Imagine you’re out delivering orders, and your car suddenly breaks down. You need repairs immediately, but your DoorDash payout won’t arrive for days. Fuel costs, maintenance issues, or personal emergencies can arise unexpectedly, leaving you in a financial bind.

Many gig economy workers face similar financial gaps, making instant cash advances a lifesaver. These short-term financial solutions help drivers cover urgent expenses, ensuring they can keep working without major disruptions.

With the right cash advance option, you can quickly access the funds you need, maintain your delivery schedule, and avoid unnecessary financial stress.

Understanding how these advances work and which services cater best to DoorDash drivers can make all the difference in staying financially secure while on the road.

Why DoorDash Drivers Might Need an Instant Cash Advance

DoorDash drivers operate in a gig-based model, meaning their income can fluctuate. Access to instant cash advances can help bridge financial gaps arising from unexpected expenses.

Unpredictable Earning Cycles

DoorDash drivers rely on weekly payouts or Fast Pay, but earnings can fluctuate due to slow orders, market changes, or bad weather. Since many depend on daily tips, a low-income shift can cause financial stress, making a cash advance a crucial fallback.

Vehicle Maintenance & Fuel Costs

Frequent driving leads to costly maintenance, from routine oil changes to emergency repairs. A sudden breakdown can take a vehicle off the road, directly affecting earnings. Additionally, fluctuating gas prices make budgeting difficult, so having instant financial support ensures drivers can keep working.

Personal Emergencies

Medical bills, rent, and utilities don’t align with DoorDash’s payment schedule. Personal emergencies can arise unexpectedly, making it essential for drivers to have quick access to cash. An instant cash advance provides financial stability, ensuring that urgent expenses don’t disrupt their ability to earn.

Let’s explore the world of loans for doordash drivers for DoorDash drivers, including the best cash advance apps, the advantages and disadvantages of seeking such advances, and important factors to consider before taking this financial step.

Evaluating Traditional vs. Gig-Specific Lending

DoorDash drivers have different borrowing options, from traditional loans to gig-focused cash advances. Understanding the pros and cons of each can help in making an informed decision.

Traditional Payday Loans

Payday loans offer quick cash but come with high interest rates and short repayment terms, often leading to a cycle of debt. Many lenders require proof of stable employment or a fixed paycheck, making it difficult for gig workers to qualify for these loans.

Online Banks & Credit Unions

Some online banks and credit unions provide small loans or overdraft protection, which can help during financial shortfalls. However, they often require a good credit score or regular direct deposits, making them less accessible for gig workers with inconsistent earnings and unpredictable income patterns.

Gig-Focused Cash Advance Apps

These apps cater to gig workers by assessing their deposit history rather than credit scores. They provide flexible cash advances with lower fees, helping drivers access quick funds without the strict requirements of traditional lenders, making them a better fit for DoorDash workers.

8 Best options to get instant cash advance for doordash drivers

When it comes to obtaining instant cash advances, DoorDash drivers have several options to choose from.

Here are some of the best instant cash advance apps for doordash drivers.

| Instant Cash Advance for DoorDash Drivers | Features | Benefits for DoorDash Drivers | Drawbacks |

|---|---|---|---|

| Beem | Peer-to-peer lending, budgeting tools, early wage access, budgeting tools, free tax filing, car insurance, best personal loans, high yield savings account and much more | Flexible loan options, potential for lower interest rates than payday loans, budgeting tools | – |

| Brigit | Free paycheck advances, budgeting tools | Fast and free advances (up to $250), no credit checks | Plus plan subscription for higher advance limit, limited advance amount |

| MoneyLion | 0% APR cash advances (up to $500), investment accounts, budgeting tools | 0% APR cash advances, higher potential borrowing limit with MoneyLion products, budgeting tools | Account activity and income requirements, potentially lower limit initially |

| Albert | Budgeting tools, automatic savings, cash advances (up to $250) | Smart savings, cash advances with no late fees, budgeting tools | Paid subscription for Genius features, lower advance limit |

