When you depend on gratuities, financial stability can feel like a gamble—a slow night, a canceled shift, or an unplanned expense can throw everything off. But what happens when you need emergency cash for restaurant workers—right now?

Financial uncertainty is a daily reality for those in the service industry. Unlike salaried employees with predictable paychecks, servers, bartenders, and kitchen staff rely on fluctuating tips that change with the seasons, weather, customer traffic, and the economy. This income volatility makes it difficult—sometimes impossible—to build savings or budget for sudden emergencies.

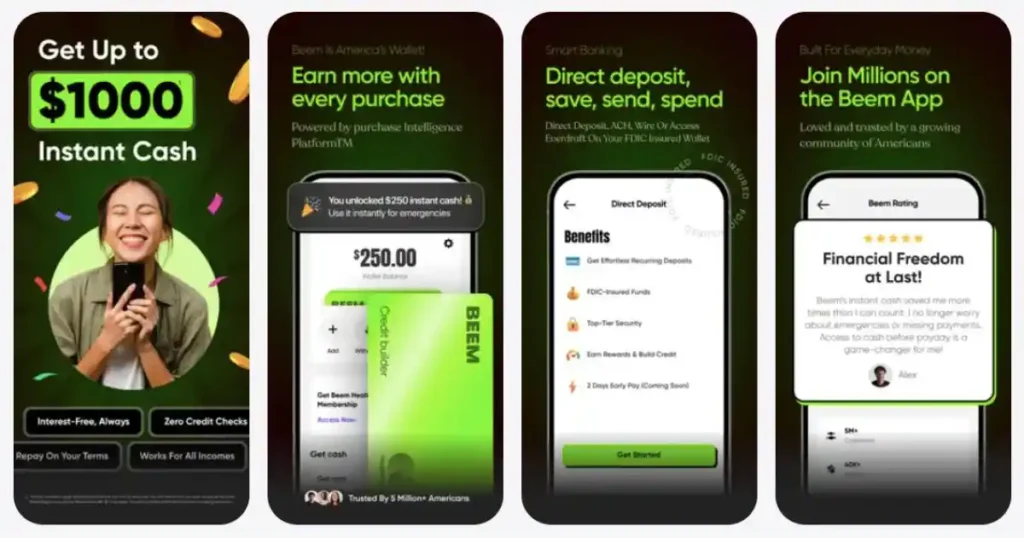

Finding emergency funds might be difficult when an unanticipated need shows up—a car repair, medical bill, rent payment, or even an impromptu flight to see family. Here is where Beem’s Everdraft finds application. From $10 to $1,000, Beem offers quick cash advances free of credit checks, interest rates, or strict due dates.

This service is dependable and readily available for restaurant employees in financial crises. Beem lets you receive the money free from late penalties or excessive interest loans.

The Financial Struggles of Restaurant Workers: Living Tip to Tip

The Challenges of Earning a Living Through Tips

Earning a living through tips presents a unique financial challenge for restaurant workers. Unlike salaried employees, whose incomes remain stable, tipped workers face fluctuating earnings that depend on customer generosity, seasonal trends, and overall business volume. This uncertainty makes budgeting difficult, often leaving workers struggling to meet their financial obligations.

A slow night or unexpected shift cut can disrupt an entire week’s income. Furthermore, tips are not always predictable, and external factors such as bad weather, economic downturns, or poor tipping habits can severely impact earnings. This financial instability forces many workers to seek emergency cash solutions.

Fluctuating Income and Unpredictable Earnings

The inconsistent character of their income is one of the toughest challenges restaurant employees face. Unlike salaried workers who get a set compensation, restaurant employees’ income relies on several outside elements:

- Customer Traffic: A sluggish night results in fewer customers and fewer tips. Though earnings might be substantial on a busy night, the unpredictability makes budgeting challenging.

- Seasonal Trends: Earnings may be intense during holidays and peak seasons, but they may drop in sluggish months, which causes financial problems.

- Shift Variability: Workers lose revenue for that day when management chooses to decrease shifts owing to low demand, making it more challenging to pay daily expenses.

- Tipping Culture: Not every customer tips generously; others may not tip at all, thereby leaving employees with significantly less than anticipated.

