Table of Contents

Losing your job is stressful, but waiting weeks or months to receive financial aid can be even more stressful. This is the unfortunate reality many people face when relying solely on traditional job loss insurance. One major obstacle? The waiting period is a crucial but commonly misinterpreted component of job loss protection. Let’s explore the workings of waiting periods in job loss insurance protection. Let’s understand how they impact financial readiness and why Beem avoids them to provide prompt support.

Why Waiting Periods Matter in Job Loss Coverage

What does a waiting period mean?

The waiting period for job loss insurance is the interval between losing your employment and starting your benefits. Even if you have made your monthly payments on time, your insurance may not take effect immediately.

Depending on the insurer, this period may also be referred to as the elimination or qualification period. When rent is due, it is not ideal to wait for help.

The impact of delays during financial emergencies

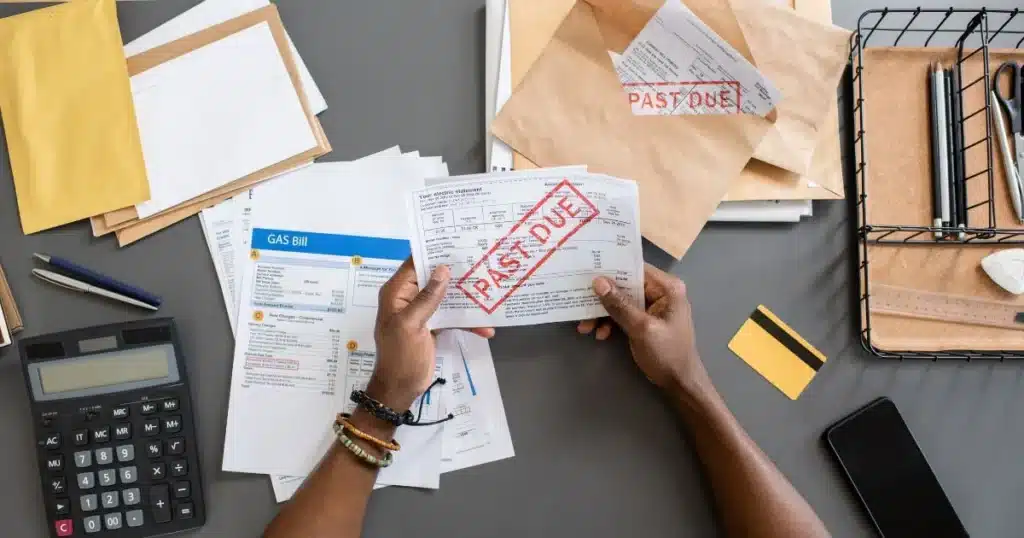

When you unexpectedly run out of money, every day counts. Thirty days of waiting to obtain funds could lead to:

- An unpaid mortgage or rent

- Increasing credit card debt

- Reduced credit ratings

- An increase in stress and anxiety

The delay could disrupt your entire financial plan, especially if you don’t have sufficient funds to cover the gap.

Also Read: How Job Loss Insurance Helps During Layoffs

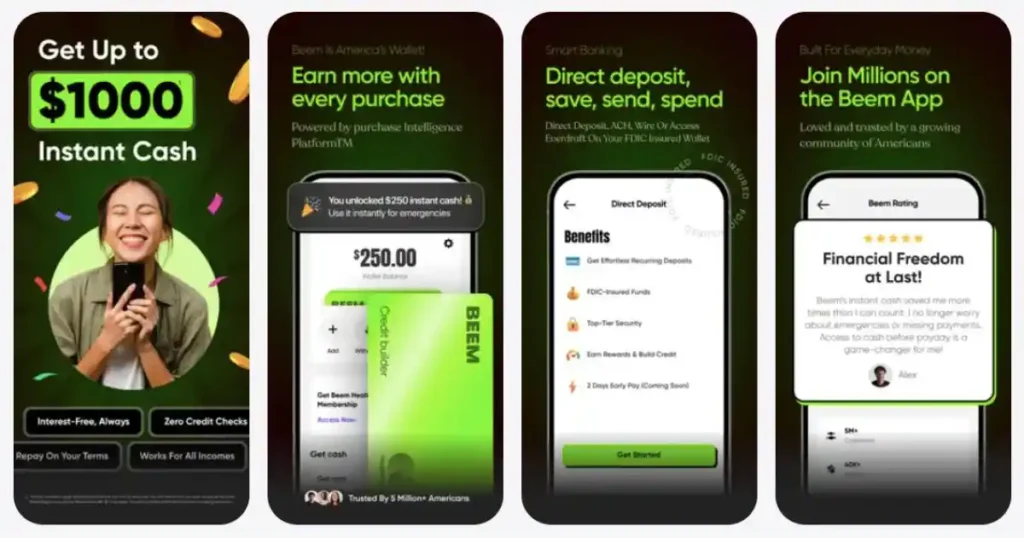

How Beem removes the friction with instant availability

Beem changes the rules in this scenario. Users don’t have to wait to access funds thanks to Beem’s real-time safety net, Everdraft™. There is no need to go through bureaucratic hoops or submit voluminous documentation. Beem gets rid of the traditional barriers by:

- Eliminating waiting periods entirely

- Providing 24-hour access to finances

- Not asking for paperwork or evidence of income

Step 1: Defining the Waiting Period

What is a waiting period in insurance?

According to insurance jargon, a waiting period is the period you must wait before your coverage begins. You are unable to file a claim during this time; however, you continue to pay your premiums.

Standard terms

- Elimination Period: Often used in disability or job loss insurance, this is the timeframe between losing your job and being eligible to start receiving benefits.

- Qualification Period: Sometimes used to refer to the duration of continuous employment required to be eligible for job loss protection.

