In the dynamic scene of personal finance, SoFi personal loans emerge as versatile financial instruments. These unsecured loans offer individuals a flexible solution for various financial needs, from consolidating high-interest debts to funding significant expenses.

The absence of collateral makes them accessible, albeit at higher interest rates. Their importance lies in bridging temporary gaps, but prudence in managing repayment is paramount.

As a tool for strategic financial maneuvering, individuals should weigh the convenience against the associated costs, ensuring informed decisions align with their overall financial objectives. This guide explore key details to find the best SoFi alternative for your financial needs and help you make the right decision for your long-term goals.

SoFi Alternative – 16 Best Apps like SoFi for you [2024]

Loans akin to SoFi cater to established professionals with a robust credit score, offering competitive interest rates and an array of perks. These lenders provide financial assistance and valuable extras like career guidance and financial planning.

However, alternative options may be more suitable for those in the early stages of their career or with less-than-ideal credit. While these loans mirror SoFi’s features, some competitors might offer even more competitive rates. Prospective borrowers fitting SoFi’s profile should explore diverse avenues before committing.

| SoFi Alternatives | Brief Description | Additional Notes |

|---|---|---|

| Beem | Offers instant cash advances, money sending, free tax filing, and budget planning tools | User-friendly platform, goes beyond immediate cash needs, prioritizes security, privacy, and support. |

| Sageworks Lending | Streamlines loan origination and boarding for banks | Operates under Abrigo, focuses on the banking sector, offers Loan Decisioning solution. |

| Finflux | Cloud-based lending platform providing a comprehensive solution | Acquired by M2P Fintech, offers app-based lending, data-driven credit scoring, and serves a global clientele. |

| LoanPro | Leading SaaS lending and loan servicing platform | Offers API integration, significant client base, focuses on streamlining loan management. |

| Upstart | Uses AI in alternative lending model to broaden loan access | Considers factors beyond traditional credit history, pre-qualification option with no credit score impact. |

| Achieve | Debt consolidation loans with direct creditor payments and rate discounts | Soft credit check for pre-qualification, joint loan possibility, origination fee applies. |

| Avant | Loans for borrowers with fair to poor credit | Fast funding, soft credit check for pre-qualification, mobile app for management. |

| Upgrade | Loans with multiple rate discounts and direct creditor payments | Lower minimum credit score requirement, origination fee applies. |

| Prosper | Peer-to-peer lending platform offering loans from $2,000 to $50,000 | Competitive rates, various fees, limited flexibility in repayment terms. |

| TurnKey Lender | AI-powered lending automation platform with global reach | Focuses on automating the entire digital lending process, serves over 50 million end users. |

| G2 Deals | Platform to discover and purchase software with exclusive deals | Part of the Best Popular Loans ecosystem, helps users make informed software decisions. |

| CloudBankIN | Comprehensive digital lending platform for various financial institutions | Offers loan origination, management, accounting, and reporting features. |

| LightStream | Loans for credit-savvy borrowers with no fees and adjustable rates | Tailored rates for specific loan purposes, requires high minimum loan amount. |

| Centrex Software | Business lending CRM and loan servicing software platform | Offers comprehensive suite of solutions, caters to brokers, lenders, and fintech firms. |

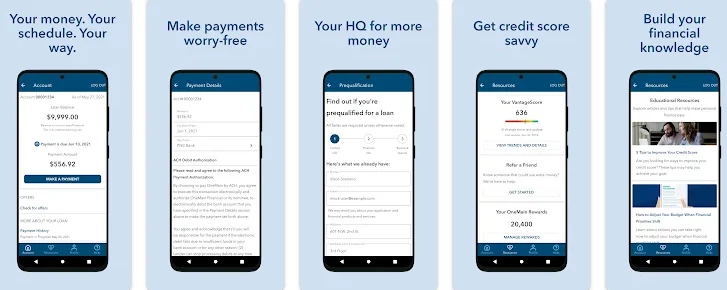

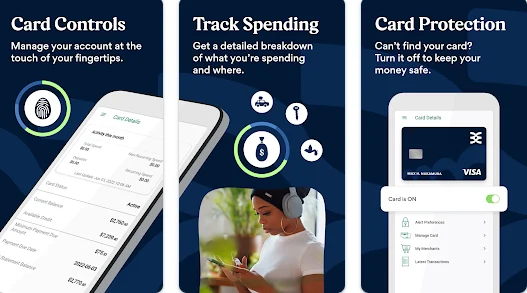

| OneMain Financial | Provides fast funding to borrowers with low credit scores | Accommodating qualifications, high rates compared to other lenders, origination fees apply. |

| Best Egg | Personal loans for fast cash and debt consolidation | Soft credit check pre-qualification, direct creditor payments for debt consolidation, origination fee applies. |

