Table of Contents

Managing your credit health goes beyond paying bills on time. It also means being mindful of how credit inquiries affect your score. Every time you apply for a loan or credit card, your credit is reviewed by lenders, often triggering what’s known as a ‘hard inquiry’. These can slightly lower your credit score, and multiple inquiries may raise red flags for lenders over time. To prevent score dips, try to limit unnecessary credit applications and space out inquiries when possible.

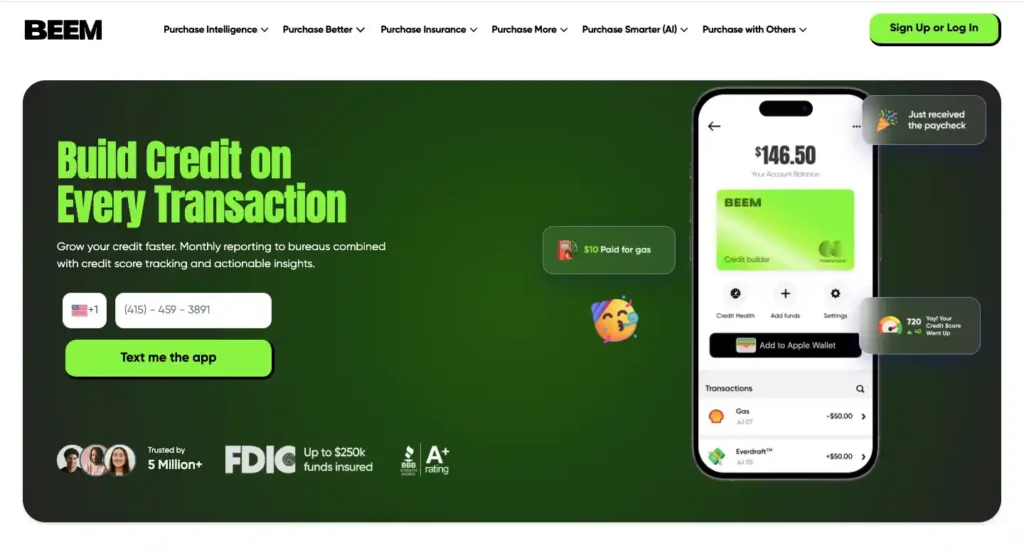

Fortunately, Beem offers powerful tools to track, manage, and minimize the impact of these inquiries. With real-time alerts, credit report monitoring, and dispute support, Beem helps you stay informed and in control of your credit profile, ensuring your score stays resilient throughout your financial journey.

Why Credit Inquiries Matter for Your Score

When you apply for a new loan, credit card, or financing option, lenders assess your creditworthiness by pulling your credit report. These checks, called hard inquiries, can slightly lower your credit score. While not individually harmful, they can collectively signal financial instability if left unmanaged, making it essential to understand and control them effectively.

Small but Significant Score Impact

A hard inquiry may lower your credit score by just a few points, typically less than five, but the effect can still matter, especially if your score is on the edge of a qualification range. The drop is temporary, but timing your applications can help avoid unnecessary damage during key financial decisions.

Multiple Inquiries Can Raise Red Flags

Applying for multiple credit products simultaneously can result in multiple hard inquiries. It can raise red flags for lenders, suggesting that you’re a higher credit risk. It might lead to rejections or higher interest rates, even if your credit history is positive.

One-Year Scoring Impact, Two-Year Visibility

Hard inquiries remain visible on your credit report for up to two years. However, they only influence your credit score for the first 12 months. Knowing how long they linger helps in planning your credit activity strategically, especially if you’re preparing for a significant financial milestone.

Monitoring Helps Minimize Damage

Tracking your credit report allows you to identify inquiries, whether authorized or not, quickly. With tools like Beem, you can stay promptly informed and dispute any suspicious activity, minimizing long-term effects on your score and maintaining a good credit profile.

