Embarking on a financial journey? Looking for loans like CashNet to navigate the realm of online lending? Finding the right loan provider becomes an adventure where unexpected expenses play hide-and-seek with our budgets.

Let us explore a wide variety of monetary possibilities! Join us as we uncover CashNet alternatives tailored to various needs and preferences. Get ready for a financial quest that’s informative, intriguing, and, most importantly, designed with you in mind!

Loans Like CashNet -15 Best Alternatives for CashNet

Searching for popular loan options similar to CashNet? Explore these reputable lenders that offer a variety of loan choices, ensuring flexibility and competitive terms to meet your financial needs.

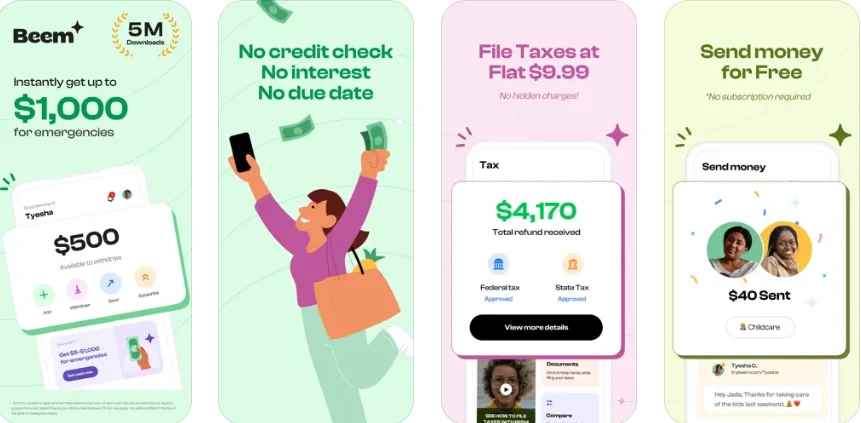

1. Beem

Beem offers Everdraft™, a unique financial solution providing instant cash from $5 to $1,000 for emergency expenses like bills, groceries, and medicines. Available to U.S. residents aged 18 and above, Everdraft™ stands out for its absence of income restrictions, tips, due dates, and credit checks.

Play Store Rating:

3.9/5 Rating , 14.9k reviews

1M+ Downloads

Apple Store Rating :

4.7/5 rating , 129 Review

Pros:

1. Instant Cash Access: Beem’s Everdraft™ provides quick access to cash ranging from $5 to $1,000 for urgent needs.

2. No Restrictions: The service eliminates income restrictions, tips, due dates, and the need for credit checks, promoting accessibility.

3. Boost Rewards: Users can earn extra cash through Boost, rewarding good financial behavior like on-time payments and avoiding overdrafts.

2. SpeedyCash. com

With 25 years of experience, Speedy Cash offers swift payday, installment, title loans, and credit lines. Available online and in-store, it serves multiple U.S. states.

Rating: 4.5/5 , 9k Reviews

While quick access to funds is a highlight, borrowers should be cautious of high APRs when considering amounts from $50 to $26,000.regulations, understanding loan requirements, and evaluating APRs for prudent decision-making.

Pros of SpeedyCash. com

1. Speedy Cash ensures rapid fund access, assisting within one day.

2. Versatile services offer online and in-store options for diverse preferences.

3. Wide loan range from $50 to $26,000 accommodates various borrowing needs.

Cons of SpeedyCash. com

Speedy Cash imposes high Annual Percentage Rates (APRs), urging careful consideration.

3. Checkintocash. com

Check Into Cash, a widespread direct lender, addresses diverse financial needs with online payday loans and in-store services. While its application process is quick, a hard credit check is conducted, impacting credit scores. Eligibility criteria include age, proof of income, and an active checking account.

Rating : 3.9/5 , 944 Reviews

Pros of Check Into Cash:

Fast Customer Approval: Offers swift online or in-store approval, connecting customers to funds within one business day.

Educational Materials: Provides comprehensive online resources explaining payday advances, application processes, and state-specific rates and terms.

Cons of Check Into Cash:

1. High APR Range: Charges substantial fees with APRs ranging from 153% to 1042%.

2. Strict Short-Term Repayment: No provision for extended terms or lower APRs.

3. Additional Fees Risk: Potential late fees, insufficient funds fees, and interest on extensions.

4. MoneyMutual

MoneyMutual acts as an online marketplace connecting borrowers, particularly those with bad credit, to lenders for short-term loans.

