Mobile banking apps have become the primary way Americans manage their money. By 2026, these apps are no longer limited to checking balances or transferring funds.

They now offer early paycheck access, high-yield savings, budgeting tools, credit monitoring, investing features, and real-time financial insights all from a smartphone.

With so many options available, choosing the right mobile banking app can feel overwhelming. Some apps are built for saving aggressively, others focus on avoiding fees, while a few aim to replace an entire financial ecosystem. The best choice depends on how you earn, spend, save, and plan your money.

This guide covers the 10 best mobile banking apps of 2026 for U.S. users, explaining what each app does well, who it’s best for, and how it compares to traditional banks.

What Makes a Mobile Banking App Best in 2026

Not all mobile banking apps offer the same value. The strongest platforms in 2026 share a few important qualities.

First, they minimize or eliminate fees. Monthly maintenance fees, overdraft penalties, and ATM charges can quietly drain your account. Top apps reduce or remove these costs altogether.

Second, they focus on speed and flexibility. Features like early direct deposit, instant transfers, and real-time alerts help users stay in control of their cash flow.

Third, they offer smart tools rather than basic access. Budget tracking, automated savings, spending insights, and credit monitoring have become expected features, not bonuses.

Finally, the best cash advance apps provide strong security, clear interfaces, and reliable customer support. A banking app should feel simple to use without sacrificing protection.

10 Best Mobile Banking Apps for 2026

1. Chime

Chime continues to rank as one of the most widely used mobile banking apps in the United States, and in 2026, it remains a top choice for everyday banking.

Chime is built around a no-fee philosophy. There are no monthly maintenance fees, no minimum balance requirements, and no hidden charges that surprise users later. This alone makes it appealing to millions of Americans who want straightforward banking.

One of Chime’s most popular features is early direct deposit. Eligible users can receive their paycheck up to two days early, which can make a real difference when managing bills or unexpected expenses.

Chime also offers automatic savings tools. Round-ups move spare change from purchases into savings, helping users build balances gradually without changing spending habits. The app includes real-time transaction alerts and balance notifications that make it easy to track money as it moves.

Chime is best for people who want simple, fee-free mobile banking with strong budgeting support and early paycheck access.

2. Ally Bank

Ally Bank is known for its competitive interest rates and strong digital banking experience. In 2026, it continues to lead in savings-focused mobile banking.

Ally’s savings accounts typically offer higher interest rates than traditional brick-and-mortar banks. This makes it a solid option for users who want their money to grow while remaining accessible.

The Ally mobile app allows users to manage checking, savings, and certificates of deposit in one place. The interface is clean and easy to navigate, even for users who are not tech-savvy.

Another standout feature is Ally’s “buckets” tool. It allows users to divide savings into different categories, such as emergency funds, travel, or large purchases, without opening multiple accounts.

Ally is ideal for users who prioritize saving, want strong interest rates, and prefer a fully online banking experience without physical branches.

3. Capital One Mobile

Capital One blends the reliability of a major U.S. bank with a modern mobile experience. For users who want a familiar institution without outdated technology, Capital One is a strong option.

The Capital One mobile app provides access to checking, savings, credit cards, auto loans, and credit monitoring tools. Users can manage nearly all aspects of their finances in one place.

Capital One does not charge monthly fees on many of its checking and savings accounts. It also offers a large fee-free ATM network across the United States.

The app includes spending summaries, customized alerts, and bill reminders. Security features such as biometric login and instant card lock add peace of mind.

Capital One is best for users who want a full-service bank with both digital convenience and optional in-person support.

