Table of Contents

Financial requirements often occur suddenly in today’s fast-paced environment, driving consumers to seek quick and simple answers.

Green Dot Bank, well-known for its prepaid card and payday lending services, provides a dependable platform for individuals in need.

In this article, we’ll look at cash advance apps that work with Green Dot to provide customers with more financial options.

What is Green Dot?

With over 30 million clients, Green Dot is a financial institution that offers prepaid card services. Prepaid cards offered by the bank are an option for customers who value convenience and portability, as they are not linked to traditional bank accounts.

Cash advances, standard payday loans, and larger personal loans are just a few of the lending options available to qualified borrowers at Green Dot Bank.

These loans are designed to help with temporary financial requirements and unforeseen bills. Loan amounts provided by Green Dot Bank can range from $100 to $1,000 or more, depending on the borrower’s eligibility and the lender’s criteria.

Benefits of Using Green Dot

Green Dot Bank provides several benefits for payday loans for a range of customers’ immediate financial needs. Its quick loan approval method stands out, which is critical when dealing with unexpected bills or difficulties.

Green Dot Bank’s shortened application procedure ensures quick and easy approval, providing customers with the required funds.

Green Dot Bank uses state-of-the-art security measures to protect its customers’ personal information in this digital age. Thanks to the bank’s advanced encryption technology and secure servers, customers can ensure that their personal and financial information is safeguarded during online loan transactions.

Furthermore, Green Dot Bank encourages its clients to be prudent with their money by reminding them never to borrow more than they can afford and to be aware of their financial limitations.

The bank’s transparent loan agreements include all relevant details and payback criteria, so borrowers won’t have to worry about overborrowing.

Top 11 Cash Advance Apps That Works With Green Dot

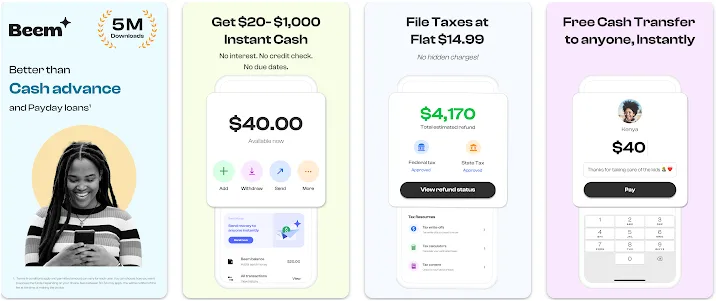

1. Beem

Beem is a dynamic alternative to an instant cash advance app that works with Green Dot to provide customers with quick and easy access to funds.

Beem differentiates itself in financial solutions by allowing seamless transactions and combining numerous elements to improve the borrowing experience.

This cooperation, tailored to suit customers’ urgent financial requirements, demonstrates Beem’s commitment to providing a user-centric and accessible platform for consumers seeking quick and easy financial solutions.

Features Of Beem:

- Users can quickly access their cash with Beem since efficiency is their top priority.

- The app simplifies borrowing by removing complications for a more user-friendly experience.

- Beem ensures transparency in its charge structure, providing consumers with a thorough awareness of related expenses.

- Beem offers repayment flexibility to accommodate users’ different financial conditions, alleviating the strain on borrowers.

- With a focus on data security, Beem implements strong safeguards to protect users’ personal and financial information during transactions.

2. Cleo

Cleo, a financial wellness app, offers Green Dot compatible cash advance services. The app focuses on assisting users in managing their finances while also providing convenient short-term borrowing choices.

Pros Of Cleo:

- Financial tracking and budgeting features.

- There are no hidden costs.

- Immediate cash advances.

Cons Of Cleo:

- New users need more borrowing amounts.

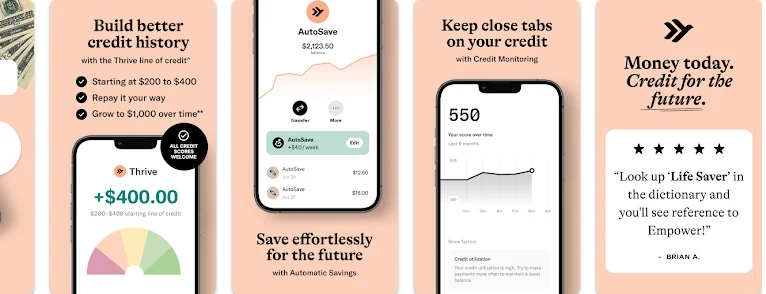

3. Empower

Empower is a financial app that works with Green Dot to offer cash advances. The software stresses financial empowerment and strives to help users make educated financial decisions.

Pros:

- Large borrowing limits for qualified consumers.

- Cash advances that do not affect credit ratings.

- Financial information tailored to you.

Cons:

- Only available in the United States.

4. MoneyLion

MoneyLion, in cooperation with Green Dot, is a complete financial platform that provides cash advances. The software integrates banking, investing, and borrowing capabilities to give customers complete financial support.

Pros:

- Membership rewards program.

- Credit-building functions.

- Immediate cash advances.

Cons:

- Premium services need a monthly membership fee.

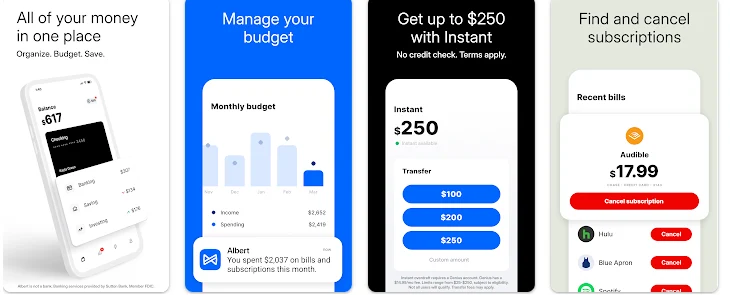

5. Albert

Albert is a financial app that collaborates with Green Dot to deliver cash advances in a novel way. The program focuses on automatic savings and budgeting while providing users instant access to cash when needed.

