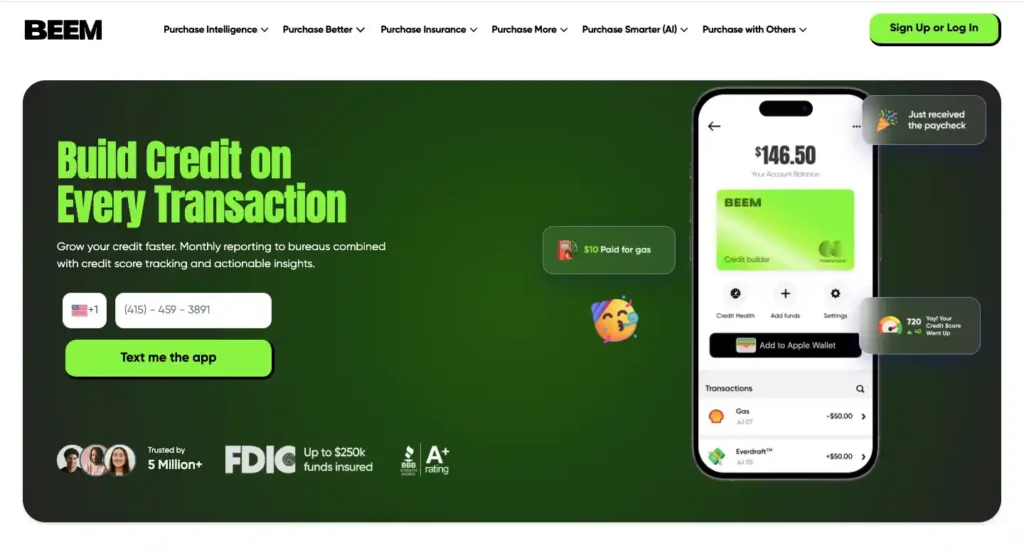

In today’s digital world, protecting your financial identity is more important than ever. Protect your credit score with Beem’s fraud detection tools, designed to help you stay ahead of cyber threats and identity theft. Your credit score is key to your financial health, and fraud can significantly damage it. From financial services to e-commerce, organizations are constantly challenged to protect their assets, data, and customers from fraudsters who use sophisticated methods to exploit system vulnerabilities.

Fraudulent activity, such as unauthorized accounts or credit inquiries, can lower your credit score and create long-term financial complications. Thankfully, tools like Beem’s services offer comprehensive protection. With real-time alerts, identity theft monitoring, and proactive fraud resolution support, Beem helps you avoid potential threats.

Why Protecting Your Credit Score From Fraud Matters

Your credit score is more than just a number; it is a vital aspect of your financial identity. It influences various key areas of your life, from securing loans and renting apartments to qualifying for the best insurance rates and even landing a job. Fraudulent activity, such as unauthorized credit inquiries or the creation of accounts under your name, can cause significant damage to your score.

These actions can remain on your credit report for years, leading to long-term financial consequences, including higher interest rates, limited access to credit, and even difficulty securing housing. Protecting your credit score from fraud is crucial to maintaining financial stability and ensuring future opportunities.

Read related blog: Online Payment Fraud

How Beem’s Fraud Detection Tools Work

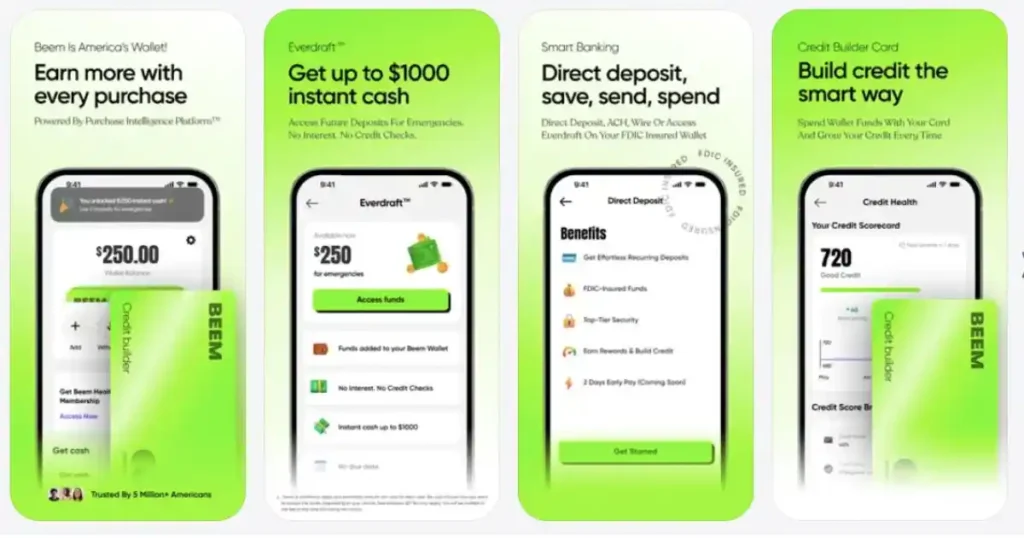

Beem offers comprehensive tools to protect your credit score and personal information from fraud. With real-time monitoring and proactive security features, The app helps you stay ahead of potential threats, ensuring you are alerted as soon as suspicious activity is detected. By using the platform’s fraud detection tools, you can monitor your credit, identify irregularities early, and take quick action to mitigate damage. Below, we explore how Beem’s features work in detail.