1. Beem

Beem, an innovative financial platform, presents an unparalleled solution for instant cash advances. With Everdraft™, users can access $5 to $1,000 from their verified bank deposits, offering a lifeline for emergencies like bills, groceries, and medical expenses.

Positioned as the premier alternative to instant cash advances and a favourable SoFi alternative, Beem distinguishes itself through a user-friendly interface and a suite of features.

The platform extends beyond immediate cash needs, allowing users to send money, file taxes for free, and benefit from a Better Financial Feed™ for budget planning and financial insights.

Beem’s commitment to security, privacy, and support ensures a worry-free financial experience for its diverse user base. With a range of options for instant cash, Beem emerges as a versatile and reliable financial companion for users seeking convenience and flexibility in managing their finances.

2. Sageworks Lending

Sageworks Lending, an instrumental player in the lending automation domain, operates under Abrigo’s umbrella. Renowned for its scalable processes, this platform streamlines loan origination and boarding, empowering banks to expedite loan bookings.

In a strategic move in May 2022, Abrigo collaborated with Validis, enhancing the efficiency of general ledger data extraction for financial institutions.

The Abrigo-Validis sync within Sageworks Lending ensures a seamless lending process with a focus on the banking sector. Offering a Loan Decisioning solution, Sageworks Lending champions efficiency and consistency in documentation and analysis.

3. Finflux

Finflux is a cloud-native SaaS lending platform providing a comprehensive solution for institutions managing lending operations.

From loan origination to financial accounting, Finflux offers an integrated approach. In a significant move, M2P Fintech acquired Finflux in July 2022, marking a strategic development.

As a SoFi alternative, Finflux delivers app-based lending, data-driven credit scoring, and robust dashboards for analytics and reporting.

Boasting a clientele of over 60 global customers, including fintechs, non-banking financial firms, microfinance institutions, banks, and credit unions, Finflux’s acquisition by M2P positions it for heightened competitiveness.

4. LoanPro

LoanPro, a leading SaaS lending and loan servicing platform and a reliable SoFi alternative, distinguishes itself through the innovative use of its API, offering seamless integration for users to consolidate the loan lifecycle within a singular source.

Noteworthy is the substantial $100 million investment secured in July 2021, spearheaded by FTV Capital, underscoring its industry significance. With a significant client base of over 600 businesses in North America and Canada, managing a robust $15 billion loan, LoanPro rivals SoFi’s commitment to streamlining loan management, servicing, and collections.

5. Upstart

Upstart distinguishes itself as a SoFi alternative by incorporating artificial intelligence into an alternative lending model to broaden access to personal loans.

Unlike traditional models, Upstart’s underwriting considers variables such as education and workplace experience alongside financial history, extending the opportunity for loans to new or less credit-worthy borrowers.

Loan amounts range from $1,000 to $50,000, and the platform offers a pre-qualification option without impacting credit scores.

While your terms are finalized after a formal application and a hard credit inquiry, Upstart’s practice of reporting payments to credit bureaus offers a chance to bolster your credit profile. However, available loan amounts may vary based on application data and your state of residence.

6. Achieve

Achieve emerges as a robust choice for those seeking debt consolidation loans. With the added benefit of funds paid directly to creditors and various rate discounts, Achieve serves as a preferable SoFi alternative for many.

Noteworthy pros include the option for a soft credit check during pre-qualification, joint loan possibilities, and the convenience of direct creditor payments.

However, the platform charges an origination fee, restricts availability in certain states, needs a dedicated mobile app, and sets a relatively high minimum loan amount. Achieve’s qualifications include:

- A minimum credit score of 620.

