Table of Contents

Cash App, renowned for its efficiency in peer-to-peer payments, provides quick and user-friendly money transfers. However, it does have limitations, particularly in the realm of international transactions and specific features. Exploring Cash app alternatives becomes essential to address these gaps and cater to broader financial needs.

Apps like Cash App: Top 14 Cash App Alternatives To Try in 2025

While Cash App excels in certain areas, its limitations may leave some users searching for alternatives. Thankfully, there is no shortage of reliable Cash app alternatives to explore, each offering a unique set of features and capabilities.

So, if Cash App doesn’t quite meet your financial needs, rest assured that alternatives are waiting to serve you better:

| Apps like Cash App | Key Features | Benefits | Focus Areas |

|---|---|---|---|

| Beem’s instant cash advance | Swift peer-to-peer payments, user-friendly interface, international transactions | Versatility, comprehensive digital finance solution | Instant cash advance and money transfers |

| Payoneer | Consolidated payments, easy fund transfers, diverse currency accounts | Centralized payment reception, versatile deposit/withdrawal options | Simplified transactions with global reach |

| Xoom | Secure money transfers, backed by PayPal, supports various funding sources | 24/7 customer support, robust data encryption | Secure and reliable money transfers, especially for larger amounts |

| Paysend | Budget-friendly fees, cashback benefits, no hidden charges | Cost-effective for international transfers, flexible retail location cash collection | Avoiding steep international transfer fees |

| Venmo | Quick transfers, cash-holding feature, personal touch with transactions | Convenient for shared expenses, modest fees for certain services | Quick and social money transfers, especially among friends |

| Google Pay | Simplifies secure money transfers, compatible with Android and iOS, mobile wallet linking | Seamless domestic transactions, straightforward online payments | Domestic transactions, limited international capability without third-party apps |

| Apple Pay | Seamless payment without physical cards, pre-installed on Apple devices | Integrated payment solution for Apple users, convenient cardless payments | Apple device users seeking an easy payment method at retail locations and for peer-to-peer transfers |

| Remitly | Operates in over 145 countries, multiple transaction methods | Extensive international reach, diverse transfer methods | International money transfers with a variety of delivery options |

| Wise | Real-time exchange rates, no hidden fees | Transparency and convenience in international transactions | International transactions with efficiency and transparency |

| Revolut | Fee-free transactions, currency conversion, business accounts | Global accessibility, seamless currency conversion, suitable for personal and business use | Versatile banking services with a focus on international accessibility and currency conversion |

| Meta Pay | Integrated within Facebook and Instagram, encrypted transactions | Platform-specific focus, convenient for Facebook Marketplace transactions | Users engaged in the Facebook ecosystem for both personal and business transactions |

| Zelle | Quick transfers among users at various banks, security measures | Immediate transfers, direct bank-to-bank transactions | Interbank transfers and straightforward transactions |

| PayPal | High transaction limits, dispute resolution, support multiple recipients | Ideal for businesses, supports a broad range of transactions including international | U.S. and international bank transfers, comprehensive for personal and business use |

| Incharge | Peer-to-peer payments, financial wellness tools | Focus on financial education, easy management of personal and shared expenses | Holistic approach to money management with an emphasis on financial wellness |

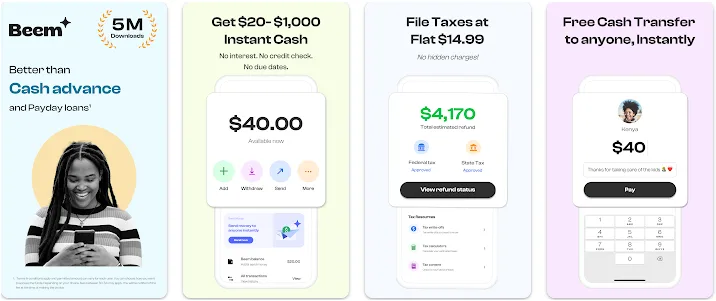

1. Beem

Beem emerges as the best alternative to instant cash advance, offering swift peer-to-peer payments and a user-friendly interface. With an emphasis on international transactions and a wide range of additional features, Beem caters to users seeking seamless domestic and international money transfers.

