In the contemporary financial landscape, short-term installment loans, several notable counterparts have emerged in alternative financial solutions akin to Credit Cube, each with its unique value proposition. These financial instruments offer diverse features, from competitive interest rates to flexible repayment structures. Notable players in this space strive to accommodate varying financial needs while emphasizing transparency and responsible lending practices.

By harnessing technology, these platforms streamline application processes, providing a seamless experience for borrowers. Consumers must conduct thorough due diligence, exploring the terms and conditions of such alternatives and ensuring alignment with their specific financial requirements.15

15 Best Loans Like Credit Cube

Let’s Have a look into the Best Options for Loans like Credit Cube with No Credit Check:

| oan Provider | Loan Amount | Interest Rate | Advantages | Disadvantages |

|---|---|---|---|---|

| Beem | $5 – $1,000 | 0.50% to 35.99% | Fast, No credit check, Flexible repayment | |

| OppLoans | $500 – $4,000 | Up to 160% APR | Fast, No credit check | High interest rates |

| Upstart | $1,000 – $50,000 | Varies | AI-based underwriting, Pre-qualification | Lower approval odds for traditional borrowers |

| Upgrade | Varies | Varies | Secured/Joint loans, Debt consolidation | Origination fee, Limited payment flexibility |

| CashNetUSA | Up to $500 | Varies | Fast, Same-day funding | High interest rates, Limited availability |

| Rocket Loans | Varies | Varies | Pre-qualification, Rate discounts | Origination fee, Limited repayment terms |

| OneMain Financial | Varies | Varies | Flexible payment, Debt consolidation | High fees, High interest rates |

| LendingClub | Up to $40,000 | Varies | Diverse financial products, Auto loan refinancing | No sub-accounts for savings goals |

| Best Egg | Varies | Varies | Debt consolidation, No late fees | Origination fee |

| LightStream | Varies | Varies | No fees, Extended repayment terms | Not for fair/bad credit, No pre-qualification |

| Avant | Varies | Varies | Fast funding, Pre-qualification | Origination fee, No co-signed/joint loans |

| MoneyLion | Up to $1,000 | 0% APR | Fast, Credit building | Low limit, Requires direct deposit |

| Possible Finance | Up to $500 | High | Credit reporting, Fast access | High interest rates, Limited availability |

| Universal Credit | $1,000 – $50,000 | High | Debt consolidation, Low minimum | High origination fees, Lower loan cap |

| Upstart | $1,000 – $50,000 | Varies | AI-based underwriting, Credit building | Credit reporting, Fast Access |

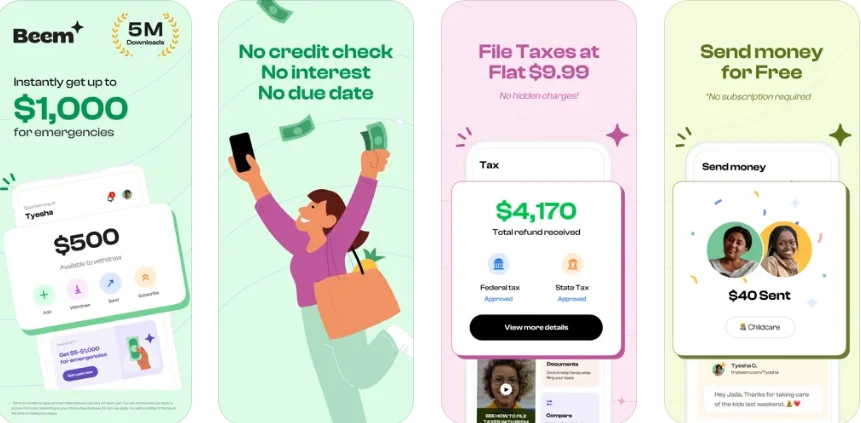

1. Beem – (Best Option for Loans like Credit cube No Credit Check)

In innovative financial solutions, Beem stands out as a premier option for those who seeking for Loans like Credit cube with No Credit Check. Offering Everdraft™, users can access $5 to $1,000 from their verified bank deposits, providing a seamless, No credit check, and interest-free approach to managing financial emergencies. This distinctive feature not only ensures swift access but also boasts repayment flexibility, aligning with the evolving needs of consumers.