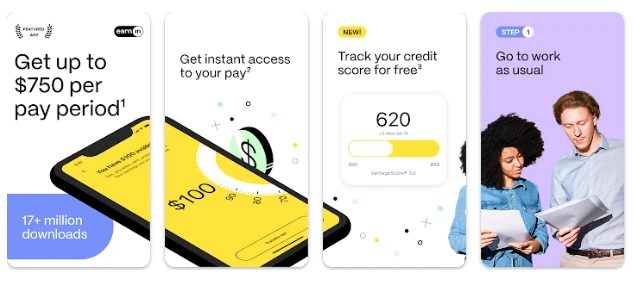

| EarnIn | Early wage access, budgeting tools, financial education | Early access to earned wages, financial education resources | Fees for certain features, may not be available in all areas |

| Dave | Budgeting tools, emergency cash advances, overdraft protection | Cash advances up to $100, budgeting tools, overdraft protection | $1-$10 monthly subscription, late fees |

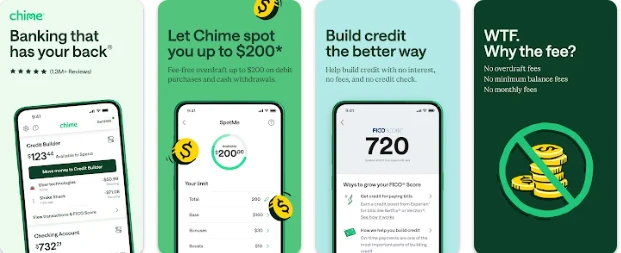

| Chime | Online banking, early wage access (with direct deposit), budgeting tools | No fees, early wage access, budgeting tools | Must be 18 or older with a valid US address and SSN |

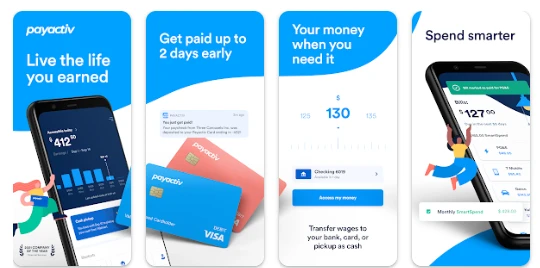

| PayActiv | Early wage access, budgeting tools, bill pay | Early access to wages, budgeting tools, bill pay services | $1-$5 monthly subscription, depending on features |

Best Instant Cash Advance Options for DoorDash Drivers

Here are some top cash advance options for DoorDash drivers, each with unique features, eligibility criteria, and funding speed.

1. Beem

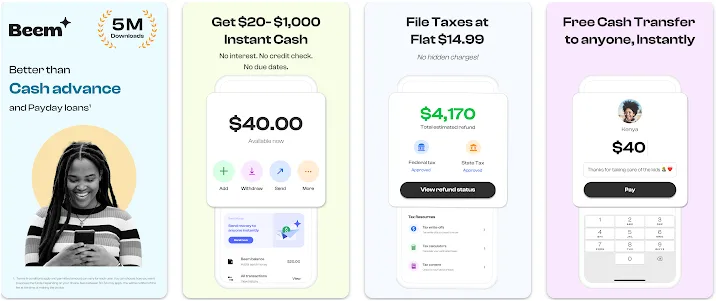

Beem is the alternative app for instant cash advances for DoorDash drivers needing quick cash during emergencies.

With Everdraft, you can secure instant cash advance ranging from $5 to $1,000 for necessities like groceries, utility bills and gas. Beem sets itself apart with its user-friendly approach, offering no-interest, no-credit-check, and no-due-date advances.

You can receive the funds instantly in your Beem account or linked Debit Card, or even opt for gift cards. The smart repayment system deducts the amount when funds become available, eliminating late payment fees.

As a DoorDash driver, you may be looking for discounts and deals to help you dash to your location and deliver on time.