- A maximum debt-to-income ratio of 45%.

- A minimum credit history of three years with no active delinquencies.

7. Avant

Avant’s loans cater to borrowers with fair to poor credit, emphasizing swift funding but lacking credit-building features or debt consolidation tools. Noteworthy advantages of this SoFi alternative include:

- Rapid funding.

- A soft credit check for pre-qualification.

- A user-friendly mobile app for loan management.

Avant offers diverse repayment term options with seven-day customer service availability. However, potential downsides include possible origination fees, the absence of co-signed or secured loans, and a limitation on direct creditor payments for debt consolidation.

To qualify, applicants need a valid Social Security number, a good-standing bank account, a minimum credit score 550, and a monthly net income of at least $1,200. Avant’s loan terms range from 1 to 5 years, with origination fees ranging from 0% to 9.99%.

8. Upgrade

Upgrade’s loans stand out with multiple rate discounts and the convenience of direct payments to creditors, complemented by a notably low minimum credit score requirement.

Prospective borrowers benefit from secured and joint loan options, a user-friendly mobile app for seamless payment management, and extended repayment terms for home improvement loans.

However, Upgrade charges an origination fee and needs more flexibility to choose payment dates. Qualifications include:

- A minimum credit score of 560.

- At least one account on the credit history.

- A maximum debt-to-income ratio of 75%.

Upgrade’s available term lengths range from 3 to 7 years, with origination fees varying from 1.85% to 9.99%.

9. Prosper

Prosper, distinguished for its peer-to-peer lending, offers a loan spectrum from $2,000 to $50,000, making it a viable option for substantial financial needs.

With no minimum income requirement, eligibility hinges on criteria like a 640 FICO® Score 8, at least three open credit accounts, and a debt-to-income ratio below 50%.

Despite competitive interest rates ranging from the upper single to double digits, Prosper imposes various fees, including origination, late payment, and failed payments, contributing to 6.99% and 35.99% APRs.

Notably, borrowers need more flexibility in repayment terms, confined to a three-year or five-year term.

10. TurnKey Lender

TurnKey, a leading global B2B SaaS company, specializes in an AI-powered lending automation platform and decision management solutions.

Recently securing $10 million in funding in July 2022, TurnKey aims to leverage these funds to explore new opportunities in embedded lending across North America, Europe, and Southeast Asia.

With a focus on automating the entire digital lending process, TurnKey serves around 180 clients and over 50 million end users across 50 countries through its SaaS platform and embedded financing software.

In a strategic move in 2022, the company joined forces with VoPay to provide lenders with digitized end-to-end process automation. As the foremost competitor and alternative to SoFi, TurnKey offers a robust lending solution on a global scale.

11. G2 Deals

Discover the intelligent way to procure software with the Best Popular Loans and G2 Deals. The G2 Deals platform empowers you to seamlessly explore curated and trusted software, taking control of your software buying journey.

Benefit from exclusive deals on various software solutions, ensuring a more innovative and cost-effective approach to software acquisition.

Join the community of savvy users relying on G2 for informed software decisions and make your software acquisition journey more innovative and efficient.

12. CloudBankIN

CloudBankIN stands out as a comprehensive digital lending platform catering to the diverse needs of financial institutions, including NBFCs, MFIs, and FinTechs.

It seamlessly handles various loan products, such as personal, business, vehicle, insurance, term, gold, and customized offerings.

Boasting features like the Loan Origination System, Loan Management System, Accounting, and Reports & Dashboards, CloudBankIN provides an automated and flexible digital lending solution with smooth integrations.

Users appreciate its user-friendly interface, easy navigation, and positive customer service experience. However, concerns include application issues, slowness, and pricing considerations, particularly for startup MFIs.

13. LightStream

LightStream caters to credit-savvy borrowers, setting itself apart with no fees and adjustable low rates tailored to specific loan purposes.

Prospective borrowers benefit from rate discounts with autopay, extended repayment terms for home improvement loans, and innovative programs like Rate Beat and Experience Guarantee. However, limitations include:

- The website must have a pre-qualification option with a soft credit check.

- No direct payments to creditors for debt consolidation.

- A relatively high minimum loan amount.

