Table of Contents

Interest rates sit quietly in the background of daily money decisions, doing their work without noise or drama. They don’t shout or flash warnings. They keep adding numbers, month after month, while people stay busy with life, bills, groceries, and the next small purchase that feels harmless enough.

Most people don’t wake up planning to overspend. They don’t decide to sink into debt for sport. What usually happens is simpler and more frustrating. They look at the price of something, glance at the monthly payment, shrug, and move on. The rate attached to that payment barely registers. The logic goes, “I can handle thirty dollars a month,” not, “I’m agreeing to pay almost double over time.” That gap in thinking is where trouble starts.

Overspending often begins with confusion about credit cards, loans, or financing plans that appear attractive on the surface. Easy approvals, delayed payments, and cheerful checkout screens make borrowing feel light. Almost playful. Interest rates are there, of course, buried in fine print or pushed to a separate screen nobody reads. When those rates finally take effect, the spending has already occurred.

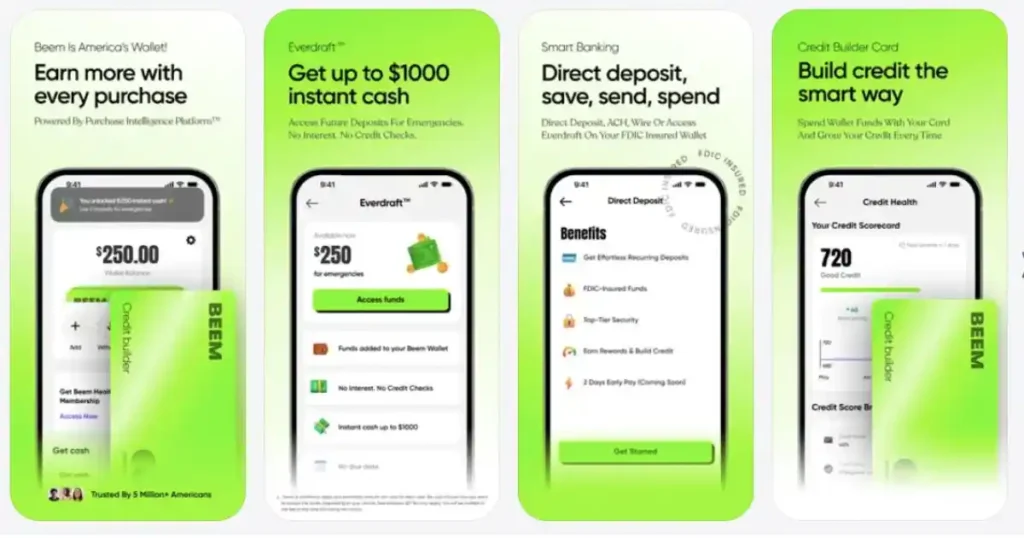

This is why tools like Beem Everdraft™ get attention. They promise something rare in modern finance: short-term help without interest quietly piling up in the dark. That difference matters more than people think.

What Interest Rates Really Represent

An interest rate is the price paid for borrowing money. That’s it. No mystery. No clever spin. When someone borrows, the lender charges for the privilege. The higher the rate, the higher the cost of that borrowed money. Simple idea. Messy outcomes.

Many people hear terms like APR and assume it’s just another bit of financial jargon meant for accountants. APR, however, is the yearly cost of borrowing, expressed as a percentage. Monthly interest is how that cost shows up in real life, month by month, quietly adding to the balance. One looks clean on paper. The other eats away at budgets.

Small increases make a big difference over time. A few extra percentage points may not seem significant at first, especially when payments are spread out over time. But those points stack. They stretch repayment timelines and inflate totals in ways most borrowers never calculate.

Credit cards are the worst offenders in this regard. They often carry some of the highest rates in personal finance, yet they’re treated like everyday tools instead of expensive debt instruments.

That disconnect leads people straight into overspending without realizing it.

Why Ignoring Interest Rates Causes Overspending

The minimum payment illusion is powerful. A statement arrives showing a low required amount, and the brain relaxes. It feels manageable. What doesn’t feel manageable is the full balance, so that number gets ignored. As long as the minimum is paid, spending feels justified. Safe, even.

When interest fades into the background, borrowing feels easier than it should. A purchase doesn’t feel like a commitment. It feels like a small monthly inconvenience. That mental trick encourages people to buy things they would hesitate over if they were forced to pay in full up front.

Deferred payments add fuel to this. “Pay later” sounds generous. It sounds helpful. But delaying the pain doesn’t remove it. It often makes it worse. Buy now, pay later plans often extend repayments over extended periods, with fees or penalties lurking for a missed payment date.

Overspending thrives in that space where the real cost stays hidden until it’s too late to undo the decision.