Rating : 4.9/5 , 99 Reviews

Despite facilitating quick access to funds, the need for upfront interest rate details and an unclear screening process pose concerns. The platform focuses on small to mid-size loans, but limited loan offers and transparency issues complicate consumer decision-making.

Pros of MoneyMutual:

1. Swift Funding: Funds can be received within 24 hours via direct deposit.

2. Diverse Loan Sizes: MoneyMutual provides options for small to mid-size loans.

3. Bad Credit Considered: Borrowers with imperfect credit can explore loan options.

Cons of MoneyMutual:

1. Hidden Interest Rates: MoneyMutual doesn’t disclose lenders’ rates upfront, requiring form submission.

2. Ambiguous Screening Process: Details about the instant review process are undisclosed.

3. Few Loan Options: No guarantee of multiple offers, limiting comparison options.

5. SmartAdvances. com

Smart Advances operates as an online lending network, linking borrowers to direct lenders for loans up to $20,000. While offering quick funding and flexibility, more extensive approvals favor good credit.

Rating : 4.8/5 , 78 Reviews

The application is efficient without a hard credit check, but potential drawbacks include the risk of high-interest rates and less flexible repayment terms. As a lending network, Smart Advances lacks direct control over the final rates and terms established by participating lenders.

Pros of SmartAdvances. com:

1. Swift approval for funds is due in 24 hours.

2. Flexible use of funds without restrictions.

Cons of SmartAdvances. com:

1. Smart Advances may feature relatively high-interest rates.

2. Repayment terms offered may need more flexibility.

3. Limited control over final loan terms.

6. CashCentral. com

Cash Central, an online lender under Community Choice Financial, focuses on rapid approval installment loans ranging from $300 to $5,000, emphasizing emergency assistance.

It offers a variety of repayment choices, but it also imposes high annual percentage rates (APRs) and other costs, such as origination and late payment charges, on customers with unsatisfactory credit. Additionally, its services are geographically restricted.

Rating :3.2/5 , 1 review

The application process is simple, but eligibility is confined to residents in particular states like Alabama and Utah.

Pros of CashCentral. com:

1. Flexible repayment periods for borrower convenience.

2. Cash Central strives for fast funding solutions.

Cons of CashCentral. com:

1. High APRs: Cash Central’s loans carry high annual percentage rates.

2. Extra Fees: Borrowers may face origination and late payment fees.

3. Limited States: Cash Central’s services are available in select states.

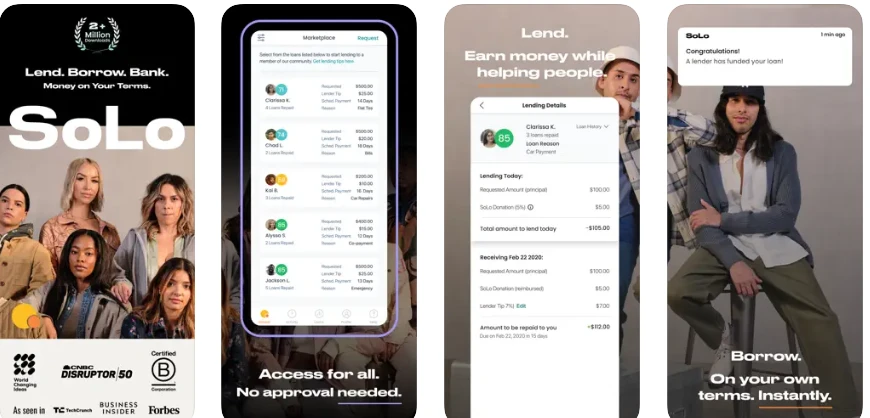

7. SoLo Funds

SoLo Funds, a distinctive peer-to-peer lending platform, provides cash advances up to $575 with user-defined fees and flexible repayment. However, longer approval times and the absence of budgeting tools are drawbacks.

PlayStore Rating : 3.8/5 , 14.7k Reviews

100k+ Downloads

Apple Store Rating : 4.4/5 , 24.9k Reviews

Users can fund others but face potential losses from defaults. Eligibility criteria include age, citizenship, and additional lender/borrower requirements.

