Many people want to help loved ones during tough times, but questions often arise around the financial and legal side of lending money. One common concern is whether you can loan money to a family member tax-free. While it may sound simple—just handing over the cash—there are rules set by the IRS that can affect whether your loan is considered a gift or if interest needs to be charged. Understanding these rules is key to avoiding unexpected tax consequences for both you and your family member. In this blog, we’ll break down how tax-free family loans work, the limits you should know about, and the safest way to support those closest to you without creating a tax headache.

Introduction: Understanding Family Loans and Taxes

For ages, people have found it most convenient to reach out to their families and loved ones when they need money. Earlier, it was easy to pull out your wallet and lend your helping hand to your family, but times have changed, and so have the norms and laws.

Every transaction needs to be scrutinized under taxation law. You might wonder whether the money you loan to a family member is taxable or not. Let’s explore the realm of family lending and find out if you can lend tax-free money to your family member.

What is a Family Loan?

A family loan is a loan made between family members. You may set up a similar lending arrangement with friends, significant others, or housemates.

This form of loan is structured entirely at the choice of you and the lender. A family loan may or may not include interest and may be repaid in installments or in whole. It might be unsecured, or you can offer security. The loan might be informal or official, with a lending agreement.

Family loans can help you avoid costly no-credit-check loans and have few approval requirements, but there are some drawbacks, such as tax consequences and embarrassment.

IRS Rules on Family Loans

The Internal Revenue Service considers whatever is transferred as a loan if there is definite intent to re-pay, regardless of the relationship. Loans to family members must have a recognized, formal process. If the loan is to fail certain prerequisites, such as charging interest, then the amount received may be classified by the Internal Revenue Service as a gift, and now there will be tax implications on both sides.

The $10,000 Exception

Loans under $10,000 are generally exempt from IRS scrutiny. No interest needs to be charged, and tax implications are minimal. However, if the loan exceeds $10,000, interest is required to avoid tax consequences. This exception applies mainly to smaller personal loans, and not charging interest can still create complications in certain situations.

Interest-Free Loans: What You Need to Know

While it may appear nice to offer an interest-free loan, the IRS has limits for loans over $10,000. Even if you don’t charge interest, the IRS might interpret a specific rate as “imputed interest.” You would, therefore, owe taxes on the estimated interest even though you did not receive any. Interest-free loans above $10,000 come with hidden hazards.

Documenting the Loan Properly

Although you trust your family, keeping things on paper is always a good idea. You can use the agreement for a family loan to avoid issues that may crop up when paying back the debt. This document will include all the terms and conditions you set for the loan.

A notarized and signed agreement may seem impersonal, but having anything in writing clears up potential misunderstandings and frustrations. Remember to include the involved parties in your decision.

Family Loan Agreement:

- What to Include

- How much is borrowed, and how will it be used?

- Terms for repayment with payment amounts, frequency, and date the loan will be fully repaid.

- Interest rate charged on the loan.

The IRS establishes an applicable federal rate each month that is the minimum interest rate allowed on private loans over $10,000.

Whether the loan may be repaid early without penalty, and how much interest would be saved by doing so.

What happens if the borrower stops paying temporarily or totally because of an emergency?

A simple trick on how things would not become hard on the lender: When you need to borrow, what it is for, and how you will pay back your debt after seeking money from them. Give your family member some time to digest the request.

Lenders should always ask themselves if they can afford to lend and whether there is a chance of losing money in case the repayment fails. Be welcoming of any queries your family members may have about your ability to repay the loan.

Potential Tax Implications

If the loan is considered a gift due to improper documentation or lack of interest, gift tax may apply. The person lending the money could face taxes on the imputed interest, while the borrower may not. Additionally, gift taxes could affect future estate planning if the loan exceeds annual or lifetime gift exclusions.

Alternatives to Family Loans

Well, let’s weigh the pros and cons of a family loan and other alternatives that will grant you more money but at least involve less risk to your relationships.

