Form 7004 provides businesses with an extension of time to file certain tax returns. By carefully gathering information, completing the form accurately, and filing on time, businesses can avoid penalties and ensure compliance with tax regulations.

In this article, we will understand more about Form 7004.

What is Form 7004?

Form 7004 is the application for automated extension of time to file specific Business income tax, report, and other late tax returns. Companies utilize this form to get an automatic extension for filing tax returns.

It provides extra time for businesses to prepare and fill their tax returns beyond the original due date.

Who Must File Form 7004?

Business entities that cannot file their tax returns by the original due date can file Form 7004 to request an extension. The types of returns that can be extended using Form 7004 include:

| S.NO | Types Of Returns |

|---|---|

| 1 | Corporation Income Tax Returns (Form 1120) |

| 2 | Partnership Income Tax Returns (Form 1065) |

| 3 | Multi-Member LLC Income Tax Returns |

| 4 | For Estate and Trust Income Tax Returns (Form 1041) |

| 5 | Certain Information Returns |

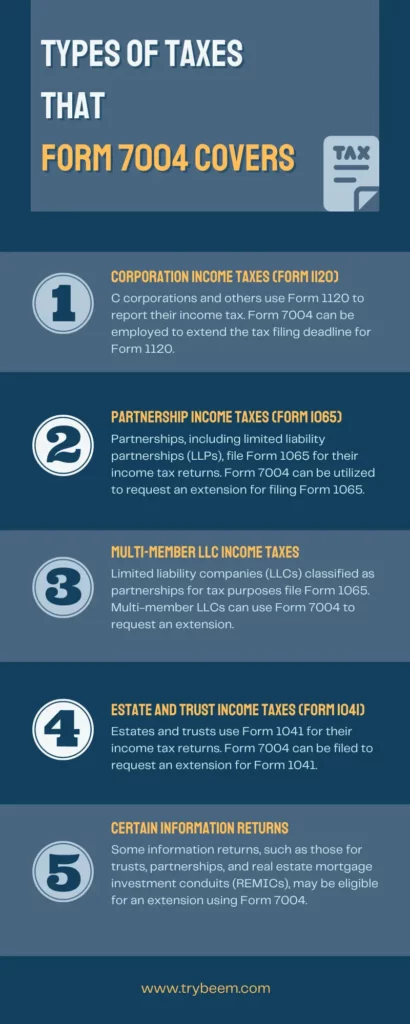

What taxes does Form 7004 cover?

Form 7004 covers various taxes, such as the Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, which covers various taxes associated with specific business entities.

It allows an extension for filing certain business income tax returns and related information returns.

Here are the main types of taxes that Form 7004 covers:

Corporation Income Taxes (Form 1120)

- C corporations and others use Form 1120 to report their income tax. Form 7004 can be employed to extend the tax filing deadline for Form 1120.

Partnership Income Taxes (Form 1065)

- Partnerships, including limited liability partnerships (LLPs), file Form 1065 for their income tax returns. Form 7004 can be utilized to request an extension for filing Form 1065.

Multi-Member LLC Income Taxes

- Limited liability companies (LLCs) classified as partnerships for tax purposes file Form 1065. Multi-member LLCs can use Form 7004 to request an extension.

Estate and Trust Income Taxes (Form 1041)

- Estates and trusts use Form 1041 for their income tax returns. Form 7004 can be filed to request an extension for Form 1041.

Certain Information Returns

- Some information returns, such as those for trusts, partnerships, and real estate mortgage investment conduits (REMICs), may be eligible for an extension using Form 7004.

Form 7004 generally provides an automatic extension of time to file these tax returns for 5 or 6 months, depending on the return type. It’s important to note that while Form 7004 extends the deadline, it does not extend the time to pay any taxes owed.

Taxes are typically still due by the return’s original due date, and interest or penalties may apply for late payments.

How Long Does Form 7004 Extend the Filing Deadline?