Pros of SoLo Funds:

1. Up to $575 Advances: Flexible amounts for diverse financial needs.

2. Choose Repayment Date: Borrowers define their preferred repayment date.

3. Tailor Borrowing with Optional Fees: Customizable experience with user-defined fees.

Cons of SoLo Funds:

1. Approval Takes 3 Days: Longer approval duration compared to competitors.

2. Limited Financial Tools: Lack of budgeting features hinders financial management.

3. Default Risks for Lenders: Potential losses for lenders due to defaults.

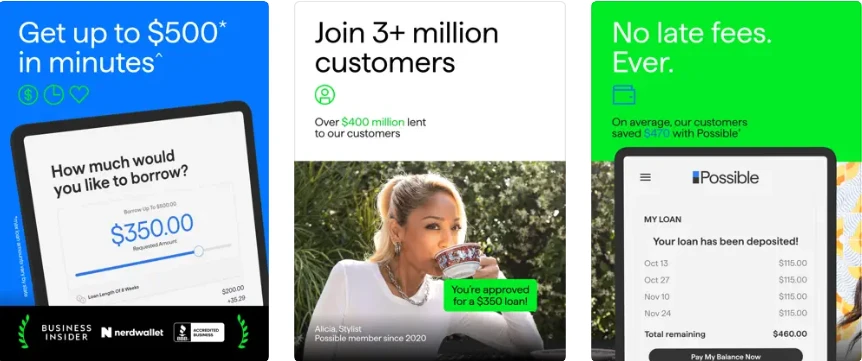

8. Possible Finance

Possible Finance offers a quick funding option of up to $500 through small installment loans with no credit check, positioning itself as an alternative to traditional payday loans.

Playstore Rating: 4.0/5 , 50.8k Reviews

1M+ Downloads

Apple store Rating : 4.8/5 , 103.9k Reviews

While serving individuals with low credit scores, the trade-off involves high interest rates and short repayment terms of eight weeks. Customer support is primarily available through an online form, making pre-assessment challenging.

Pros of Possible Finance:

1. Swift Funding: Possible Finance offers quick solutions with fast funding.

2. Low Credit Approval: Acceptance for low credit scores and limited history.

Cons of Possible Finance:

1. High Rates: Possible Finance has relatively high rates, impacting borrowing costs.

2. Limited Support: Customer assistance mainly through online forms.

3. Transparency Issues: Assessing loan terms can be challenging.

4. Short Repayment: Bi-weekly payments over eight weeks may strain finances.

9. CashUSA. com

CashUSA.com operates as a free lending network, aiding bad credit borrowers in securing loans up to $10,000. The quick prequalification process promises potential funds by the next business day upon approval.

Rating : 2/5 , 11 Reviews

There’s no set minimum credit score, as partner lenders establish their criteria, potentially providing opportunities for those with low credit. Drawbacks include the potential for high APR rates, the necessity of providing personal information, and potential phone calls from lenders.

Pros of CashUSA. com:

1. Varied Loan Options: CashUSA.com offers diverse loan choices, enhancing chances for a suitable match.

2. Competitive Lenders: Engages competing lenders for borrower benefits.

3. Personal Loan Specialists: Provides personal loan specialists for guided assistance.

Cons of CashUSA. Com:

1. Borrowers face the possibility of high APR rates from individual lenders, impacting overall loan costs.

2. The necessity to provide personal information during the application process may deter some users.

3. Expect potential privacy concerns as borrowers may receive phone calls from lenders throughout the loan application process.

10. Albert

Albert, a financial services app utilizing FDIC-insured Sutton Bank, redefines banking with fee-free services, no monthly or overdraft fees, and a focus on user-friendly experiences. Albert prioritizes simplicity by offering banking, savings, budgeting, and investing features.

Playstore Rating : 4.1/5 , 91.3k Reviews

5M+ Download

Apple store Rating : 4.6/5 172.5k Reviews

Users benefit from Genius, a team of financial experts. Pros include fee-free services, cash-back rewards, and interest-free cash advances, while limitations involve the absence of mobile check deposits and app-only accessibility.

Pros of Albert:

1. Fee-Free Service: Albert exempts users from monthly service fees.

2. Cash-Back Rewards: Users benefit from rewarding cash-back incentives.

3. Interest-Free Cash Advance: Albert provides flexible, interest-free cash advances.

Cons of Albert:

1. Lacks Mobile Check Deposit: A convenient check deposit feature needs to be added.

2. App-Exclusive Access: Albert’s services are limited to mobile apps.

11. BadCreditLoans. com

BadCreditLoans.com, founded in 1998, is an essential website that links borrowers with an array of lenders specializing in personal loans up to $10,000. While not a direct lender, it efficiently matches individuals with limited options due to bad credit.

