Table of Contents

In the world of personal finance apps, Klover has been making waves as a go-to choice for those seeking quick and convenient cash advances. Offering small, interest-free advances and a unique Points Program to boost advance amounts, Klover has undoubtedly gained attention.

However, for those in the USA looking for alternatives, there’s a thriving landscape of similar apps designed to provide instant cash access without the hassle of traditional loans. These apps like Klover cater to the financial needs of individuals, especially in the USA, offering a lifeline when unexpected expenses arise before payday.

Explore this dynamic world of apps like Klover, where financial flexibility is just a tap away.

Top 15 Apps like Klover – Best Alternatives for Klover

| Apps like Klover | Features | Fees | Eligibility | User Reviews | Available in US |

|---|---|---|---|---|---|

| Beem | Early wage access, budgeting tools, cash advances, Personal Loans, Car Insurances, High Yield Savings Account, Send Money Online | $2.99 monthly subscription | Employed with direct deposit | 4.4 stars on Google Play | Yes |

| Cleo | Budgeting tools, financial education, goal setting | Free, with optional premium features for $5.99/month | Must be 18 or older with a US bank account | 4.7 stars on Google Play | Yes |

| Payactiv | Early wage access, budgeting tools, bill pay | $1-$5 monthly subscription, depending on features | Employed with direct deposit | 4.3 stars on Google Play | Yes |

| Branch | Early wage access, budgeting tools, financial education | $3-$9 monthly subscription, depending on features | Employed with direct deposit | 4.2 stars on Google Play | Yes |

| Chime | Online banking, early wage access, budgeting tools | No fees | Must be 18 or older with a valid US address and SSN | 4.7 stars on Google Play | Yes |

| MoneyLion | Mobile banking, budgeting tools, credit building, loans | $9.99 monthly subscription | Must be 18 or older with a US bank account | 4.1 stars on Google Play | Yes |

| Brigit | Emergency cash advances, budgeting tools | $9.99 monthly subscription | Must be 18 or older with a US bank account and regular income | 4.3 stars on Google Play | Yes |

| Opploans | Personal loans, credit building | Fees vary depending on loan amount and creditworthiness | Must be 18 or older with a US bank account and regular income | 4.2 stars on Google Play | Yes |

| Cash App | Mobile payments, peer-to-peer transfers, early wage access (with direct deposit) | No fees for basic features, fees for some optional features | Must be 18 or older with a US bank account | 4.6 stars on Google Play | Yes |

| FloatMe | Emergency cash advances, bill pay | $9.99 monthly subscription | Must be 18 or older with a US bank account and regular income | 4.4 stars on Google Play | Yes |

| Albert | Budgeting tools, financial education, micro-investing | Free, with optional premium features for $2.99/month | Must be 18 or older with a US bank account | 4.7 stars on Google Play | Yes |

| B9 | Early wage access, budgeting tools, financial education | $9.99 monthly subscription | Must be 18 or older with a US bank account and regular income | 4.5 stars on Google Play | Yes |

| Avant | Personal loans, credit building | Fees vary depending on loan amount and creditworthiness | Must be 18 or older with a US bank account and regular income | 4.1 stars on Google Play | Yes |

| Dave | Budgeting tools, emergency cash advances, overdraft protection | $1-$10 monthly subscription, depending on features | Must be 18 or older with a US bank account and regular income | 4.6 stars on Google Play | Yes |

| EarnIn | Early wage access, budgeting tools, financial education | $3-$8 monthly subscription, depending on features | Employed with direct deposit | 4.5 stars on Google Play | Yes |

Let’s explore the top apps like Klover in detail:

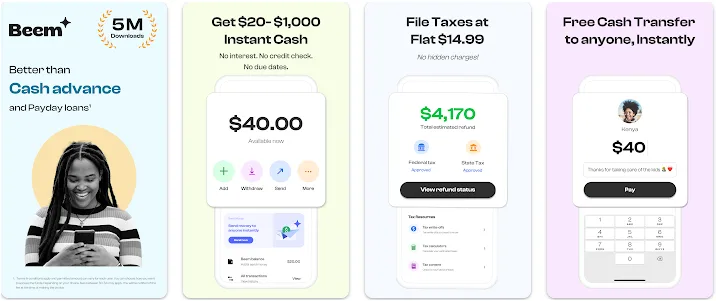

1. Beem

Beem is a standout alternative to the Klover app, offering a hassle-free means of obtaining small advances to address unexpected financial obligations. This user-friendly platform grants access to earned funds without the hassle of credit checks, late fees, or interest charges. Beem is the #1 alternative for an instant cash advance of $5 – $1,000.

Notably, Beem distinguishes itself with its innovative Points Program, enabling users to accumulate credits by participating in surveys and watching ads. These credits can augment the advance amount or cover the fee for same-day funding.

