Table of Contents

Apps like Albert offer unparalleled convenience in financial transactions, streamlining payments, and budgeting.

Albert, in particular, stands out with its robust features, including budget tracking, automated savings, and financial insights. It empowers users to manage their money, fostering financial literacy effortlessly.

However, scrutinizing alternatives is crucial to address individual preferences, security concerns, and cost-effectiveness.

Diverse apps like Beem, Venmo, and Cash App provide similar functionalities, each with unique perks and drawbacks.

Exploring alternatives ensures users find a platform aligning with their specific needs and preferences, fostering a more personalized and secure financial experience.

Albert is a popular financial app offering budgeting, savings, and cash advances. However, you may want to explore other apps like Albert for various reasons, such as additional features, lower fees, or simply a better user experience.

Here’s a curated list of the 9 best alternatives to Albert in 2025, along with their key features, pros, cons, and unique offerings.

Apps Like Albert – Quick Comparison

| App | Best For | Key Features | Free Plan | Cash Advance |

|---|---|---|---|---|

| Beem | All-in-one financial solution | Instant cash advances, budgeting, rewards, tax filing | Yes | Yes |

| Venmo | Peer-to-peer payments | Money transfers, social feed, rewards | Yes | No |

| Cash App | Simplified investing | P2P payments, Bitcoin trading | Yes | No |

| Zelle | Bank-integrated transfers | Instant bank transfers | Yes | No |

| Brigit | Budgeting and cash advances | Credit builder, budgeting tools | Yes | Yes |

| MoneyLion | Comprehensive financial tools | Credit builder, investing | Yes | Yes |

| Empower | High cash advance limits | Smart savings, budgeting | Yes | Yes |

| Chime | Online banking | Fee-free overdrafts | Yes | Yes |

| Earnin | Paycheck advances | Early wage access | Yes | Yes |

Apps like Albert – 9 Best Alternatives for Albert

| App | Pros | Cons |

|---|---|---|

| Beem | Beem ensures bank-level security with PCI-DSS certification, safeguarding personal and financial information. | |

| Venmo | Encrypts financial information, Fast transactions, Sign up for Venmo card, Accepted by various merchants | Fees for instant transfers and credit card payments, Payments cannot be canceled once sent, Limited to US transactions |

| Cash App | Free transfers for debit and bank accounts, Stock and Bitcoin investing, Debit card for cash withdrawals, Unique identifier for privacy | No FDIC insurance unless Cash Card is acquired, Transactions cannot be canceled, Fees for instant transfers and specific transactions |

| Zelle | Fast and secure money transfers, No or minimal fees, Contactless transactions | Limited to US banks, No debit or credit card payments, Fees and limits vary by bank, No transaction reversal |

| Brigit | No interest on cash advances, Discovers side hustles, Automatic advances to prevent overdrafts, Up to $250 cash advances | Monthly subscription fee, Requires linking external checking account |

| Money Lion | No monthly fee for cash advances, Instant access to funds for a small fee, Diverse financial services, Credit building loans, Cryptocurrency investment | Requires linking external bank account, Needs to receive cash advances in external accounts |

| Empower | No fee cash advances up to $250, Automated savings feature, Personalized budgeting tools, Savings recommendations | Monthly subscription fee, Cash account pays low APY, Eligibility for cash advances may change |

| Chime | Fee-free overdraft protection, Credit builder credit card, High-yield interest, No monthly or minimum balance fees | Mobile check deposits limited, No joint accounts, Potential costs for cash deposits |

| Earnin | No fees or interest charges, Up to $750 per pay period access, Alerts for low balances, Early paycheck access | Requires external bank account access, Risk of bad borrowing habits, Eligibility only for direct deposit, Potential reliance on tips |