Play store Rating:

3.9/5 Rating , 14.9k reviews

1M+ Downloads

Apple Store Rating :

4.7/5 rating , 129 Review

Beem’s commitment to transparency is evident in its absence of income restrictions, credit checks, due dates, or tips, setting it apart as a user-friendly financial tool. Beyond instant cash, Beem extends its utility by facilitating instant money transfers, tax filing services, and a comprehensive Better Financial Feed™ for effective budget planning and financial management. With robust security measures, Beem prioritizes user data protection, making it a trusted choice for those seeking a multifaceted financial solution.

2. OppLoans

Functioning across 37 states, OppLoans has been providing unsecured installment loans for bad credit borrowers since 2012. With the advantage of obtaining loans within 1-2 days and the flexibility to alter payment dates, OppLoans presents a compelling option. While quick access to funds is advantageous, it’s essential to acknowledge the drawbacks, notably the elevated interest rates and relatively short repayment terms.

Rating: 4.7/5 , 4k Reviews

Offering loan amounts ranging from $500 to $4,000 without necessitating a credit check, OppLoans positions itself as a practical alternative to payday loans. However, clients should be mindful of the higher APR of 160%, which may pose affordability challenges in certain states. Despite the cons, OppLoans caters to diverse financial needs, making it a noteworthy consideration for those seeking a reputable lending solution.

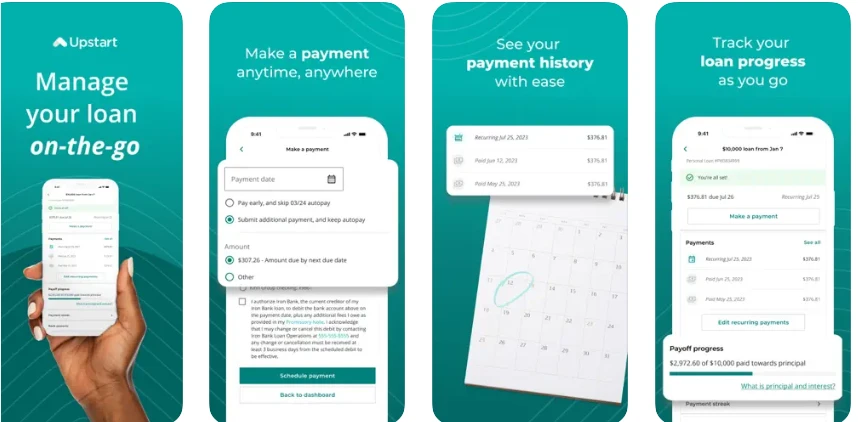

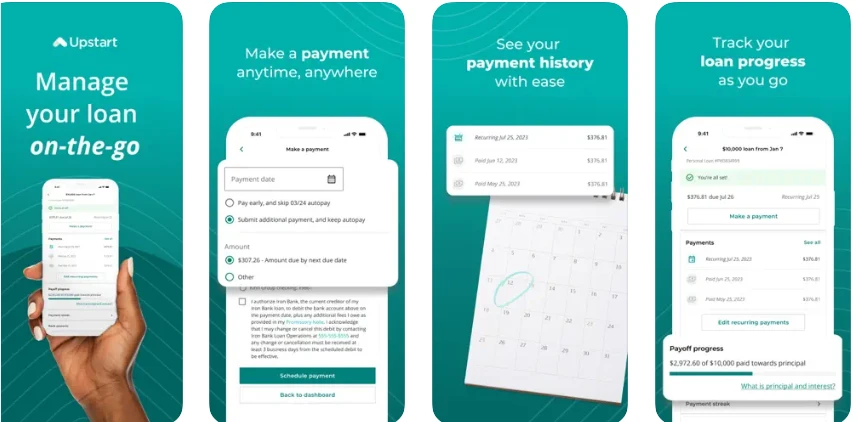

3. Upstart

Distinguished for its innovative approach, Upstart incorporates artificial intelligence into an alternative lending model to enhance accessibility to personal loans. Going beyond traditional metrics, Upstart’s underwriting model assesses education, workplace experience, and various variables, extending loan opportunities to new or less creditworthy borrowers.