Its versatility and user-centric design make it a compelling choice for those searching for a comprehensive digital finance solution.

Play store ratings:

3.9star

14.9K reviews

1M+Downloads

Apple store ratings:

4.3 out of 5

21.3K Ratings

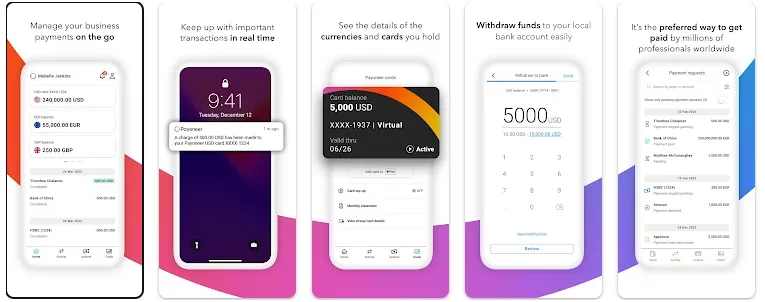

2. Payoneer

Payoneer, a payment app, streamlines financial transactions by consolidating payments into one account. Sign-up requires only a valid email address, offering convenience.

It differs significantly from Cash App, standing out with these distinctive features. Additionally, it facilitates easy fund transfers to other accounts, simplifying transactions with family and friends for users. Its key benefits include:

- Centralized payment reception

- Versatile deposit and withdrawal options

- Diverse currency accounts

- The ability to receive payments globally

Play store ratings:

4.3star

101K reviews

5M+Downloads

Apple store ratings:

4.5 • 3.1K Ratings

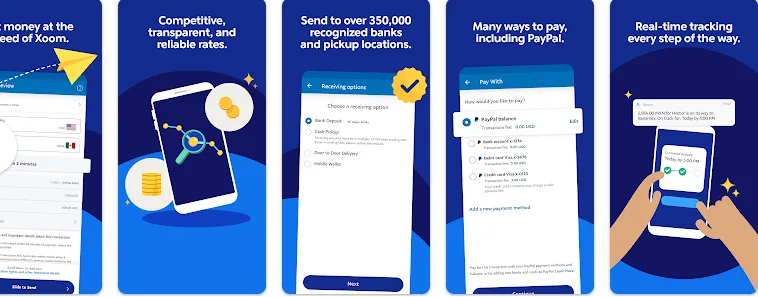

3. Xoom

Xoom, a popular payment app in the U.S. with over 40 million global users, offers secure money transfers and bill payments. Backed by PayPal, it boasts 24/7 customer support and robust personal and financial data encryption.

Xoom allows funds to be sent via credit/debit cards, bank accounts, or PayPal, though bank transfers may take up to three days. Unlike Cash App, Xoom mandates a verification process for sending over $1,000 daily, ensuring added security for more significant transactions.

Play store ratings:

4.8star

317K reviews

5M+Downloads

Apple store ratings:

4.8 • 1.1M Ratings

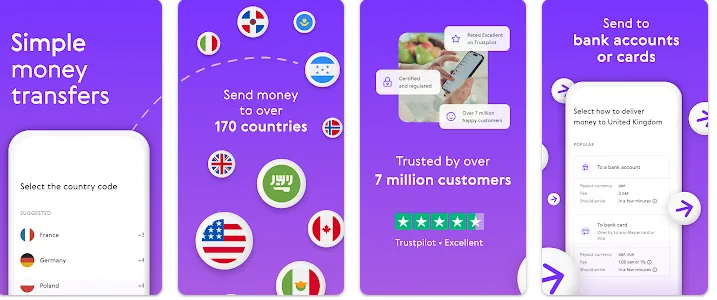

4. Paysend

Paysend, a mobile app, offers a flexible alternative to traditional bank transfers, ideal for avoiding steep international money transfer fees. Users can also collect cash at select Paysend retail locations. Users and retailers enjoy a 6% cashback benefit when shopping with certain retailers.