Detailed Analysis of Apps Similar to Albert

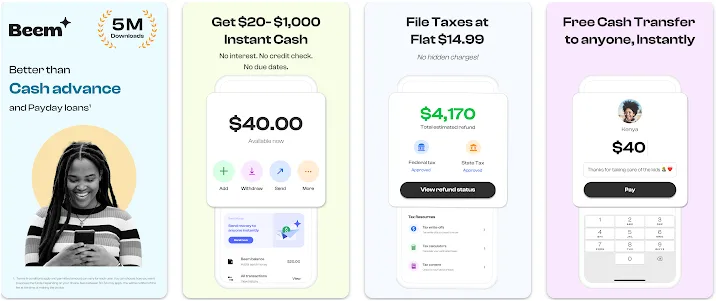

1. Beem

Beem, a dynamic Smart Wallet App, emerges as a compelling alternative to Albert, catering to diverse financial needs with innovative features.

Everdraft™ offers instant cash advances of up to $1,000 for emergencies, free from interest, income restrictions, and credit checks.

Beem facilitates seamless money transfers to anyone, irrespective of their banking affiliation, and provides a Better Financial Feed™ for comprehensive budget planning and personalized insights.

With credit monitoring and robust security measures, Beem stands out as a versatile financial solution.

Beem stands out among apps like Albert due to its comprehensive features. As the #1 Smart Wallet App, Beem helps users with instant cash advances, budgeting, and tax filing.

Beem’s Everdraft™ feature allows users to access emergency funds without interest or credit checks.

Key Features:

- Instant cash advance with Everdraft™

- Budget planner for smarter financial management

- Free tax filing and credit monitoring

Why Beem is an Albert Alternative: Beem offers similar functionalities to Albert, including cash advances and budgeting tools, while also integrating rewards and a more user-friendly interface.

Sending Limits

Beem allows users to send money instantly to anyone, offering flexibility through various channels, including bank accounts, gift cards, and prepaid cards.

Data Security

- Beem ensures bank-level security with PCI-DSS certification, safeguarding personal and financial information.

- The end-to-end encryption and cybersecurity expertise provide users with a worry-free experience, aligning with the highest industry standards.

2. Venmo

Venmo is a great alternative to Albert if your focus is on social and quick money transfers. Known for its social feed, Venmo also offers cashback rewards on specific purchases.

Key Features:

- Instant money transfers between users.

- Cashback rewards on eligible purchases.

- Integrated with many apps and retailers.

Why Venmo is a Website Like Albert: Though not focused on budgeting, Venmo’s ease of payments and rewards make it appealing for those seeking streamlined financial solutions.

Venmo is a famous mobile payment app that lets users send and receive cash quickly to and from friends.

It’s widely used for splitting bills, sharing expenses, and making payments for goods and services. With its user-friendly platform and convenient features, Venmo has become a go-to option for many people looking for a quick and secure way to handle their finances.

Pros

- Employs encryption and security measures to protect users’ financial information.

- Transactions are processed quickly, allowing for seamless money transfers between users.

- Users can sign up for a Venmo card, which can be utilized for online and in-store purchases.

- Accepted by various merchants, making it versatile for everyday transactions.

Cons:

- While Venmo offers free transfers between friends using linked bank accounts, it charges a fee for instant transfers and credit card payments.

- Once a payment is sent, it cannot be canceled, which can be inconvenient if a mistake is made.

- Limited to transactions within the United States, so it’s not suitable for sending money internationally.

Sending Limits

Venmo limits the amount of money users can send and receive, depending on various factors such as account verification and transaction history.

Data Security

Venmo prioritizes the security of users’ personal and financial information through encryption, authentication measures, and regular security audits to safeguard from unauthorized access and data breaches.

3. Cash App®

Cash App is a robust alternative to Albert, offering quick and fee-free money transfers for debit card and bank account transactions.

It provides additional features like stock and Bitcoin investing and offers a debit card for convenient cash withdrawals and purchases.

However, users should be mindful of certain drawbacks, such as transaction fees for instant transfers and the absence of FDIC insurance unless a Cash Card is obtained.