Apple store Rating 4.1/5 , 18 Reviews

With loan amounts spanning from $1,000 to $50,000, Upstart provides a pre-qualification option that doesn’t impact credit scores, ensuring a user-friendly experience. It’s crucial to note that available loan amounts may vary based on application data and state regulations, adding a layer of customization to Upstart’s lending offerings.

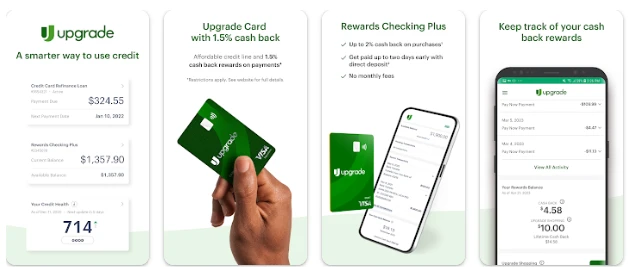

4. Upgrade

Upgrade’s loans have features like secured and joint options, multiple rate discounts, and a user-friendly mobile app. Noteworthy is the ability to make direct payments to creditors, which is particularly beneficial for debt consolidation. However, drawbacks include an origination fee and a need for more flexibility in payment dates. Eligibility is accessible with a minimum credit score of 560, at least one account in credit history, and a 75% maximum debt-to-income ratio.

Play Store Rating : 4.7/5 , 19.1k Reviews

500K+ Downloads

There’s no minimum income requirement, and diverse income sources are accepted. Loan terms vary between 3 to 7 years, and associated fees include an origination fee (1.85% to 9.99%), a $10 late fee, and a $10 failed payment fee. Upgrade emphasizes transparency, providing clear information on potential costs related to late payments or additional charges.

5. CashNetUSA

CashNetUSA distinguishes itself by offering swift same-day deposits, catering to those needing urgent funding during emergencies. Boasting a rapid application process and minimal eligibility requirements, borrowers may secure loans up to $500 with the flexibility to repay on their next payday sans prepayment fees for early settlements. However, the lender’s availability is restricted to 29 states, with interest rates considerably higher than industry averages.

Play Store Rating 4.3 /5 , 20.3K Reviews

500k+ Downloads

Apple Store Rating : 4.8/5 , 33.1K Reviews

CashNetUSA’s loan portfolio includes payday loans, installment loans, and lines of credit, with varying amounts and terms contingent on the borrower’s location. The lender accommodates individuals with lower credit scores, employing a comprehensive approval process beyond traditional FICO evaluations. Despite the potential for quick fund disbursement, borrowers should exercise caution due to the elevated interest rates associated with CashNetUSA loans.

6. Rocket Loans

Rocket Loans distinguishes itself by providing swift funding for online personal loans, catering to borrowers with fair and reasonable credit. Noteworthy features include the option to pre-qualify through a soft credit check, a rate discount for autopay, and a wide range of loan amounts. However, the lender has some limitations, such as charging an origination fee, needing more direct payment to creditors for debt consolidation loans, and offering only two repayment term options.

Play store Rating : 4.8/5 , 24.1k Reviews

1M + Downloads

Apple store Rating : 4.9/5 , 124.5k Reviews

Rocket Loans sets a minimum credit score requirement of 640, requires U.S. residency, and mandates borrowers to be 18 years old in most states. While it provides flexibility in loan amounts, repayment terms vary from 3 to 5 years, and fees include an origination fee (1.49% to 8.48%), a $15 late fee, and a $15 unsuccessful payment fee. Borrowers should be mindful of the conditions outlined in the disclaimer, emphasizing that eligibility is not guaranteed and that loan terms depend on various factors, including credit profile and requested amount.

