Managing cash flow can be challenging for most of us. However, the rise of digital banking solutions like Current has changed how we handle our finances, offering greater convenience and control. A critical element in this financial toolkit is cash advance apps. These apps provide a lifeline for when funds are tight or unexpected expenses arise. However, not all cash advance apps sync seamlessly with digital banking platforms like Current.

This blog explores the top cash advance apps that work effortlessly with Current, offering insights into features, benefits, and how they can enhance your financial management strategy. Whether going through a financial tight spot or planning for future needs, understanding these apps can be a game-changer in your financial journey. So, let’s get started!

Top 10 Cash Advance Apps That Work With Current

Cash advance apps offer an immediate solution for short-term financial needs, bridging the gap until the next paycheck. However, it is essential to understand how these apps integrate with innovative digital banking platforms like Current.

This compatibility can significantly impact user experience and financial management efficiency. This section will examine the pros and cons of different cash advance apps that are harmonious with Current. We will focus on providing a balanced view that helps you decide which app best suits your financial circumstances and lifestyle.

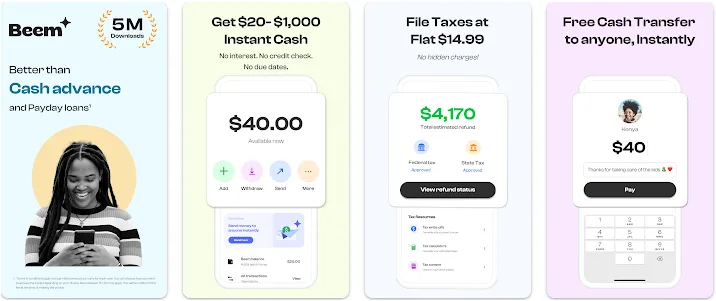

1. Beem

Access Immediate Funds with Beem’s Everdraft. Instantly receive between $5 and $1,000 for your future Beem Wallet deposits today. Everdraft, Beem’s innovative cash advance feature, offers a hassle-free solution with no credit checks, zero interest and no income requirements. Plus, enjoy the flexibility of no set repayment dates!

Features

Beem evaluates your financial situation to determine if you qualify for a credit line. Qualifying users can access all app features, including the option to withdraw up to the approved amount. Access to Everdraft and other features comes with a manageable monthly subscription fee, available in two tiers – $2.47 or $9.97.

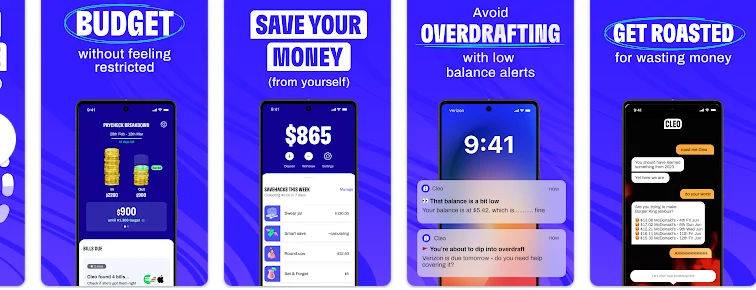

2. Cleo

Cleo is an AI-powered financial assistant that helps you track spending, build credit, and avoid overdraft fees. Cleo offers features like cash advances, budgeting tools, and saving strategies.

Cleo communicates in a fun, relatable way with memes and sometimes a little “roasting” to motivate you. Users highly recommend Cleo, as shown by the numerous positive app store reviews. Apps like Cleo prioritizes security and doesn’t sell your data.

| Pros | Cons |

| AI money coach for personalized financial advice. Cash advances up to $250. | Requires subscription to Cleo Plus or Cleo Builder. Limited features without a subscription. |

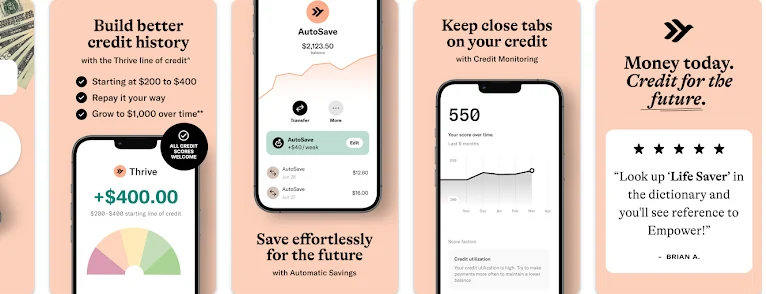

3. Empower

Empower is a financial service that provides customers with cash advances of up to $250 without requiring credit checks or charging fees. They determine eligibility by looking at earned income and account activity. Additionally, Empower offers a payout system that allows customers to receive their money two days earlier than usual.