Paysend’s fees are budget-friendly, with a $3 money order purchase fee and a reasonable $1.80 transaction fee. Unlike Cash App, Paysend stands out for its absence of hidden, monthly, foreign transaction, or service charges, making it a cost-effective choice for money transfers.

Play store ratings:

4.6star

102K reviews

10M+Downloads

Apple store ratings:

4.7 • 10.9K Ratings

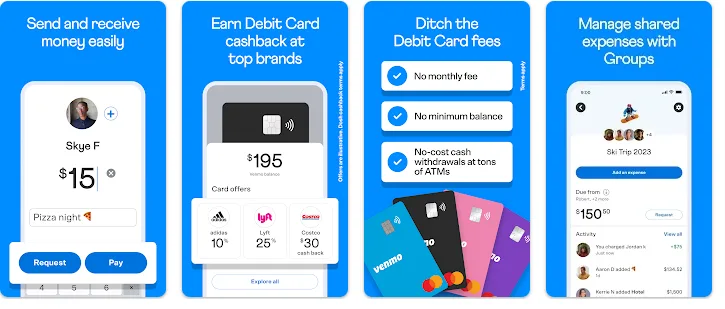

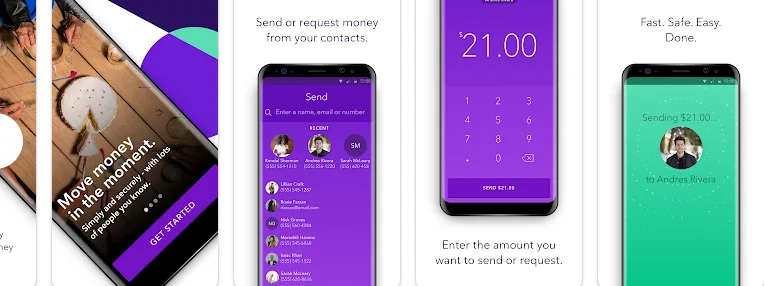

5. Venmo

Venmo, a Cash App alternative, offers quick money transfers and a convenient cash-holding feature. It supports seamless money-sending, spending, and bank transfers, making it an excellent choice for shared expenses. Users can add a personal touch to transactions with animated stickers and emojis.

Venmo charges a modest 1.75% fee for credit card transfers, with a minimum of $0.25 and a maximum of $25 for instant bank cash-outs. It features data encryption, multi-factor authentication, and a spending limit of $299.99, potentially expandable to $60,000 weekly. However, unlike Cash App, Venmo doesn’t guarantee fund recovery in case of mistaken transactions, emphasizing the need for sender caution.

Play store ratings:

4.2star

755K reviews

50M+Downloads

Apple store ratings:

4.9 • 15.4M Ratings

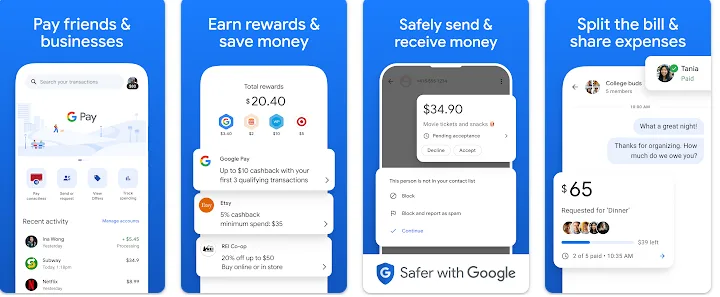

6. Google Pay

Google Pay, formerly Android Pay, has a longstanding presence and simplifies secure money transfers to friends and family. Online payments are initiated directly from your smartphone, and you can link a mobile wallet. It’s compatible with Android and iOS devices, facilitating:

- Buying

- Selling

- Receiving

- Transferring funds

While Google Pay offers seamless transactions within the U.S., international transfers are limited. Google Pay excels in domestic transactions compared to Cash App but needs more global versatility. You must link Google Pay with a third-party app like Wise to access a broader range of international services.