Form 7004 automatically extends the time to file certain business income tax returns. The extension period granted depends on the type of return being filed. Generally, the extension periods are as follows:

- Corporation Income Tax Returns (Form 1120):

- The automatic extension is typically for five months, extending the filing deadline from the original due date.

- Partnership Income Tax Returns (Form 1065):

- The automatic extension is typically for 6 months, extending the filing deadline from the original due date.

- Form 1041 for Estate and Trust Income Tax Returns:

- The automatic extension is typically for 5½ months, extending the filing deadline from the original due date.

How to File Form 7004?

Filing Form 7004 involves completing the form accurately and submitting it to the appropriate address by the original due date of the tax return. Here are the general steps to file Form 7004:

- Obtain the Form:

- Download Form 7004 from the official IRS website or get a copy from a tax professional.

- Complete the Form:

- Provide the required information, including your business name, address, EIN (Employer Identification Number), and the type of tax return for which you request an extension.

- Indicate the Type of Tax Return:

- Check the box indicating the type of tax return you request an extension (e.g., Form 1120 for corporations, Form 1065 for partnerships).

- Estimate Tax Liability:

- If applicable, estimate the total tax liability and the amount paid with the extension.

- File Electronically or Mail:

- You can file Form 7004 electronically using the IRS e-file system or mail the completed form to the appropriate IRS address.

- Keep a Copy:

- Retain a copy of the filed Form 7004 for your records.

- Pay Taxes Due:

- Remember that filing Form 7004 does not extend the time to pay any taxes owed. Pay any estimated taxes by the original due date to avoid penalties and interest. Here is how you can get IRS penalty protection up to $10,000.

- File the Tax Return by the Extended Deadline:

- Use the extended period to gather the necessary information and file the tax return by the deadline.

