Table of Contents

Financial anxiety is more common than ever, and it has little to do with how disciplined or hardworking you are. Rising living costs, unpredictable income, debt, and timing gaps between bills and paychecks all create real emotional strain. When money feels uncertain, it’s easy for fear and self-doubt to take over. But sometimes, the breakthrough doesn’t start with earning more or cutting everything out of your budget. It starts with shifting your mindset.

A positive money mindset doesn’t mean ignoring real financial challenges. It means changing how you relate to money, reducing shame, releasing pressure, and building emotional resilience so you can make healthier decisions without fear. And when mindset shifts are paired with supportive tools like Beem’s Smart Wallet and Everdraft™, your clarity and confidence grow even stronger.

Here are 10 powerful mindset shifts that can lower anxiety, improve your financial habits, and help you build a healthier, more empowered relationship with money.

1. Shift From Shame to Self-Compassion

Financial anxiety grows in silence and shame, but compassion creates space for progress. When you stop blaming yourself, your mind becomes clearer and more open to realistic solutions. Compassion helps you step out of survival mode and into problem-solving mode, where you can actually make changes instead of feeling stuck.

Why This Shift Matters

Many people believe their financial struggles are personal failures, when they’re usually the result of external factors like inflation, rising rent, or uneven pay cycles. Self-compassion helps you separate your identity from your circumstances, reducing guilt and emotional paralysis. When you treat yourself with kindness, you’re more open to problem-solving and less likely to spiral into avoidance. This shift builds emotional resilience, which is essential when navigating financial uncertainty.

2. Shift From Perfectionism to Progress

You don’t need to be perfect with money. You just need to get a little better over time. This shift reminds you that even imperfect steps count, because consistency matters more than rigid rules. When progress becomes the goal, setbacks stop feeling like failures and become part of your learning curve.

Why This Shift Matters

Perfectionism creates unrealistic expectations and often leads to giving up entirely after one misstep. Instead of striving for flawless budgeting, focus on small improvements that accumulate over time. A single payment made on time, a subscription canceled, or a $10 saving is still movement in the right direction. Progress keeps you motivated, while perfectionism leads to burnout.

3. Shift From Fear of the Unknown to Predictability and Clarity

Anxiety thrives in uncertainty, and clarity reduces fear. Predictability lets your nervous system relax because it knows what to expect instead of bracing for the worst. When you can see your financial path clearly, your decisions become more confident and less reactive.

Why This Shift Matters

When you don’t know what your finances will look like next week, everything feels urgent. Predictability softens this stress by giving your mind structure and expectation. Tools like Beem’s Smart Wallet forecast your cash flow, show upcoming bills, and highlight future tight spots, giving you clarity instead of chaos. Understanding what’s ahead brings instant emotional relief.

4. Shift From Avoidance to Awareness

Ignoring money problems doesn’t protect you, it amplifies anxiety. Awareness gives you back your power by showing you what needs attention and what doesn’t. This shift helps you build healthier habits over time because you’re addressing reality, not running from it.

Why This Shift Matters

Avoidance is a common coping mechanism when finances feel overwhelming, but it creates more stress in the long run. Awareness helps you make decisions with confidence because you actually know what’s going on. Checking your balance, reviewing expenses, or planning ahead becomes less scary when approached gently and regularly. Awareness is the foundation of financial peace, even if the numbers aren’t perfect yet.

5. Shift From Crisis Mode to Planning Mode

You can’t build financial stability when you’re always reacting. Planning mode creates mental space and emotional steadiness by giving you direction instead of chaos. Even simple planning reduces stress because it tells your brain, “I know what I’m doing next.”

Why This Shift Matters

Crisis mode drains your emotional energy and makes it harder to think clearly. Planning mode, even in small doses, gives you structure and reduces last-minute panic. Predictive budgeting tools like Beem help you move into planning mode by showing you your upcoming financial landscape. When you anticipate instead of react, anxiety becomes easier to manage.

6. Shift From “I Can’t Save” to “I Can Start Small”

Saving doesn’t need to be huge to make a difference. This mindset shift makes saving feel accessible instead of overwhelming, which encourages consistency. When you start small, you train your brain to feel capable, and capability builds confidence.

Why This Shift Matters

People often believe they can’t save unless they can save a lot, which keeps them from saving at all. Micro-saving, even $1 or $3 at a time, builds confidence and creates a safety cushion over time. Small savings reduce stress by giving you something to fall back on. Starting small removes the emotional pressure and makes saving achievable.

7. Shift From Comparing Yourself to Others to Comparing Yourself to Your Past Self

Comparison steals peace, but self-reflection builds motivation. Looking inward shows you real progress that social media could never measure accurately. This shift keeps you grounded in your own journey rather than someone else’s curated highlight reel.