Inflation and economic downturns can directly influence consumer purchasing, and this volatility makes building funds or making financial plans challenging. Many restaurant employees find themselves haggling for money when an emergency expense arises.

Lack of Employer Benefits and Financial Support

Many restaurant employees cannot afford to take a day off, even when unwell, as missing a shift results in lost income. Unlike salaried workers who may receive paid sick leave, restaurant employees often have to choose between their health and financial stability. This can lead to employees working while ill, potentially worsening their condition and spreading illness in the workplace.

- Many service sector employees do not receive employer-sponsored health benefits, forcing them to pay for medical expenses out of pocket. Without access to affordable healthcare, minor illnesses or injuries can become significant financial burdens. Some workers avoid seeking medical care altogether due to cost concerns, which can have long-term consequences for their health.

- Most restaurant employees lack access to pension plans or employer-sponsored 401(k) programs, which challenges their long-term financial security. Unlike corporate jobs, which offer retirement contributions and matching programs, restaurant workers often have to rely on their savings, which is challenging to maintain with inconsistent earnings. The absence of structured retirement planning leaves many workers vulnerable in their later years.

- Additionally, many restaurant employees receive their schedules with little notice, sometimes just days or hours in advance. This unpredictability makes it difficult to make financial plans beforehand, as they cannot rely on a stable paycheck. The lack of consistent scheduling prevents them from taking on additional work, arranging childcare, or managing other financial responsibilities.

Without these safety nets, restaurant employees are left to fend for themselves in crises, sometimes resorting to costly financial solutions that can set off debt cycles. High-interest payday loans, credit card debt, and borrowing from friends or family become standard solutions, further exacerbating financial instability.

Why Restaurant Workers Need Access to Emergency Cash

Unlike many salaried jobs, restaurant work typically lacks essential benefits such as:

- Paid sick leave: Many restaurant workers cannot afford to take a day off, even when ill, because missing a shift means losing income.

- Health insurance: Out-of-pocket medical expenses can be overwhelming, and many service industry workers do not receive employer-sponsored health benefits.

- Retirement savings: Most restaurant workers cannot access employer-sponsored 401(k) plans or pensions, challenging long-term financial security.

- Unpredictable scheduling: Many restaurant workers receive their schedules on short notice, making it hard to plan financially.

Without these safety nets, restaurant workers are left to fend for themselves in emergencies, often turning to expensive financial solutions that can lead to debt cycles. This constant cycle of financial strain underscores the need for accessible and flexible emergency cash solutions like Beem’s Everdraft™ to provide relief in times of need.

Why Beem’s Everdraft™ is a Lifeline for Restaurant Workers?

For restaurant employees who sometimes have unpredictable incomes, Beem provides quick cash advances that offer vital financial relief. Unlike conventional financial solutions, Beem’s Everdraft guarantees quick and hassle-free access to emergency money, which demands copious documentation, credit checks, or employer involvement.

- A short-term cure

Whether covering utilities, rent, or an unexpected auto repair, Beem offers quick assistance without the hassle of drawn-out loan applications or approval delays. Workers who pay the most can get it fast, with late fees or service interruptions.

- No interest, hidden fees, or debt traps

Beem’s EverdraftTM works honestly, unlike payday loans with outrageous interest rates and hidden expenses. There are no compounding interest rates or unanticipated charges; hence, workers can borrow without worrying about starting a debt spiral.

- Flexible repayment options

Beem knows that restaurant employees have erratic wages; hence, repayment is meant to be stress-free. No late fines, no set due dates, and no pressure from conventional lending organizations characterize this approach. Users can repay quickly, preserving financial stability and being free from extra debt.

- Instantaneous access to emergency funds

When financial crises strike, waiting to pay cheque deposits or employer-backed advances is not always a choice. Beem lets restaurant employees access the money right now to cover pressing needs without delay.

The procedure offers some financial freedom and discretion since it does not depend on employer approval. For restaurant employees living on a tip, Beem provides much-needed financial consistency in harsh conditions.

Whether dealing with an unanticipated medical bill, rent shortfall, or daily living expenses, Beem’s EverdraftTM guarantees that service industry employees have a dependable and moral way out of financial problems, enabling them to survive without turning to predatory lenders or high-interest credit options. Beem provides quick cash advances with features including:

- A quick way to meet unexpected needs without the fuss of a loan application.

