Table of Contents

Personal loans have minimal hassles, unlike other loans. It may cost you more due to high interest rates, but you don’t have to explain the loan usage. Usually, the repayment plan is 60 months or less, but you can extend the term. You can get such loans from credit unions, banks, or any other loan provider and pay them back based on the loan terms.

Personal loans are popular for weddings, home renovations, or business purposes. Can you use a personal loan to start a business? This article will teach you a lot about personal loans for business purposes. And how to use funds strategically to help your struggling business finances. Read on!

Introduction

A business person would opt for a personal loan over a business loan for simplicity. A business loan requires you to provide all details about your business, profits, and revenue from the last few years. A personal loan is also quick and doesn’t require any documentation. You just need to submit your ID and financial background.

The other reason is the credit score. A personal loan might be available for an individual with a low credit score, but business loans require you to have a credit score of over 600 to apply for them. You can use a personal loan to help your business if you need quick money.

Understanding Your Options

A personal loan or its alternatives might help you with your financial needs. You can use it for fun, pleasure, vacation, wedding, or business. This makes personal loans the most independent form of loan, where you decide what to do with your money. Personal loans also do not require collateral as they are unsecured loans.

Personal loans, however, have some disadvantages as well. The borrowing limit is around $100,000, while you can get up to $5 million for a business loan. The high interest rates impact your credit score, and there is no improvement in your business credit even if you pay your loan on time. You must evaluate these factors before you apply for a loan.

Personal Loans vs. Business Loans

Key Differences, Interest Rates, and Repayment Terms

There are a lot of points one must cover before applying for a personal loan for business expenses. The key differences are the interest rate, repayment terms, and documentation. Business loans require you to provide collateral or security as they are secured loans. They provide funds up to $5 million and review your business background before loan approval.

On the other hand, a personal loan is quick and hassle-free. They do not need your business background or how you use your funds. They check your credit history and select your interest rates based on it. You’ll have loan tenures of around 60 months, but a limited borrowing limit of $100,000.

Eligibility and Requirements

Factors Affecting Loan Approval For Both Options

The eligibility criteria for loans require you to provide your credit score and identification. The lender might require your revenue, profits, and details about your business to approve your business loans. They might also ask for a collateral asset and check it before approval. But for personal loans, you just need to provide details for your credit score. No collateral, business revenue, or any other information is necessary.

Using a Personal Loan for Business Startup

You can ask for a start-up loan, a type of personal loan backed by the government. These loans allow new businesses to access funding and use funds for marketing or equipment. The loans can be based on your business size and have different terms, but they also provide necessary guidelines and support to help your business grow.

You must provide information about your business, future expenses, and cash flow to approve these loans. You must also pass a credit score check to pay your loan, even if your business operations are unsuccessful.

Advantages of a Personal Loan

Speed and Accessibility

Personal loans are the first choice for many business owners because they’re fast and usually get approved within the same day. Businesses needing quick funds might select personal loans despite their high interest rates or credit score checks. They also do not require collateral or other security, as they are unsecured loans. This makes personal loans accessible for all businesses.

Flexibility In the Use of Funds

Most business loans require you to provide details about how you plan to use your funds. But in personal loans, you do not have to explain yourself. You can take a loan for your wedding, home renovation, buying a luxury item, or paying off a pending loan. This makes you free to use your funds based on your choice. You can select personal loans if you get rejected for a business loan to support your business.

Disadvantages of a Personal Loan

Higher Interest Rates

The most significant disadvantage of a personal loan is its high interest rates. It is an unsecured loan; hence, you must pay high interest rates to minimize the risk. A personal loan also does not require you to explain the usage of funds, allowing the lender to charge high interest rates.

Read Related Article: Why Car Insurance is Expensive in Georgia: Cost Breakdown

Potential Impact on Personal Credit

Due to high interest rates, most might miss a payment or two. This missed payment can become a nightmare, as it will multiply manifold due to higher penalties. If you miss payments on your loan, it might affect your credit score. You must stay careful when taking a personal loan and plan your expenses accordingly.

When to Consider a Personal Loan

Choosing between a personal loan and a business loan depends on the purpose of the loan, the amount needed, and your financial situation. Here are some scenarios where a personal loan might be more appropriate than a business loan and vice versa:

Small Business Startups

A personal loan can be a quick and flexible option if you’re starting a small business and need initial funding. Personal loans often have fewer requirements and can be obtained faster than business loans. This can be useful for small-scale startups with modest capital needs.