Why This Shift Matters

Social media amplifies unrealistic financial expectations, making many people feel behind. Instead of comparing yourself to others’ highlight reels, compare yourself to where you were a month or a year ago. This mindset shift builds pride, not shame. Growth becomes more visible when you measure it against your own journey.

8. Shift From Scarcity Thinking to Opportunity Thinking

Scarcity mindset tells you there’s never enough; opportunity mindset says, “I can find a way.” An opportunity mindset opens mental pathways that stress usually closes off. When your brain believes solutions exist, it becomes more creative and resourceful, even under pressure.

Why This Shift Matters

Scarcity leads to fear-based decisions, stress spending, and reactive choices. Opportunity thinking encourages creativity, problem-solving, and seeking new ways to earn or save. Beem’s GPT tools, like Deals GPT and Jobs GPT, support this mindset by helping you find savings and income opportunities you may not have known existed. Possibilities open up once you stop assuming you’re stuck.

9. Shift From Stress Spending to Intentional Spending

Emotional spending offers short-term relief but long-term anxiety. Intentional spending makes your purchases feel meaningful instead of impulsive, which lowers guilt and increases satisfaction. This shift strengthens your sense of control, giving you more confidence with each decision.

Why This Shift Matters

When you’re stressed, your brain craves comfort, often through spending money on convenience, food, or small treats. Intentional spending doesn’t mean cutting everything; it means choosing purchases that truly matter to you. This shift helps you spend with awareness rather than impulse. Intentionality leads to more satisfying financial decisions.

10. Shift From Feeling Alone to Feeling Supported

Money is emotional, and emotional challenges need emotional support. Feeling supported helps regulate your stress response and reduces the shame that often accompanies financial struggles. When you know you’re not facing money challenges alone, your ability to cope increases dramatically.

Why This Shift Matters

Feeling isolated increases anxiety and makes financial challenges heavier. Support systems, whether personal or digital, help lighten that load. Beem’s Smart Wallet, Everdraft™, and personalized GPT tools work like financial companions, giving guidance, clarity, and help when you need it most. Support transforms financial stress from something you carry alone into something you navigate with help.

How Beem Reinforces These Mindset Shifts (Without Adding Stress)

Beem is built for real people navigating real challenges, not for those with perfect budgets, flawless financial habits, or predictable pay cycles. It recognizes that money stress is rarely caused by a lack of effort; it’s caused by unpredictable expenses, timing gaps, and systems that make managing finances harder than it needs to be.

That’s why Beem focuses on reducing emotional pressure just as much as financial pressure. By giving you clarity, safety, and guidance, Beem helps reshape your relationship with money in a way that feels supportive, manageable, and achievable. It reinforces every positive mindset shift by replacing panic with predictability, shame with understanding, and overwhelm with guided steps that fit into your real life.

Smart Wallet Creates Predictability

By showing your future cash flow and potential shortfalls, Beem’s Smart Wallet reduces uncertainty and helps shift your mindset from fear to stability. Predictability is one of the strongest antidotes to financial anxiety. When you can see what your money will look like next week or next month, you stop bracing for financial surprises and start planning with confidence.

The Smart Wallet also helps reframe budgeting: instead of guessing or hoping your money lasts, you make informed decisions based on real projections. This gives you emotional breathing room and makes the future feel less intimidating. It turns what used to be a source of anxiety, the unknown, into a clear roadmap you can act on calmly.