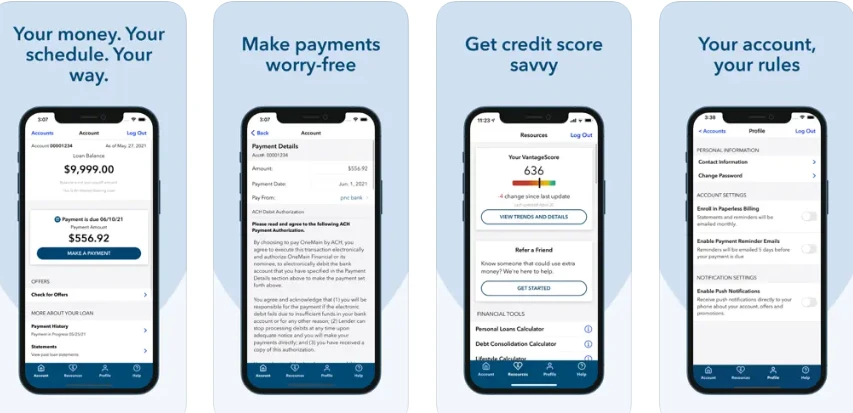

7. OneMain Financial

OneMain Financial prioritizes borrowers’ ability to repay, offering swift funding to those with lower credit scores, albeit with higher interest rates. Pros include flexible payment date options, joint and secured loans, and direct creditor payments for debt consolidation. Drawbacks encompass comparatively high rates, origination fees, and a need for rate discounts with limited loan amounts.

Play store Rating : 4.3/5 , 4.64k Reviews

1M+ Downloads

Apple store Rating : 4.5/5 , 3.9k Reviews

Qualifications are accessible, requiring no specified minimum credit score or history, yet a preference for some credit background. The lender accepts diverse income sources and provides a range of loan terms from 2 to 5 years, accompanied by fees such as origination fees ($25 to $500), late fees ($5 to $30), and non-sufficient funds fees ($10 to $50). Applicants should be mindful of state-specific loan restrictions and regulations outlined in the disclaimer.

8. LendingClub

LendingClub, renowned for its comprehensive services, offers distinctive financial solutions. The Rewards Checking account stands out, providing 1% cash back on eligible purchases and a modest APY on balances, all without monthly maintenance or overdraft fees. While high-yield savings accounts feature competitive interest rates and no maintenance fees, the absence of sub-accounts for specific goals may be a drawback.

Playstore Rating : 3.3/5 , 1.62k Reviews

100k+ Downloads

Apple store Rating : 4.3/5 , 2.5k Reviews

LendingClub’s certificates of deposit (CDs) offer competitive rates across various terms, ensuring a guaranteed return. Additionally, it excels in providing unsecured personal loans up to $40,000 with flexible terms and auto loan refinancing with low rates and no origination fees.

9. Best Egg

Best Egg is a premier choice for borrowers seeking swift access to personal loans, especially for debt consolidation. With the convenience of pre-qualification through a soft credit check, Best Egg offers various loan amounts, catering to unsecured and secured loan preferences. Notable benefits include direct payments to creditors for debt consolidation and the absence of late fees.

Playstore Rating : 4.0/5, 635 Reviews

50k+ Downloads

Apple store Rating : 4.7/5 5.2k Reviews

However, an origination fee is applicable, and there are no rate discounts or the option to select an initial payment date. While qualifications include a minimum credit score of 600 and a U.S. citizenship requirement, a mobile app for loan management must be needed.

10. LightStream

LightStream, catering to creditworthy borrowers, distinguishes itself with an offering free of fees and featuring variable low rates based on the loan’s purpose. Its strengths are the absence of costs, a discount for autopay, and extended repayment terms for home improvement loans.

Playstore Rating: 2.5/5 , 171 Reviews

LightStream does not allow potential applicants to pre-qualify through a soft credit check on its website and does not facilitate direct payments to creditors for debt consolidation. While requiring a minimum credit score of 660 and specific credit history criteria, LightStream impressively waives origination and late fees.

11. Avant

Avant’s loans cater to individuals with fair to bad credit seeking swift funding yet needing credit-building or debt consolidation features. Noteworthy strengths include:

- Rapid fund disbursement.

- Pre-qualification through a soft credit check option.

- A user-friendly mobile app for loan management.