Rating: 2.7/5 , 13 Reviews

Pros include flexible loan amounts, a straightforward application process, and rapid fund disbursement. However, potential cons involve the attraction of higher APRs for borrowers with lower credit scores.

Pros of BadCreditLoans. com:

1. BadCreditLoans.com offers loans from $500 to $10,000, meeting diverse financial needs.

2. The platform ensures an easy application process and fast fund disbursement.

3. BadCreditLoans.com accepts borrowers with less-than-ideal credit, expanding financial opportunities.

Cons of BadCreditLoans. com:

1. The platform focuses on smaller loans, capping at $10,000.

2. Borrowers may encounter higher APRs based on individual credit scores and the selected lender, reflecting potential increased risk.

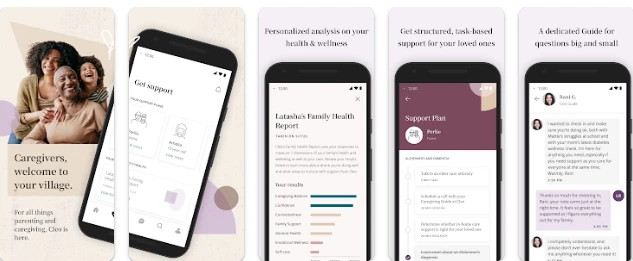

12. Cleo

Cleo, a finance app from the U.K. accessible on both Apple and Android devices, offers users cash advances up to $100 without conducting credit checks and interest charges.

However, members must contend with a monthly fee, a waiting period for fund transfers, and a somewhat limited cash-advance maximum. Cleo sets itself apart by integrating money-management tools into its platform.

Play store rating :

4.0/ 5 rating , 73 reviews

10k+ downloads

Apple store:

4.7/5 Rating , 2.6k Reviews

Pros of Cleo:

1. Cleo offers cash advances without requiring a credit check, broadening access to financial assistance.

2. Users benefit from interest-free cash advances, offering short-term financial relief.

3. Cleo stands out with built-in money-management tools for effective financial management.

Cons of Cleo:

1. Cleo restricts cash advances to a maximum of $100.

2. Cash advances on Cleo require membership in Cleo Plus or Cleo Builder, each with associated costs.

3. Fund transfers may experience delays, taking several days.

4. Cleo needs transparency about the specific terms and conditions of its cash advances.

13. 24/7 Lending Group

24/7 Lending Group is a dependable online referral service that connects subprime applicants with a vast network of direct lenders.

Rating : 4.3/5 , 2.9k Reviews

Offering loans up to $35,000 with a capped maximum APR of 35.99%, the platform ensures a seamless online application process and quick funding, often with next-day disbursement.

It caters to diverse financial needs by supporting various lenders, rates, and repayment terms up to 72 months. However, the absence of guaranteed rates and terms is a notable drawback.

Pros of 24/7 Lending Group:

1. Easy Online Application: Streamlined online application process for borrower convenience.

2. Quick Funding: Rapid disbursement, with many loans funded the next day.

3. Direct Deposit Option: Convenient direct deposit option for receiving loan funds.

4. Variety of Lenders and Rates: Access to diverse lenders and competitive interest rates.

5. Wide Range of Loan Amounts: Accommodates diverse financial needs with loans up to $35,000.

Cons of 24/7 Lending Group:

1. No Guaranteed Rates and Terms: Lack of assurance regarding specific loan rates and terms, introducing an element of uncertainty for borrowers.