Qualifications entail U.S. citizenship, a minimum age of 18, a credit score of 660, a robust credit history, and the possession of assets like retirement and investment accounts. LightStream offers flexible term lengths ranging from 2 to 7 years, and notably, there are no origination or late fees.

14. Centrex Software

Centrex Software, a dedicated business lending CRM and loan servicing software platform, stands out as a top choice for brokers, lenders, banks, investors, and fintech firms.

With a remarkable 22% revenue growth in 2019-2020 and an impressive 35% growth in 2020-2021, Centrex offers a comprehensive suite of solutions, outshining SoFi with its all-in-one software approach.

Centrex introduced cutting-edge relationship-building technology at the Broker Fair in December 2021, featuring a white-label mobile app to enhance business customer retention.

This innovative solution positions Centrex Software as a strong contender capable of attracting clients away from SoFi.

15. OneMain Financial

OneMain Financial focuses on providing fast funding to borrowers with low credit scores, prioritizing the ability to repay loan applications.

While the lender offers options like choosing and changing payment dates, joint and secured loans, and direct payments to creditors for debt consolidation, it comes with cons, such as relatively high rates compared to other lenders, origination fees, and limited loan amounts.

Qualifications are accommodating, requiring a taxpayer identification number, a minimum age of 18 in most states, and no specified minimum credit score or history.

OneMain Financial offers term lengths from 2 to 5 years, with fees like origination fees ranging from $25 to $500 or 1% to 10% of the loan amount and late fees ranging from $5 to $30 or 1.5% to 15% of the monthly payment.

Borrowers must have sufficient disposable income, and the lender accepts various income sources.

16. Best Egg

Best Egg caters to borrowers seeking personal loans for fast cash and debt consolidation. With a soft credit check pre-qualification option, borrowers can explore various loan amounts, including unsecured and secured options.

The lender provides direct payments to creditors for debt consolidation and boasts no late fees but comes with an origination fee.

Qualifications include a minimum credit score of 600, U.S. citizenship, 24 months of credit history with at least one account, a minimum annual income of $3,500, and a maximum debt-to-income ratio of 40% or 65%, including the mortgage.

Available term lengths range from 3 to 5 years, with origination fees varying from 0.99% to 8.99%.

Top Loan Lenders For Bad Credit – SoFi Alternative

Unveiling a spectrum of lending alternatives akin to SoFi, these financial platforms cater to diverse needs, ensuring a lifeline for users with varied credit scores.

Beem stands out as a top SoFi alternative with innovative solutions, providing instant cash advances and user-friendly features that extend beyond immediate cash needs.

Sageworks Lending, under Abrigo’s umbrella, streamlines loan processes for efficient bookings, while Finflux, acquired by M2P Fintech, offers a comprehensive cloud-native lending solution.

LoanPro, with its API-driven lending and significant investments, rivals SoFi’s commitment to streamlined loan management. Upstart revolutionizes lending with AI-driven models, providing access to personal loans for diverse borrowers.

Top Loan Lenders For Good Credit

LightStream and Best Egg stand out as premier choices for borrowers with good credit seeking reliable and flexible loan options. LightStream caters to credit-savvy borrowers with its no-fee structure, offering adjustable low rates tailored to specific loan purposes.

The platform’s innovative programs, such as Rate Beat and Experience Guarantee, enhance the borrowing experience.

Best Egg, on the other hand, provides a seamless process with a soft credit check pre-qualification option, allowing borrowers to explore a wide range of loan amounts for fast cash and debt consolidation.

Both platforms prioritize user-friendly interfaces, offering extended repayment terms and direct payments to creditors for added convenience, making them top contenders for those with good credit profiles.

Loan Lenders For Debt Consolidation

Achieve and Avant emerge as prominent choices for borrowers seeking debt consolidation loans. Achieve offers the benefit of funds paid directly to creditors and various rate discounts.

The platform allows for a soft credit check during pre-qualification, providing joint loan possibilities and the convenience of direct creditor payments. However, it’s essential to note Achieve’s origination fee, state availability restrictions, lack of a dedicated mobile app, and a relatively high minimum loan amount.

