The need for quick financial solutions has given rise to many mobile applications in the ever-changing world of personal finance. Dave, a well-known platform that provides quick cash loans of up to $500, is leading the way in this field.

Read on to explore the varied spectrum of quick cash options in sync with Dave’s creative financial ecosystem; we will also explain the dynamic offers of Beem (the best alternative to cash advance apps), Cleo, Empower, and more to give you varied options.

Cash Advance Apps that Work With Dave

Here are some top cash advance apps that work with Dave:

Beem

Better than cash advance apps, Beem stands out in banking simplicity because of its user-friendly layout and easily accessible functionality. The Beem account is simple to use, providing consumers with a smooth experience. One of its main draws is its low interest rates, making it a tempting option for individuals looking to save money.

While Beem does not have an extensive branch network for people who prefer traditional banking techniques, its great customer service ratings show its efficiency. Customer service replies are quick, which improves the overall user experience and compensates for the restricted branch structure. Beem, emphasizing usability and customer happiness, is an appealing alternative for anybody looking for a simple and effective banking service.

Features:

Beem offers cost-effective interest rates, quick replies from customer service, simple and efficient account management, along with limited branch structure.

Cleo

Cleo introduces an AI assistant to help consumers manage their finances. While its cash advance option of up to $250 is enticing, it is accompanied by a monthly cost of $5.99 for Cleo Plus, which may deter specific customers.

Pros:

– Credit-building features

– AI-powered financial guidance

Cons:

– There is a monthly subscription fee.

Empower

Empower offers customers up to $250 cash advances without credit checks or charges. To establish eligibility, the app examines earned income and account activity and provides a two-day-earlier payout system.

Pros:

– No interest or fees

– Early paycheck

Cons:

– Account conditions determine cash advance amounts.

– A paid membership service ($8 per month) is available.

MoneyLion

MoneyLion offers Instacash, which allows customers to get cash advances of up to $500. The service does not affect credit ratings, and there are no costs for regular delivery. For instant cash advances, however, “Turbo Fees” may apply.

Pros:

– There are no expenses for regular delivery.

– Paycheck two days early

Cons:

– “Turbo Fees” for same-day cash advances

Albert

Albert provides cash advances of up to $250 without interest or fees. Many functions, like cash advances, do, however, need a $14.99 monthly subscription charge.

Pros:

– Up to $250 in cash advances

– No interest or fees

Cons:

– There is a monthly subscription price.

Klover

Klover offers consumers a cash advance of up to $200 with no interest or late fees. The payback is automatically withdrawn from the user’s account on the next paycheck.

Pros:

– Cash advances of up to $200

– Quick sign-up

Cons:

– Proof of three regular direct payments over the last two months is required.

Also Read: Cash Advance Apps that Work with PayPal

Branch

Branch is a digital wallet that allows users to access up to 50% of their income as a cash advance. Repayment occurs automatically on payday, but employees must sign up for this perk.

Pros:

– Cash advance of up to 50% of paycheck

– Easy payback on payday

Cons:

– The employer must register to use the service.

Varo

Varo Advance, Varo’s cash advance service, offers up to $250 with no fees for quantities of $20 or less. Higher sums, on the other hand, may be subject to fees. Varo also offers a two-day early payout.

Pros:

– No fees on cash advances of $20 or less

– Early payday by two days

Cons:

– Expensive fees for more outstanding sums

– Limited cash advance limit

Brigit

Brigit customers may get up to $250 in cash advances without interest, fees, or tips. Users must, however, subscribe to a subscription service that costs between $9.99 and $14.99 monthly.

Pros:

– No interest, fees, or tips

– A cash advance of up to $250 is available.

– Additional perks are available.

Cons:

– Account conditions determine cash advance amounts.