Beem tracks working hours and offers advances based on already earned income. There are no formal interest charges, as the service operates on a voluntary tip model. If DoorDash earnings are deposited in a linked account, Beem can provide instant cash, often with a small expedited transfer fee.

How It Works:

Tracks hours worked via timesheets or GPS and provides an advance on already earned income. It operates on a voluntary tip model instead of traditional interest charges.

DoorDash Driver Compatibility:

If you deposit DoorDash earnings in a linked checking account, Beem analyzes your deposits and allows early cashouts. Instant funding is available with a small “Lightning Speed” fee.

Pros & Cons:

Pros: Beem charges no mandatory fees and offers real-time wage tracking, helping DoorDash drivers manage earnings efficiently and budget better without relying on high-interest credit options.

Cons: New users may only qualify for lower advance limits ($100–$250), which might not cover larger expenses. However, consistent use and timely repayments can increase the limit over time.

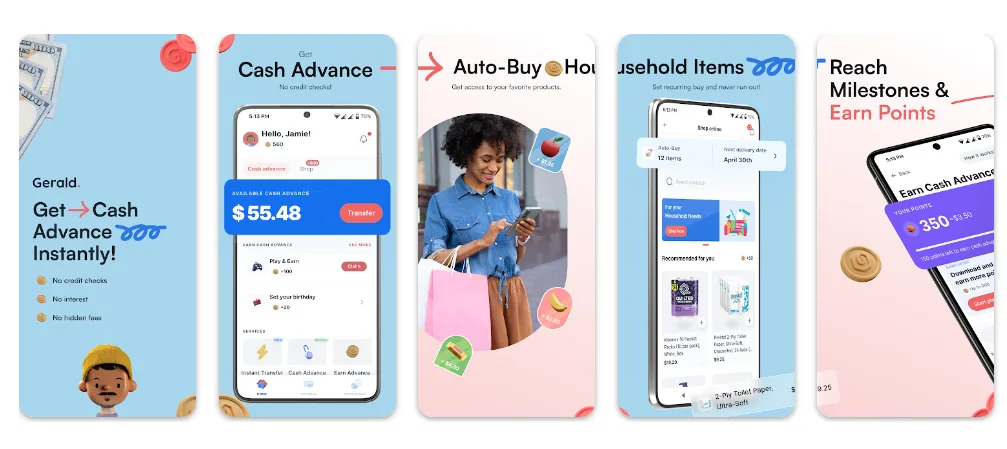

2. Gerald

Gerald shines as the top choice for DoorDash drivers seeking financial empowerment. For a monthly subscription fee of $9.99, Gerald provides access to a robust suite of budgeting tools and features tailored to the gig economy.

It offers interest- and fee-free cash advances of up to $215, enabling drivers to manage their finances effectively. Moreover, Gerald goes the extra mile by allowing users to access up to half of their forthcoming paycheck early, offering unparalleled flexibility.