| Pros | Cons |

| Personalized budgeting tools. No monthly fees or overdraft charges. | Cash advance limited to $250. May lack advanced financial management features. |

4. MoneyLion

MoneyLion offers Instacash, a service that allows customers to receive cash advances of up to $500 without impacting their credit ratings. Regular delivery of funds through Instacash does not come with any costs. However, for instant cash advances, MoneyLion may apply “Turbo Fees,” which are fees associated with receiving the funds immediately rather than waiting for the regular delivery timeline.

| Pros | Cons |

| Instant access to earned money. Comprehensive financial services, including budgeting tools. | Cash advance amount not clearly specified. May have eligibility requirements for financial services. |

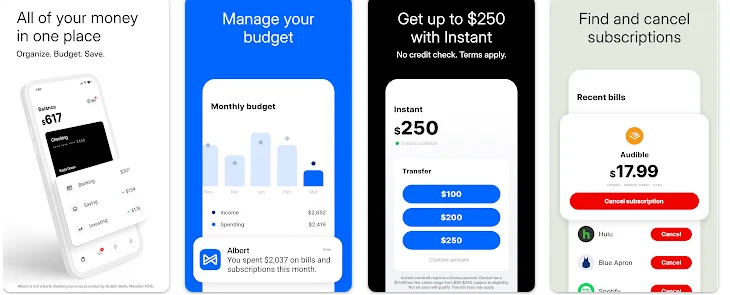

5. Albert

Albert offers cash advances of up to $250 without charging interest or fees. However, some features, including cash advances, require a monthly subscription fee of $14.99.

| Pros | Cons |

| Quick access to funds. The overdraft limits up to $250. | Cash advance amount not specified. Features may be basic compared to other apps. |

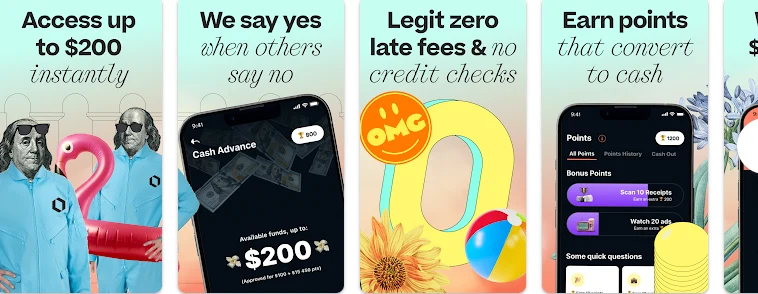

6. Klover

Klover provides consumers with a cash advance of up to $200, and they don’t charge interest or late fees. The repayment is automatically withdrawn from the user’s account on their next paycheck.

| Pros | Cons |

| Instant access to up to $100. No late fees, credit checks or interest. | Lower cash advance limit compared to others. Limited to basic cash advance service. |

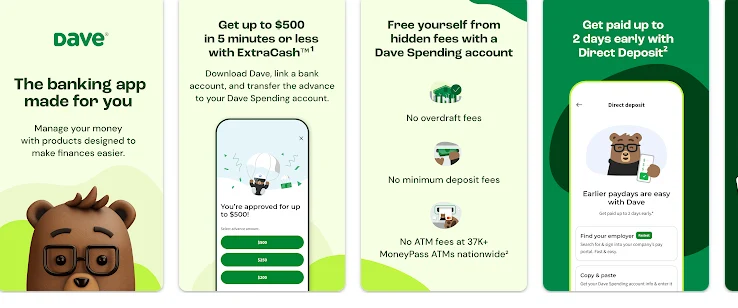

7. Dave

Dave is a popular platform in the realm of quick financial solutions, offering cash loans of up to $500. It’s part of the wave of mobile applications addressing the need for fast financial assistance in today’s dynamic personal finance landscape.

| Pros | Cons |

| Cash advances up to $500. Includes credit-building and budgeting tools. | Might have eligibility criteria for higher advance amounts. Limited financial services beyond cash advances. |

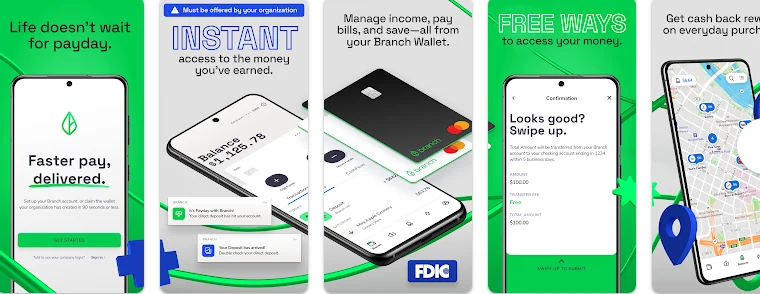

8. Branch

Branch is a digital wallet platform that enables users to access up to 50% of their income as a cash advance. The repayment is automatic and happens on payday. However, employees need to sign up for this perk to avail themselves of this service.