Avant, specializing in swift funding for fair to poor credit borrowers, presents advantages like rapid funding, a user-friendly mobile app, and flexible repayment options. Yet, potential downsides include possible origination fees and limitations on direct creditor payments.

Best Lenders For Installment Loans

Upstart and Prosper stand out as premier choices for borrowers seeking installment loans. Upstart’s innovative AI-driven model broadens access to personal loans, considering factors beyond traditional financial history.

This inclusive approach allows new or less credit-worthy borrowers to secure loans ranging from $1,000 to $50,000. Upstart’s flexible terms and credit reporting practices offer opportunities to strengthen credit profiles.

Meanwhile, Prosper, renowned for its peer-to-peer lending, provides a spectrum of loans from $2,000 to $50,000.

With competitive interest rates, Prosper accommodates diverse financial needs, although borrowers face limited flexibility with fixed three- or five-year repayment terms. Both platforms showcase unique features, making them top choices as SoFi alternatives in the installment loan landscape.

Best Loan Lenders For Home Improvements

Upgrade and OneMain Financial emerge as top choices for borrowers seeking loans for home improvements. Upgrade offers multiple rate discounts and the convenience of direct payments to creditors, complemented by a notably low minimum credit score requirement.

With secured and joint loan options, a user-friendly mobile app, and extended repayment terms, Upgrade caters to those looking to enhance their homes.

Meanwhile, OneMain Financial provides fast funding to borrowers with low credit scores, offering options like choosing and changing payment dates, joint and secured loans, and direct payments to creditors for debt consolidation.

Both platforms provide flexibility and accessibility for homeowners embarking on improvement projects.

Best Short-Term Loan Lenders

Beem and Sageworks Lending are exceptional short-term loan lenders, offering unique features and solutions to meet urgent financial needs.

Beem’s Everdraft™ allows users to access instant cash advances from $5 to $1,000, providing a lifeline for emergencies such as bills and medical expenses. With a user-friendly interface and additional features like free tax filing and budget planning, Beem ensures a versatile and reliable financial experience.

On the other hand, Sageworks Lending, operating under Abrigo’s umbrella, excels in streamlining loan origination and boarding processes, empowering banks to expedite loan bookings. The platform’s Loan Decisioning solution ensures efficiency and consistency in documentation and analysis, making it a strategic choice for short-term lending needs.

Best SoFi Alternatives For Emergency Loans

In times of financial urgency, Finflux and TurnKey Lender emerge as standout alternatives for emergency loans, each offering unique features to address immediate monetary needs.

Finflux, now under the umbrella of M2P Fintech, provides a cloud-native SaaS lending platform with a comprehensive approach to loan origination and financial accounting. With app-based lending, data-driven credit scoring, and robust analytics, Finflux stands out as a versatile solution.

TurnKey Lender, a global B2B SaaS company, specializes in AI-powered lending automation and decision management.

Recently securing $10 million in funding, TurnKey’s focus on digitized end-to-end process automation positions it as a robust choice for those seeking efficient emergency loan options.

Best For Military Members

In catering to the unique financial needs of military members, LoanPro and Centrex Software emerge as notable options. LoanPro, a leading SaaS lending platform, streamlines loan management and servicing and offers innovative integration through its API.

With a substantial North American and Canadian client base, LoanPro’s $100 million investment underscores its commitment to industry significance.

Centrex Software, with its cutting-edge relationship-building technology, including a white-label mobile app, positions itself as a strong contender capable of meeting the specific requirements of military members with efficiency and innovation.

Where To Get Loans Like SoFi – Top SoFi Alternatives

In seeking financial flexibility, borrowers seeking alternatives to SoFi can explore various lending avenues. Traditional banks, online lenders, credit unions, and peer-to-peer lending platforms offer diverse options catering to different needs and preferences.

1. Traditional banks

Traditional banks offer stability but may have stringent processes. They’re ideal for those valuing a familiar approach. However, expect thorough documentation, robust credit checks, and interest rates influenced by market conditions.

2. Online lenders

Online lending platforms revolutionize borrowing with streamlined processes and competitive rates. They provide speed and convenience. However, thorough research is essential to ensure credibility and compliance.

3. Credit unions

Credit unions prioritize community and member well-being. They offer a personalized touch and may provide favorable terms. Membership criteria exist, but credit assessments can be more flexible than traditional banks.