Also Read: I Got Scammed on the Cash App. What Do I Do?

Play store ratings:

4.0star

1.02Cr reviews

100Cr+Downloads

Apple store ratings:

4.7 • 1.9M Ratings

7. Apple Pay

Apple Pay, designed for Apple lovers, offers a seamless payment experience without needing physical cards or cash. It’s widely accepted, including at some gas stations. Apple device owners can use it effortlessly as the software comes pre-installed.

Just link your credit or debit card to the built-in wallet on your Apple Watch, iPad, iPhone, or Mac. Apple Pay also features Apple Cash for money storage and payments to friends, family, and retailers. It provides an integrated, cardless payment solution tailored to Apple users compared to Cash App.

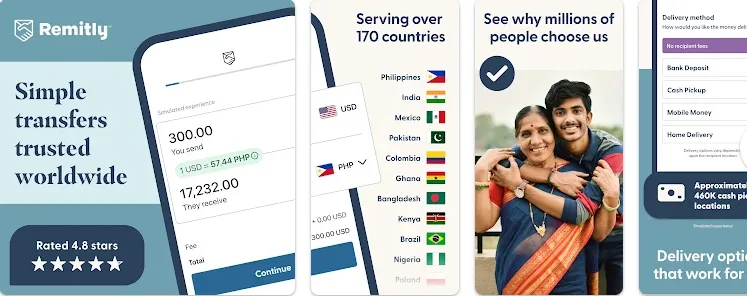

8. Remitly

Remitly, a versatile money transfer app, operates in over 145 countries, offering multiple transaction methods such as mobile payment, home delivery, bank deposit, and cash pickup.

Fees depend on the chosen method, typically under $4, though express or economy options may incur higher costs. Compared to Cash App, Remitly stands out with its extensive international reach and diverse transfer methods, catering to a wide range of global financial needs.

Play store ratings:

4.8star

808K reviews

10M+Downloads

Apple store ratings:

4.9 • 1.5M Ratings

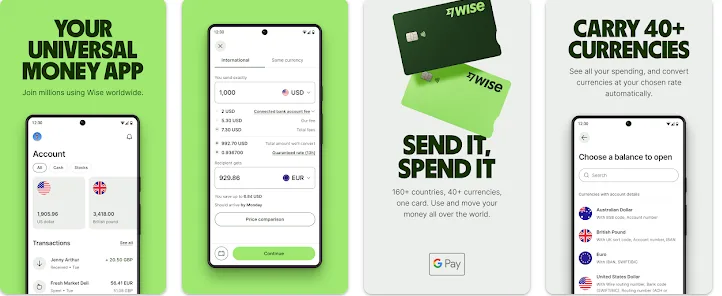

9. Wise

Wise streamlines fund transfers, addressing the common issue of delays in business transactions. Despite being relatively new, it has garnered a dedicated user base thanks to its innovative “Social Graph Technology.” Upon downloading the app, users input their preferred payment details, whether a bank account or credit card, and receive notifications via text or email upon fund receipt.

Wise operates seamlessly worldwide, providing real-time exchange rates without hidden fees for money transfers. Compared to Cash App, Wise excels in international transactions, offering transparency and convenience for businesses.

Play store ratings:

4.7star

852K reviews

10M+Downloads

Apple store ratings:

4.7 • 58.4K Ratings

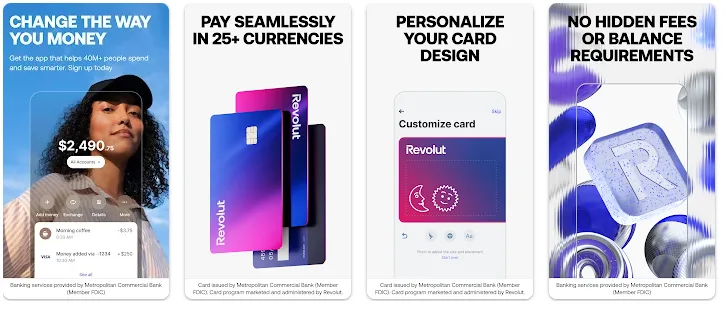

10. Revolut

Revolut, a top payment app since its inception in 2015, offers user-friendly and flexible banking services. Linked to the MasterCard contactless network, it enables fee-free transactions below specific thresholds based on the user’s location. Revolut excels in currency conversion, even for non-supported currencies, providing quick and hassle-free exchanges.