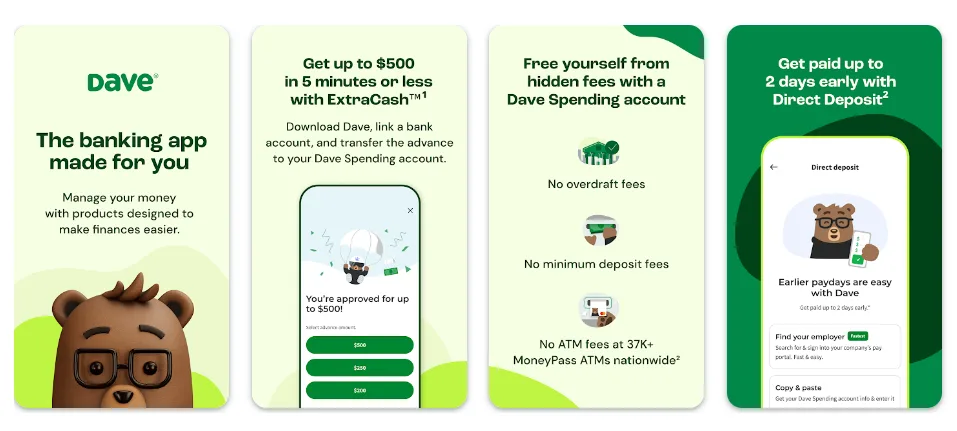

3. Dave

Dave is a flexible cash advance app, offering up to $500 without credit checks or late fees. You can choose your advance amount, access funds instantly, and settle without interest or surprise fees. Multiple factors determine eligibility, and your limit updates daily. Dave simplifies repayment, aligning it with your payday, and does not impose late fees.

How It Works:

Subscription-based service ($1/month) that offers small advances (up to $200) before your next deposit. It uses AI to predict potential cash shortages, helping users avoid overdraft fees.

DoorDash Compatibility:

Works if DoorDash payouts are consistently deposited into a linked checking account. Best for covering small, immediate expenses like gas or groceries.

Pros & Cons:

Pros: Transparent subscription fee, includes budgeting insights to help manage finances.

Cons: Maximum advance is limited, making it insufficient for major car repairs or emergencies.

4. Cleo

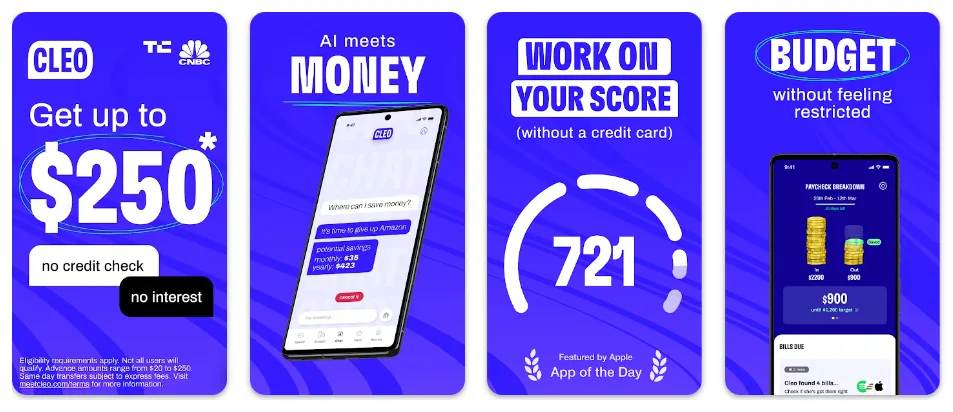

Cleo offers a cash advance of up to $250 with no interest or credit checks, making it a go-to for emergency funds. Choose same-day access for $3.99 or wait 3-4 days at no extra cost. Cleo calculates eligibility based on earned income, ensuring no interest rates or late fees.

Auto-pay and flexible repayments simplify the process, always deducting the borrowed amount or less.

5. Brigit

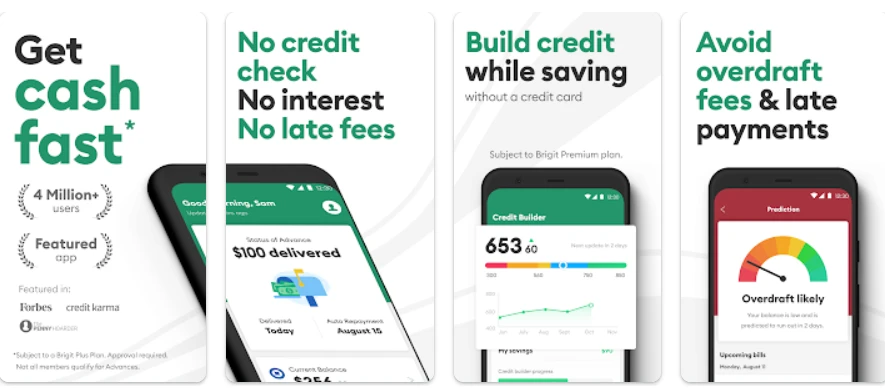

Brigit offers small cash advances ranging from $50 to $250 to help you cover expenses until your next payday. There’s a monthly subscription fee, and an optional fee for faster access to the cash. Repayment is automatic on your next payday.

