Online installment loans provide a convenient financial solution for individuals needing immediate funds. These loans permit borrowers to repay the amount borrowed in fixed installments over a specified period. With an easy online application process, borrowers can access quick approval and flexible repayment terms.

This lending option helps manage unexpected expenses or make significant purchases while spreading the financial burden over time. You can use the Beem app to obtain the best offers on personal loans. Find out where to get the best online installment loan in Arizona.

Best Online Installment Loan in Arizona

In Arizona, online installment loans offer residents a reliable financial resource. These loans enable borrowers to access funds swiftly, with the convenience of flexible repayment schedules. A curated list of Arizona’s top Online Installment Loan providers is available for those seeking the best options, ensuring a seamless borrowing experience tailored to individual needs.

Lendingclub

LendingClub is Arizona’s top choice for online installment loans, catering to borrowers with bad-to-fair credit. With loan amounts reaching $40,000 and APRs as low as 9.57%, it offers a swift funding process within four business days. While accommodating co-applicants and allowing long-term visas, LendingClub’s 3% – 8% origination fee and potential APRs up to 35.99% should be considered.

Citi® Personal Loan

Citi personal loans emerge as the ideal choice for Arizona residents seeking online installment loans, especially those with excellent credit aiming to consolidate debt at a lower interest rate. With generous loan amounts up to $30,000, extended payoff periods of 12 – 60 months, and the absence of origination and prepayment fees, Citi provides a favorable financial solution.

Axos Loan

Axos Bank is a premier choice for Arizona residents seeking online installment loans, catering to those with good or excellent credit. With a favorable APR range of 6.79% – 21.99%, loan terms spanning 36-72 months, and quick nationwide funding, Axos Bank provides a reliable financial solution. Although a potential origination fee of up to 2% exists, the bank’s same-day approval and funding add to its appeal, making it a top pick for borrowers with a minimum credit score of 720.

Upstart Loan

Upstart is the preferred choice for Arizona residents seeking online installment loans, especially those with fair-to-good credit. Offering loans ranging from $1,000 to $50,000, Upstart impresses with low APRs of 4.6% – 35.99%, accommodating a broad credit score range starting at 300 in most states. While featuring high customer satisfaction and no prepayment fees, applicants should note the potential 0% – 12% origination fee. With quick approvals and funds available in as little as one business day, Upstart provides a compelling borrowing option.

Sofi Loan

SoFi is the top choice for Arizona residents seeking online installment loans, especially those with good-to-excellent credit. With some of the market’s lowest interest rates ranging from 8.99% to 25.81%, SoFi offers substantial loans up to $100,000. Boasting flexible terms of 24 – 84 months and no origination fees, it stands out for debt consolidation. While a credit score 680+ is required, the quick decision process (2-4 business days) and the co-applicant option make SoFi an excellent borrowing solution.

Arizona Lending Laws

Arizona lending laws govern various aspects of borrowing and lending within the state. Usury laws cap interest rates to protect consumers, and Arizona law dictates specific regulations for payday loans, title loans, and installment loans. Borrowers are afforded certain rights and disclosures, ensuring transparency and fair lending practices. To maintain Arizona’s balanced and regulated financial landscape, lenders and borrowers must adhere to these laws.

Other Considerations

When navigating financial decisions, it’s essential to consider factors beyond interest rates and loan amounts. Other crucial considerations include:

- Fees: Scrutinize origination fees, late payment charges, and hidden costs.

- Repayment Terms: Assess the flexibility of repayment schedules and penalties for early payments.

- Customer Service: Evaluate the lender’s reputation for responsive and reliable customer support.

- Credit Impact: Understand how the loan may impact your credit score and future financial standing.

- Reviews and Ratings: Research customer reviews and ratings for insights into the lender’s reliability and satisfaction.

Installment Loans Alternative – Use Instant Cash Advance App

Exploring installment loan alternatives like instant cash advance apps offers quick financial relief without the complexities of traditional borrowing. These apps provide accessible, on-demand funds, empowering users to manage urgent expenses conveniently and efficiently.

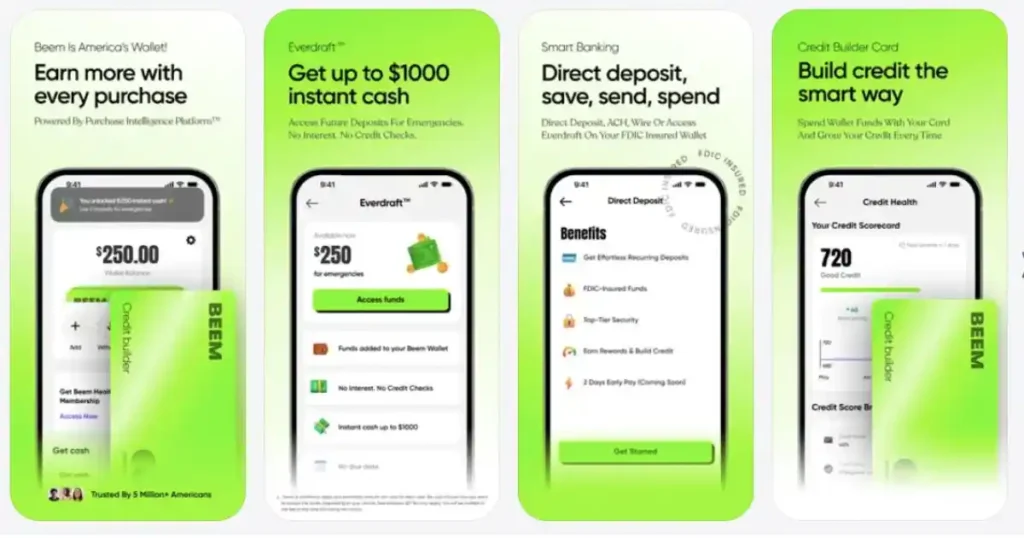

Beem

Beem is an innovative installment loan alternative, offering instant cash advances with no income restrictions, tips, or credit checks. Formerly known as Everdraft, Beem provides users aged 18 and above in the United States with quick access to $5 – $1,000 for emergencies. With a proprietary algorithm, Beem evaluates factors like bank balance, transaction history, and spending habits, ensuring a convenient and transparent borrowing experience without additional fees, interest, or impact on credit scores.