- Unlike payday loans, there is no interest or hidden costs, so debt building is not possible.

- Repay when you can, stress-free and without the pressure of traditional lenders.

- Instant access to funds without the requirement for employer approval or engagement.

How Restaurant Workers Can Get Emergency Cash Fast?

Understanding Emergency Cash Advances

When someone lacks quick access to money, an emergency cash advance is a temporary financial fix meant to help address pressing needs. Unlike conventional loans, cash advances are fast, flexible, and require a credit check.

Emergency cash advances are vital for those working in restaurants since:

- They guarantee timely payment of bills and offer instant relief between pay cycles.

- They help avoid overdraft fees, late payments, and utility shutoffs, which can increase financial difficulty.

- They relieve the tension of borrowing from friends or relatives, impairing personal connections.

- They stop credit card users from needing high-interest payday loans or cash advances.

Though not a long-term financial fix, a cash advance might be a vital lifeline under trying circumstances.

The Unique Financial Challenges of Restaurant Workers

Daily Income Variability

The daily income of a restaurant employee can vary greatly. _ While a slow Monday lunch might produce $30, a Friday night duty could bring in $300 in tips. This inconsistency makes plans for constant expenses like utilities, auto payments, and rent difficult.

Limited Access to Traditional Banking Solutions

Many people employed in restaurants either:

- Don’t have a bank account – Direct deposit and online loan access are challenging.

- Have a low credit score – Approval of credit cards and personal loans presents difficulties.

- Cash payments – This complicates financial planning and budgeting.

- Lack of credit history – A lack of credit history makes it difficult to qualify for credit alternatives in a financial crisis.

High Risk of Unexpected Expenses

Financial crises can strike anytime, from a car breaking down to a last-minute rent increase. Regretfully, these unexpected expenses might be catastrophic since restaurant employees survive by having immediate cash flow.

Expanding the Discussion on Emergency Cash Needs

Alternative Financial Solutions for Restaurant Workers

1. Leveraging Friends and Family

Although leveraging close friends seems like a simple fix, there are possible drawbacks:

- Should payments be postponed, relationships might be strained.

- It is not always a good choice since loved ones do not have additional money.

- Ignorance of formal agreements could cause misinterpretation.

2. Payday Loans and High-Interest Lending

Many employees of restaurants opt for payday loans. However, these carry significant hazards:

Extremely high interest rates—sometimes exceeding 400% APR.

- Often, short payback times cause a loop in borrowing.

- Hidden costs that, over time, raise the total owed.

3. Credit Cards and Overdraft Protection

While some employees of restaurants utilize credit cards in case of an emergency, this presents some difficulties:

- High interest rates should the sum remain unpaid as a whole.

- Quick accumulation of overdraft fees might cause more serious financial troubles.

- It calls for a good credit score, which not all restaurant employees possess.

Common Questions About Emergency Cash for Restaurant Workers

How much money can I get with Beem’s Everdraft™?

With Everdraft™, you can instantly access between $10 and $1,000, depending on your eligibility. Beem’s system evaluates your financial habits—not your credit score—so you can get the help you need, when you need it most.

Do I need a credit check to qualify?

No credit check required. Beem doesn’t rely on traditional credit reports or income verification. Your financial freedom shouldn’t be limited by outdated systems.

How fast can I get my cash advance?

Get your cash immediately after approval. No long waits, no hoops to jump through—just quick and easy access to the money you need.

Do I have to pay back the cash advance by a specific date?

No due dates, no pressure. Pay back your cash advance on your own terms. Beem is designed to support your financial flow, not stress you out.

Is Beem better than payday loans?

Absolutely. Beem is everything payday loans aren’t. You’ll never pay interest, face hidden fees, or get trapped in a cycle of debt. With Beem, it’s transparent, fair, and built to empower—not exploit.

Conclusion: A Reliable Solution for Financial Stability

Beem’s Everdraft™ provides an efficient, transparent, and stress-free way for restaurant workers to access emergency cash. With no credit checks, no interest, and flexible repayment terms, it offers a much-needed financial safety net in an unpredictable industry.Need emergency cash now? Sign up for Beem and get instant access to Everdraft™—your financial safety net for unexpected expenses! Download the app here.