Real-Time Credit Alerts

One of Beem’s most powerful features is its real-time credit alerts, which notify you whenever there is a change to your credit report. It includes opening a new account, a hard inquiry, or suspicious activity. These alerts allow you to react quickly before fraudulent activity can have a lasting impact on your credit score.

You’ll be the first to know whether a new credit card was opened in your name or a hard inquiry you didn’t authorize. With this immediate feedback, you can contact creditors or the credit bureaus to resolve any issues before they escalate.

Identity Theft Monitoring and Dark Web Surveillance

Beem goes beyond standard credit monitoring with continuous identity theft and dark web surveillance. It closely monitors your personal information, including your Social Security number, address, and other sensitive data.

If any of this information is found on the dark web or used fraudulently, the app will instantly notify you. It gives you a critical early warning about potential identity theft so you can take action, such as freezing your credit, contacting authorities, or alerting your financial institutions. This constant vigilance ensures that your personal information remains safe and secure.

Step-by-Step Fraud Resolution Support

In the unfortunate event that fraudulent activity is detected, Beem provides step-by-step fraud resolution support. The app doesn’t just alert you to suspicious activity; it helps you take proactive steps to resolve it. It includes contacting your financial institutions to report fraud, freezing your accounts if necessary, and disputing any incorrect items on your credit report.

Beem’s expert guidance walks you through every stage of the process, making correcting errors and restoring your credit easier. This hands-on approach minimizes the damage caused by fraud and helps you regain control over your financial security quickly.

Privacy Scans and Credit File Locking

Beem also offers monthly privacy scans to identify and remove your personal information from people-finder websites. These sites often share your details without your consent, potentially exposing you to unwanted solicitations or fraud. By removing your information from these sites, The app reduces the likelihood of misusing your data.

Additionally, the platform offers the ability to lock and unlock your credit file, adding extra protection against unauthorized access. No one, including potential identity thieves, can open accounts in your name without explicit permission. With this added security measure, your credit remains safer than ever.

Additional Security Features

Beem goes beyond fraud detection and credit monitoring by offering a comprehensive suite of additional security features to protect your financial well-being. These tools provide an extra layer of protection, ensuring your data and finances remain safe from identity theft, fraud, and cyber threats. Below are some key features Beem provides to safeguard your personal and financial information.

Identity Theft Insurance Coverage

Beem offers identity theft insurance coverage of up to $1 million for eligible expenses. This coverage includes protection for lost wages, legal fees, and expenses for clearing fraudulent charges. With this level of protection, you can rest assured knowing that you have financial support if your identity is compromised.

Regular Credit Updates

The platform delivers weekly or monthly credit updates to help you monitor your financial health. These updates provide valuable insights into your credit status, allowing you to spot any irregularities or potential issues early. Regularly checking these updates can help you stay on top of changes to your credit and make timely adjustments.

Secure Encryption and Privacy Protocols

The app employs top-notch encryption and privacy protocols to protect your sensitive data. It ensures that your personal and financial information remains safe from hackers and malicious actors. With Beem’s advanced security measures, you can trust that your data is handled with the highest level of care and protection.

By combining these additional security features with its fraud detection and credit monitoring tools, Beem offers a holistic approach to financial protection, giving you peace of mind knowing that your personal and financial information is secure.

Read related blog: Pay Off Debt With Beem’s Personal Loans to Boost Your Credit Score

Proactive Steps to Take With Beem

Staying proactive is key to maximizing the benefits of Beem’s fraud protection tools. Regular monitoring and immediate action when needed are essential for keeping your credit score safe. While the app sends real-time alerts to help identify unauthorized activity, taking control by regularly reviewing your credit and using the platform’s additional features is essential. Below are some proactive steps you can take to ensure your financial security remains intact.

Regularly Review Your Credit Report

Make it a habit to review your credit report frequently. It allows you to spot unfamiliar accounts or credit inquiries that might indicate fraud. Although Beem sends real-time alerts for suspicious changes, checking your report helps ensure you’re not missing any potential issues.

Respond Promptly to Beem’s Alerts

If the app notifies you of suspicious activity, act quickly to minimize potential damage. Follow the recommended steps in the alerts, such as contacting your financial institutions or freezing your accounts. Taking swift action is crucial to prevent further unauthorized activity from affecting your credit score.

Use Beem’s Goal-Setting Tools

Beem’s goal-setting features help you stay on top of your credit health. You can stay focused and motivated by setting specific financial goals, such as improving your credit score or paying down debt. These tools also help you track your progress, ensuring you make consistent strides toward your financial goals.

Take Advantage of Beem’s Credit Improvement Tools

The app’s credit improvement tools offer valuable insights and resources to help you enhance your financial standing. Whether you understand the factors affecting your credit score or receive tips on improving it, these tools equip you with the knowledge to stay ahead of any credit challenges.

By actively utilizing Beem’s tools and taking these proactive steps, you can ensure that your credit remains protected and your financial future stays secure.

Read related blog: Online Banking Frauds

Final Thoughts – Stay Ahead of Fraud With Beem

Protecting your credit score is essential in today’s financial landscape, and Beem’s comprehensive fraud detection and identity monitoring tools make it easier than ever to safeguard your financial future. With real-time alerts, step-by-step fraud resolution, and additional security features like identity theft insurance and credit file locking, Beem provides the protection you need to stay ahead of fraud.

By taking proactive steps and using Beem’s tools to monitor and manage your credit, you can rest easy knowing that your financial identity is safe. Don’t wait until it’s too late; download the Beem app today and protect your credit score and personal information from fraud.