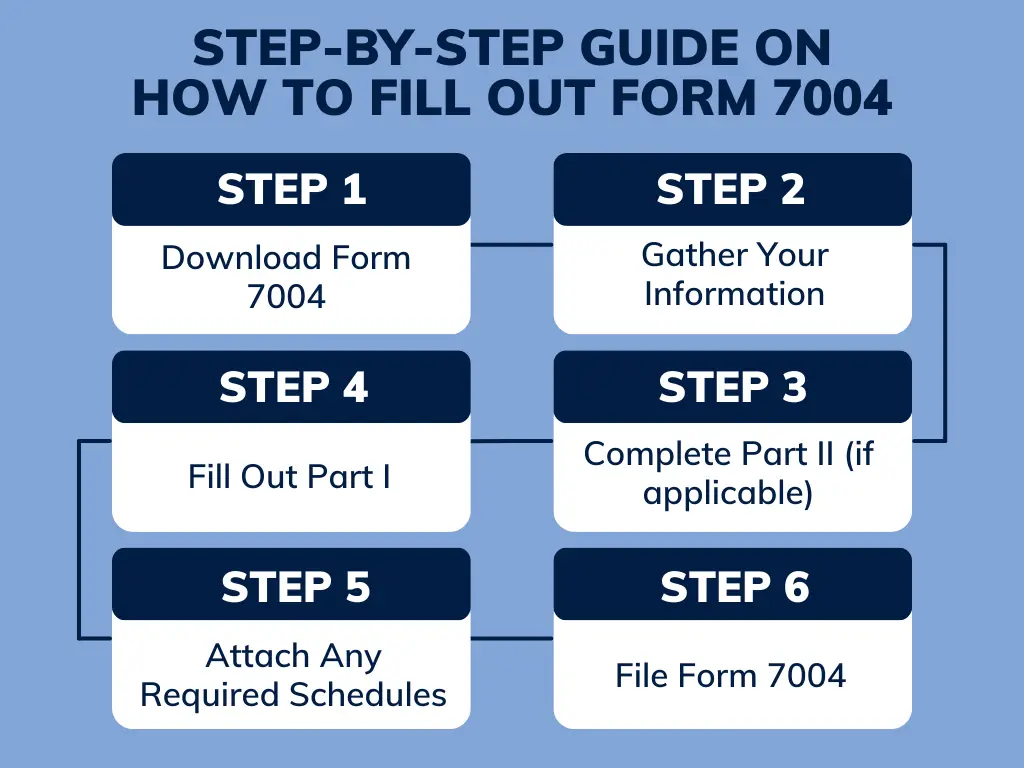

Step-by-Step Guide on How to Fill Out Form 7004

Business entities should carefully review the instructions for Form 7004 and ensure they file it correctly and on time to receive the extension for filing their specific business tax returns.

Download Form 7004

- Visit the IRS Website:

- Go to the official IRS website at www.irs.gov.

- Search for Form 7004:

- Use the search bar or navigate to the “Forms & Instructions” section to find Form 7004.

- Download the Form:

- Download the PDF version of Form 7004 to your computer or device.

Gather Your Information

- Business Information:

- Collect details such as your business name, address, and Employer Identification Number (EIN).

- Tax Year and Return Type:

- Determine the tax year for which you request an extension and identify the return type (e.g., Form 1120 for corporations and Form 1065 for partnerships).

- Estimated Tax Liability:

- If applicable, estimate your total tax liability and the amount paid with the extension.

Fill Out Part I

- Identification Information:

- Complete the top section with your business details, including name, address, and EIN.

- Check the Appropriate Box:

- Check the box for the type of tax return for which you are filing an extension.

- Estimate of Total Tax Liability:

- If applicable, enter your estimate of the total tax liability for the tax year.

- Total Payments and Balance Due:

- Enter the total payments made and the balance due.

Complete Part II (if applicable)

- Type of Return:

- If filing an extension for a fiscal-year return or short tax year, complete Part II.

- Provide Explanation:

- Clearly explain why the extension is necessary for a fiscal-year return.

Attach Any Required Schedules

- Check for Additional Schedules:

- Additional schedules may be required depending on the type of return and specific circumstances.

- Complete and Attach Schedules:

- Please fill out any necessary schedules and attach them to Form 7004.

File Form 7004

- Electronic Filing (Optional):

- Consider filing Form 7004 electronically using the IRS e-file system for faster processing.

- Mailing Address:

- If filing by mail, refer to the instructions for the correct mailing address based on your location and the extended return type.

- Keep a Copy:

- Retain a copy of the filed Form 7004 for your records.

Conclusion

Filing Form 7004 provides businesses with an extension of time to file certain tax returns. By carefully gathering information, completing the form accurately, and filing on time, businesses can avoid penalties and ensure compliance with tax regulations.

Remember to consult the specific instructions for Form 7004 and, if needed, seek guidance from a tax professional to address any unique circumstances.

Always meet the extended filing deadline and fulfill any tax payment obligations to stay in good standing with the IRS.

FAQs

How much does it cost to file Form 7004?

Filing Form 7004 itself does not incur a direct cost. However, businesses are still responsible for taxes owed by the original due date to avoid penalties and interest. There may be associated fees if you’re using tax preparation software or seeking professional assistance to complete the form.

What happens if you fail to file Form 7004?

Please file Form 7004 on time to avoid late filing penalties. The penalty is generally based on the unpaid tax amount and accrues for each month or part of a month that the return is late.

Can I file Form 7004 myself?

Yes, businesses can file Form 7004 themselves. The form is designed to be completed by businesses seeking an extension for filing certain tax returns.

Is Form 7004 federal or state?

Form 7004 is a federal tax form used to request an extension of time to file certain federal business income tax returns. State tax authorities may have their extension forms or accept the federal extension if applicable.

What is the Form 7004 6-month extension?

The 6-month extension refers to the maximum extension period granted by Form 7004 for certain tax returns.