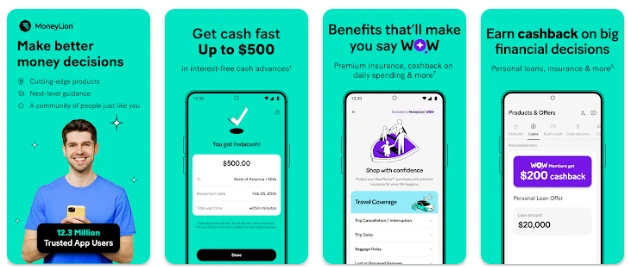

6. MoneyLion

MoneyLion offers cash advances up to $1,000 for frequent users. These advances come in $100 increments. There are optional fees for monthly membership and for faster access to the money. You’ll repay the advance on the date MoneyLion determines is your next payday.

It can take 1-2 business days to receive the money in your account if you have a MoneyLion checking account, otherwise it can take 2-5 days. For a fee, you can get the money within minutes.

Find the best deals on Nike and Jordan shoes at up to 30% off here.

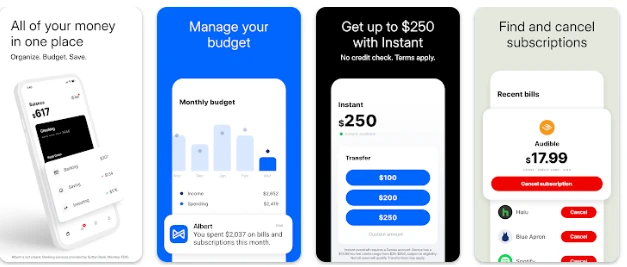

7. Albert

Albert simplifies managing your finances by letting you create and send invoices, track expenses, and keep everything organized. Plus, you can store unlimited invoices and expenses for free, giving you peace of mind and a clear picture of your business’s health.

8. EarnIn

Earnin is tailored for gig workers and links to bank accounts to verify earnings. It provides cash advances against expected income and offers budgeting tools.

How It Works:

An app designed for gig workers like DoorDash, Uber, and Instacart. It links to your bank account or DoorDash earnings to verify income and provide cash advances.

Key Features:

Provides cash advances against your gig income, typically without high fees or interest. Offers community perks, including a unified dashboard for gig deposits and budgeting tools.

Why It’s Great for DoorDash Drivers:

Perfect for multi-platform gig workers—aggregates earnings from multiple sources. Repayments align with your deposit schedule, making it a flexible option for managing cash flow.

9. Chime

Chime offers a fee-friendly banking experience with no monthly fees, overdraft fees, and access to a large free ATM network. Plus, you can start an account with no minimum deposit and enjoy early access to your direct deposits. However, keep in mind there are no physical branches, and depositing cash incurs fees.

10. Payactiv

It offers the benefit of early access to your paycheck and potentially secure bill pay, it has limitations on access and might have fees. Full functionality depends on your employer’s participation.

Steps to Qualify for a DoorDash Cash Advance

Qualifying for a cash advance requires meeting certain eligibility criteria. Lenders assess financial stability, account status, and identity verification to determine approval and borrowing limits for gig workers.

Consistent Earnings & Deposits

Cash advance apps review recent deposit history to assess financial stability. Drivers with regular earnings from DoorDash and other gig platforms are more likely to qualify for higher advance amounts.

Active Checking Account

Most services require a valid U.S. checking account for fund transfers and repayments. Some platforms also support digital wallets or prepaid debit cards, but options may vary.