Why insurers use waiting periods

Waiting periods are in place to reduce risk and lower policy costs. Insurers utilise them to:

- Discourage inaccurate claims

- Verify that coverage is limited to long-term losses.

- Payouts should be limited to control costs.

Even while these insurance policies offer benefits, they rarely help those in need.

Step 2: Typical Waiting Periods in Job Loss Insurance

Employer-sponsored policies

Many employer-sponsored group insurance plans have waiting periods ranging from 30 to 90 days. These waiting periods are meant to end short-term unemployment and temporary layoffs.

Individual policies from Aflac, Allstate, and State Farm

Typically, Aflac has a 30-day prohibition. Up to 60 days may pass with Allstate. The timeframe for State Farm may range from 30 to 90 days, depending on the policy.

What happens if you lose your job during the waiting period?

Unfortunately, you’re not in luck. Even if you have been making payments for months, you will not be eligible for a payout if you lose your employment during the waiting period.

Why are many users caught off guard?

Most policyholders wait until it’s too late to read the fine print. Waiting period language is often obscured by terms and conditions, resulting in miscommunications and unfulfilled expectations.

Step 3: How Waiting Periods Affect Your Financial Plan

Managing bills during the delay window

Even a 30-day wait can have disastrous financial consequences if you are already struggling to make ends meet. Rent, groceries, utilities, and auto payments don’t wait.

Risk of debt accumulation or missed payments

Delays in access could result in:

- High-interest rate credit card debt

- Balances owed on outstanding loans

- Bank overdraft fees

- Utility disconnections

The emotional toll of not having fast access

There is a lot of psychological stress just from losing a job. Financial strain from delayed benefits is likely to result in poor decision-making, anxiety, and despair.

Step 4: Beem’s No-Waiting-Period Advantage

Everdraft™ offers real-time cash access

Beem’s Everdraft™ feature provides an instant cash cushion if your income is lost. You do not need to wait 30, 60, or 90 days.

No forms, no approval delay, no income documentation

Beem does not tolerate paperwork delays. With just a few taps on the phone:

- You’ve been approved.

- Your money is given to you.

- You’re back on track.

Beem’s value for gig workers, freelancers, and hourly earners

These workers are often excluded from traditional job loss insurance due to their erratic earning patterns. To level the playing field, Beem gives them the following:

- Real-time assistance

- Modifiable terms for repayment

- No red tape

Real-World Use Cases Where Beem Outperformed Waiting-Based Policies

- An Uber driver who experienced an unexpected suspension of their account

- When a store was shrinking, a retail employee was let go.

- A freelance designer who lost a big customer out of the blue

In each case, Beem supplied monies before a claim would have been processed under standard procedures.

Also Read: Job Loss Insurance vs Emergency Funds

Step 5: Comparing Waiting Periods Across Providers

Beem vs. Aflac

Although Aflac is a well-known brand, its 30-60 day waiting period may prevent you from receiving your money when needed. Beem avoids the lag.

Beem vs. Allstate

Strict eligibility and documentation requirements are standard with Allstate plans. Beem stays away from the red tape.

Beem vs. State Farm

Although State Farm offers outstanding plans, they have an extended lead time and require underwriting. As soon as you’re ready, Beem is prepared.

| Provider | Waiting Period | Income Proof Required | Cash Access Time |

| Beem | None | No | Instant |

| Aflac | 30–60 days | Yes | Post-waiting period |

| Allstate | 60–90 days | Yes | Post-waiting period |

| State Farm | 60–90 days | Yes | Post-waiting period |

Step 6: How to Avoid Gaps During Waiting Periods

Build an emergency fund or use a HYSA

One excellent method of building a financial cushion is through a high-yield savings account (HYSA). However, it takes time, and not everyone can save a substantial amount of money quickly.

Use Beem to bridge the gap

As a kind of online safety net, Beem transfers funds immediately, while your insurance, if any, takes effect later.

Stack Beem with traditional insurance for holistic coverage

You are not forced to choose between the two. You can acquire both long-term coverage and immediate help by combining Beem with your employer’s policy for layered protection.

Keep digital access ready before layoffs happen

Prepare your Beem account in advance of a crisis. This will ensure that funds are accessible without hastening the moment of employment loss.

Also Read: How To File A Job Loss Insurance Claim Successfully

FAQs on Understanding Waiting Periods in Job Loss Insurance Protection

Can I skip the waiting period if I pay a higher amount?

Although expensive and still requiring approval, some insurers offer riders the option to shorten or eliminate the waiting period.

Does Beem require a waiting period?

There is no waiting period, and Beem offers instant financial access.

What if I’m already unemployed — can I still apply?

Even though Beem’s tools are designed for active workers, you may still qualify for Everdraft™ if you have a recent earning history. Check the app for your eligibility.

How do waiting periods differ for self-employed users?

Conventional policies often fail to provide sufficient coverage for freelancers. They often have stricter documentation requirements or longer wait times. Beem works best for independent freelancers.

Is there a grace period or partial payout during the wait?

Insurers usually do not issue partial payouts. After the waiting period, it’s either full benefits or nothing. Beem is breaking that mold.

Final Thoughts: Don’t Wait for Help When You Need It Most

Waiting periods may be advantageous to insurance companies, but they are hardly ever beneficial to you. In times of uncertainty, you need to be able to access financial aid immediately, not after a month. When researching waiting periods in job loss insurance protection, you’ll find that traditional policies can leave you vulnerable when you need help the most.

Beem offers a safe solution by providing immediate financial access and eliminating paperwork and waiting periods via Everdraft™. Whether you are a freelancer, gig worker, hourly worker, or someone juggling several side ventures, Beem offers the rapid and flexible safety net that today’s workforce needs. Your relaxation shouldn’t be delayed by red tape. Download the Beem app here.