4. SoFi

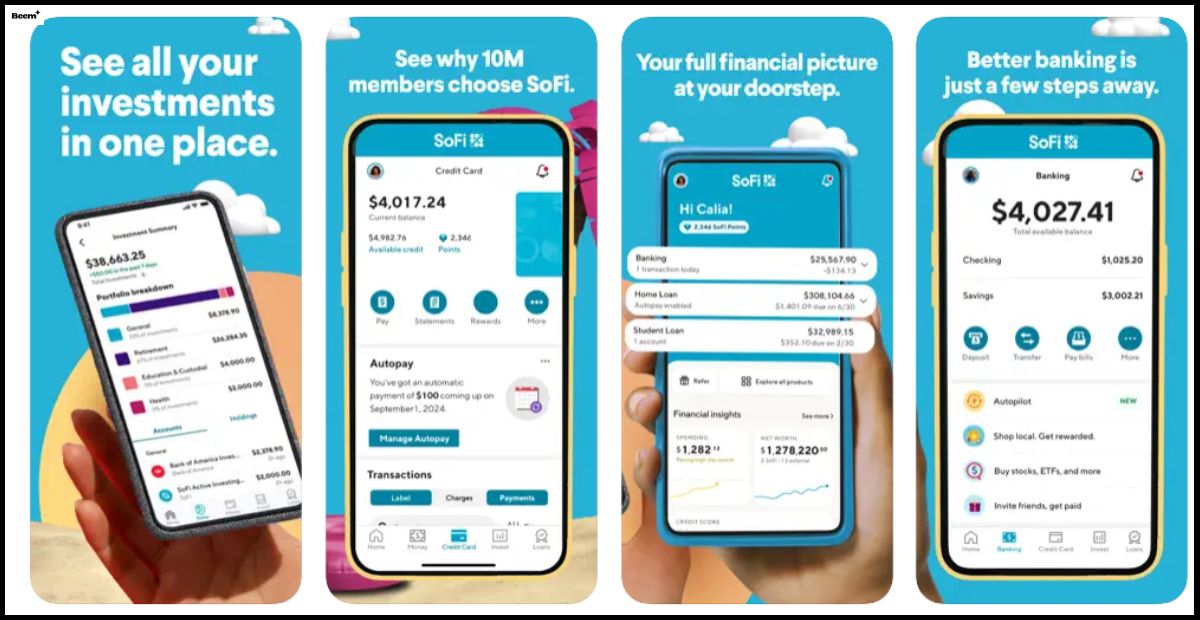

SoFi has grown into a broad financial platform, and its mobile banking app reflects that expansion. In 2026, SoFi remains a top choice for users who want banking, saving, and investing under one roof.

SoFi’s checking and savings accounts offer competitive interest rates and no account fees. Users can earn cash-back rewards on debit card purchases and receive early access to paychecks through direct deposit.

One of SoFi’s biggest advantages is integration. From the same app, users can invest in stocks and ETFs, track credit scores, refinance loans, and access financial education tools.

SoFi is well-suited for professionals and higher earners who want a single app to manage daily banking and long-term financial planning.

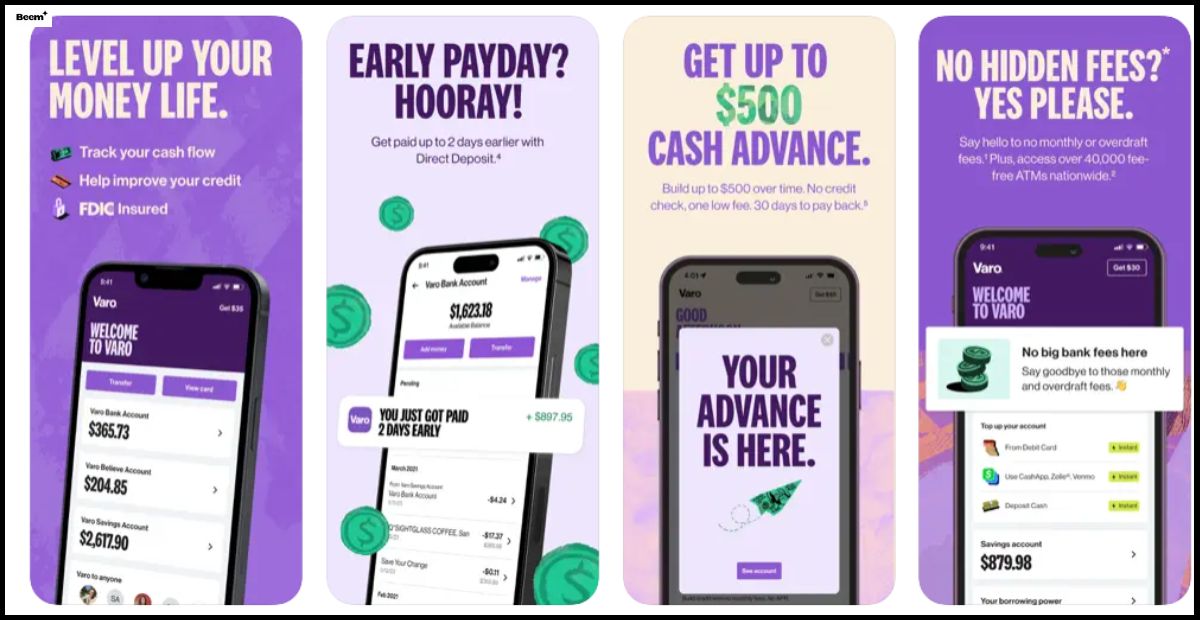

5. Varo Bank

Varo Bank focuses on helping users manage cash flow and grow savings without relying on fees or credit-based products.

Varo offers early direct deposit, allowing eligible users to receive paychecks up to two days early. The app also includes automatic savings tools that move money into savings based on user-defined rules.

Varo’s savings account often provides higher interest rates when certain activity requirements are met, encouraging consistent usage and responsible money management.