Verification of Identity

Applicants must verify their identity using a government-issued ID, such as a driver’s license or Social Security number. Some apps may also request DoorDash account integration or earning screenshots for verification.

Maintaining Good Standing with the App

Timely repayment of advances helps increase borrowing limits over time. Consistently missing payments can lower eligibility, add additional fees, or cause account suspension.

How to Get Instant Pay on DoorDash

To access instant pay as a DoorDash driver, you’ll typically need to follow these steps:

1. Sign Up: Create a DoorDash driver account if needed. This initial step is your gateway to accessing convenient cash advances.

2. Choose a Partner App: DoorDash frequently collaborates with cash advance apps. Sign up for one of these partner apps and link it to your DoorDash account to unlock the benefits of instant earnings access.

3. Complete Deliveries: Continue your routine of completing deliveries. Your earnings will accumulate in your DoorDash account, providing a steady income stream.

4. Cash Out: When needed, utilize the partner app to cash out your earnings swiftly. The money will be securely deposited within minutes into your bank account or digital wallet, providing financial flexibility.

Pros & Cons of Using Cash Advances for DoorDash Earnings

Cash advances can be a helpful financial tool but also come with risks. Understanding the advantages and potential downsides can help drivers decide when and how to use these services.

| Pros of Cash Advances for DoorDash | Cons of Cash Advances for DoorDash |

|---|

| Immediate Access to Funds – Cash advances provide quick financial relief for urgent expenses like car repairs or medical bills, ensuring drivers can continue working without disruptions. Most services offer same-day or instant transfers for a small fee. | Potential Fees or High Interest – Some cash advance apps charge additional costs, including optional “tips,” subscription fees, or instant transfer charges. While they may seem small, these expenses can add up over time. |

| No Traditional Credit Check – Most gig-focused cash advance apps do not require a hard credit check. Instead, they assess deposit frequency and earnings history, making them more accessible for gig workers with fluctuating incomes. | Risk of Dependence – Relying too heavily on cash advances can create a cycle of borrowing, reducing future payouts. Drivers may find themselves constantly needing advances, leading to long-term financial strain. |

| Flexible, App-Based Solutions – Many cash advance platforms are app-based, allowing drivers to conveniently manage borrowing, repayments, and budgeting from their smartphones. These features help users track finances and avoid late payment issues. | Low Initial Limits – First-time users may only qualify for small advances, which might not be enough to cover large expenses like major car repairs. Over time, responsible use can increase borrowing limits. |

What are the Advantages of cash advance for doordash drivers

Obtaining an instant cash advance as a DoorDash driver offers several advantages:

1. Financial Flexibility: Cash advances allow you to access your earnings on your terms, helping you cover unexpected expenses or manage your finances more effectively.

2. Avoiding Late Fees: By accessing your earnings instantly, you can avoid late payment fees on bills, which can quickly add up and strain your finances.

3. Emergency Funds: Cash advances can serve as an emergency fund, allowing you to address unforeseen situations without resorting to high-interest loans or credit card debt.

4. Peace of Mind: Knowing you have quick access to your earnings can reduce financial stress and provide peace of mind as you navigate the gig economy.

Lace up your kicks! Get up to 30% off on Nike and Jordan shoes and sneakers.

What are the Disadvantages of cash advance for doordash drivers

While instant cash advances offer numerous benefits, it’s crucial to be aware of their prospective drawbacks:

1. Fees and Interest: Some cash advance apps may charge fees or interest for their services. Understanding the terms and costs of the advance you’re considering is essential.

2. Potential Dependency: Relying too heavily on cash advances can lead to financial dependency, making it challenging to manage your finances without them.

3. Reduced Future Earnings: Cashing out your earnings early may mean less money available for future expenses or goals, as you’re essentially borrowing from your future earnings.

4. Limited Access: Not all cash advance apps may be available to DoorDash drivers in all regions, so the availability of these services may vary.