| Pros | Cons |

| Instant cash advance feature. Helps manage finances effectively. | Details of cash advance amount not specified. Limited information on additional features. |

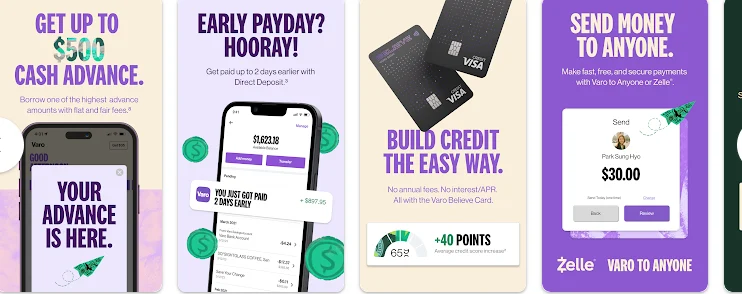

9. Varo

Varo Advance is Varo’s cash advance service, providing up to $250 with no fees for amounts of $20 or less. Larger sums may be subject to fees. Varo also offers a two-day early payout feature.

| Pros | Cons |

| No monthly fees. “Varo Advance” offers up to $250 initially, potentially increasing to $500. | Advance amount may start lower for new users. Requires continued banking and timely payments for higher advances. |

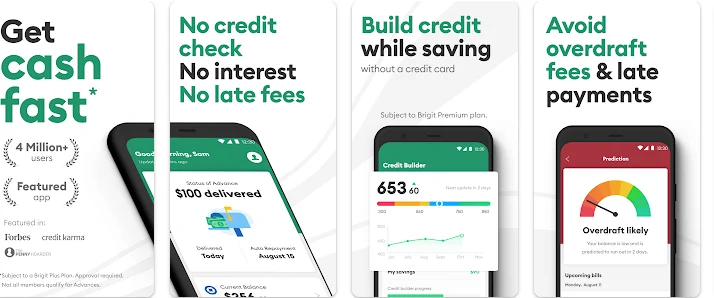

10. Brigit

Brigit provides customers with cash advances of up to $250 without charging interest, fees, or tips. However, users are required to subscribe to a subscription service, which costs between $9.99 and $14.99 per month.

| Pros | Cons |

| Offers advances ranging from $50 to $250. Accessible funds for immediate needs. | Limited to smaller cash advances. May lack extensive financial management tools. |

Also Read: Cash Advance Apps that Work with PayPal

Summary of the Best Cash Advance Apps that Work with current

Cash advance apps, when paired with advanced digital banking platforms like Current, offer a responsive approach to personal finance. As we have explored the various cash advance apps compatible with Current, it is evident that each has unique features, benefits and considerations.

While these apps provide a quick fix for immediate cash needs, it is important to approach them with a mindful strategy, understanding their terms and how they fit into your overall financial planning. By choosing the right cash advance app that aligns with Current, you can navigate short-term financial gaps effectively while keeping your financial goals on track.

What is Current?

Current is a cutting-edge digital banking platform designed to serve modern financial needs. It overcomes traditional banking barriers by offering swift, user-centric services that cater to everyday financial activities. Current provides a comprehensive suite of tools, including budgeting, saving, and faster direct deposits, ensuring users have total control over their finances at their fingertips.

Benefits of Using current

- Get real-time updates on your financial transactions, allowing for better control and immediate rectification.

- Allocate funds to specific saving goals, making the journey towards achieving financial targets systematic and straightforward.

- Track your spending habits, categorize expenses and set limits to ensure you’re always aligned with your financial goals.

- Receive your paycheck up to two days faster, giving you quicker access to your funds.

What Are Cash Advance Apps that Work with Current?

Cash advance apps like Beem are financial tools that allow users to access funds before their next paycheck, effectively bridging the gap during financial crunches. These apps, especially compatible with Current, provide a seamless financial experience. They offer features like low or no interest on advances.

Choosing a Cash Advance App that Works with Current

When choosing a cash advance app compatible with Current, ensuring smooth integration for smooth transactions is important. Prioritize apps with minimal fees and interest rates to avoid extra costs. Consider the advanced limits of the app to match your financial requirements and opt for those offering additional features like budgeting, saving, and financial advice to make your overall financial management seamless. Remember, while these apps offer quick solutions for urgent cash needs, they should be used responsibly within a comprehensive financial plan.