Table of Contents

We’ve all been there—unexpected expenses pop up just when we least expect them. Whether it’s a surprise car repair, a last-minute medical bill, or simply needing a little extra cash to make it to payday, finding a quick solution can feel like a race against time. That’s where cash advance apps that work with Venmo come in.

Whether it’s an unexpected car repair, a medical bill, or simply needing a few extra bucks until payday, having access to cash can make all the difference.

These apps provide a reliable solution for quick financial relief, and many of them are compatible with popular payment platforms like Venmo.

How do you manage your finances? Or have you ever thought of using any qualified source of managing cash? Today, managing finances can be a challenge.

And thankfully, cash advance apps offer a lifeline, and integrating with platforms like Venmo simplifies the process even further.

Let’s dive deep into some top cash advance apps that seamlessly work with Venmo.

What advance app works with Venmo?

Below is a table summarizing popular cash advance apps and their compatibility with Venmo.

| Advance App | Works with Venmo? | Key Features |

|---|---|---|

| Beem | Yes | Instant cash advances, no credit checks, Everdraft™, budgeting tools. |

| Cleo | Yes | AI-powered budgeting, overdraft protection, and personalized financial insights. |

| Empower | Yes | Up to $250 cash advance, budgeting tools, and early paycheck access. |

| MoneyLion | Yes | Up to $500 cash advance, credit-building tools, and investment options. |

| Albert | Yes | Instant advance up to $250, smart savings tools, and financial coaching. |

| Klover | Yes | Instant cash advances without credit checks and paycheck-based limits. |

| Dave | Yes | Borrow up to $500, budgeting tools, and early payday advances. |

| Branch | Yes | Advances based on earned wages, budgeting tools, and bill tracking. |

| Varo | Yes | No-fee banking, early paycheck access, and instant cash advance features. |

| Brigit | Yes | Up to $250 cash advance, credit monitoring, and budgeting insights. |

Cash Advance Apps That Work With Venmo

Venmo, known for its peer-to-peer payment system, has become a go-to platform for many. To get access to the cash advances in Venmo, Users can integrate this tool with cash advance apps, making transactions more fluid. So, let’s look at some of the most common advanced apps that work with Venmo.

| Service/App | Key Features | Pros | Cons | Unique Aspects |

|---|---|---|---|---|

| Beem | Everdraft™ Instant Cash advance, Financial Tools, Security & Alerts | Access $5 to $1,000 instantly, budget planning, identity theft protection | No cons. Just complete your KYC, check qualification, subscribe & withdraw cash in minutes. | Smart Wallet App with comprehensive financial management |

| Cleo | User-centric cash advance, overdraft protection | Savings potential, minimal details required, freelancer-friendly | Limited to $250, cost for same-day access | Zero interest cash advance platform |

| Empower | Budgeting tools, AutoSave, cash advances | No late fees, overdraft fee reimbursement | Monthly subscription, no free next-day advances | Robust budgeting and saving aids |

| MoneyLion | Cash advances, Credit Builder Plus, financial tools | Interest-free advances, credit building, mobile banking and investment | $19.99 monthly fee, interest on credit-builder loans | Interest-free advances with credit building services |

| Albert | Cash advance feature, integrated financial services | No credit check, zero fees on advances, transparent fees | Fee for instant transfers, Genius Subscription required | Comprehensive platform with no-fee advances |

| Klover | Cash advances tied to points program | No fees, overdraft prevention, budgeting tools | Waiting period for advances, data sharing concerns | Advances tied to points and user data sharing |

| Dave | Banking app, cash advances up to $500 | Low monthly fee, large advance amounts, job board access | Account requirement for express fees, fees for express payments | Large advances with low monthly fee and credit services |

| Branch | Cash advances, financial services | Instant Pay with debit card, fee-free ATMs | Fees for external transfers, advance limits vary | Cash advances with credit-building and budgeting |

| Varo | Online banking, cash advance, credit tools | Swift paycheck access, interest-free borrowing, automated savings | Low initial limit, direct deposit requirement | Online banking with swift access and interest-free borrowing |

| Brigit | Paycheck advances, financial insights | Quick advances up to $250, detailed financial insights | Monthly cost of $9.99, varying availability of features | Quick advances with comprehensive financial insights |