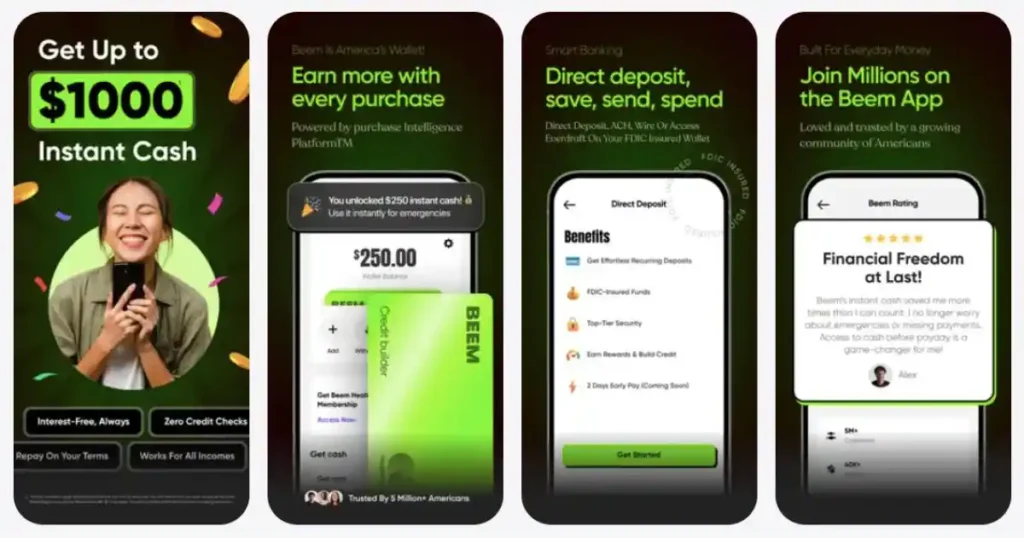

Everdraft™ Provides Safe, Interest-Free Backup

Knowing you have up to $1,000 available instantly, without interest or credit checks, eases the pressure of timing mismatches. This shift moves you out of crisis thinking and into confidence. Instead of spiraling into fear when an unexpected bill hits, you know you have support that won’t punish you with interest, hidden fees, or credit damage.

Everdraft™ acts like a cushion between you and life’s unpredictable moments, reducing the emotional weight of living paycheck to paycheck. It prevents panic-driven decisions, protects your mental health, and lets you handle financial bumps with stability rather than shame or fear. This kind of safety net makes it much easier to develop healthier, calmer money habits over time.

GPT Tools Offer Personalized Guidance

From helping you find savings to discovering flexible work, Beem’s GPT tools support opportunity thinking and reduce the emotional burden of decision-making. Instead of sifting through overwhelming information, you get tailored recommendations designed for your actual financial reality.

These tools feel like a knowledgeable partner, someone who helps you evaluate options, compare prices, review spending patterns, or spot opportunities you might have missed. That level of support lightens your mental load and empowers you to take small but impactful actions without feeling lost or pressured. Over time, this builds a mindset rooted in clarity, possibility, and confidence rather than fear or confusion.

Mindset Challenges, Positive Shifts, Emotional Benefits, and How Beem Supports Each One

| Common Financial Mindset Challenge | Positive Mindset Shift | Emotional Benefit | How Beem Reinforces This Shift |

| Shame about finances | Self-compassion | Reduces guilt and opens space for clearer thinking | Smart Wallet provides non-judgmental clarity so you understand your money without shame |

| Perfectionism around budgeting | Focus on progress, not perfection | Lowers pressure and builds consistent habits | Beem adjusts forecasts in real time, showing improvement even when life fluctuates |

| Fear of the unknown | Seek predictability and clarity | Calms anxiety by reducing uncertainty | Smart Wallet forecasts future cash flow and highlights upcoming tight days |

| Avoiding money decisions | Embrace gentle awareness | Encourages more confident decision-making | Beem organizes spending and bills automatically so awareness feels easier |

| Constant crisis mode | Move toward planning mode | Reduces overwhelm and restores a sense of control | Predictive alerts and insights help you plan before problems occur |

| Feeling unable to save | Start with micro-saving | Builds confidence and a sense of capability | Beem identifies safe moments for small savings without hurting cash flow |

| Comparing yourself to others | Compare yourself to your past self | Increases self-esteem and encourages long-term growth | Spending insights show real, personal progress instead of external benchmarks |

| Scarcity thinking | Opportunity thinking | Encourages creativity and problem-solving | DealsGPT and JobsGPT uncover savings + earning opportunities |

| Stress-driven spending | Intentional spending | Reduces guilt and increases satisfaction | Smart Wallet shows how today’s spending affects future balance, encouraging mindful choices |

| Feeling alone in money struggles | Feel supported and guided | Reduces emotional burden and isolation | Everdraft™, GPT tools, and real-time insights act as reliable financial companions |

Mindset Shifts Make Financial Change Possible

Money anxiety often feels overwhelming because it affects your mind, emotions, and sense of security. But changing your money mindset, even in small ways, can create room for clarity, confidence, and better decision-making. When combined with supportive tools like the Beem app, these mindset shifts help you break free from fear and build a healthier relationship with money.

You don’t need perfection. You just need support, awareness, and a mindset that believes change is possible.

FaQs on Positive Money Mindset

How can mindset shifts really reduce financial anxiety?

Mindset shifts help by reducing shame, improving clarity, and creating emotional resilience. When your mindset is calm and supportive, you make better decisions and feel more in control. This emotional foundation is crucial for managing money confidently, even before your financial circumstances change.

What’s the easiest mindset shift to start with?

Most people find it helpful to begin with self-compassion, separating their worth from their financial situation. This shift reduces guilt and makes it easier to look at your finances without fear. Small mindset changes create a ripple effect that supports long-term financial stability.

How does Beem help with money anxiety?

The Beem app supports a healthier money mindset by reducing uncertainty and offering tools that guide, predict, and protect. Smart Wallet gives clear visibility into the future, Everdraft™ provides safe financial backup, and Debt, Deals, and JobsGPT tools offer solutions tailored to your needs. This reduces emotional pressure and helps you make decisions with confidence.