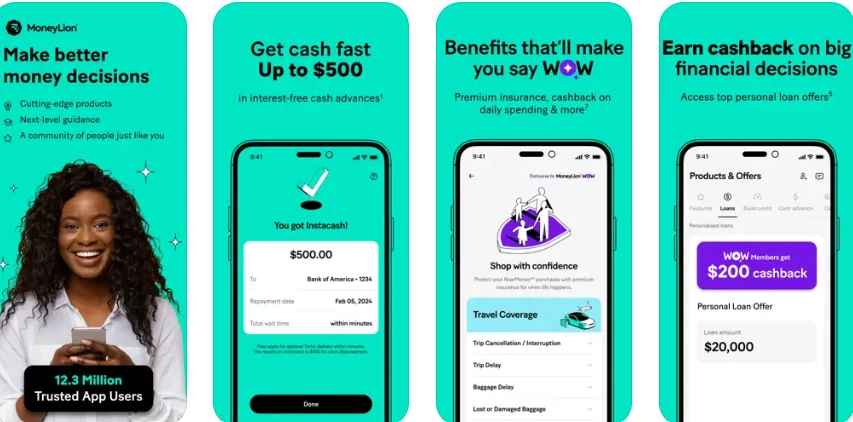

14. MoneyLion

MoneyLion specializes in credit builder loans, featuring the Credit Builder Plus loan offering from $500 to $1,000, complemented by a $19.99 monthly membership fee. With no credit checks, it’s accessible for those with poor or no credit history.

Play Store : 4.5/5 , 115K Reviews

5M+ Downloads

Apple Store : 4.7/5 , 122.1k Reviews

Although it supports credit improvement by reporting to credit bureaus, the monthly fee can elevate total borrowing costs, particularly for those with higher interest rates. The funding process, taking up to three business days, reflects a moderate pace.

Pros of MoneyLion:

1. No Credit Checks: Accessible to individuals with bad or no credit history.

2. Credit Monitoring Services: Membership includes weekly credit score updates and information on relevant credit events.

3. Credit Improvement: Reports payments to all three credit bureaus, enhancing credit score.

Cons of MoneyLion:

1. Expensive Fees: High total borrowing cost, particularly for those with elevated interest rates, due to the $19.99 monthly membership fee.

2. Small Loan Amounts: Limits loans to a maximum of $1,000.

3. Slow Funding: Loan funds may take up to three business days to be disbursed.

4. Current CFPB Lawsuit: Ongoing legal challenges pose potential risks.

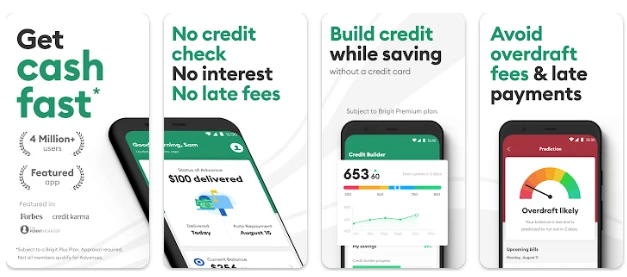

15. Brigit

Brigit, an innovative financial app, provides interest-free paycheck advances up to $250, addressing short-term needs. Beyond advances, it features budgeting tools and offers auto advances with a Brigit Plus membership to prevent overdrawing.

Play store rating :

4.5/5 rating , 180k reviews

5M+ Downloads

Apple store rating:

4.8/5 rating , 284.9k reviews

A $9.99 monthly fee applies. Eligibility, determined by a “Brigit score,” relies on factors like income and banking history. Notably, joint checking accounts need to be supported.

Pros of Brigit

1. Brigit provides small cash advances, up to $250.

2. It offers budget tracking tools to facilitate effective financial management.

3. Brigit Plus membership includes auto advances to prevent overdrawing and enhance financial security.

Cons of Brigit:

1. Brigit charges a $9.99 monthly fee for access to its services.

2. Users are required to permit Brigit to track their bank accounts.

3. The service is not available for joint checking accounts.

16. Green Arrow

Green Arrow Provides us with short-term loans but charges very High Interest rates. The rates can be even higher than payday loans. Due to the high cost, you should choose a Green Arrow loan if you can repay it quickly this can support you in minimizing the total amount of interest you pay

Pros

- May Eligible with bad credit

- Undeniably fast funding time

- availability of a small amount

Cons

- High interest rates

- The range of interest rates is not revealed on the website

But if you need low interest rates loans you can always look for Best Alternatives for Green Arrow

Top Loan Lenders for Bad Credit like CashNet

Individuals with less-than-perfect credit scores can also explore loan options, as several lenders specialize in providing financial assistance to those with poor credit histories.

Payday Say

Payday Say is a loan-connecting service that facilitates quick, secure connections between borrowers and direct lenders, offering up to $5,000 with a user-friendly, streamlined online process for those over 18.

CashUSA

Like CashNetUSA, CashUSA provides financial assistance from $500 to $10,000, with 90-day to 72-month repayment terms. The straightforward online application process requires a steady post-tax income of at least $1,000.