Playstore Rating:

Rating : 4.2/5 , 6.6k reviews

10k+ download

Apple store Rating: 2.2/5 , 72 reviews

Avant stands out for its extensive repayment term options and customer service availability seven days a week. However, potential downsides include:

- The possibility of an origination fee.

- The absence of co-signed, joint, or secured loans.

- No direct payment to creditors for debt consolidation.

12. MoneyLion

MoneyLion Instacash, a feature within the MoneyLion financial app, enables users to borrow up to $500 against their upcoming paycheck, distinguishing itself from Elastic by offering this service without fees and with a 0% interest rate. The sole requirement is repayment by the next paycheck, although extensions may be feasible.

Play Store : 4.5/5 , 115K Reviews

5M+ Downloads

Apple Store : 4.7/5 , 122.1k Reviews

With a paid Credit Builder subscription, advances can be increased to $700, reaching $1,000 with a Roar Money account featuring direct deposit. While regular transfers take 24 to 48 hours, opting for the same-day Instacash “turbo” transfer incurs fees. There’s no credit check, and additional banking and investment services are available.

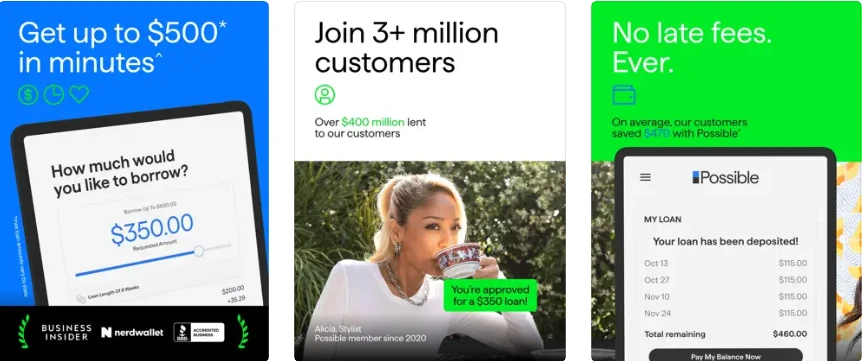

13. Possible Finance

Possible Finance differentiates itself by reporting payments to major credit bureaus, potentially aiding borrowers in building or enhancing their credit history. Offering quick access to up to $500, this lender imposes no strict credit score requirements. However, the convenience comes at a cost, with interest rates reaching the triple digits, potentially resulting in significant overall expenses. Notably, Possible Finance’s services are only available in some states.

Playstore Rating: 4.0/5 , 50.8k Reviews

1M+ Downloads

Apple store Rating : 4.8/5 , 103.9k Reviews

The application process involves no hard credit inquiry, making it accessible to those with weaker credit profiles. Responsible repayment allows borrowers to contribute positively to their credit history, with installment payments reported to two major consumer credit bureaus. Eligibility depends on regular income, valid identification, and specific income criteria, requiring a checking account with three months’ history, monthly income deposits of around $750, and a positive balance.

14. Universal Credit

Universal Credit, a fintech company powered by Upgrade, facilitates loans ranging from $1,000 to $50,000, originating through Cross River Bank and Blue Ridge Bank. While maximum interest rates are relatively high, Universal Credit targets borrowers with low credit scores and elevated debt-to-income ratios.

Rating : 4.8/5 , 2.9k Reviews

Favorable customer reviews suggest it may be ideal for consolidating higher-interest debt. With a low borrowing minimum and funds available within a day, it caters to borrowers with a minimum credit score of 580.

However, rates, origination fees, and a maximum loan cap of $50,000 should be considered. Universal Credit suits those consolidating loans, dealing with low credit scores, preferring swift access to funds, and accepting higher interest rates for smaller amounts. Alternatively, borrowers needing over $50,000 or seeking lower fees may explore alternative lending options for more competitive rates and terms.

15. Upstart

Upstart distinguishes itself by incorporating artificial intelligence into its alternative lending model, aiming to enhance accessibility to personal loans. Beyond traditional financial metrics, Upstart’s underwriting model considers factors such as education and workplace experience. This unique approach may make personal loans accessible to new borrowers or those with less-than-ideal credit.