Personal Loans: If one needs to raise cash for personal use, he or she may borrow from a bank, credit union, or online lender. A personal loan is a one-time advance of cash that is repaid via monthly repayment plans for two to seven years. The cash is used to clear debt or renovate the house.

A personal loan APR ranges from 6% to 36%. For most lenders, borrowers with excellent credit earn the lowest APR available-690 or better. Many online lenders and some credit unions lend you with very low credit scores. Bad credit loans are likely to have the highest APR available within a lender’s range, although they are far cheaper than payday and other no-credit-check loans.

Co-signer personal loan: Many lenders let you add a family member or significant other as a co-signer for a loan application. This can increase your odds of qualifying and ease a little stress off your loved one since they’re not providing the funds.

However, the relationship can still be damaged. Defaulting on a loan co-signed can also damage both credit scores. A co-signer must pay for the loan if the borrower fails to do so.

Cash advance apps: when you borrow a few hundred dollars through cash advance apps and pay the money back on payday. These apps do not charge interest but will charge you a subscription fee and fast funding fee—and mostly, ask for small tips. But if you use an app, plan how to pay back the advance on time.

Buy now, pay later: A “buy now, pay later” loan is financing extended at check-out, which breaks your one shopping trip bill into multiple (usually four) payments. Most major retailers offer this, which should be used only for big-ticket items like mattresses or laptops. Only use one payment plan at any given time so you do not end up overspending and trying to remember which payments are when.

Giving it as a gift: when you accept and agree upon it by both parties, it would be considered not to be repaid, thus as a gift. This is at your discretion, in case of fear of the loan putting your relationship at risk and if the family member could afford to part with the money as a gift.

Benefits of Charging Interest

Charging interest on a family loan may appear needless, but it has legal and financial benefits. It protects both parties from tax issues because the IRS does not consider the loan a gift. Interest also formalizes the loan arrangement, establishing a clear repayment plan and guaranteeing compliance with IRS regulations.

Avoiding Gift Tax Issues

You should ensure that the loan is correctly documented to minimize gift tax. Charge an interest rate that is at least equivalent to the IRS’s applicable federal rate (AFR). This guarantees that the loan is not considered as a gift. Formalizing the loan with written agreements and precise payback terms is critical to avoiding gift tax issues.

Legal Considerations and Best Practices

Family loans should always be formalized in writing. The agreement should clearly state the loan amount, interest rate, and repayment terms. It protects both the lender and the borrower. More importantly, it keeps their tax trouble at bay because it sticks to the applicable federal rate set by the IRS. One should also consult a tax advisor or lawyer to determine if they are in accordance.

Conclusion: Making Informed Decisions About Family Loans

Family loans can be a thoughtful way to provide financial support, but they also come with responsibilities. Following IRS guidelines, documenting the loan, and setting clear terms can help avoid tax complications and protect your relationship.