Pros:

- Intelligent savings features.

- There are no hidden costs.

- Immediate cash advances.

Cons:

- Some regions have limited availability.

6. Klover

Klover is a cash advance app that works with Green Dot to provide customers with immediate access to funds. The software makes it simple for users to bridge financial gaps by simplifying the borrowing procedure.

Pros:

- Simple to use interface.

- A quick approval procedure.

- Flexible Repayment alternatives.

Cons:

- Borrowing limitations may differ.

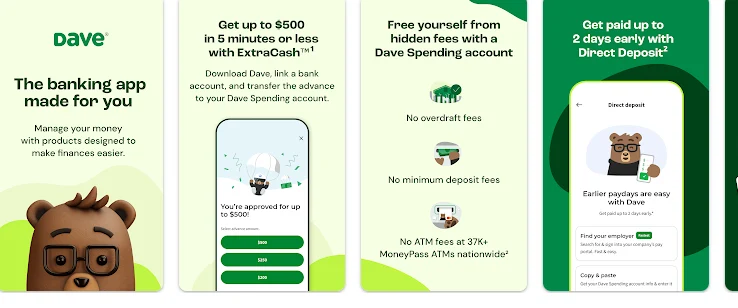

7. Dave

Dave is a financial app that works with Green Dot to offer users cash advances and other financial tools. The app’s goal is to assist users in avoiding overdraft fees and better manage their finances.

Pros:

- There is no interest in qualifying users.

- Predictive warnings to help you avoid overdrafts.

- Budgeting tools for customers.

Cons:

- Premium services need a monthly membership fee.

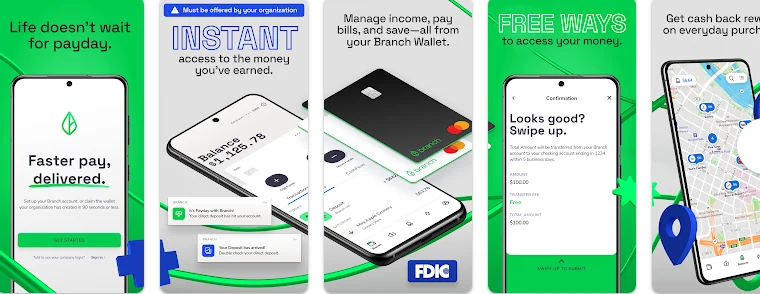

8. Branch

Branch is a financial app that works with Green Dot to provide cash advances to qualified customers. The software focuses on financial wellness solutions, such as easy financial access.

Pros:

- Quick cash advances.

- No-cost overdraft protection.

- Budgeting options.

Cons:

- Availability is restricted to specific locations.

9. Green Dot SpotMe

Green Dot SpotMe is a one-of-a-kind tool provided by Green Dot that allows qualifying customers to overdraft their prepaid card for a charge. This tool is a built-in cash advance option, giving consumers financial freedom.

Pros:

- No credit check is necessary.

- Obtaining extra cash quickly.

- A transparent fee structure.

Cons:

- Only qualifying Green Dot cardholders are eligible.

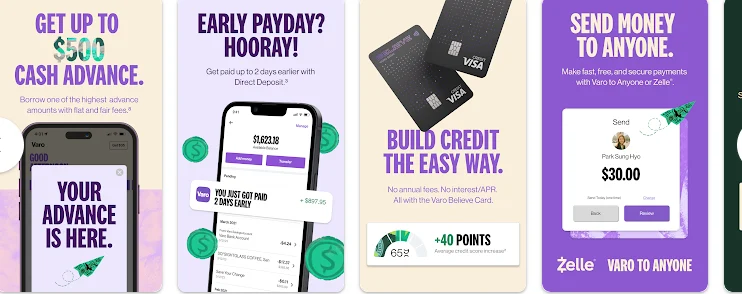

10. Varo

Varo is a mobile banking app with Green Dot that provides consumers with cash advances. The app includes a variety of banking functions and focuses on financial inclusion.

Pros:

- There are no hidden costs.

- A savings account with a high rate of return.

- Obtaining financial advances quickly.

Cons:

- Some functions are only available to qualified users.

11. Brigit

Brigit is a financial app that works with Green Dot to provide cash advances to customers who want immediate financial assistance. The software assists users in avoiding overdraft fees and successfully managing their financial flow.

Pros:

- Predictive cash advance possibilities.

- There are no interest costs for qualified users.

- Budgeting tools.

Cons:

- Premium services require a monthly subscription price.

Summary of the Best Cash Advance Apps that Work with Green Dot

Choosing a cash advance app compatible with Green Dot is a personal and budgetary decision. A diverse range of consumers are attracted to each app due to its unique features, advantages, and disadvantages.

From Klover’s intuitive layout to MoneyLion’s all-encompassing financial platform and Albert’s budgeting focus, there’s a little something for everyone.

However, it’s important to know how to get cash advance from Green dot. You’ll need to explore cash advance apps that work with Green Dot cards.

Conclusion

The partnership between Green Dot and a range of cash advance apps presents a comprehensive financial solution for users seeking accessibility and convenience during urgent financial needs. Each lender offers distinct features catering to diverse preferences and requirements.

For a seamless and user-centric borrowing experience, Beem emerges as a standout choice. With its commitment to transparency, quick access to funds, and a user-friendly interface, Beem ensures a reliable financial tool in collaboration with Green Dot.

Explore the possibilities with Beem and experience a harmonious blend of efficiency and empowerment in your financial journey.