CashAdvance. com

With no credit score requirements, CashAdvance.com offers a fee-free loan-connecting service catering to bad credit borrowers. It efficiently matches requests with online creditors, ensuring funds of $100 to $999 reach borrowers within 24 to 48 hours.

BadCredit

A reliable cash advance app, BadCredit offers a quick and secure application process for borrowers aged 18 or more with a valid Social Security number. It simplifies the process and facilitates next-day fund transfers.

OppLoans

With a decade-long track record, OppLoans extends loans from $500 to $5,000, providing short-term and installment options. While there are no prepayment fees, borrowers should be aware of interest rates starting at 59% and reaching up to 199%, varying availability by state.

Top Loan Lenders for Good Credit

Leading lenders for borrowers with good or excellent credit scores (690 and above) offer favorable terms, including low interest rates and additional perks. Here are some notable options:

Achieve

Achieve provides possible interest rate discounts for borrowers with good credit. Discounts can be obtained by adding a qualified co-borrower, demonstrating sufficient retirement funds, or using a significant portion of the loan to pay off existing qualifying debts. Keep in mind an origination fee of 1.99% – 6.99%.

Best Egg

Best Egg offers its lowest rates to individuals with a minimum income of $100,000 and a credit score of at least 600. While funds can be received within one business day, there’s an origination fee ranging from 0.99% – 8.99%. Income requirements may affect eligibility for the lowest rates.

Discover Personal Loans

Discover’s loans have a modest minimum income requirement of $25,000 and come with no origination fees. However, applying with a co-borrower is prohibited, and the loan limit is capped at $40,000.

LendingPoint

LendingPoint, with a maximum borrowing limit of $36,500, is suitable for those seeking small- to mid-sized loans. Borrowers may receive funds within one business day but should be prepared for an origination fee. Applying with a co-borrower is not an option.

LightStream

LightStream offers extended loan lengths ranging from 24 to 144 months, allowing borrowers to access up to $100,000 with same-day funding and no fees. Meeting specific criteria beyond a good credit score is necessary. Unfortunately, prequalification is unavailable, requiring a hard credit pull for offers.

Loan Lenders for Debt Consolidation

Exploring options like debt consolidation loans can be a strategic move when managing overwhelming debt. Here are prominent lenders specializing in debt consolidation:

Upstart

Upstart caters to those seeking smaller loans, starting at $1,000. While it boasts low APRs of 6.40%, securing the best rates requires strong credit. Remember the origination fee (0.00% – 12.00%) and limited loan terms.

Prosper

As a peer-to-peer lender, Prosper links borrowers with investors, providing a seamless online process for prequalification. Fixed interest rates, ranging from 1.00% – 7.99% origination fee, streamline debt consolidation.

Wells Fargo

Wells Fargo stands out for larger debt consolidation loans, reaching up to $100,000, with flexible repayment terms spanning 12 to 84 months. Fee transparency, absence of origination fees, late fees, and prepayment penalties, coupled with swift approval, enhance its appeal.

LightStream

LightStream offers competitive APRs, commencing at 7.49%, and facilitates sizable loans up to $100,000 with an extended repayment period of 144 months. However, preapproval is not an option.

Upgrade

Upgrade, an online lender, addresses debt consolidation needs with loans up to $50,000. A lenient repayment term of 84 months, no prepayment penalties, but an origination fee (1.85% – 9.99%) positions it as a viable choice.

Best lenders for installment loans

Navigating installment loans demands careful consideration, especially for those with less-than-perfect credit. Here’s a roundup of reputable lenders offering installment loans:

Achieve

Achieve offers interest rate discounts via co-borrowers, retirement savings, and direct debt consolidation. Funding in 24-72 hours, but a 1.99% – 6.99% origination fee applies.

Discover Personal Loans

Discover impresses with fee-free loans up to $40,000, ideal for individual solid credit. No cosigners accepted, emphasizing creditworthiness.

LendingPoint

LendingPoint targets good-credit borrowers (min. 660 scores) with potential origination fees and a maximum APR of 35.99%. Joint loans are unavailable.

LightStream

LightStream’s fee-free, same-day funding suits good-to-excellent credit borrowers. Extended 24-144-month terms compensate for the lack of prequalification.

PenFed Credit Union

PenFed breaks barriers with modest $600 loans, a 17.99% APR cap, and no origination fees. Membership is required, and specific requirements are undisclosed.