List of 10 Cash Advance Apps That Work With Venmo

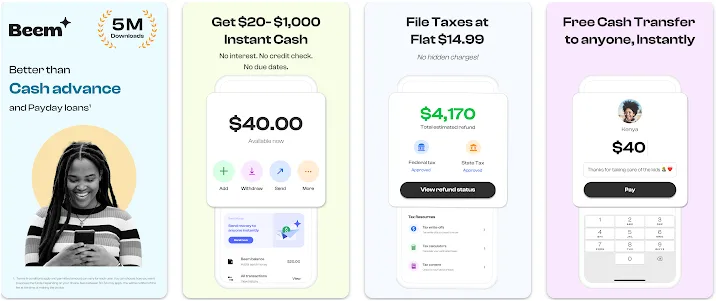

1. Beem

Beem is a premier Smart Wallet App tailored for the modern individual. Offering instant cash advance through Everdraft™, this app blends financial tools like budget planning and identity protection, ensuring users optimize their financial health.

Features Of Beem:

Everdraft™ Instant Cash: Access $5 to $1,000 without interest or credit checks.

Beem Boost: Unlock additional cash boosts on your Everdraft™ amount.

Comprehensive Financial Tools: Utilize budget planners and receive personalized money management insights.

Enhanced Security & Alerts: Benefit from identity theft protection and timely alerts to sidestep overdrafts and late fees.

2. Cleo

Cleo emerges as a user-centric cash advance platform, offering up to $250 with zero interest and no credit checks. Beyond immediate funds, it champions genuine overdraft protection, ensuring financial security. Its freelancer-friendly approach and streamlined process prioritize user convenience and inclusivity.

Pros

Genuine savings potential of up to $180 annually.

Minimal details are required for inclusive accessibility.

Cons

Limited Advance Amount Up to $250 maximum.

Additional cost for same-day access.

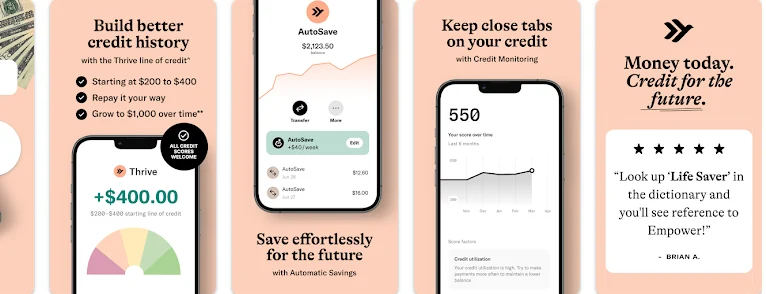

3. Empower

Empower Financial stands out with its robust budgeting tools, including the AutoSave feature that aids in building savings. While offering advances up to $250, users face a potential two-day wait for fee-free transactions, and weekend support limitations underscore its customer service nuances.

Pros

No late fees incurred.

Reimbursement for overdraft fees.

Cons

Mandatory monthly subscription fee.

Lack of free next-day advances.

4. MoneyLion

MoneyLion offers interest-free cash advances up to $250 and features a Credit Builder Plus membership to improve credit.

Although it reports to major credit agencies and provides various financial tools, there’s a $19.99 monthly fee for this credit-enhancing service.

Pros

Receive interest-free cash advances of up to $250.

Utilize Credit Builder Plus for credit-building loan opportunities.

Benefit from integrated mobile banking and investment functionalities.

Cons

Monthly fee of $19.99 for Credit Builder Plus.

Interest charges on credit-builder loans.

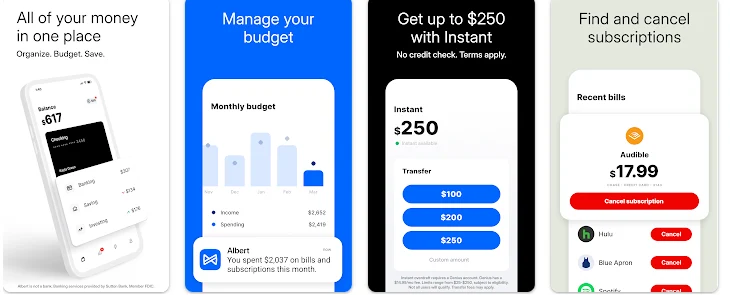

5. Albert

Albert emerges as a cutting-edge financial app, offering users a no-fee, no-interest cash advance feature, seamlessly integrating savings, investing, and cashback rewards into one comprehensive platform.