Cash App is a top choice among apps similar to Albert for users interested in payments and investing. It allows users to buy stocks or Bitcoin directly from the app.

Key Features:

- P2P payments and banking.

- Bitcoin and stock trading.

- Cash card with customizations.

Why Cash App is an Albert Alternative: While Albert focuses on savings and budgeting, Cash App offers additional investment options, making it a versatile alternative.

Cash App’s business accounts cater to various payment options but have specific limitations and fees.

Pros

- Free money transfers for debit card and bank account transactions.

- Offers stock and Bitcoin investing.

- Provides a debit card for cash withdrawals and purchases.

- User-friendly with a unique identifier, “$Cashtag,” for added privacy.

Cons

- Lack of FDIC insurance unless a Cash Card is acquired.

- Inability to cancel accepted transactions.

- Fees associated with instant transfers.

- Transaction fees for specific types of transactions, such as credit card payments.

Sending Limits

Daily and weekly sending limits: $250 per week and up to $1,000 monthly. Limits can be increased by verifying identity and linking a bank account.

Data Security

- Utilizes encryption technology for data protection.

- A unique identifier, “$Cashtag,” for user privacy.

- Allows users to set up two-factor authentication.

- Compliant with PCI Data Security Standard Level 1 for enhanced security.

4. Zelle

Zelle specializes in fast, bank-integrated money transfers. Unlike Albert, Zelle does not require a separate wallet; it works directly with your bank account.

Key Features:

- Instant transfers to linked bank accounts.

- No fees for transactions.

Why Zelle is an Alternative to Albert: If you value direct bank-to-bank transfers over cash advances, Zelle is a solid choice.

Zelle is a digital payment network in the United States that allows users to send and receive money directly from their bank accounts.

It is a fast, safe, and convenient way to transfer funds between friends, family, or other trusted individuals. To use Zelle, you need to have a bank account at a participating financial institution.

Many major banks and credit unions in the US offer Zelle as a feature within their mobile banking apps.

If your bank or credit union does not offer Zelle directly, there are other P2P payment apps like Zelle that offer similar services, you can try out.

Pros

- Send and receive money within minutes.

- No or deficient transaction fees.

- Contactless transfers for added convenience.

- Most banks don’t impose receiving limits.

Cons

- Limited to transactions between U.S. banks.

- Does not support debit or credit card payments.

- Fees and transaction limits vary by bank.

- No transaction reversal for refunds.

Sending Limits

Transaction limits vary between banks. Limits may differ for business and personal accounts. Receiving amounts are generally not capped.

Data Security

- Zelle maintains a safe transaction platform without sharing sensitive financial information.

- Utilizes authentication and monitoring features for enhanced security.

- Collects limited personal information, stored for four years after closing the app profile.

- Do not sell personal information to third parties.

5. Brigit

Brigit is another powerful app like Albert, offering credit-building and budgeting tools. It’s particularly beneficial for users who need regular access to small cash advances.

Key Features:

- Cash advances up to $250.

- Credit builder for improving credit scores.

- Budget insights and alerts.

Why Brigit is Similar to Albert: Brigit’s focus on cash advances and budgeting mirrors Albert’s core strengths while also including credit-building.

Brigit is a financial guardian, offering intuitive overdraft predictions and quick cash advances up to $250 without interest or credit checks.

With features similar to Albert, Brigit aids in financial health tracking and identifies trends to keep users on top of their financial game.

However, a monthly subscription fee of $9.99 for Brigit Plus unlocks the cash advance option, distinguishing it from Albert.

Brigit’s additional offerings include a credit builder loan, identity protection, and insights on spending habits, providing a comprehensive financial toolkit for users.

Pros

- No interest charges on cash advances.

- Facilitates the discovery of side hustles for additional income.

- Allows automatic advances to prevent overdrafts.