4. Peer-to-peer lending

P2P lending connects borrowers with individual investors for flexible terms. It’s user-friendly with quick processes, but rates vary based on creditworthiness. Understand the unique risks associated with the absence of traditional banking regulations.

What Are The Banks Offering Loans Like SoFi?

Several banks provide loan options comparable to SoFi, catering to diverse financial needs. Traditional banks such as Wells Fargo, Chase, and Bank of America offer personal loans with varying terms and interest rates.

Online banking institutions like Discover and Marcus by Goldman Sachs are noteworthy contenders, providing competitive rates and user-friendly platforms for seamless transactions.

Credit unions like Navy Federal Credit Union extend personalized loan solutions, often with member-centric benefits. Additionally, regional banks may offer localized lending options.

It’s essential to scrutinize interest rates, fees, and repayment terms to align with individual financial goals. While each bank presents unique features, borrowers should assess the overall lending landscape to secure the most favorable terms and a hassle-free borrowing experience.

What Are The Loan Eligibility and Requirements?

Before embarking on a loan application, understanding eligibility criteria is crucial. Lenders typically assess credit scores, income stability, and debt-to-income ratios.

A higher credit score enhances approval chances and secures favorable terms. Stable employment and a reliable income source are fundamental requisites ensuring repayment capability. Additionally, lenders scrutinize debt obligations to gauge financial health.

Documentation plays a pivotal role; expect to provide proof of identity, income statements, and employment details. Some loans may necessitate collateral, such as property or assets.

Each loan type comes with distinct prerequisites, so meticulous preparation and adherence to these criteria significantly streamline the application process, increasing the likelihood of loan approval.

How To Choose The Right SoFi Alternative For You?

Selecting the right loan demands a strategic approach to align your financial needs with available options. Here are some tips to help you choose the right SoFi alternative for you:

- First, evaluate the loan’s purpose – whether for a home, education, or debt consolidation.

- Understand the interest rates and terms, ensuring they match your financial capacity.

- Thoroughly review associated fees, such as origination and prepayment charges.

- Scrutinize your credit score, as it significantly influences the offered rates.

- Consider the loan’s flexibility, checking for features like adjustable rates or fixed terms.

- Lastly, compare offers from various reputable lenders, assessing their customer service and online tools.

A meticulous evaluation ensures the chosen loan aligns seamlessly with your unique financial circumstances.

Conclusion

In navigating the expansive realm of alternative lending, borrowers exploring options akin to SoFi find a spectrum of choices tailored to their diverse needs.

The landscape is dynamic from innovative platforms like Beem providing instant cash solutions to established players such as Upstart revolutionizing lending with AI-driven models.

Credit-savvy borrowers may turn to LightStream for fee-free, low-rate options, while Achieve and Avant cater to those seeking effective debt consolidation solutions.

The strategic use of P2P lending through Prosper and advanced automation platforms like TurnKey Lender adds depth. Ultimately, informed decisions hinge on meticulous assessment and alignment with individual financial goals.

FAQs for SoFi Alternative

Are there loan lenders like SoFi?

Numerous lenders offer comparable loan options, providing alternatives for borrowers seeking financial flexibility.

How hard is it to get a loan with SoFi?

SoFi’s eligibility standards vary, but a good credit score and stable income generally increase approval chances.

Is SoFi a direct lender?

SoFi is a direct lender, facilitating a direct borrowing relationship between the company and borrowers.

Do other loan lenders provide the same loans as SoFi?

Various lenders offer similar loans, catering to diverse financial needs with comparable or enhanced features.

What are some good alternatives to SoFi?

Some top alternatives to SoFi include Beem, Chime, Achieve, and Acorns. Each offers different features for instant cash advances, money management, and tax planning among other benefits, catering to different financial needs.

Which SoFi alternative is best for no-fee banking?

Chime is a great SoFi alternative if you’re looking for mobile banking with no monthly fees, early direct deposit, and tools for saving and budgeting.

Are the fees higher with SoFi alternatives?

Fees can vary from different SoFi alternatives. While SoFi offers competitive rates, some alternatives like Chime and Marcus offer fee-free options.