Additionally, it offers business accounts with competitive international card acceptance fees, catering to small business owners. Compared to Cash App, Revolut prioritizes global accessibility, seamless currency conversion, and versatility for personal and business use.

Play store ratings:

4.5star

2.75M reviews

10M+Downloads

Apple store ratings:

4.7 • 43.4K Ratings

11. Meta Pay

Meta Pay, formerly Facebook Pay, caters to Facebook users, especially those engaged in Facebook Marketplace. Here’s how it is a preferred Cash app alternative:

Platform Integration:

Seamlessly integrated within Facebook and Instagram, Meta Pay provides a free, user-friendly payment option for these platforms.

Secure Transactions:

All transactions are encrypted, prioritizing user data protection and privacy.

Messenger Convenience:

Users can make payments conveniently through Facebook Messenger.

Versatile Usage:

Meta Pay enables payments to private individuals and businesses, offering flexibility in transaction types.

Compared to Cash App, Meta Pay stands out for its platform-specific focus, serving the needs of those deeply involved in the Facebook ecosystem.

12. Zelle

Zelle, a free app, facilitates money transfers among users at various banks and credit unions. Users can send funds using a phone number or email via the mobile app or bank website. Zelle ensures quick transfers, typically within minutes, with added security measures.

Payment cancellations are possible for recipients not on Zelle. Compared to Cash App, Zelle focuses on interbank transfers and straightforward transactions with user-friendly features.

If a bank or credit union doesn’t support Zelle, the limit is $500. But don’t worry, there are apps like zelle with the same or much better features that you can try out.

Play store ratings:

4.0star

141K reviews

10M+Downloads

Apple store ratings:

4.8 • 529.9K Ratings

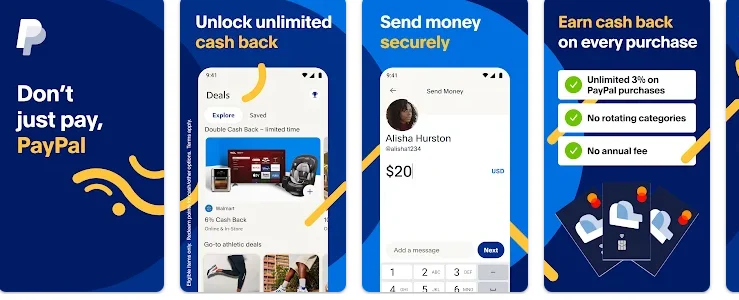

13. PayPal

PayPal excels in U.S. bank transfers, offers higher limits, and boasts broader international capabilities than Cash App. However, it may have limited access for some prepaid or online-only bank accounts.

Here are the reasons why it is one of the best Cash App alternatives:

- PayPal allows transactions up to $60,000.

- It offers dispute resolution and free transfers.

- Works on various devices and supports multiple recipients.

- Ideal for businesses with invoice tools.

- Users with PayPal Cash Cards have daily limits.

- Fees include 2.9% for credit card transfers.

- Security features like encryption and 24/7 monitoring.

Play store ratings:

4.3star

3.18M reviews

100M+Downloads

Apple store ratings:

4.4 • 16.2K Ratings

14. Incharge

Incharge is a compelling alternative to Cash App, offering users a robust platform for managing their finances. Incharge facilitates easy peer-to-peer payments, making it a versatile solution for personal and shared expenses. Focusing on financial wellness, it provides tools to:

- Track expenses

- Set savings goals

- Gain better control over money

Its user-friendly interface and commitment to financial education set it apart in the digital finance landscape, making it a valuable choice for those seeking a holistic approach to money management.