Dave

Dave emerges as a reliable installment loan alternative, providing quick access to up to $500 within 5 minutes or less. With no interest or late fees, users can settle later. Boasting 5 million members who’ve collectively taken 71 million advances, Dave offers financial management tools like the Dave Spending account for controlled spending, cashback rewards, and a Goals account with a 4.00% APY.

Additionally, Dave presents various earning opportunities, including instant-paying surveys and hassle-free job applications through their Side Hustle board. With FDIC insurance and a dedicated support team, Dave prioritizes users’ financial well-being.

Klover

Klover revolutionizes the instant cash advance experience, offering up to $200 with zero interest or late fees. Users can sign up within seconds, connect their bank accounts for seamless transactions, and access funds regardless of their payday timeline.

Klover incentivizes financial responsibility through points earned for surveys and ads, which can be redeemed for more significant advances or entered into daily sweepstakes. With a data privacy and security commitment, Klover ensures encrypted protection, allowing users to leverage their data for personalized financial tools.

Albert

Albert provides a convenient installment loan alternative with its “Instant” feature, offering cash advances of up to $250. By setting up a direct deposit and demonstrating 60 days of steady income from the same employer, users qualify for up to three interest-free advances per pay period. The optional “Genius” premium membership at $96 per year unlocks additional features, making Albert a flexible and accessible financial tool for users seeking quick cash without interest or late fees.

Payactiv

Payactiv shines as a leading installment loan alternative, embracing the Earned Wage Access model to provide users instant access to earned wages. Users can access their money immediately with no interest charges, offering financial flexibility without the pitfalls of traditional payday loans. Payactiv’s solution includes innovative budgeting tools, early access to funds, and additional features like sending money to friends. As a Certified B-Corp, Payactiv prioritizes users’ financial well-being, promoting sustainable economic prosperity.

Comparing Installment Loan And Instant Cash App

Comparing installment loans and instant cash apps reveals distinct approaches when managing unexpected expenses. Understanding their differences ensures you make informed financial decisions.

Installment Loan:

Installment loans offer a structured repayment plan, providing a lump sum with fixed monthly payments and interest rates. Ideal for more considerable expenses, they allow borrowers to budget over time but may involve credit checks and accrued interest.

Instant Cash App:

Instant cash apps provide quick, small-dollar advances on earned wages without interest or credit checks. Offering immediate access to funds, they cater to urgent needs, promoting financial flexibility but with potential usage fees and limits.

Benefits Of Cash App

Cash apps bring unparalleled convenience and financial flexibility to modern life:

- Instant Access: Gain immediate access to funds, eliminating the wait associated with traditional banking.

- Budget Management: Facilitate effective budgeting with real-time insights into spending habits.

- Security Measures: Enjoy encrypted transactions and fraud protection, ensuring a secure financial experience.

- No Credit Checks: Escape the hassle of credit checks, making cash apps accessible to a broader user base.

Compare Installment Loans In Arizona

Securing the best installment loan in Arizona requires strategic planning and informed choices.

- Research Lenders: Explore reputable lenders with positive reviews.

- Compare Rates: Scrutinize interest rates for the most favorable terms.

- Check Terms: Ensure flexible repayment options that suit your budget.

- Review Fees: Be aware of any hidden fees to avoid surprises.

- Verify Requirements: Confirm eligibility criteria to streamline the application process.

Tips For Getting The Best Installment Loan In Arizona

Securing the best installment loan in Arizona demands strategic considerations.

- Research Lenders: Explore trustworthy options with positive reviews.

- Compare Rates: Scrutinize interest rates for favorable terms.

- Check Terms: Prioritize flexible repayment plans aligned with your budget.

- Review Fees: Be aware of any hidden charges to avoid surprises.

- Confirm Eligibility: Ensure you meet all requirements for a streamlined application.

Is An Arizona Personal Loan Right For You?

Whether an Arizona personal loan is right depends on your financial needs and circumstances. Assess factors like interest rates, repayment terms, and eligibility criteria. Personal loans can be suitable for consolidating debt, covering unexpected expenses, or financing major purchases, offering flexibility when managed responsibly. Consider your financial goals before committing.

Conclusion

Arizona residents seeking financial solutions have diverse options, from trusted online installment loans like LendingClub, Citi, Axos, Upstart, and SoFi to innovative instant cash advance apps such as Beem, Dave, Klover, Albert, and Payactiv.

Understanding lending laws, considering various factors, and exploring alternatives empower individuals to make informed choices for their unique financial needs. Choose wisely based on your circumstances to navigate Arizona’s diverse landscape of installment loans and instant cash apps.

FAQs

Can you get installment loans in Arizona?

Yes, residents of Arizona can access installment loans, providing a flexible and structured borrowing option.

What is the most accessible installment loan to get approved for?

Online installment loans from platforms are known for their accessibility, offering quick approvals and accommodating a broad credit score range, making them relatively easy to get approved for.