Additionally, Beem’s straightforward and accessible approach to financial assistance makes it attractive for individuals seeking quick cash access without the burdensome financial complexities.

Key Features:

- Innovative Points Program for earning credits.

- instance cash with app No credit checks, No late fees and No interest charges.

2. Cleo

Cleo, our final recommendation among apps similar to Klover, stands out as a versatile financial assistant powered by A.I. It offers comprehensive money management solutions beyond mere cash advances.

While Apps like Cleo does require a subscription for its advanced features and offers relatively modest cash advances, its strengths lie in its ability to streamline financial management. Here are two key features:

Key Features:

- Cleo allows you to effortlessly view all your account balances in one convenient place.

- It enables you to set budgets, monitor progress, gain insights into your spending patterns, and receive personalized tips for saving money.

3. Payactiv

Payactiv is a valuable financial app tailored to employees seeking more control over their finances. It empowers users to access their earned wages before the next payday, eliminating the need for costly traditional payday loans.

With Payactiv, users gain peace of mind, knowing they can readily cover unexpected expenses without financial stress. Key features include

Key Features:

- Users can conveniently access their hard-earned wages when needed, avoiding fees associated with traditional loans.

- Sign-up is straightforward, requiring only the employer’s name and email address, making it accessible to a broad user base.

4. Branch

Branch is a versatile mobile banking app that simplifies financial management for users on the move. This app offers a range of features, allowing users to:

- Easily view all account balances in one consolidated place, providing a comprehensive financial snapshot.

- Conveniently transfer funds between accounts, pay bills and monitor payment history.

- Locate nearby ATMs and branches, enhancing accessibility and convenience for users on the go. Branch is an essential tool for those seeking efficient financial control at their fingertips.

There are a few other best apps like Branch which can give you all the above features as well as better financial insights on your spending, you can try that out.

5. Chime

Chime is a versatile mobile app designed to empower users in effectively managing their finances. As an alternative to Klover, this app offers a range of features, allowing users to:

- Gain insights into your spending habits by visualizing where your money is going, making it easier to find saving opportunities.

- Stay financially responsible by setting and tracking budget goals, ensuring you meet your financial targets.

Chime also provides access to exclusive deals and discounts, helping users secure the best prices on products and services. Additionally, it facilitates seamless money transfers, allowing users to send and receive funds from friends and family.

6. MoneyLion

MoneyLion is a multifaceted, free financial management app to streamline money-related tasks. It encompasses an array of features, including:

- Take control of your finances by tracking your spending patterns, facilitating savings, and promoting financial discipline.

- Enjoy the benefits of a savings account with a competitive interest rate, allowing your money to grow steadily.

Additionally, MoneyLion offers a credit monitoring service, informing you about your credit score’s status. It also boasts a supportive user community where you can seek advice and support on your financial journey.

7. Brigit

Brigit, one of the top apps like Klover, is a free financial app designed to empower users with effective money management. It offers personalized recommendations, budgeting tools, and expense tracking to ensure you stay on top of your bills and save money.

Additionally, Brigit provides free credit monitoring and reporting services to help users maintain a healthy credit profile. Its user community fosters a supportive environment for individuals striving to enhance their financial well-being. With Brigit, you can regain control of your finances effortlessly. Try it today for free!

8. OppLoans

OppLoans is a lender specializing in bad credit personal loans, offering a distinct alternative to apps like Klover. What sets OppLoans apart is its potential for same-day funding, providing quick access to loan amounts ranging from $500 to $4,000, with repayment terms spanning 9 to 18 months, a stark contrast to typical cash advance apps.

While APRs can reach 160%, OppLoans reports your payments to major credit bureaus, aiding in credit score improvement—a feature not commonly found in cash advance apps. This makes OppLoans an appealing choice for those seeking credit-rebuilding opportunities.

9. Cash App

Apps like Cash App, provided by Square, is a mobile payment service facilitating hassle-free money management via smartphones. It simplifies financial transactions on iOS and Android with its user-friendly features. Users can send and receive money free of charge, avoiding the need to link bank accounts or credit cards.

The app enables instant transfers to debit cards, easy peer-to-peer payments, and simplified expense splitting. A standout feature is real-time transaction tracking, informing users about their spending. This transparency and convenience make Cash App an excellent choice for modern money management.

Key Features:

- Send and receive money for free

- Real-time transaction tracking

10. FloatMe

Apps like FloatMe offers a hassle-free solution for those needing quick cash. Their instant cash app ensures you can access the money you require with just a few taps on your device. Notable features include instant cash deposits into your account and the ability to withdraw funds anytime.

Similar to other apps like Klover, FloatMe operates without hidden fees or charges, providing a convenient and transparent way to access funds 24/7.