Apple store Rating 4.1/5 , 18 Reviews

Loan amounts range from $1,000 to $50,000, and Upstart provides a pre-qualification option without affecting credit scores. While final terms require a formal application and a hard credit inquiry, timely payments may positively impact your credit history.

However, loan amounts are subject to limitations based on application data and state regulations. Upstart stands out for its innovative approach, broader borrower inclusivity, and potential credit-building opportunities.

Top Loan Lenders For Bad Credit Like Credit Cube

OppLoans emerges as a leading choice among lousy credit loan lenders, offering a viable solution akin to Credit Cube. With loan amounts varying from $500 to $4,000, OppLoans caters to individuals facing credit challenges. What sets it apart is the flexibility in repayment terms, from six to 36 months.

While interest rates are relatively high, OppLoans provides quick funding, often on the same day. The straightforward application process and the absence of prepayment penalties contribute to its appeal. Despite the high-risk borrower focus, OppLoans is a dependable option for those seeking financial assistance with less-than-ideal credit scores.

Top Loan Lenders For Good Credit

Upstart and LightStream emerge as top-tier loan lenders for those with good credit, providing innovative and customer-centric financial solutions. Upstart, known for its unique lending model integrating artificial intelligence, breaks traditional barriers by considering education, work experience, and financial history. Offering loan amounts from $1,000 to $50,000, Upstart stands out with a pre-qualification option that doesn’t impact credit scores.

LightStream, on the other hand, caters to creditworthy borrowers, boasting low rates and fee-free loans tailored to specific purposes. With a focus on clarity and customer satisfaction, Upstart and LightStream exemplify excellence in serving individuals with good credit and seeking reliable lending options.

Loan Lenders For Debt Consolidation

Upgrade emerges as a leading choice among loan lenders for debt consolidation, offering a range of features to streamline the process. The upgrade provides a comprehensive solution with secured and joint loan options, multiple rate discounts, and a user-friendly mobile app. Notably, the ability to make direct payments to creditors enhances the effectiveness of debt consolidation.

While borrowers benefit from a minimum credit score requirement of 560, flexible eligibility criteria, and diverse accepted income sources, drawbacks include an origination fee and limited flexibility in payment dates. Upgrade’s commitment to transparency ensures clear communication on potential costs, emphasizing its dedication to providing a reliable platform for effective debt management.

Best Lenders For Installment Loans

CashNetUSA stands out as one of the prominent lenders for installment loans, providing swift same-day deposits to address urgent financial needs. With a streamlined application filling and minimal eligibility requirements, borrowers can secure installment loans up to $500, offering flexibility for repayment on their next payday without prepayment fees for early settlements.

However, it’s crucial to note that CashNetUSA’s services are available in 29 states, and the interest rates are notably higher than industry averages. Despite accommodating individuals with lower credit scores through a comprehensive approval process, borrowers should exercise caution due to the elevated interest rates associated with CashNetUSA loans.

Best Loan Lenders For Home Improvements

LightStream is a top choice among loan lenders for home improvements, offering a distinguished blend of benefits for creditworthy borrowers. With focuses on providing a fee-free experience, LightStream stands out by offering variable low rates based on the loan’s purpose. The absence of origination and late fees contributes to the appeal for those seeking funding for home improvement projects.

Additionally, LightStream extends favorable terms, including a discount for autopay and extended repayment options. While pre-qualification through a soft credit check is unavailable on their website, the emphasis on cost transparency and borrower-friendly features positions LightStream as a premier option for those looking to finance home upgrades.

Best Short-Term Loan Lenders

Beem is a leading option among short-term loan lenders, offering a unique and reliable alternative to traditional instant cash advances. With its innovative Everdraft™ feature, users can seamlessly access funds ranging from $5 to $1,000 from verified bank deposits. What sets Beem apart is its interest-free approach to managing financial emergencies, coupled with repayment flexibility that caters to consumers’ evolving requirements.