- Quick access to up to $250 without credit checks.

Cons

- The monthly subscription fee may be high.

- Mandatory linking of external checking account for eligibility.

Sending Limits

Cash advances up to $250. Repayment flexibility is based on the user’s next payday. Instant transfers are available for a small fee.

Data Security

- Requires linking an external checking account.

- Utilizes bank-level security with connections to thousands of banks.

- Protects sensitive financial information through established security measures.

- Approval for repayment extensions without additional fees.

6. Money Lion

MoneyLion provides a wide array of financial tools, including investing, credit-building, and banking. It’s a great website like Albert for users seeking a full financial toolkit.

Key Features:

- Cash advances and credit-building.

- Investment options and budgeting.

- Rewards and cashback opportunities.

Why MoneyLion is an Albert Alternative: With added benefits like investing and rewards, MoneyLion enhances the user experience beyond what Albert offers.

MoneyLion, akin to Albert, offers Instacash cash advances up to $500 without fees, with the option for more significant advances through a premium membership.

While instant transfers cost $0.49 to $8.99, the app provides financial services beyond cash advances.

Users can access features like RoarMoney for mobile banking; investment accounts with no minimums or fees, Credit Builder Plus for credit-building loans, and the ability to invest in cryptocurrency.

However, linking an external bank account is required for eligibility, and there might be a delay in receiving cash advances in external accounts.

Pros

- No monthly fee for cash advances.

- Option for instant access to funds for a small fee.

- Diverse personal finance and banking options are available.

- Offers credit-building loans and cryptocurrency investment.

Cons

- Mandatory linking of an external bank account if not using RoarMoney.

- Needs to receive cash advances in external accounts.

Sending Limits

Cash advances up to $500. Option for instant access with varying fees. More extensive cash advance options with a premium membership.

Data Security

- Requires linking an external bank account.

- Utilizes security measures for financial transactions and data protection.

- Provides various financial services with a focus on user privacy.

- No monthly fee for cash advances enhances affordability and accessibility.

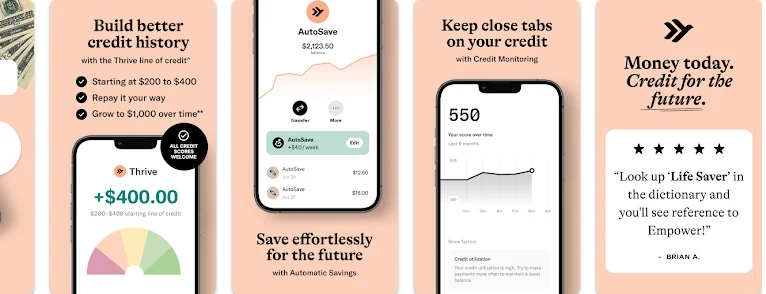

7. Empower

Empower focuses on budgeting and high cash advance limits, making it ideal for users needing immediate funds.

Key Features:

- Cash advances up to $250.

- Smart savings tools.

- Automatic budgeting and spending tracking.

Why Empower is a Similar App to Albert: Empower provides competitive cash advance limits and intuitive budgeting tools, closely aligning with Albert’s features.

Empower emerges as a modern alternative to Albert, providing access to features like cash advances, automatic savings, and personalized budgeting.

With Empower Cash Advance, users like Albert can secure up to $250 without fees, interest, or credit checks.

The app’s subscription cost of $8 per month may be considered high, but it encompasses a range of financial tools, including automated savings and interest checking.

While offering personalized insights, Empower evaluates bank account history and direct deposit information to determine cash advance eligibility, creating a streamlined financial experience with instant delivery options.

Pros

- No fee or interest cash advances up to $250.

- Automated savings feature for effortless money-saving.

- Comprehensive financial tracking and budgeting in one place.

- Offers personalized savings recommendations and interest checking.

Cons

- The monthly subscription cost may be high.

- Cash account pays a relatively low APY.