Pros

No credit check is required.

Transparent fee structure.

Zero fees and interest on cash advances.

Flexible payment options.

Cons

Fee associated with instant transfers.

Requirement for a Genius Subscription.

6. Klover

Klover provides up to $200 in advances tied to its points program. While tasks earn points convertible to cash, its revenue model via user data sharing may spark privacy concerns.

Pros

No fees are charged.

Prevents overdrafts.

Offers helpful budgeting tools.

Cons

Waiting period to qualify for cash advances.

Three-day post-payday wait for subsequent advances.

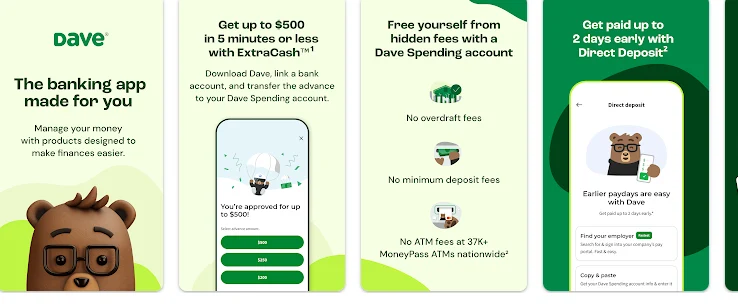

7. Dave

Dave is a prominent banking app granting cash advances up to $500 sans interest or late fees, complemented by a $1 monthly fee.

It boasts credit-building services and budgeting tools and offers free and expedited advance delivery options.

Pros

Low monthly subscription fee of $1.

Offers large advance amounts.

Membership provides access to a side hustle job board.

Cons

Need a Dave Spending Account for the most favorable express payment fees.

Elevated fees for express payments.

Minimum two-day wait for free advances.

8. Branch

The branch provides financial services, including cash advances up to $150, with credit-building tools and budgeting features. Upon approval, funds can be seamlessly transferred to your Venmo account.

Pros

Instant Pay option is available with a branch debit card.

Access to over 40,000 fee-free ATMs.

Cons

The fee is applied for Instant Pay to external bank transfers.

Advance limits are based on individual payment history and factors.

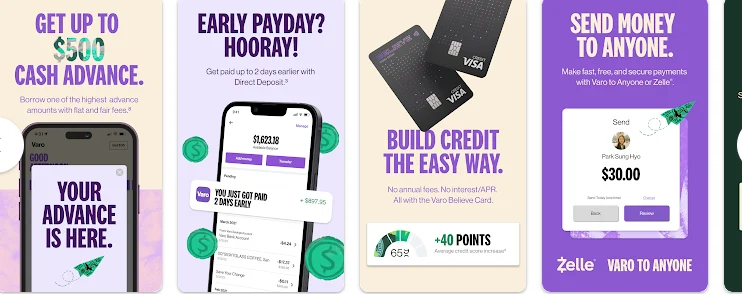

9. Varo

Varo is a forward-thinking online banking service offering swift paycheck access, an interest-free cash advance feature, and tools to enhance credit health.

Pros

Swift paycheck access.

Interest-free borrowing.

Automated savings features.

Cons

The initial borrowing limit is low.

Requirement of $800 in direct deposits.

10. Brigit

Brigit effortlessly blends quick paycheck advances of up to $250 with valuable financial insights, providing a comprehensive way to handle money matters and avoid overdraft charges.

Pros

Quick advances of up to $250.

Deep insights into your spending patterns and overall financial behaviors.

Cons

With a Monthly cost of $9.99 for the service.

Availability of features might vary based on user needs.