Notably, Beem stands out for its commitment to transparency, with no income restrictions, credit checks, due dates, or tips, making it a user-friendly financial tool. Beyond short-term loans, Beem provides additional utility through instant money transfers, tax filing services, and a comprehensive Better Financial Feed™ for effective budget planning and financial management. The robust security measures further establish Beem as a trusted choice for those seeking a multifaceted short-term financial solution.

Best Alternatives For Emergency Loans

Beem shines as one of the best alternatives for emergency loans, offering an innovative financial solution that stands out in instant cash advances. With its unique Everdraft™ feature, Beem provides users swift access to funds ranging from $5 to $1,000, sourced from verified bank deposits. Its interest-free and transparent approach sets Beem apart, eliminating income restrictions, credit checks, due dates, or tips.

The repayment flexibility aligns seamlessly with evolving consumer needs. Beyond instant cash, Beem extends its utility with features like instant money transfers, tax filing services, and a comprehensive Better Financial Feed™ for effective budget planning. Beem’s commitment to robust security measures makes it a trusted choice for those navigating financial emergencies.

Best For Military Members

OneMain Financial and Universal Credit are noteworthy options for military members seeking financial solutions. OneMain Financial offers swift funding to individuals with lower credit scores, providing flexibility with payment dates, joint and secured loans, and direct creditor payments for debt consolidation. While interest rates may be comparatively higher, they accommodate diverse income sources, making them accessible for military members.

On the other hand, Universal Credit, powered by Upgrade, facilitates loans ranging from $1,000 to $50,000, targeting borrowers with low credit scores and elevated debt-to-income ratios. With favorable customer reviews for consolidating higher-interest debt, Universal Credit provides quick access to funds, catering to military members dealing with financial challenges.

Where To Get Loans Like Credit Cube

In the ever-evolving landscape of personal finance, finding suitable loan options akin to Credit Cube requires a comprehensive understanding of various lending avenues. While Credit Cube offers short-term installment loans, borrowers seeking alternatives can explore the following lending sources:

1. Traditional Banks

Traditional banks have long been a cornerstone of the lending industry, providing a range of loan products to meet diverse financial needs. Personal loans from banks typically involve a thorough application process, credit checks, and stringent eligibility criteria.

These loans may offer competitive interest rates, especially for borrowers with a strong credit history. However, the application and approval procedure can be time-consuming compared to online alternatives. Traditional banks are suitable for those who value the stability and reputation of established financial institutions.

2. Online Lenders

The rise of online lenders has transformed the lending landscape, offering borrowers a convenient and efficient way to access funds. Online lenders, including fintech companies and peer-to-peer platforms, streamline the application process, often providing quick approvals and fund disbursement. Borrowers can explore online lending options with varying terms, interest rates, and eligibility requirements. These lenders leverage technology to assess creditworthiness, making them more accessible for individuals with diverse financial backgrounds. The online lending space caters to the need for speed and convenience in obtaining loans.

3. Credit Unions

Credit unions are member-owned financial cooperatives that give various financial services, including loans. Unlike traditional banks, credit unions focus on serving their members, often offering more personalized service and competitive interest rates.

Credit unions are an excellent option for borrowers looking for community-oriented financial institutions. While membership criteria may apply, credit unions generally have a more lenient approach to credit assessments, making them accessible to a broader range of borrowers.

4. Peer-To-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders, cutting out the intermediary role of traditional financial institutions. Borrowers create listings detailing their loan requirements, and investors can choose to fund these loans in exchange for returns.

P2P lending offers a decentralized approach to borrowing, potentially providing more flexibility in terms and rates. However, borrowers should be mindful of the varying degrees of risk associated with P2P lending, as individual investors’ risk appetites may influence interest rates.

Individuals seeking loans similar to Credit Cube’s offerings have many options. Traditional banks, online lenders, credit unions, and peer-to-peer lending platforms have unique characteristics catering to different borrower preferences.

Whether prioritizing speed, personalized service, competitive rates, or a decentralized lending experience, borrowers can align their needs with the diverse offerings available in the lending market. As with any financial decision, thorough research and a clear understanding of terms and conditions are essential to making educated decisions that align with one’s financial objectives.