- Eligibility for cash advances may change over time.

- The monthly fee applies after the initial 14-day free trial.

Sending Limits

- Cash advances up to $250.

- Instant delivery is available for eligible Empower Checking Account customers.

- Evaluation of bank account history and direct deposit details for eligibility.

Data Security

- Employs robust security standards to safeguard user information.

- No hidden fees, interest, or credit checks enhance user financial security.

- Personalized financial insights ensure a tailored and secure experience.

- Cash advances and financial recommendations are provided without hidden risks.

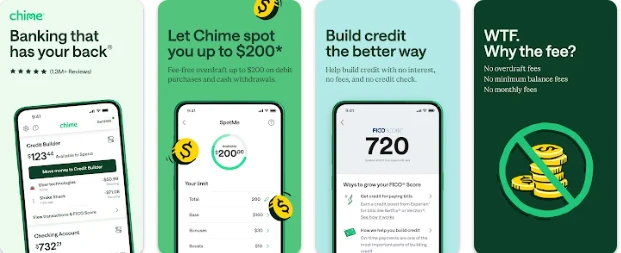

8. Chime® Pay Anyone

Chime is a leading alternative to Albert for users looking for online banking with no hidden fees. Its SpotMe™ feature allows for fee-free overdrafts.

Key Features:

- No overdraft fees with SpotMe™.

- Early direct deposits.

- No monthly fees or minimum balance.

Why Chime is an Albert Alternative: Chime’s banking services and fee-free overdrafts make it a strong competitor to Albert’s cash advance offerings.

Chime is a compelling alternative to Albert, offering fee-free banking with unique features. With no monthly maintenance or lowest balance fees, Chime’s SpotMe program provides fee-free overdraft protection, allowing users to overdraw up to $200 on debit card purchases.

Chime is among the options accepted by payday loan providers, with 8 such lenders accommodating Chime users.

While requiring a direct deposit of at least $200 to qualify for SpotMe, Chime also offers a credit builder credit card and high-yield interest on checking and savings accounts.

However, mobile check deposits are limited to direct deposit users, and joint accounts are unavailable. Depositing cash may incur costs with cash deposit partners.

Pros

- Fee-free overdraft protection with SpotMe.

- Qualification for SpotMe with a direct deposit of $200.

- Offers a credit builder credit card and high-yield interest.

- No hidden fees, including no monthly or minimum balance fees.

Cons

- Mobile check deposits are available only with direct deposits.

- Absence of joint account options.

- Potential costs for depositing cash with specific partners.

Sending Limits

- Overdraft protection with a credit limit of $40 to $200.

- Early direct deposit provides access to paychecks up to two days earlier.

Data Security

- Utilizes robust digital security measures to safeguard user information.

- Offers fee-free banking without compromising on security.

- Implements secure methods for early direct deposit and automatic savings.

- Focus on digital banking ensures a secure and convenient financial experience.

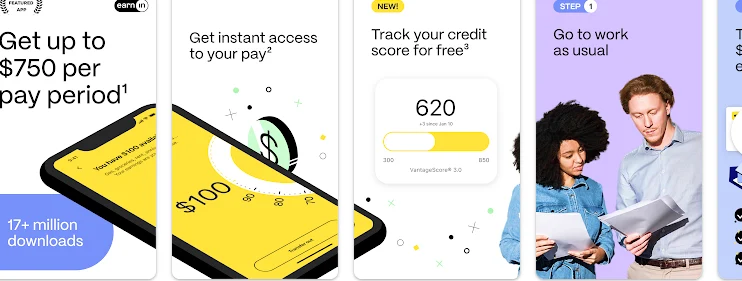

9. Earnin

Earnin’s early wage access makes it a top choice for users seeking alternatives to Albert. It offers quick access to earned wages without fees.

Key Features:

- Access up to $100/day from earned wages.

- No hidden fees or interest.