Factors to Consider Before Getting an Instant Cash Advance for DoorDash Drivers

Before you decide to get an instant cash advance as a DoorDash driver, it’s essential to consider the following factors:

1. Cost: Review the fees and interest rates associated with the cash advance. Calculate how much the advance will cost you in the long run.

2. Repayment Terms: Understand when and how you’ll need to repay the cash advance. Some apps deduct the advance from your future earnings.

3. Budgeting: Assess your overall financial situation and determine whether a cash advance is the best solution for your current needs.

4. Alternative Options: Explore other options for covering your expenses, such as creating an emergency fund or seeking assistance from financial counselors.

5. Financial Goals: Consider how taking an advance may impact your long-term financial goals and whether it aligns with your financial strategy.

Can DoorDash Drivers Get a Quick Cash Advance?

Yes, DoorDash drivers can indeed obtain quick cash advances. Several financial service providers and mobile apps have recognized the need for such services in the gig economy. They have tailored their offerings to cater to these drivers’ unique financial situations.

These cash advances are designed to provide swift access to funds, helping DoorDash drivers bridge the gap between their earnings and financial responsibilities.

Conclusion

In the world of gig work, instant cash advances have emerged as a valuable tool for DoorDash drivers seeking financial flexibility and relief from unexpected expenses.

These advances can provide a lifeline for those navigating the gig economy, but they should be used judiciously, with a clear understanding of the associated costs and implications.

Ultimately, seeking an instant cash advance should be based on carefully considering your financial circumstances and needs. When used wisely, these advances can help DoorDash drivers better manage their finances and achieve more stability in their gig work journey.

With Beem Everdraft, you can also get an instant cash advance of $20 – $1,000 for emergencies like paying bills, gas, groceries & medicines without any income restrictions, due dates, and credit checks.

Most Frequent Questions Asked About Cash Advance For DoorDash Drivers

Do I Need to Have a Full-Time Job to Use These Apps?

No, gig income qualifies for cash advances. Most lenders focus on deposit frequency and earnings history rather than requiring a traditional 9-to-5 job, making these services accessible to DoorDash drivers and other gig workers.

How do DoorDash drivers borrow money?

DoorDash drivers can borrow money through cash advance apps and services that cater to gig workers. These apps typically allow drivers to access their earnings before their scheduled payday, providing a quick and convenient way to borrow money when needed.

Why Do DoorDash Drivers & Ridesharers Choose Beem?

DoorDash drivers and ridesharers choose Beem for its convenience and reliability. Beem’s Everdraft feature provides quick cash advances from $20 to $1,000 for essential expenses without interest, credit checks, or due dates.

Funds are instantly available in your Beem account or linked debit card; you can even opt for gift cards. Plus, Beem’s smart repayment system ensures you won’t incur late payment fees, making it the perfect choice for drivers in emergencies.

Can I get a loan if I work for DoorDash?

Yes, but it depends on your credit history and income documentation. Personal loans are a good option, but consider fees with cash advance apps. Build credit and document your earnings to improve your chances.

Is DoorDash ‘Fast Pay’ Better Than a Cash Advance?

Fast Pay allows daily cashouts for a $1.99 fee, making it a more affordable option for small needs. However, cash advances provide access to funds beyond your available DoorDash earnings, making them more useful for larger or unexpected expenses.

Are There Any ‘Scam’ Apps I Should Avoid?

Beware of apps that require upfront fees, lack transparency about interest rates, or have poor user reviews. Legitimate services should clearly outline fees, provide customer support, and have a verifiable business presence. Always research before signing up.

What is a cash advance for DoorDash drivers?

A cash advance is a short-term financial solution that allows DoorDash drivers to access their earnings before their scheduled payout. It can be obtained through DoorDash’s Fast Pay, DasherDirect, or third-party cash advance apps.

Do cash advances require a credit check?

Most cash advance services, especially those tailored for gig workers, do not require a traditional credit check. Instead, they assess your earnings history, deposit frequency, and transaction patterns.