The app’s interface is straightforward, with clear spending breakdowns and balance updates. There are no monthly fees, minimum balance requirements, or overdraft penalties within set limits.

Varo is best for users who want help staying on budget and getting paid faster without complicated features.

6. Discover Mobile Banking

Discover is best known for its credit cards, but its mobile banking app has become increasingly competitive.

Discover’s checking account offers cash back on debit card purchases, which is uncommon among banks. Users also benefit from no monthly fees and no minimum balance requirements.

The Discover mobile app includes spending insights, bill pay, and account alerts. Its customer support is consistently rated highly, which adds confidence for users who value service.

Discover’s savings accounts also offer competitive interest rates, making it a solid option for users who want checking and savings together.

Discover is ideal for users who value strong customer service and want to earn rewards on everyday spending.

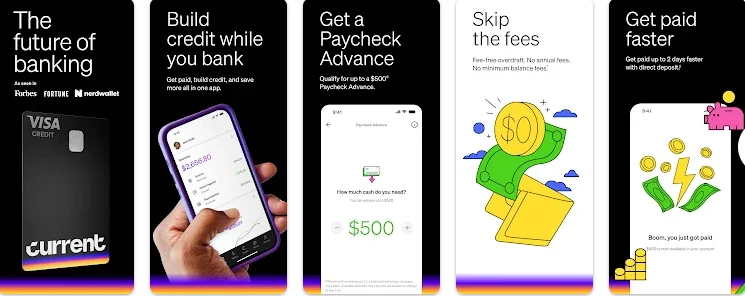

7. Current

Current is designed for people with irregular income, such as gig workers, freelancers, and hourly employees.

The app offers early direct deposit, real-time spending notifications, and instant balance updates. These features are especially useful for users who need to track cash flow closely.

Current also provides budgeting tools that categorize spending automatically. Some plans include fee-free overdraft protection within limits.

The app’s interface is modern and easy to understand, with clear visuals that show where money is going.

Current is best for people who rely on flexible income and need real-time insight into their finances.

8. Axos Bank

Axos Bank is a fully online bank that focuses on eliminating common banking fees.

Axos offers checking and savings accounts with no monthly maintenance fees and no minimum balance requirements. Many accounts include unlimited domestic ATM fee reimbursements.

The Axos mobile app supports mobile check deposit, bill pay, transfers, and account alerts. While the design is more practical than flashy, it is reliable and functional.

Axos also provides access to investment and lending products, making it a good choice for users who want a traditional online banking structure without physical branches.

Axos is best for users who want fee-free banking and wide ATM access.

9. Wells Fargo Mobile

Wells Fargo has invested heavily in improving its mobile app, making it a solid option in 2026 for existing customers.

The Wells Fargo mobile app allows users to manage checking, savings, credit cards, mortgages, and loans in one place. Features include bill pay, Zelle transfers, and customizable alerts.

Security tools such as biometric login and fraud monitoring are built into the app. Wells Fargo also offers extensive branch and ATM access across the country.

While Wells Fargo accounts may include more fees than online-only banks, customers who value physical locations may find the trade-off worthwhile.

Wells Fargo Mobile is best for users who already bank with Wells Fargo and want a reliable digital experience.

10. Bank of America Mobile Banking

Bank of America’s mobile app is designed for users who want access to a broad financial ecosystem.

The app supports checking, savings, credit cards, investments, and retirement accounts. Users enrolled in the Preferred Rewards program can earn higher rewards and fee discounts.

Bank of America’s mobile app includes spending analysis tools, budgeting insights, and real-time alerts. It also integrates seamlessly with Zelle for peer-to-peer payments.

Like Wells Fargo, Bank of America is better suited for users who want both digital and in-person banking options.

Bank of America Mobile Banking is best for customers who want rewards, investment integration, and nationwide branch access.

How to Choose the Right Mobile Banking App

Choosing the best mobile banking app depends on how you use your money.

If avoiding fees is your priority, apps like Chime, Varo, and Axos are strong choices. If you want high-yield savings, Ally and SoFi stand out. For full-service banking with branches, Capital One, Wells Fargo, and Bank of America offer reliable options.

It’s also important to consider how often you need customer support, whether early paycheck access matters to you, and how much value you place on budgeting and financial insights.

Many Americans use more than one app, pairing a daily spending account with a high-yield savings option.

Final Thoughts on the Best Mobile Banking Apps of 2026

Mobile banking apps in 2026 offer more power, flexibility, and transparency than ever before. Whether you’re managing everyday expenses, building savings, or planning for the future, the right app can simplify your financial life.

The best mobile banking apps for the USA focus on low fees, smart features, strong security, and easy-to-use design. By choosing an app that fits your habits and goals, you can take better control of your money without relying on outdated banking systems.