Best Loan Lenders for Home Improvements

Embarking on home improvements and need financing? Explore these lenders offering competitive rates and terms tailored to your needs:

Best Egg

Best Egg offers versatile secured and unsecured loans. Secured loans with lower rates benefit those with a credit score of 700+ and a $100,000 annual income. Quick funding adds appeal.

Discover

Discover caters to good to excellent credit, offering personal loans with favorable rates and no fees for timely payments. Cosigners are not allowed, potentially challenging lower credit applicants.

LightStream

LightStream’s extended 24-144-month terms suit large projects, compensating for the lack of prequalification. Ideal for substantial amounts and extended repayment periods.

PenFed Credit Union

PenFed facilitates swift repayment with 12-60-month terms, minimizing interest costs. Membership is required, and vigilance against late payments is crucial to avoid fees potentially reaching $29.

SoFi

SoFi stands out with same-day funding, which is ideal for homeowners needing prompt financial support. An optional origination fee of up to 6.00% allows reduced monthly payments, providing flexibility for borrowers.

Best short-term loan lenders

In search of a short-term loan? Explore these reputable lenders offering swift solutions for your financial needs:

Avant

Avant’s online loans cater to fair credit (minimum 580). Its user-friendly app allows adjustments, autopay enrollment, and timely reminders, making short-term loans convenient despite potential origination fees.

LightStream

LightStream’s online unsecured loans stand out with the Rate Beat program, offering potential rate advantages. No fees or prepayment penalties exist, but they are exclusive to suitable credit applicants.

PenFed

PenFed, a credit union, caters to small loans starting at $600, with lower APRs. A credit score of 700+ is necessary, and co-borrowers with strong credit enhance approval chances.

SoFi

SoFi prioritizes suitable credit applicants with same-day funding, Unemployment Protection benefits, and career coaching. While an optional origination fee applies, it suits substantial loan needs, starting at $5,000.

Upgrade

Upgrade’s innovative secured loans accept cars as collateral, offering lower APRs. Despite risks, it’s advantageous for the right borrower with collateral meeting requirements.

Best Alternatives for Emergency Loans

Exploring reliable emergency loan alternatives is crucial during unexpected financial crises. Here are reputable options from online lenders to guide you toward a safe and affordable choice:

Avant

Avant caters to fair credit with a 580 minimum requirement. While suitable for emergencies, its $35,000 limit makes it ideal for smaller-scale needs.

Best Egg

Best Egg’s Secured Loan + Homeowner Discount offers lower APRs using home fixtures as collateral. Quick funding, but consider the risk of repossession.

Discover

Discover offers competitive rates and repayment assistance options for qualified borrowers. Coordinate to avoid a $39 late payment fee.

LightStream

LightStream excels in home improvement emergencies with a 144-month term. Same-day funding and a $25,000 minimum make it appealing but involve a hard credit pull.

SoFi

SoFi provides same-day funding for 82% of applicants under specific conditions. Competitive APRs and optional origination fees cater to substantial loans, starting at $5,000.

Best for military members

When seeking personal loans tailored for veterans and military personnel, consider these reputable options designed to address unique financial needs:

Achieve

Achieve stands out with joint loans and potential APR discounts. A higher maximum APR and mandatory origination fee might outweigh the benefits for credit improvement seekers.

Discover

Discover offers U.S.-based specialists for assistance and diverse repayment options. Challenges for bad-credit borrowers exist, with no option to add co-borrowers. Timely communication is crucial to avoid fees.

LightStream

LightStream’s online personal loans reach $100,000 with a 144-month term for home improvements, suitable for good-to-excellent credit. A satisfaction guarantee and a potential $100 bonus enhance its appeal.

Navy Federal Credit Union

Navy Federal Credit Union excels in military personal loans, offering a low APR for new military members. Small loans start at $250, and a 15-year term adds flexibility. Application impact and score requirements undisclosed.

PenFed

Pentagon Federal Credit Union supports military personnel with special assistance programs during furloughs. While offering paycheck protection and low-interest loans, late payment vigilance is crucial, with fees set at $29.

Where to get loans like CashNet

When searching for loans resembling CashNet, borrowers have various options, each catering to different needs. Explore the following categories to find a lending solution that suits your preferences and financial situation.

1. Traditional banks

- Traditional banks remain a viable option for individuals seeking loans similar to CashNet.

- Established financial institutions provide various loan products with varying terms and conditions.