Read: Loans Like Oportun: Lower Interest Rates with Beem’s Personal Loans Marketplace

Types of Interest-Driven Financial Mistakes

Credit card overspending tops the list. Compounding interest turns everyday purchases into long-term burdens. Groceries, gas, a night out. None of it feels dramatic at the time. Months later, the balance still hasn’t moved much, and frustration sets in.

Payday loans and high-fee cash advances are another trap. They promise speed and relief but charge brutally for it. People reach for them in moments of pressure, not because they want to overspend, but because they feel cornered. The rates attached make escape harder than expected.

Financing big items, such as electronics, furniture, or trips, often comes with friendly sales talk and rushed decisions. Terms get skimmed. Interest details get skipped. The excitement of the purchase carries the moment, while the repayment drags on long after the novelty fades.

Missed payments on existing debt push things further downhill. Rates jump. Fees appear. Balances swell. What started as manageable slides into something heavier.

How High Interest Debt Grows Faster Than Expected

Compounding interest creates a vicious cycle of debt. Interest is added to the balance, and then the next round of interest is charged on that new, larger amount. It’s a snowball that doesn’t need a hill. Time does the work.

Missing one payment can trigger penalties that raise the rate or add fees. That single slip multiplies the damage. Suddenly, a larger portion of each payment goes toward interest rather than the actual debt. Progress slows. Morale drops.

Picture a small purchase, perhaps a few hundred dollars, on a credit card. It feels minor. But with a high rate and minimum payments, that amount can linger for years. The final total paid ends up far higher than the sticker price. That gap is where regret lives.

The Long-Term Consequences of Ignoring Interest Rates

Debt accumulates quietly, only to suddenly feel overwhelming. Balances spread across accounts become harder to track. Monthly obligations grow, even though spending hasn’t increased.

Interest-heavy payments crowd out other goals. Savings get postponed. Emergency funds stay empty. Plans for travel, education, or home improvements keep getting delayed because there’s never quite enough left at the end of the month.

Credit scores suffer when balances remain high, and payments become stretched thin. That opens the door to even worse rates down the line. It’s a loop that feeds itself.

The stress is constant. Not dramatic, not explosive. Just a steady hum of anxiety that never fully turns off.

How to Understand and Manage Interest Rates the Right Way

Reading APR details before using credit sounds boring. It is. But it works. Knowing the rate changes how decisions feel. Suddenly, borrowing looks less friendly.

Tracking how much interest gets paid each month brings clarity fast. Numbers don’t lie, even when they’re uncomfortable. Paying more than the minimum, even a little, reduces the principal and speeds up the process.

Lower rate options matter. So does skipping financing for things that aren’t necessary. Not everything needs to be purchased immediately.

Managing interest isn’t about perfection. It’s about awareness and small corrections that prevent big messes later.

Read: The Link Between Inflation and Interest Rates

How Beem Everdraft™ Helps You Avoid High-Interest Mistakes

Beem Everdraft removes interest from the equation altogether. The cash arrives without a rate attached, without hidden math waiting to surprise the user later.

There are no complex terms to decode or traps tucked into footnotes. The focus remains on short-term support, not long-term extraction.

By offering access to funds without compounding costs, it helps people sidestep credit card fees, overdraft penalties, and emergency borrowing that can spiral out of control. It serves as a fallback when budgets are tight and timing is off.

When rates rise and pressure builds, having an option that doesn’t punish the borrower makes a real difference.

FAQs on Why Ignoring Interest Rates Leads to Overspending

Why do people ignore interest rates when borrowing?

Many never learned how they work. The language can be confusing, and spending decisions often stem from emotion or urgency rather than calm calculation.

How do interest rates cause overspending?

Low minimum payments and delayed billing can make short-term chases feel less substantial in the long term, although they are actually more substantial. Fees and long repayment periods are often overlooked until later.

What is the easiest way to understand interest rates?

Focus on APR, compounding, and the total amount repaid over time. Set aside the monthly minimum for a moment and consider the broader perspective.

Can Everdraft help me avoid high-interest debt?

Yes. It provides instant cash without interest, preventing short-term needs from becoming long-term debt.

How can I minimize the monthly interest I pay?

Cut back on credit use, pay more than required when possible, and build a buffer so emergencies don’t force expensive borrowing.

Conclusion

Ignoring interest rates doesn’t feel reckless in the moment. It feels normal. That’s what makes it dangerous. The cost remains quiet while spending continues, until the weight of repayment finally becomes impossible to ignore.

Understanding borrowing terms before using credit changes the entire dynamic. It slows down decisions. It forces honesty. It puts control back where it belongs.

Tools like Beem Everdraft offer breathing room without adding pressure, giving people a way through financial gaps that doesn’t punish them later. And in a world where interest keeps climbing, that kind of option isn’t just helpful, it’s necessary. Download the app now!