Read related blog: How Often Should You Check Your Credit Score? Beem Makes It Easy

How Beem Helps You Track and Manage Credit Inquiries

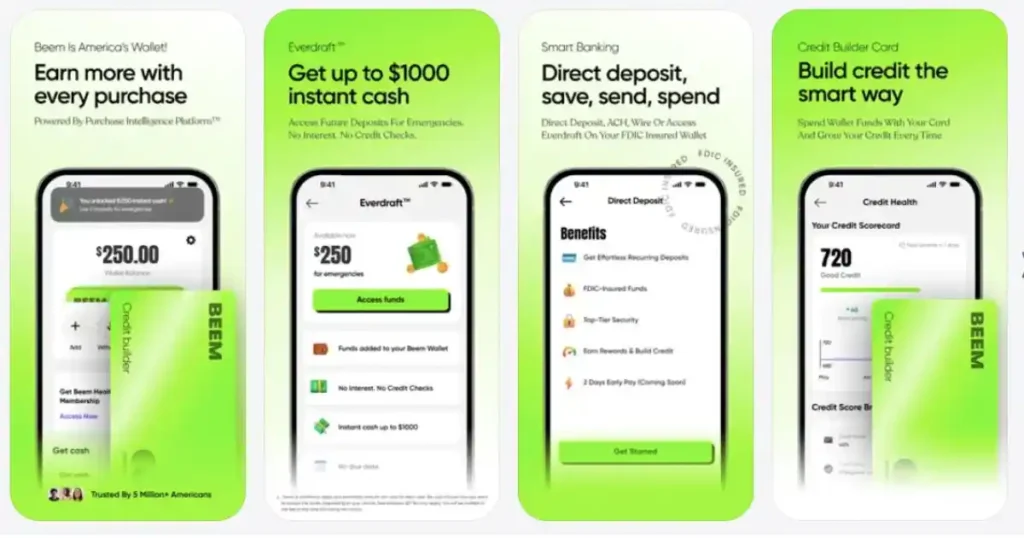

Beem simplifies credit management by giving you the tools to proactively track, understand, and respond to credit inquiries. Its credit monitoring features ensure that you’re never caught off-guard by changes in your credit profile. Whether you’re looking to monitor for fraud or reduce the chances of a score dip, Beem is designed to provide transparency and control.

Real-time alerts inform you of new hard inquiries, soft checks for score monitoring don’t affect your rating, and you’re given simple dispute guidance if something looks suspicious. With Beem, staying on top of credit inquiries becomes part of your smart financial habits.

Real-Time Alerts for Hard Inquiries

Beem will immediately notify you when a new hard inquiry appears on your credit report. This real-time alert system acts as a robust defense against unauthorized credit checks. Instead of finding out weeks later, you’re informed instantly, giving you time to confirm, investigate, and respond before any damage is done to your credit score.

Instant Awareness of New Activity

Hard inquiries can appear fast and unexpectedly. Beem’s alerts notify you when one is added to your report, so you’re never caught off guard. Awareness of an inquiry, as it occurs, gives you the upper hand in preventing score drops and stopping fraudulent credit activity early.

Confirm Legitimate Applications Quickly

If you’ve recently applied for a credit card, loan, or lease, Beem’s real-time alert lets you confirm whether the inquiry is legitimate. This immediate feedback helps you tie each investigation to a specific application, providing peace of mind or signaling a red flag when something doesn’t align.

Act Immediately on Suspicious Inquiries

If the alert reveals an unfamiliar inquiry, you can investigate it immediately. Quick action limits the damage caused by potential identity theft or credit fraud. Beem empowers you to take control by responding before unauthorized activity further impacts your financial health.

Stay Informed Without Waiting for Statements

Traditional monitoring tools only notify you monthly. Beem skips the wait, alerting you the moment your credit is accessed. This proactive feature ensures you’re always in the loop, keeping your credit score safe from slow reaction times and delayed discovery.

Easy Dispute Guidance

Spotting an unauthorized hard inquiry can be stressful, but Beem makes a potentially confusing situation manageable. Its step-by-step dispute guidance walks you through contacting credit bureaus, gathering documentation, and removing errors, giving you clarity and confidence to take action quickly and protect your credit standing.

Clear Instructions for Taking Action

Beem breaks down the dispute process into clear, easy-to-follow steps. You’ll know who to contact, what to include in your dispute letter, and how to follow up. It removes any uncertainty from the process and empowers you to take corrective steps confidently.