– Subscription service comes at a fee

Summary of the Best Cash Advance Apps that Work with Dave

Beem is a perfect choice for individuals who value ease of use and budgeting, thanks to its straightforward design and low interest rates. Cleo distinguishes itself by incorporating an AI assistant; nonetheless, the $5.99 monthly price for Cleo Plus may dissuade some consumers. Empower provides no-interest, no-fee cash advances and a convenient two-day early paycheck function. MoneyLion’s Instacash offers up to $500 with no credit check, but consumers should be wary of potential “Turbo Fees.” Dave, a pioneer in the area, guarantees fee-free banking and extensive budgeting features, albeit there are fees for rapid transactions.

Branch, a digital wallet, enables a smooth 50% paycheck cash advance, subject to employer agreement. Varo distinguishes itself by fee-free modest cash advances and a two-day early payday incentive. Meanwhile, Brigit provides interest-free financial loans in exchange for a monthly subscription. In summary, these applications offer a wide range of functions that cater to varied financial demands, leaving Dave users spoiled for choice when it comes to quick cash solutions.

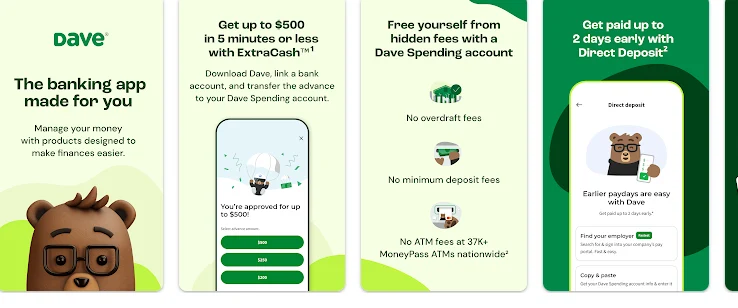

What is Dave?

Dave is a personal financial app noted for its ExtraCashTM function, which provides up to $500 in short-term loans. The app offers fee-free banking, no overdraft fees, and free ATM withdrawals at 32,000 locations.

Benefits of Using Dave

No Credit Check: Because Dave does not conduct a credit check, it is available to a broader spectrum of individuals.

No Late Fees: Users will not suffer late fees, giving them repayment flexibility.

Budgeting Tools: Dave provides tools to assist consumers in limiting their spending and successfully managing their finances.

No-Fee Banking: Dave offers no-fee banking services, contributing to a more cost-effective financial experience.

What Are Cash Advance Apps that Work with Dave?

Green Dollar Loans: Ideal for rapid cash advance solutions for all credit kinds with consistent income.

Big Buck Loans: Ideal for cash advance applications like Dave’s, with terms of up to two years.

Super Personal Finder: The best option for financial advance applications like Dave’s is giving up to $50,000 with 10-year payback terms.

Low Credit Finance: Recommended for cash advance applications that connect with Chime, such as Dave, that provide up to $5000 with low APRs and easy-to-understand loan terms.

Heart Paydays: Ideal for cash advance applications like Dave, delivering same-day options from direct lenders with no hidden fees or complicated industry jargon.

Choosing a Cash Advance App that Works with Dave

Consider the following aspects while choosing a cash advance app that works well with Dave:

Eligibility Criteria:

Depending on criteria such as income and account activity, different applications may have different eligibility requirements. Choose an app that is appropriate for your financial position.

Fees:

Observe any membership fees, rapid transfer fees, or other costs related to the cash advance app.

Payback conditions:

Know the payback conditions, including when the borrowed money will be withdrawn from your account.

Extra Features:

Some applications provide extra features such as credit-building tools, savings alternatives, and early paycheck access. Based on your requirements, evaluate these extra benefits.

User Reviews:

Read user reviews to learn about other people’s experiences with the cash advance app. Positive feedback might suggest a trustworthy and user-friendly service.

Conclusion

A wide variety of cash advance applications that work with Dave are available in the ever-changing world of personal finance. Beem, the best alternative to instant cash advance app, is perfect for people who value simplicity and cheap interest rates. It offers you a loan with zero interest, with a wide variety of features and factors to smoothen your finances. Explore Beem, your partner, for easy financial efficiency and a smooth and intuitive banking experience.