15. Chime

Chime is a popular online-only financial technology company that offers various banking services through its mobile app. It functions as an alternative to traditional banks, providing users with checking and savings accounts, debit cards, and other financial tools.

Key Features of Chime:

- No Monthly Fees: Chime doesn’t charge monthly maintenance fees, minimum balance fees, or overdraft fees.

- Early Direct Deposit: Get your paycheck up to two days early with direct deposit.

- SpotMe: Overdraft protection up to a certain limit without fees.

- High-Yield Savings Account: Earn a competitive interest rate on your savings.

- Fee-Free ATMs: Access a vast network of fee-free ATMs across the U.S.

- Mobile Check Deposit: Deposit checks directly through the app.

- Pay Friends Feature: Easily send and receive money from other Chime users.

- Credit Builder Card: Helps build credit history with responsible use.

You can transfer money from apps like cash app to chime within few minutes. That’s one of the highly used feature in this app.

Transferring Money from Cash App to Chime:

You can easily transfer money from Cash App to your Chime account using two methods:

- Direct Transfer (Linked Account): If you’ve linked your Chime account to Cash App, you can transfer money directly. In Cash App, go to your balance, select “Cash Out,” enter the amount, and choose Chime as the destination.

- Manual Transfer (Unlinked Account): If your Chime account is not linked, you can still transfer funds by using your Chime routing and account numbers. In Cash App, add your Chime bank details, and then follow the steps for a direct transfer.

Pros and Cons of Using Cash App

| Pros | Cons |

|---|---|

| Easily make and receive mobile payments | Low early limit for the first 30 days |

| Buy and sell Bitcoin and Simplifies reimbursements | Does not come with Federal Deposit Insurance Company (FDIC) coverage |

| No fee option to send and receive money and Invest in stocks with no commission fees | Cannot be used internationally |

Conclusion

While Cash App excels in certain aspects, its limitations necessitate exploring alternative options. Various payment apps like Cash app cater to specific financial needs and preferences. Look for the best Cash app alternatives for your financial needs and make an informed decision.

Whether you prioritize international accessibility, cost-effectiveness, or specialized features, these alternatives offer a comprehensive range of solutions.

By diversifying, you can tailor your digital finance experience to suit evolving needs, ensuring a robust and adaptable financial strategy in today’s dynamic landscape. Use Beem to get $5 – $1,000 instant cash advance for emergencies like paying bills, gas, groceries and medicines without any income restrictions, due dates, interest or credit checks!

Frequently Asked Questions About Apps Like Cash App

What is Cash App?

Cash App is a popular mobile payment service that allows users to send and receive money and make investments, among other features of financial management. It is popular for its user-friendly interface and quick transfers.

Why look for alternatives to Cash App?

While Cash App is widely used, some users may prefer alternatives due to different features, lower fees, better customer service, or additional financial services like savings or credit-building tools. Alternatives can offer unique benefits depending on your needs.

What are the top apps like Cash App?

Top alternatives include Venmo, PayPal, Zelle, Google Pay, Apple Pay, Revolut, Chime, and Wise.

Which alternative offers the best peer-to-peer payments?

Venmo and PayPal are popular peer-to-peer payment platforms, offering free transfers between users with options to link bank accounts or debit/credit cards.

Which alternative to Cash App is best for budgeting and saving?

Venmo and PayPal are popular peer-to-peer payment platforms, offering free transfers between users with options to link bank accounts or debit/credit cards.

Are there fees involved with alternatives to Cash app?

Fees can vary by alternatives to Cash App. For instance, Venmo and Zelle offer free transactions between friends, but charge fees for instant transfers or using credit cards.

How secure are Cash App alternatives?

Most Cash App alternatives like Beem, PayPal, Venmo and Chime, use advanced encryption methods to protect users’ personal and financial information. So, ensure to use official apps and keep your account information secure to prevent fraud.