credit card utilization to 20% within 4 months.”

- “Pay off $2,000 in revolving debt by December 31st.”

Why This Matters: Specific goals give you something tangible to work toward. You’ll also be able to celebrate small wins along the way, which keeps motivation high.

Motivation Tip: Write your goals somewhere visible — like a note on your bathroom mirror or a digital wallpaper for your phone.

Step 4 – Build Your Action Plan

This is the heart of your custom credit improvement plan: laying out the actionable steps to move you toward your goals.

Make On-Time Payments a Priority

Your payment history accounts for 35% of your credit score, making it the most critical factor. If you can, set up autopay for minimum payments. Use calendar reminders or budgeting apps for other bills to stay on top of due dates.

Pro Tip: Even one missed payment can stay on your report for up to seven years — but consistent on-time payments help repair that damage over time.

Pay Down High-Interest and Revolving Debt

Use proven debt repayment strategies:

- Avalanche Method: Pay extra toward debt with the highest interest rates first.

- Snowball Method: Pay off the smallest debts first to build momentum.

Either method works — what’s important is consistency.

Example: If you have a $500 credit card balance at 24% interest and a $2,000 loan at 5% interest, start attacking that $500 balance aggressively.

Read related blog: Solutions for Overcoming Low Credit Scores: Practical Tips and Strategies

Keep Credit Utilization Low

Credit utilization — the ratio of your current credit card balances to your total credit limits — impacts 30% of your score. Aim to keep it below 30% and ideally below 10% for maximum impact.

Quick Tips to Reduce Utilization:

- Pay down cards multiple times a month

- Ask for a credit limit increase (but don’t use the extra limit!)

- Spread balances across multiple cards if possible.

Avoid Unnecessary Credit Applications

Every time you apply for credit, a hard inquiry is placed on your report, which can ding your score by a few points. Limit new applications to necessities only.

Best Practice: Space out applications by at least 6 months, and avoid multiple applications in a short window unless you’re rate shopping (like for a mortgage or auto loan).

Maintain Old Credit Accounts

Older accounts help your credit history look more established and reliable. Even if you no longer use an old card, keep it open unless it’s costing you hefty annual fees.

Pro Tip: To keep the account active, make a small purchase on old cards once every few months and pay it off immediately.

Regularly Review and Dispute Credit Report Errors

Make it a habit to pull your credit reports at least twice a year — more if you’re actively working on improvements. New errors or signs of identity theft can pop up unexpectedly.

Resource Tip: You can sign up for alerts with your banks or use an app that notifies you when new accounts are opened in your name.

Step 5 – Diversify and Build Credit Responsibly

A well-rounded credit profile includes a mix of account types, such as:

- Credit cards

- Installment loans (e.g., car loans, mortgages)

- Retail store accounts

If your credit profile is thin, consider:

- Secured Credit Cards: Easy to get, even with low scores

- Credit-Builder Loans: Offered by some credit unions and online banks

- Becoming an Authorized User: Get added to a family member’s or friend’s card (with their permission) to benefit from their positive history.

Why This Matters: Credit mix accounts for 10% of your score. Even one new positive account can make a noticeable difference over time.

Read related blog: Avoid Common Credit Mistakes With Beem’s Monitoring Tools

Step 6 – Monitor Your Progress and Adjust

Progress tracking keeps you engaged and motivated. Use a journal, spreadsheet, or digital credit monitoring tool to:

- Record payments made

- Note new score changes.

- Track debt payoff amounts.

- Update your goals as needed.

Celebrate Milestones: Whether it’s paying off your first card or hitting your first 20-point score jump, acknowledge your achievements. Progress, no matter how small, builds momentum.

Reality Check: There will be setbacks. Life happens — unexpected expenses, emergencies, even forgotten payments. What matters is how quickly you regroup and refocus on your plan.