- Balance Shield alerts to avoid overdrafts.

Why Earnin is an App Similar to Albert: Earnin focuses on paycheck advances, a feature that aligns closely with Albert’s financial offerings.

Earnin provides a unique alternative to Albert, offering users access to their earned wages without fees or interest.

With the Cash-Out program, members can access up to $100 daily and $750 per pay period before the traditional payday.

The app’s Balance Shield feature monitors bank accounts, providing alerts and allowing users to arrange up to $100 cashouts to cover low balances.

While standard transfers take two to three days, Lightning Speed transfers offer instant access for a fee. Earnin encourages tips but doesn’t mandate them, providing financial flexibility with early paycheck access.

Pros

- No fees or interest charges.

- Access to up to $750 per pay period.

- Alerts for low bank account balances.

- Flexibility to tap into earned wages instantly.

Cons

- Requires access to the external bank account.

- Risk of fostering bad borrowing habits with high limits.

- Eligibility only for those receiving direct deposit.

- Potential reliance on tips, though not mandatory.

Sending Limits

- Access up to $100 daily and $750 per pay period.

- Alerts for low balances with the option to cash out.

Data Security

- Requires linking to the external bank account.

- Utilizes security measures for financial transactions.

- Alerts and Balance Shield feature for enhanced financial health monitoring.

Exploring these apps like Albert can help you find the perfect tool to meet your financial needs. Whether you prioritize cash advances, budgeting, or online banking, there’s an Albert alternative suited for you.

Which Albert Alternative Is Right For You?

Consider your specific financial requirements and preferences when choosing the best Albert alternative:

- Evaluate factors like fee structures, cash advance limits, and additional features like budgeting tools and savings options.

- Compare subscription costs and weigh them against the offered benefits.

- Assess the eligibility criteria for cash advances and the convenience of fund transfers.

- Look for apps that align with your banking habits and provide security measures for sensitive information.

Ultimately, the best alternative seamlessly integrates with your financial goals, balancing features, costs, and user-friendly interfaces.

Conclusion

Selecting the suitable Albert alternative depends on your unique financial requirements and priorities. With its Everdraft™ feature and comprehensive financial feed, Beem stands out for quick cash advances.

Venmo and Cash App offer convenient peer-to-peer transactions but have distinct pros and cons.

Brigit acts as a financial guardian, while MoneyLion provides diverse financial services. Empower offers personalized budgeting, and Chime’s fee-free banking and SpotMe features are appealing. Earnin provides flexibility with earned wage access.

Frequently Asked Questions About Albert

What are the best apps like Albert?

The best apps similar to Albert include Beem, Venmo, Cash App, Zelle, Brigit, MoneyLion, Empower, Chime, and Earnin.

Which Albert alternative offers the best cash advances?

Beem, Empower, and Earnin are excellent options for cash advances. Beem’s Everdraft™ feature stands out for its interest-free and credit-check-free advances.

Are there free websites like Albert?

Yes, apps like Chime, Venmo, and Zelle offer free services, making them great alternatives to Albert.

What makes Beem the best alternative to Albert?

Beem provides an all-in-one financial solution with unique features like Everdraft™, budgeting tools, and tax filing, making it an outstanding alternative to Albert.

Can I use multiple apps similar to Albert?

Absolutely! Many users combine apps like Albert with alternatives like Beem, Brigit, and Chime to maximize financial benefits.

What is better than Albert App?

If you’re looking for an alternative to the Albert app, Beem stands out as a smarter option. Unlike Albert, Beem offers unique features like instant cash advances through Everdraft™, no credit checks, a comprehensive budgeting tool, and free tax filing—all in one app. It’s designed to give you more control and flexibility over your finances.

How to get $250 right now?

If you need $250 right now, consider using an instant cash advance app like Beem. Beem’s Everdraft™ feature allows you to access quick cash without interest or credit checks, making it a hassle-free solution for urgent financial needs.