Your credit score affects everything from loan approvals to apartment rentals to job offers in some industries. If your score is currently in the “poor” range (typically below 580), it can feel like the odds are stacked against you. But the truth is, poor credit is not a life sentence. With a clear plan and consistent effort, you can move your credit from poor to good — and even beyond.

This guide breaks down the step-by-step strategy you can follow to build better credit. Whether you’re recovering from financial hardship or just starting fresh, these practical steps — supported by Beem’s smart credit monitoring tools — can help get your score moving in the right direction.

Improve Poor to Good Credit Score Step-by-Step

Step 1: Know Where You Stand

Before you can improve your credit, you need to understand it. Start by pulling your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion. You’re entitled to one free report per year at AnnualCreditReport.com.

Know what your score means:

- Poor: Below 580

- Fair: 580–669

- Good: 670–739

- Very Good: 740–799

- Excellent: 800+

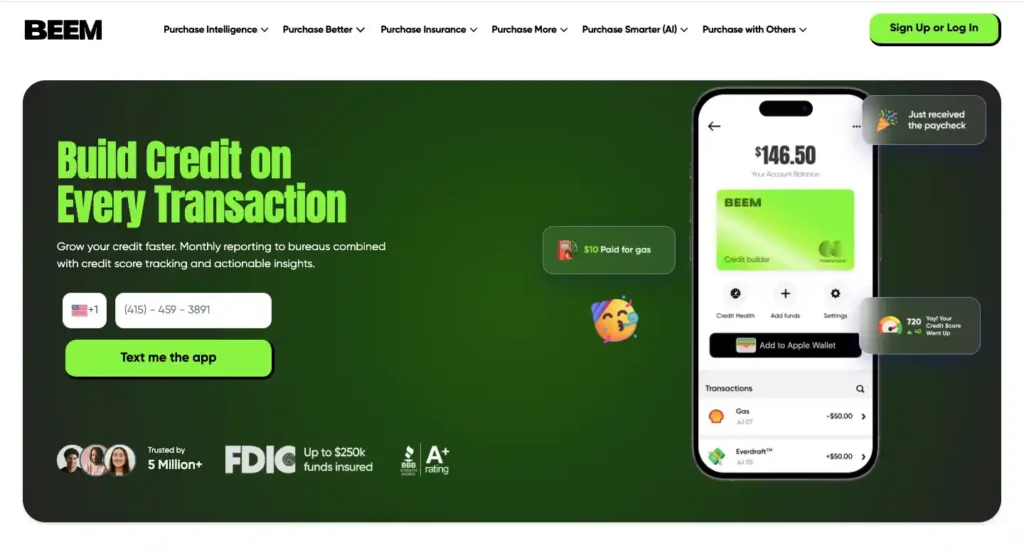

Beem makes this process easy by giving you access to your updated credit score, a breakdown of what’s affecting it, and tools to track progress over time.

Step 2: Dispute Errors on Your Credit Report

A 2021 study by the FTC found that one in five people had an error on their credit report. Incorrect information — like duplicate accounts, wrong balances, or falsely reported late payments — can drag your score down for no reason.

What to do:

- Review your report line by line

- Identify inaccuracies

- File disputes online with each bureau

Disputing and correcting errors can result in a quick credit score bump. It’s one of the easiest first wins on the path from poor to good credit.

Step 3: Make On-Time Payments a Priority

Payment history accounts for 35% of your credit score. That means late payments are credit score poison — especially if you’re trying to recover.

Here’s how to build consistency:

- Set calendar alerts or use Beem’s payment reminders

- Enroll in autopay for at least the minimum payment

- Contact creditors before due dates if you’re struggling to pay

Even making the minimum payment on time is better than missing it altogether. Just six months of consistent, on-time payments can make a noticeable difference in your score.

Step 4: Reduce Your Credit Utilization Ratio

Credit utilization — the percentage of your available credit that you’re using — accounts for 30% of your credit score. If you’re maxing out your cards, your score suffers.

Aim to keep your utilization below 30%, or ideally under 10%.

Ways to lower it:

- Pay down high balances

- Make multiple payments throughout the month

- Request a credit limit increase (but avoid triggering a hard inquiry)

- Don’t open new accounts just for more credit

Beem helps by displaying your credit usage visually, so you always know if you’re in the “safe zone.”

Step 5: Don’t Close Old Accounts

Credit age plays a role in your score. The longer your history, the better — so avoid closing old accounts, especially those in good standing.

Keeping an old, unused card open with a zero balance:

- Boosts your average credit age

- Lowers your credit utilization ratio

Only consider closing accounts if they have high annual fees and you’re not using them. Otherwise, keep them open for the benefit of your score.

Step 6: Handle Collections and Charge-Offs Smartly

If you have old debts in collections, they’re likely hurting your score. But paying them off can help — especially under newer scoring models like FICO 9 and VantageScore 3.0.

Steps to take:

- Confirm the debt is accurate

- Try negotiating a pay-for-delete

- Pay or settle what you can, then follow up to ensure it’s reported correctly

Collections and charge-offs are often the heaviest anchors weighing down your credit score. These accounts indicate to lenders that you’ve defaulted on debt, and they can stay on your credit report for up to seven years. However, they don’t have to define your financial future.

Begin by verifying the validity of the collection or charge-off account. Request a debt validation letter from the collector to confirm the debt belongs to you. If it’s legitimate, consider negotiating a payoff or a settlement. Some agencies may agree to remove the entry if you pay in full — a strategy known as “pay-for-delete.”