Key Features:

- Instant cash deposits

- 24/7 availability

11. Albert

Albert’s banking app offers users a user-friendly interface for efficient financial management. With Albert, you can effortlessly track your finances, pay bills, and initiate quick fund transfers. Additionally, the app provides cashback rewards, enhancing your savings.

The best part? Albert is entirely free to download and use, making it a cost-effective solution for financial management. Take control of your finances today with Albert’s convenient bill payment, fast fund transfers, and the opportunity to earn cashback rewards – all accessible through its easy-to-use interface.

Key Features

- User-friendly interface

- Cashback rewards

12. B9

A B9 cash advance offers a quick and convenient way to access additional funds when in a financial pinch. These short-term loans come with the benefit of not requiring a credit check, making them accessible to many borrowers.

The application process is straightforward and speedy, making it an efficient solution for covering unexpected expenses or emergencies. When you need a cash injection, consider applying for a B9 cash advance to bridge the gap until your next payday. Discover how these loans can provide valuable financial assistance in times of need.

13. Avant

Avant distinguishes itself as a personal loan provider that accommodates self-employment income, a feature notably absent in Klover’s cash advance qualifications.

While not a banking app like Klover, Avant offers loans of up to $35,000 with a relatively low credit score requirement of 580 and APRs starting at 9.95%. It’s essential to note an administrative fee of 4.75% and past legal issues involving improper debt collection practices, resulting in a $1.6 million settlement.

Despite some customer complaints, Avant maintains a mixed reputation, with a high Trustpilot rating.

14. Dave

Dave, a mobile app, provides a valuable service by assisting users to avoid costly overdraft fees. To utilize Dave’s benefits, users must connect their U.S. bank accounts, allowing the app to monitor their account balances.

Dave then scrutinizes spending patterns and issues timely alerts when overdraft risks emerge, enabling users to adjust their expenses or transfer funds to evade fees. Nonetheless, it’s worth noting that Dave exclusively caters to U.S. bank accounts and may only sometimes possess the most current balance information.

Therefore, verifying balances before substantial transactions is advisable to avoid any surprises manually.

15. EarnIn

EarnIn is a valuable alternative for Klover, offering quick access to earned wages without fees or interest charges. This app allows you to receive payment for the work you’ve already completed, providing up to $100 per day.

Within one business day, the funds are deposited into your bank account. Earnin’s convenience is unmatched, whether you’re at home or on the move. It’s a reliable solution for those seeking rapid access to cash without the hassle of waiting for paychecks or incurring additional costs.

EarnIn features:

- Quick access to earned wages without fees or interest charges.

- Request up to $100 daily, with funds deposited within one business day.

16. ONE@Work

ONE@Work is a financial app that partners with employers to help employees manage their pay. It offers tools to get paid early, save for the future, and budget effectively. There are more apps like one@work in the market, but this one stands out from them thanks to the below features:

Key features:

- Get Paid Early: Access your earned wages before your regular payday. This can be helpful for covering unexpected expenses or bills.

- Save Automatically: Set up automatic savings goals to easily put money aside for the future.

- Build Your Budget: Track your income and expenses to create a personalized budget that works for you.

- Financial Education: Access resources and tools to learn more about personal finance and make informed decisions.

Conclusion

Financial apps like Klover provide crucial access to quick funds and improved money management. Klover offers cash advances, but various alternatives cater to diverse needs. Therefore, it is essential to explore all alternatives for Klover before making a financial decision.

From Beem’s responsible spending promotion to SoFi’s comprehensive services, these apps empower users to take control of their finances, minimize fees, and bridge income gaps. The choice depends on individual preferences, making financial empowerment highly accessible.

Frequently Asked Questions About Apps like Klover

What is Klover

Klover is a cash advance app that allows you to access a portion of your earned wages before your payday.

How does Klover work?

Klover links to your employer’s time-tracking system to determine your earnings and offers advances based on your work.

Are there any fees associated with Klover?

Klover offers a free basic plan, but they also have a premium plan with a monthly fee. The fees vary depending on the plan, and premium users may receive additional benefits.

How quickly can I access the funds through Klover?

Klover typically allows you to access your funds immediately, making it a convenient option for covering unexpected expenses or emergencies.

What are apps like Klover, and how do they work?

Apps like Klover provide cash advances without interest, aiming to help users bridge short-term financial gaps.

These apps typically connect to your bank account to analyze cash flow and offer small advances based on your income and spending habits.

What are some alternatives to Klover?

Popular alternatives to Klover include apps like Beem, Earnin, Dave, Brigit, and MoneyLion. These apps also offer small cash advances and financial management tools.

How much can I borrow with apps like Klover?

The amount varies by app, but most cash advance apps offer between $20 and $250 per advance, depending on your income and account activity.

Is my bank information safe with apps like Klover?

Most reputable cash advance apps use secure encryption and comply with financial data protection regulations to keep your information safe. Be sure to verify the app’s security features before linking your bank account.