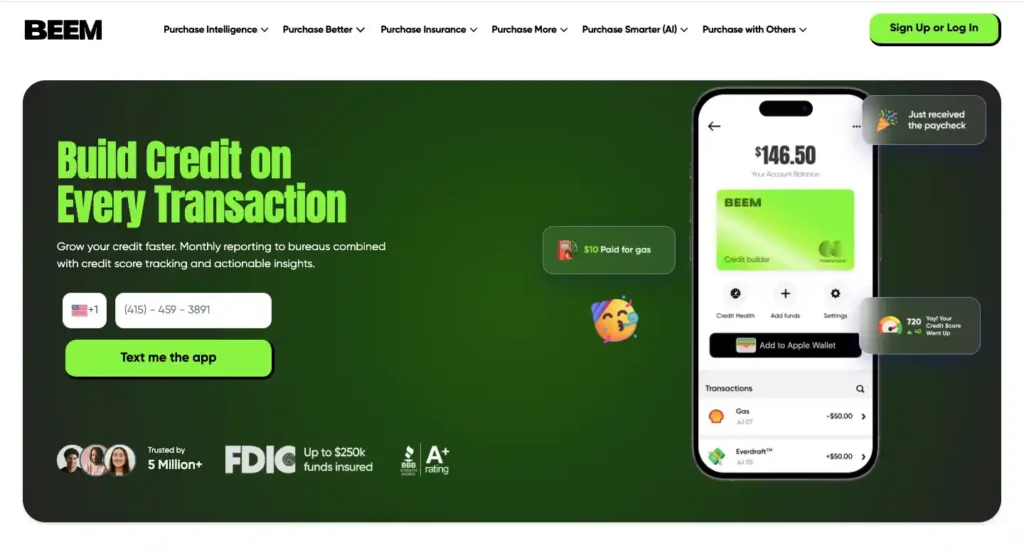

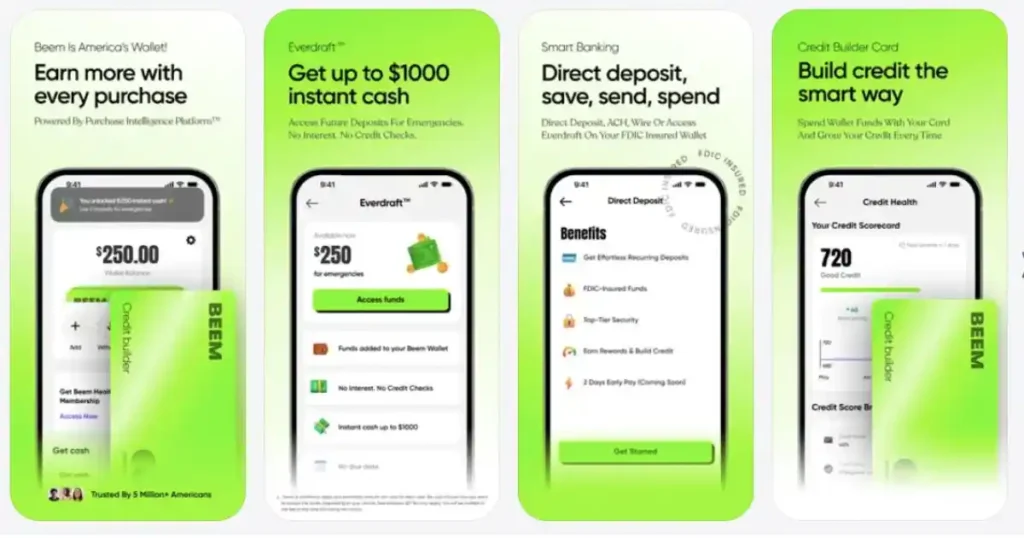

At the same time, lending money to family isn’t always the easiest or most comfortable solution. That’s where Beem offers a better alternative. With Beem, you can access funds quickly—Better Than Any Instant Cash Advance, with the ability to withdraw $10–$1000 of verified bank deposits early, with no credit checks, no interest, no income restrictions, no due dates, and no tips¹. Instead of risking strain over repayment or tax implications, Beem provides a safe, flexible way to handle financial needs—helping you and your family avoid the stress that traditional loans can create. Download the app to learn more.

FAQs on Can You Loan Money to a Family Member Tax-Free

1. What are the tax implications of loaning money to a family member?

When you help your family member with more than $10,000 loan without charging interest, the Internal Revenue Service may impute interest. This is directly associated with the happening of the taxes that you did not intend to pay.

2. How can I avoid gift tax when loaning money to a family?

To avoid a gift tax when giving money to the family, ensure your document for the loan charges interest. You may review the Applicable Federal Rate published by the IRS each year for guidance.

3. What documentation is needed for a family loan

A written loan agreement involving the amount, the interest rate on the loan, and repayment terms would be necessary to avoid confusion and tax issues.