Here are the Best Cash Advance Apps that Work with Venmo

| App | Description |

|---|

| Beem | Beem offers cash advances with no interest or credit checks through Everdraft™. Users can manage finances, file taxes for free, budget, send money, and monitor credit securely. |

| Cleo | Cleo provides a budgeting assistant and cash advance feature with up to $100, powered by AI. The app also includes spending insights and personalized financial tips. |

| Empower | Empower offers cash advances of up to $250 with fast funding, plus budgeting tools and spending insights, aimed at helping users manage day-to-day financial needs. |

| MoneyLion | MoneyLion provides cash advances, credit-building loans, investment tools, and financial tracking to support a range of personal finance goals. |

| Albert | Albert offers up to $250 in cash advances and includes automatic saving features, budgeting tools, and financial guidance from a team of experts. |

| Klover | Klover provides cash advances up to $100 without credit checks, along with insights into spending and opportunities to earn rewards through surveys and promotions. |

| Dave | Dave offers cash advances up to $500, coupled with budgeting tools, overdraft protection, and a “Side Hustle” feature for finding part-time work. |

| Branch | Branch allows users to access earned wages early, up to $500, and offers additional features like expense tracking and budgeting tools for financial control. |

| Varo | Varo provides cash advances with no fees, overdraft protection, and budgeting tools, focusing on helping users manage and grow their finances responsibly. |

| Brigit | Brigit offers up to $250 in cash advances and includes budgeting insights, credit monitoring, and resources to help improve financial health and avoid overdrafts. |

- Beem

- Cleo

- Empower

- Money Lion

- Albert

- Klover

- Dave

- Branch

- Varo

- Brigit

Several top-notch cash advance apps sync seamlessly with Venmo, offering users swift access to funds and financial tools. From Beem’s user-friendly interface to MoneyLion’s rewards program and Dave’s no-fee structure, these platforms cater to diverse financial needs with efficiency and innovation.

What is Venmo?

Venmo is a mobile payment platform enabling users to seamlessly send and receive money, primarily for peer-to-peer transactions, with features like credit cards, debit cards, and teen account options.

Benefits of Using Venmo

Efficient Transactions: Simplifies peer-to-peer money transfers among friends and family.

Cash Back Rewards: With the Venmo Credit Card, you can achieve up to 3% cash back on eligible purchases.

Versatile Spending: The Venmo Debit Card expands spending capabilities, offering up to 5% cash back on activated app offers.

Teen Accessibility: Allows teenagers (ages 13-17) to manage money responsibly with parental oversight and no monthly fees.

Choosing a Cash Advance App that Works with Venmo

When selecting a cash advance app integrated with Venmo, consider factors like interest rates, fees, credit-building features, user reviews, and specific needs.

Ensure compatibility, assess costs, and prioritize tools that align with your financial target and spending habits for optimal benefits.

Conclusion

In wrapping up, navigating the world of cash advance apps integrated with Venmo offers convenience and financial flexibility. Users can make informed choices by understanding each app’s unique features, benefits, and potential drawbacks.

Prioritizing financial wellness and aligning with personalized needs ensures a seamless experience, maximizing convenience and utility. Meanwhile, if you need instant cash for emergencies like paying medical bills or house repairs, check out Beem’s Everdraft™, which offers the best alternative for an instant cash advance of $5 – $1,000 without any income restriction or credit checks.

Frequently Questions Asked About Cash Advance Apps That Work With Venmo

What are cash advance apps that work with Venmo?

Cash advance apps that work with Venmo are financial applications that allow users to borrow money against their future paychecks and easily transfer those funds to their Venmo account. This makes it convenient to access cash for emergencies or unexpected expenses.

How do cash advance apps integrate with Venmo?

Apps like Beem cash advance enable users to withdraw borrowed funds directly to their linked bank account. From there, users can quickly transfer the money to their Venmo account for immediate use.

Which cash advance apps work well with Venmo?

Best cash advance apps that work with Venmo include Beem, Dave, MoneyLion, Empower, and Brigit.

Can I use multiple cash advance apps with Venmo?

Yes, you can use multiple cash advance apps, but be mindful of how much you borrow in total. Using several apps can lead to repayment challenges if not managed properly.

Are cash advance apps safe to use with Venmo?

Most reputable cash advance apps employ robust security measures to protect user data and transactions.