Short-Term Financing Needs

For immediate, short-term financial needs such as covering cash flow gaps or handling urgent expenses. Personal loans can provide quick access to funds with a straightforward application process.

Limited Business Credit History

If your business is new or has a limited credit history, you might need help to qualify for a business loan. Personal loans may be easier with good credit and a stable income.

Minor Business Expenses

For smaller business expenses, such as purchasing office supplies or minor equipment, personal loans can cover these minor expenses without requiring complex business loan applications.

Small Business Startups

Limited Funding Needs

Small businesses have limited funding needs but want to stay a step ahead. Companies might consider taking a personal loan to ensure they have specific capital to make business decisions. Small yet adequate funding during the initial days can give the business the kickstart to grow.

Quick access to capital

Most startup businesses need more experience and networks to raise capital in the market. They need a helping hand to provide them with initial capital. Personal loans might be costly, but they provide capital. Quick access to capital can help businesses market their products and services well for customers.

Good Personal Credit

Higher Chances of Approval

Personal loans are primarily based on your credit score. An excellent credit score might help you reduce your interest rate substantially. If you have good personal credit, you have a high chance of approval at a lower interest rate. Similarly, your credit score will diminish if you fail to repay your loan.

Short-Term Business Needs

Covering initial expenses

Most businesses consider taking a personal loan to cover the money for short-term business needs. It might be to manage a sudden need for expenses, solve a conflict of stuck packages, or provide your employees with a bonus. No matter the emergency, a quick personal loan can cover a small expense. Some small businesses also use these loans to cover initial costs for the company.

Potential Risks and Drawbacks

When deciding between a personal loan and a business loan, weighing the potential risks and drawbacks of choosing a personal loan for business purposes is essential. Here are some key considerations:

Impact on Personal Credit

A personal loan can impact your credit score if you fail to repay, and similarly, a business loan might result in the loss of personal assets that you have put in as collateral. Both loans impact your credit if you miss a payment.

Limited Loan Amounts

A personal loan might seem like a loan where you need to explain yourself to your lender about your usage of funds, but it is limited. Unlike business loans, where you can get up to $5 million as a loan, personal loans only allow you to get $100K. This might be enough for a dream wedding or a magical vacation, but as a business expense, it is much less.

Shorter Repayment Terms

Personal loans come with a repayment term of 60 months or less. However, business loans can take several months, depending on the lender. Most businesses work on this barter system, where you pay interest and help each other manage the finances. Business loans are more flexible for your payment terms than personal loans.

Personal Liability

Business Debts Can Affect Personal Assets

Business debts can affect personal assets and finances. If they cannot, people who take a personal loan based on their credit score might ruin only their financial background. On the other hand, business debts require collateral, and failing to repay your business loans might result in losing personal assets.

Read Related Article: Using a Car as Collateral For a Personal Loan

Higher Interest Rates

Increased Cost of Borrowing

Personal loans are only one of the solutions to save your business. These loans come with high interest rates and are even higher for those with poor credit backgrounds. You might lose your business and profits even before you start it due to the burden of paying back the loan. Evaluating loans beforehand and comparing them to find the best course of action is better.

Limited Funding

Potential for Insufficient Capital

Personal loans are also tied to limited funding of $100,000. Most businesses require funds of over $500,000 to show practical work. If you apply for a personal rather than a business loan, your hands are tied with just $100,000, and you must manage it. It is better to select a business loan to get the required funding for your business.

Alternatives to Personal Loans

Businesses can get quick funds as an alternative to personal loans in several ways. If you are not satisfied with your personal loan terms and want to explore other options, you must select an alternative best suited for you. These alternatives include credit cards, Lines of credit from a trusted source, P2P lending, or cash advances from a credit union. Most of these alternatives have different terms and conditions from a personal loan, but are at much lower interest rates.

Crowdfunding

Raising Funds From a Large Group of People

Another alternative to personal loans is crowdfunding. It is similar to asking for money from a large group of people who feel your business can provide something unique. Crowdfunding has similar procedures to donations and allows a company to ask for money from the public directly to overcome any financial difficulties.