Support for Contacting Credit Bureaus

Disputing a hard inquiry means dealing with credit reporting agencies. Beem provides direct links and sample letters, allowing you to communicate efficiently with Equifax, Experian, or TransUnion. There is no more guesswork—just a clear path to resolving the issue.

Ensure Fraudulent Inquiries Don’t Linger

Unauthorized inquiries can negatively impact your score if they remain unresolved. Beem helps you act so that fraudulent or erroneous entries don’t stay on your report and hurt your credit for months. Early dispute efforts can preserve your score and prevent more serious fraud.

Empowerment for All Users

Many people avoid disputing inquiries because they feel overwhelmed. Beem’s support removes the fear of doing it wrong and empowers anyone, regardless of experience, to fix their credit report. You can confidently clean up your report and secure your financial reputation with guided assistance.

Soft Inquiries Without Score Impact

Curious about your credit score but afraid to check it too often? Beem uses soft inquiries, which have no impact on your credit score. You can monitor your score frequently, catch early changes, and stay informed about your credit health without paying a price for your curiosity.

Safe, Frequent Credit Checks

Soft inquiries don’t affect your credit score, so you can check your report and score as often as possible. Beem allows safe, routine monitoring—an essential tool for staying updated without damaging your profile.

Understand Score Changes Over Time

Regularly using Beem gives you a better understanding of how your credit score fluctuates. Whether building credit, reducing debt, or applying for loans, regular checks help you track your progress and make more informed financial decisions.

No Risk, All Awareness

Unlike lender-driven hard inquiries, soft pulls initiated by you pose zero risk. You get complete visibility into your credit profile without worrying about losing points or harming your approval odds on future applications.

Stay Ahead of Credit Problems

Beem’s soft inquiry checks help you detect issues early, like sudden score drops or suspicious changes. The earlier you catch a problem, the faster you can respond. This regular monitoring is your frontline defense against long-term credit damage.

Read related blog: What to Do When Your Credit Score Drops: Beem’s Solutions

Innovative Strategies to Prevent Unnecessary Score Dips

Credit inquiries are often unavoidable when applying for new credit, but how you approach them can make all the difference. Implementing smart, proactive habits can help you avoid unnecessary hard inquiries and maintain a healthy credit score. Here are key strategies to minimize score dips and maintain a healthy credit profile.

Use Pre-Qualification Tools Before Applying

Many lenders offer pre-qualification, which uses a soft inquiry to estimate your chances of approval without affecting your score. It allows you to explore your options risk-free and submit a complete application only when you’re confident. It’s a great way to minimize unnecessary hard inquiries and avoid wasting valuable credit score points.

Research Lenders Before Submitting Applications

Not all lenders treat applications the same. Some run hard inquiries during the initial application stages, while others wait until later. Doing your homework before applying helps you choose lenders that are less likely to trigger immediate hard pulls, allowing you to plan your credit journey more efficiently.

Avoid Applying for Multiple Products at Once

Spacing out your credit applications over time helps avoid the negative impact of multiple inquiries clustering together. Applying for several products quickly can make you appear financially unstable. Instead, plan your applications strategically to reduce risk and give your score time to recover.

Monitor and Dispute Inquiries with Beem

With Beem, you can review your credit report regularly and identify any unfamiliar or unauthorized inquiries. If you notice anything suspicious, Beem guides you through the dispute process. It ensures your credit remains protected and that errors or fraud don’t unnecessarily drag your score down.

Read related blog: Can I Improve My Credit Score With Cash Advance?

Final Thoughts – Stay in Control with Beem

Hard inquiries are a routine part of building credit, but being mindful of them is crucial to protecting your score. Too many inquiries in a short span can signal risk and temporarily drop your score, potentially costing you better loan terms. Beem provides real-time insights, soft inquiry score checks, and easy-to-use tools to manage disputes, making credit monitoring simple and stress-free.

Instead of worrying about each application’s impact, you can focus on making wise financial decisions. With Beem in your corner, you’ll have all the tools to manage your credit journey and maintain a strong financial foundation. Download the app now!