What are the Banks Offering Loans Like Credit Cube?

For individuals seeking loans resembling the offerings of Credit Cube, several reputable banks present viable alternatives. Leading the pack is Wells Fargo, a major financial institution known for its diverse loan products, including personal loans with competitive interest rates. Citizens Bank is another noteworthy option, providing flexible terms and favorable rates for qualified applicants.

Additionally, TD Bank stands out for its customer-centric approach, offering unsecured personal loans tailored to individual financial needs. These banks prioritize transparency and reliability, embodying the stability that borrowers seek in their financial partners. As with any financial decision, prospective borrowers should carefully review each bank’s terms, conditions, and eligibility criteria to make an informed choice aligned with their unique financial requirements.

What are the Loan Eligibility and Requirements?

Let us first understand the eligibility criteria and requirements, which are crucial when considering loans akin to Credit Cube. Financial institutions typically assess several factors before approving a loan application. Here’s a concise overview:

Credit Score:

Lenders often assess your credit score as a key determinant. A higher credit score enhances your eligibility for favorable loan terms.

Income and Employment:

Demonstrating a stable income and employment history reinforces your ability to repay the loan. Lenders may request proof of income through pay stubs or tax documents.

Debt-to-Income Ratio:

Maintaining a balanced debt-to-income ratio assures lenders of your capacity to manage additional debt responsibly.

Collateral:

Secured loans may need collateral, such as real estate or vehicles, providing a layer of security for the lender.

Personal Information:

Complete and accurate personal information, including identification, residential details, and contact information, is essential for the application process.

Meeting these criteria enhances your chances of loan approval and secures terms that align with your financial goals. Continually review and understand the specific eligibility requirements of the chosen lender before initiating the application process.

How To Choose The Right Loan For You?

Navigating many loan options requires a strategic approach to align your financial needs with the most suitable lending solution. Consider these key pointers:

Assess Your Needs:

Clearly define the purpose of the loan. Understanding your needs guides your loan selection for home improvement, debt consolidation, or an unexpected expense.

Interest Rates:

Compare interest rates from various lenders. Opt for the lowest rate possible to minimize the overall cost of borrowing.

Hidden Fees:

Scrutinize the fine print for hidden fees or charges. Origination fees, prepayment fines, and late payment fees can significantly impact the total expense.

Repayment Terms:

Evaluate the repayment terms offered. A balance between manageable monthly payments and a proper loan duration ensures financial comfort.

Credit Requirements:

Know your credit score and choose loans aligned with your credit profile. Some lenders specialize in catering to borrowers with varying credit histories.

Secured vs. Unsecured:

Determine whether a secured or unsecured loan suits your circumstances. Secured loans may provide lower interest rates but require collateral.

Lender Reputation:

Research the reputation of potential lenders. Reviews, customer feedback, and the lender’s track record contribute to a reliable borrowing experience.

Making a proper decision based on these factors ensures that the chosen loan complements your financial goals and sets you on a path to successful repayment.

Conclusion

In the dynamic landscape of short-term installment loans, alternatives to Credit Cube abound, offering diverse features and catering to varied financial needs. Understanding eligibility criteria, encompassing credit score, income, and collateral, is pivotal for informed borrowing decisions. When choosing the right loan, meticulous assessment of needs, interest rates, fees, and lender reputation ensures financial alignment.

In this ever-evolving financial realm, borrowers find a spectrum of lending solutions, each with unique offerings. Thorough research remains imperative to secure loans that harmonize with individual financial objectives.

FAQs

Are there loan lenders like Credit Cube?

Reputable lenders like OppLoans, Upstart, and LightStream offer comparable short-term installment loans.

How hard is it to get a loan with Credit Cube?

Credit Cube’s requirements are moderate, but alternatives like Upstart and OppLoans provide accessible options with varying criteria.

Is Credit Cube a direct lender?

Credit Cube is a direct lender, simplifying the borrowing process for short-term installment loans.

Do other loan lenders provide the same loans as Credit Cube?

Various lenders offer similar short-term installment loans, each with unique features. Explore options like Upstart, OppLoans, and LightStream.