If the agency refuses, don’t worry. Under newer credit scoring models (like FICO 9 and VantageScore 3.0), paid collections are ignored. Even if your score doesn’t immediately rise, future lenders will appreciate seeing that you took responsibility for your debts. Beem can help you monitor these updates in real time so you’re never left wondering when your report changes.

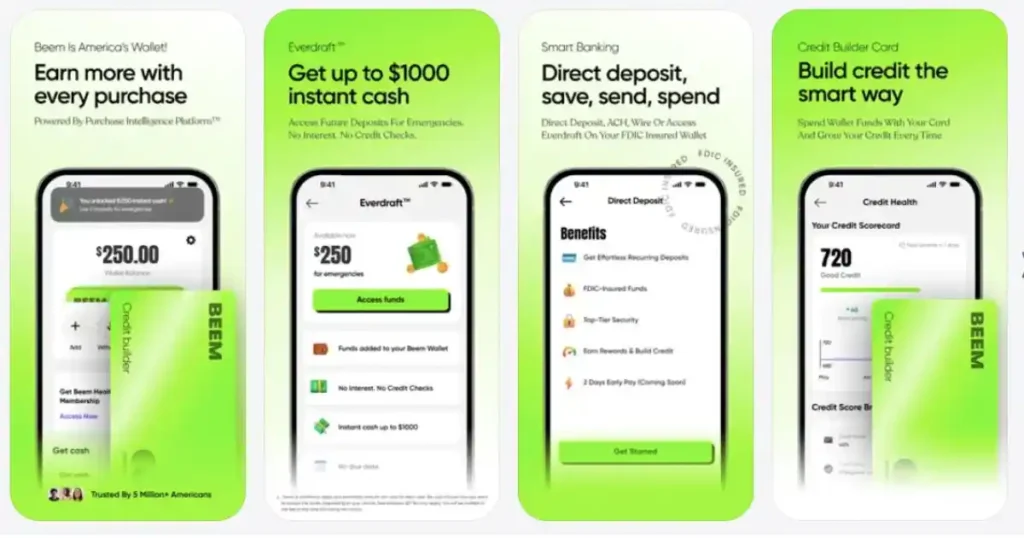

Step 7: Use Credit-Building Tools

If you have a thin credit file or no open accounts, using credit-building tools can help.

Start with:

- Secured credit cards

- Credit-builder loans

- Authorized user status

When you’re starting from poor credit, traditional lenders may be hesitant to extend you a new credit line. That’s where credit-building tools come in — they’re designed for people who are rebuilding or just beginning their credit journey.

A secured credit card is one of the most popular options. You place a refundable deposit (usually $200 to $500), which becomes your credit limit. By using it responsibly — keeping the balance low and paying in full — you show that you can handle credit well.

Credit-builder loans are another effective method. Offered by many credit unions and fintech apps, these loans place the borrowed money into a savings account. You then make fixed monthly payments. Once you’ve paid off the loan, you get access to the funds. Meanwhile, your on-time payments are reported to the credit bureaus.

If you have a trusted friend or family member with strong credit, you can ask to be added as an authorized user on their account. You won’t need to use the card; you’ll simply benefit from their good history, which may improve your score over time.

Beem helps you evaluate these options based on your current credit profile and goals, guiding you to the right choice for where you are now.

Step 8: Mix Up Your Credit Types (Responsibly)

Having a diverse credit mix — like a credit card, auto loan, and student loan — shows lenders you can manage various types of debt. It makes up about 10% of your credit score.

But don’t open accounts you don’t need. Focus on:

- Managing existing accounts well

- Gradually adding new types when appropriate

- Avoiding hard inquiries unless necessary

Consistency matters more than variety when rebuilding.

Step 9: Be Patient, Consistent, and Informed

Credit recovery doesn’t happen overnight. But with consistency, most people can go from poor to good credit in 6 to 12 months.

Here’s what to avoid during this time:

- Late payments

- High credit utilization

- Unnecessary credit applications

Instead, track your progress weekly using Beem’s score tracker. Seeing improvement, even small changes, keeps you motivated and on track.

How Beem Helps You Improve Credit Smarter

Beem is more than a credit monitoring tool. It’s a credit improvement partner. Here’s how Beem helps you move from poor to good credit:

- Monitors your credit score in real time

- Breaks down what’s helping or hurting your score

- Sends alerts on due dates, new accounts, and usage spikes

- Helps identify credit-building opportunities like secured cards

- Educates you with digestible content and goal-based tips

Whether you’re recovering or starting fresh, Beem makes every step visible and actionable.

Frequently Asked Questions (FAQs)

How long does it take to improve poor credit to good?

Most people can see meaningful improvement in 6–12 months with consistent action.

Can I build credit without a credit card?

Yes. You can use credit-builder loans, report rent payments through services, or become an authorized user.

What’s the fastest way to raise my score?

Disputing errors, reducing high balances, and making all payments on time are the top ways.

Should I pay off all debts at once?

If possible, yes — but focus on high-interest and maxed-out accounts first.

Do hard inquiries lower my score?

Yes, slightly. Limit new applications while you’re rebuilding.

Conclusion

Improving your credit score is a marathon, not a sprint. The steps may seem simple, but staying consistent with them is where the real challenge lies. From paying on time and keeping your balances low to correcting report errors and using smart tools — every action counts.

Even if your score is in the 500s today, with discipline and the right guidance, you can cross into the 600s and beyond within a year. As you move up the credit ladder, more financial doors will open: better loan terms, lower interest rates, and even new job opportunities.

Beem was designed to help people like you — individuals who want better credit, more control, and clear insights without the jargon. Use it as your day-to-day support system for building credit smarter, not harder.

Start today, and a year from now, you’ll be thankful you did.