- While application processes may be more rigorous, traditional banks offer stability and regulatory adherence.

2. Online lenders

- Online lenders have emerged as convenient alternatives, providing swift access to funds akin to CashNet.

- A multitude of digital platforms specialize in quick, hassle-free loan approvals.

- Borrowers can explore diverse online lending options catering to different credit profiles and financial needs.

3. Credit unions

- Credit unions present a community-focused approach to lending, extending services akin to CashNet.

- Members of credit unions often benefit from lower interest rates and personalized financial solutions.

- While membership requirements exist, credit unions prioritize the well-being of their community.

4. Peer-to-peer lending

- Peer-to-peer lending platforms connect borrowers with individual investors willing to fund loans.

- Similar to the concept of CashNet, these platforms facilitate direct lending relationships.

- Borrowers may find competitive rates and flexible terms through peer-to-peer lending channels.

What are the Banks Offering Loans like CashNet?

When scouting for financial support, traditional banks can be sturdy anchors. Several banks offer loans akin to CashNet, ensuring stability and reliability in lending.

Wells Fargo: A prominent traditional bank, Wells Fargo offers various loan options, providing solutions tailored to different financial requirements.

Chase Bank: With a widespread presence, Chase Bank is known for its diverse lending products, including personal loans and lines of credit.

Bank of America: A major player in the banking sector, Bank of America extends personal loans to eligible customers, catering to their financial needs.

Citibank: Citibank provides a range of loan products, permitting customers to choose the one that aligns with their specific circumstances.

U.S. Bank: U.S. Bank is a reliable choice for those seeking personal loans, offering competitive rates and terms.

What are the Loan Eligibility and Requirements?

When considering a personal loan, it’s essential to grasp the eligibility criteria and necessary documentation. Lenders typically evaluate applicants based on the following factors:

1. Credit Score: Crucial for eligibility and rates, maintain an excellent credit history for competitive loan offers and favorable terms from lenders.

2. Income Verification: Submit proof of income through documents like pay stubs or tax returns for lenders to assess repayment capacity.

3. Debt-to-Income Ratio: Keep your DTI below 43%, with lower ratios preferred by lenders, showcasing your ability to manage existing debts.

4. Collateral (for Secured Loans): Secured loans may require collateral, reducing risk for lenders, while unsecured loans often carry higher interest rates without collateral.

Standard documents required during the application process include:

- A detailed loan application.

- Personal identification (government-issued IDs and Social Security numbers).

- Proof of address (lease or utility bill).

- Proof of income (W-2s, pay stubs, or tax returns).

How do You Choose the Right Loan?

You must conscientiously evaluate your financial circumstances and repayment capacity when pursuing a loan. Here are some essential tips to contemplate when choosing a loan:

1. Define Loan Purpose: Identify the purpose of the loan, whether it’s for home improvements, debt consolidation, or other specific needs.

2. Assess Your Credit Score: Understand your credit score to gauge the loan types and interest rates you may qualify for.

3. Compare Interest Rates: Shop about and compare interest rates from various lenders to secure the most favorable terms.

4. Check Fees and Repayment Terms: Be aware of any fees, charges, or prepayment penalties, and carefully review repayment terms.

5. Research Lender Reputation: Investigate the reputation of potential lenders through reviews and customer feedback to ensure reliability.

Conclusion

Embarking on a financial journey can be daunting, but alternatives to CashNet offer diverse solutions. From Beem’s Everdraft™ to traditional banks like Wells Fargo, the options cater to various needs.

Whether you’re exploring loans for bad credit, home improvements, or debt consolidation, understanding the pros and cons is crucial. Each lender brings unique features, making aligning their offerings with your financial goals essential. Choose wisely, and may your financial quest be prosperous!

FAQs

-

Are there loan lenders like CashNet?

Various lenders offer similar services to CashNet, providing diverse options for borrowers seeking financial assistance.

-

How hard is it to get a loan with CashNet?

CashNet’s eligibility criteria may vary, but generally, individuals with stable income and a decent credit score find it relatively accessible to secure a loan through CashNet.

-

Is CashNet a direct lender?

CashNet is a direct lender, facilitating a direct borrowing experience for individuals seeking short-term loans.

-

Do other loan lenders provide the same loans as CashNet?

Several alternative lenders offer loans comparable to CashNet, allowing borrowers to explore various options based on their financial needs and preferences.