Business Credit Cards

Short-Term Financing With Rewards

Many businesses also use business credit cards to manage their short-term financial needs. A business credit card comes with short-term financing solutions and offers rewards for timely payments. You can trust a card to overcome any financial difficulties in the business and pay back in the next cycle. This way, you can get short-term loans without comparing any lenders or looking for the best loan options.

Small Business Administration (SBA) Loans

Government-Backed Loans With Favorable Terms

Various types of government loans help small businesses acquire funds when they need them. Small business administration and start-up loans are some of the best loans for a new business. The government ensures that the terms and conditions of the loan are favorable for small businesses and that they are provided with security against exploitation.

Read Related Article: How to Build Credit With No Credit History? Complete Guide

Conclusion

Loans are a type of financial assistance that can help a business or an individual overcome a shortage of funds. Personal loans are designed for those who seek quick funds at high interest rates to avoid explaining the usage of funds to the lender. These loans are outstanding for short-term funding needs, fun, and planning a wedding or vacation. Businesses requiring funds over $100,000 should not consider these loans, as they have limitations.

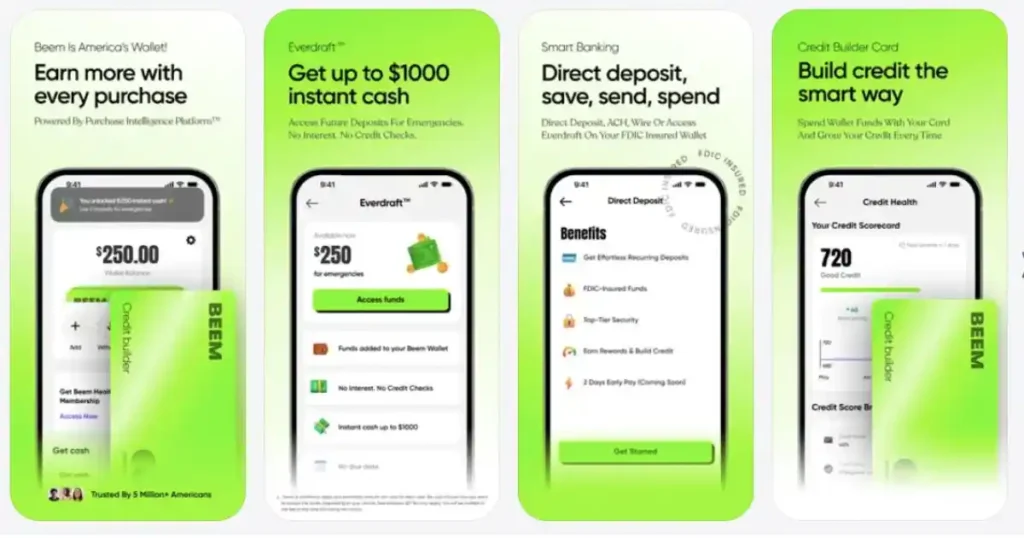

Business loans or any other secured loans require you to submit collateral. You must consult a financial advisor if you’re confused. To improve your financial stability, you can try Beem, an app that’s a platform for financial guidance, assistance, and loan options. With Beem’s Everdraft™, you can get up to $1,000 without interest or due dates and explore ways to invest your funds for a better financial future. Download the app here.

FAQs for Can You Use a Personal Loan to Start a Business?

Can I use a personal loan to buy business equipment?

You can take a personal loan to buy your business’s tools, machinery, or equipment. Personal loans do not require you to explain the use of your loan funds. You might use the funds for several reasons and do not need to inform the lender regarding your expenditures.

Is it better to start a business with a personal or business loan?

You must consider the pros and cons of these loans well before you decide on one. Consider a business loan if you have collateral and need significant funds with flexible repayment terms. These loans have lower interest rates and are much safer if you miss deadlines. On the other hand, if you need quick funds and can manage with a small amount of funds, you must consider personal loans.

What are the tax implications of using a personal loan for business expenses?

There are no negative sides to a business if it uses a personal loan for its business expenses. They can claim the interest paid for the personal loan as business expenses under Article 37 of the Income Tax Act. This makes your interest rates a tax deduction on your income. However, you might miss a repayment deadline due to high interest rates, resulting in poor credit scores.