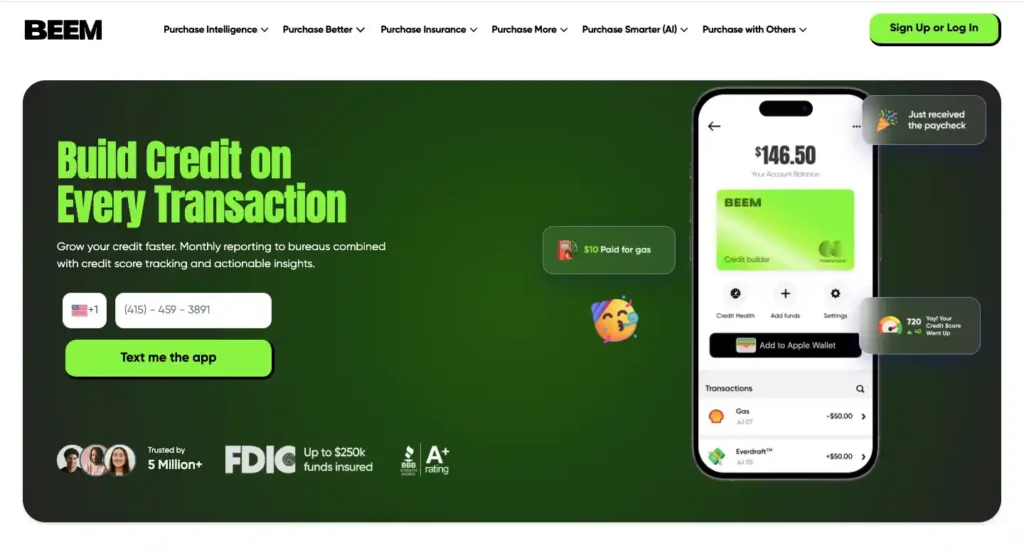

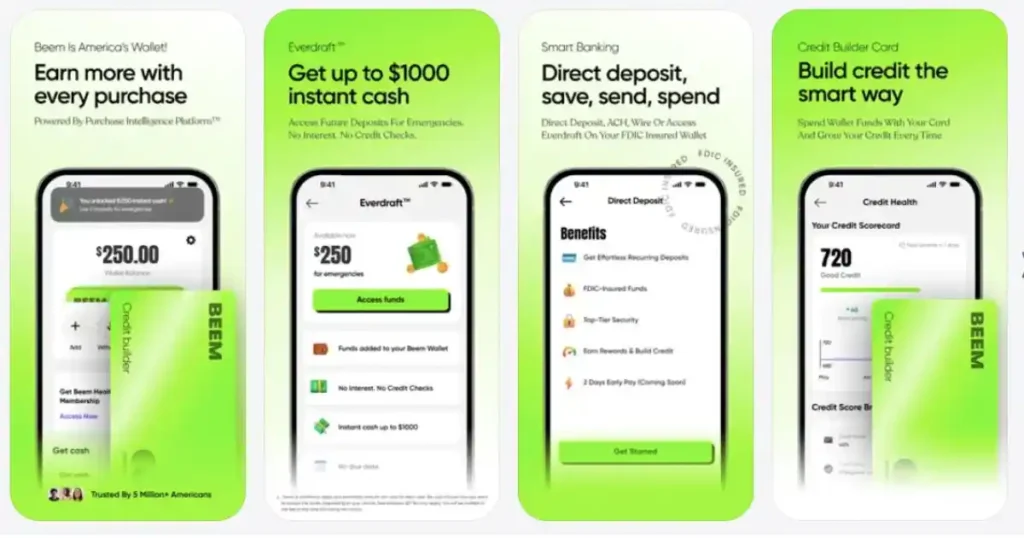

Take Charge of Your Credit Journey with Beem’s Monitoring and Tools

Now that you’ve mapped out your plan, don’t go it alone — empower yourself with the proper digital support. Beem’s Credit Monitoring App is designed to make the journey smoother and more successful.

What Beem Offers:

- Real-Time Alerts: You will receive immediate notifications when changes occur on your credit report, helping you react quickly to potential issues.

- Score Factor Breakdown: Understand exactly what’s helping — and hurting — your score.

- Personalized Tips: Based on your unique profile, Beem suggests targeted steps you can take to accelerate your progress.

- Historical Tracking: Visualize your score journey over time with easy-to-read graphs and reports.

- Fraud Detection: Beem’s monitoring helps guard your profile against identity theft and unauthorized activity.

Why It Matters: When you’re actively improving your credit, knowledge is power. The more aware you are of your credit activity, the faster you can make informed decisions and adjust your strategy as needed. With Beem by your side, managing your custom credit improvement plan becomes less stressful and much more effective.

Read related blog: What to Do When Your Credit Score Drops: Beem’s Solutions

Final Thoughts

Creating a custom credit improvement plan isn’t about quick fixes or gimmicks. It’s about understanding your starting point, setting clear and achievable goals, and consistently following a disciplined path toward financial health. Credit improvement is a journey — and like any journey, it requires patience, persistence, and the right tools. But the payoff is worth it: lower interest rates, easier loan approvals, better job prospects, and a sense of financial confidence.

With a thoughtful plan, a proactive mindset, and powerful tools like Beem’s Credit Monitoring App, you can build the strong credit profile you deserve — and open the door to bigger, brighter financial opportunities ahead. Download the app today.